Suggestion for Writ of Garnishment

Description

Definition and meaning

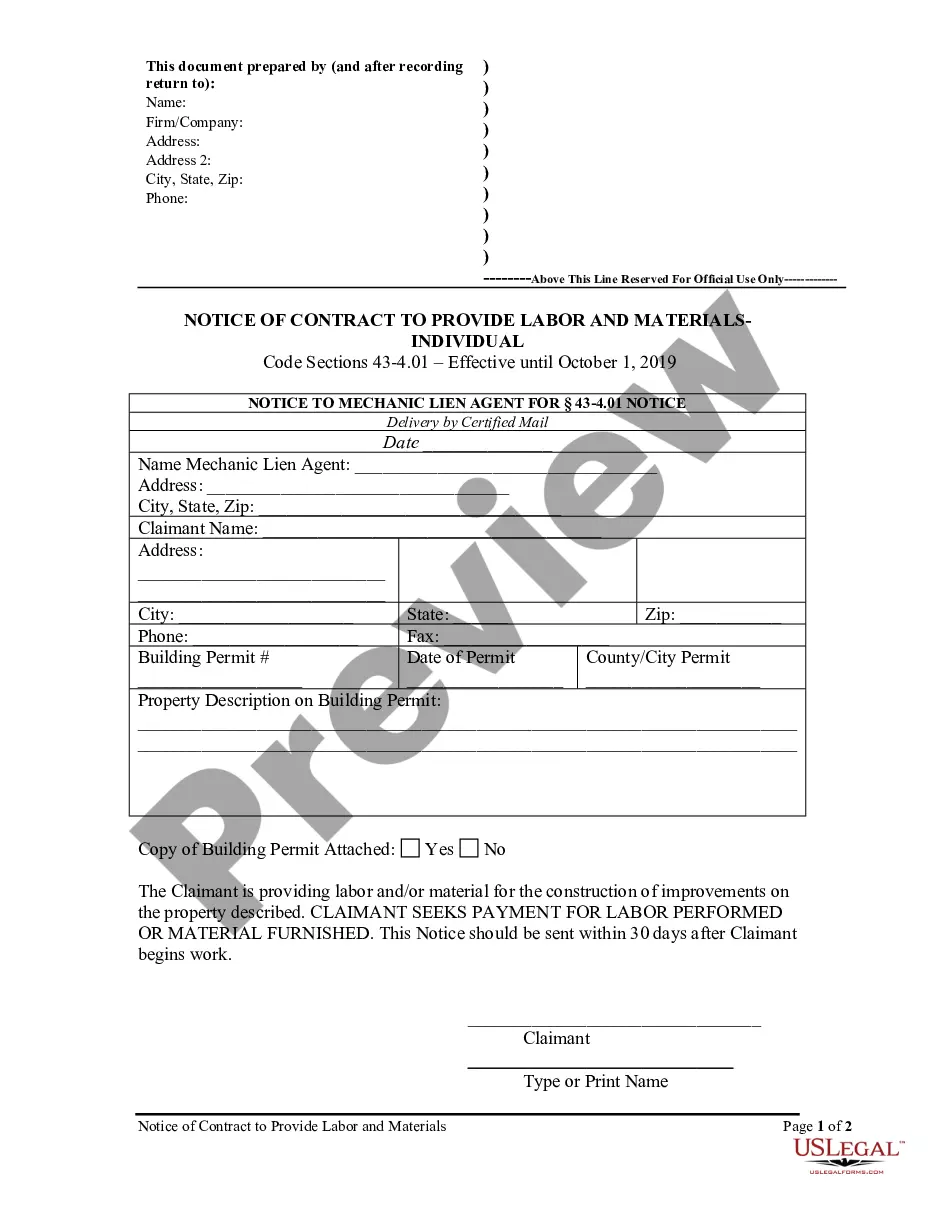

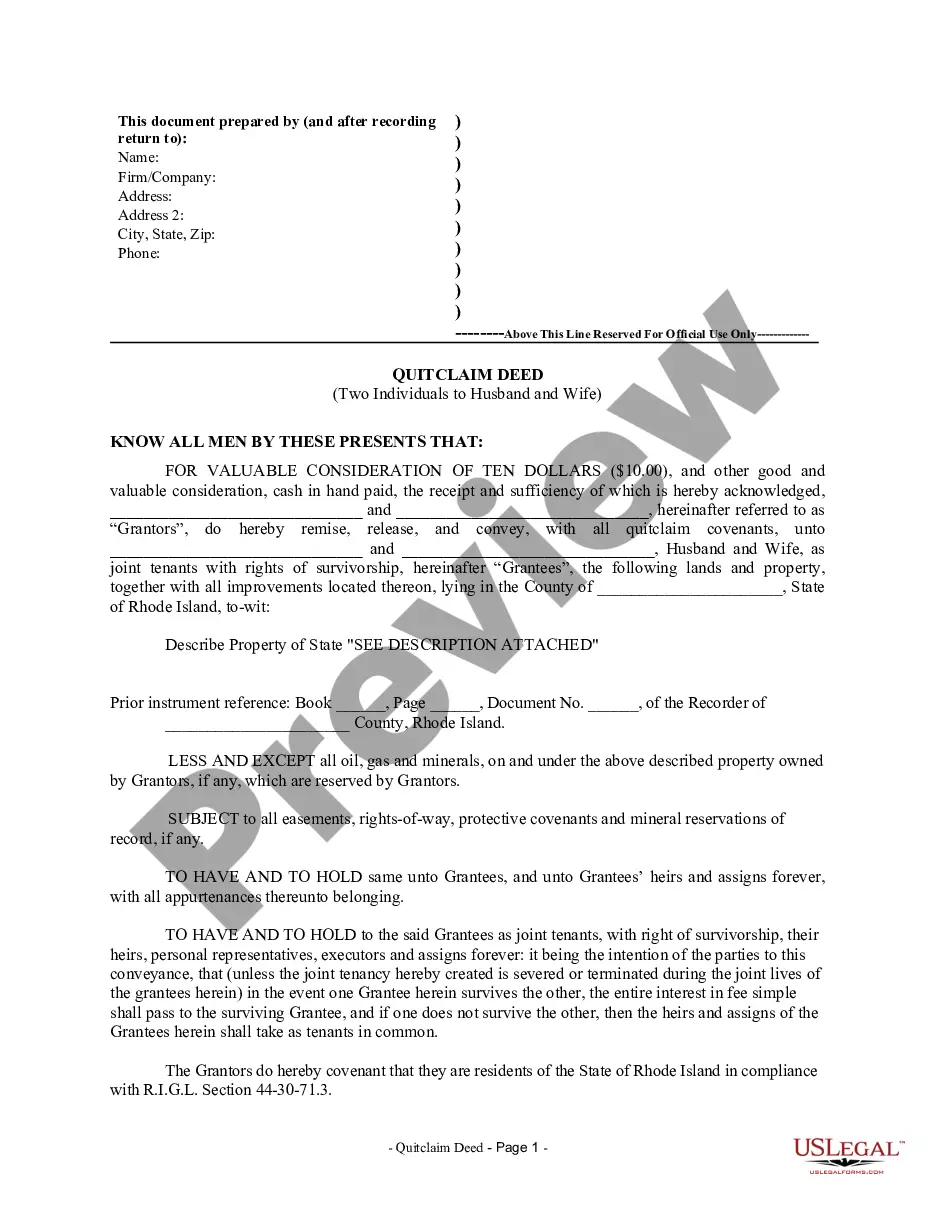

The Suggestion for Writ of Garnishment is a legal document filed by a creditor requesting the court to order a third party, known as the garnishee, to pay the amount owed by the debtor directly to the creditor. This writ is typically used when a judgment has been obtained against the debtor, and the creditor seeks to collect on that judgment through the garnishee, who may hold money or property belonging to the debtor.

How to complete a form

When completing the Suggestion for Writ of Garnishment, follow these steps:

- Identify all relevant parties: Include the names of the plaintiff (creditor) and defendant (debtor).

- Provide details of the judgment: Include the date of the judgment, the amount owed, and any applicable interest and attorney fees.

- Identify the garnishee: Include the name and address of the third party who may owe money or hold property of the debtor.

- Sign the document: Ensure the document is signed and dated by the creditor or their attorney.

Ensure all details are accurate to avoid delays in the garnishment process.

Legal use and context

The Suggestion for Writ of Garnishment is utilized in civil cases where a creditor holds a court judgment against a debtor. By filing this document, the creditor notifies the court of the intent to garnishee a third party. This garnishment can be directed towards wages, bank accounts, or other types of assets held by the garnishee. The procedure is governed by state-specific laws, and compliance is crucial to ensure successful enforcement of the judgment.

Key components of the form

Essential components of the Suggestion for Writ of Garnishment include:

- Case Information: Details regarding the court case number and the names of all parties involved.

- Judgment Details: Information on the judgment amount and date.

- Garnishee Information: The name and address of the garnishee.

- Creditor’s Signature: The form must be signed by the creditor or their attorney to be valid.

Common mistakes to avoid when using this form

To maximize the chances of a successful garnishment, avoid these common errors:

- Inaccurate Information: Double-check names, addresses, and case numbers to ensure accuracy.

- Omitting Details: Make sure to include all relevant judgment details, including amounts.

- Employer Identification: Ensure the garnishee is correctly identified, especially if it’s an employer.

Addressing these issues can help streamline the garnishment process.

What to expect during notarization or witnessing

When a Suggestion for Writ of Garnishment requires notarization, follow these guidelines:

- Identify the Notary: Locate a licensed notary public who can witness signatures.

- Present Identification: Bring valid identification to confirm your identity.

- Sign in Presence of Notary: Do not sign the document until you are in the presence of the notary, who will then notarize the document.

Having the document notarized ensures its validity and enforceability in court.

Key takeaways

The Suggestion for Writ of Garnishment is a crucial legal tool for creditors seeking to enforce a judgment. Ensure that the form is completed accurately, includes all relevant details, and is signed appropriately. Avoid common mistakes to increase effectiveness, and be prepared for the notarization process to validate the document legally.

How to fill out Suggestion For Writ Of Garnishment?

Aren't you tired of choosing from countless templates every time you want to create a Suggestion for Writ of Garnishment? US Legal Forms eliminates the wasted time numerous American people spend searching the internet for appropriate tax and legal forms. Our professional crew of attorneys is constantly updating the state-specific Samples collection, to ensure that it always provides the appropriate files for your situation.

If you’re a US Legal Forms subscriber, just log in to your account and click on the Download button. After that, the form may be found in the My Forms tab.

Visitors who don't have an active subscription need to complete a few simple actions before having the capability to download their Suggestion for Writ of Garnishment:

- Use the Preview function and read the form description (if available) to make certain that it’s the correct document for what you’re looking for.

- Pay attention to the applicability of the sample, meaning make sure it's the appropriate template for the state and situation.

- Make use of the Search field on top of the web page if you want to look for another document.

- Click Buy Now and choose a convenient pricing plan.

- Create an account and pay for the services using a credit card or a PayPal.

- Get your template in a needed format to finish, print, and sign the document.

Once you have followed the step-by-step recommendations above, you'll always be able to log in and download whatever document you will need for whatever state you need it in. With US Legal Forms, finishing Suggestion for Writ of Garnishment samples or any other official documents is simple. Get started now, and don't forget to double-check your examples with certified lawyers!

Form popularity

FAQ

After the Writ is sent to the Sheriff, you may call the Sheriff's office to inquire about the status of execution efforts.In the event the Sheriff locates property on which to levy, he will contact you to request an advancement of fees. The property may then be seized and sold at a Sheriff's public auction.

A Writ of Possession in NC gives the county sheriff the authority to remove the tenant out of your rental property. After the Writ of Possession is issued by the court, the sheriff would be required to carry out the eviction seven days after it's issued.

Served By: The writ is served by the U.S. Marshal or other person, presumably a law enforcement officer, specially appointed by the court pursuant to Federal Rule of Civil Procedure 4.1(a).

The creditor must serve the Writ of Garnishment on the garnishee via certified mail, restricted delivery, private process, or sheriff/constable. For more information on service of process see Frequently Asked Questions about Service.

North Carolina is unique in that it doesn't allow a creditor with a money judgment to garnish wages.The only debts that North Carolina allows a creditor to collect using a wage garnishment are as follows: unpaid income taxes. alimony.

Identify The Funds Or Asset You Want To Collect. Prepare The Writ Of Execution. Prepare The Notice of Execution. Prepare The Writ Of Garnishment. Prepare Instructions To The Sheriff Or Constable. Have Your Papers Served And Watch For A Claim Of Exemption. Track Your Collection And Judgment.

Wage garnishment can follow a debtor from job to job, but it requires separate court orders. This means a creditor will need to request the wage garnishment every time a person changes jobs.

When a court issues a writ of execution, a sheriff, deputy sheriff, or a court official is usually charged with taking possession of any property that is owed to the plaintiff. If the property is money, the debtor's bank account may be frozen or the funds may be moved into a holding account.

The writ gives the Sheriff the authority to seize property of the judgment debtor and is valid for 180 days after its issuance. You must give the Sheriff signed, written instructions to levy on (seize) and sell, if necessary, specific property belonging to the debtor to satisfy your judgment.