Texas Credit Memo Request Form

Description

How to fill out Credit Memo Request Form?

If you need to aggregate, obtain, or produce legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the website's user-friendly and convenient search to locate the documents you need.

Various templates for business and personal use are organized by categories and claims, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you obtained within your account. Visit the My documents section and choose a form to print or download again.

Stay competitive and download, as well as print the Texas Credit Memo Request Form with US Legal Forms. There are numerous professional and state-specific templates you can utilize for your business or personal needs.

- Use US Legal Forms to find the Texas Credit Memo Request Form with just a couple of clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Texas Credit Memo Request Form.

- You can also access forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/county.

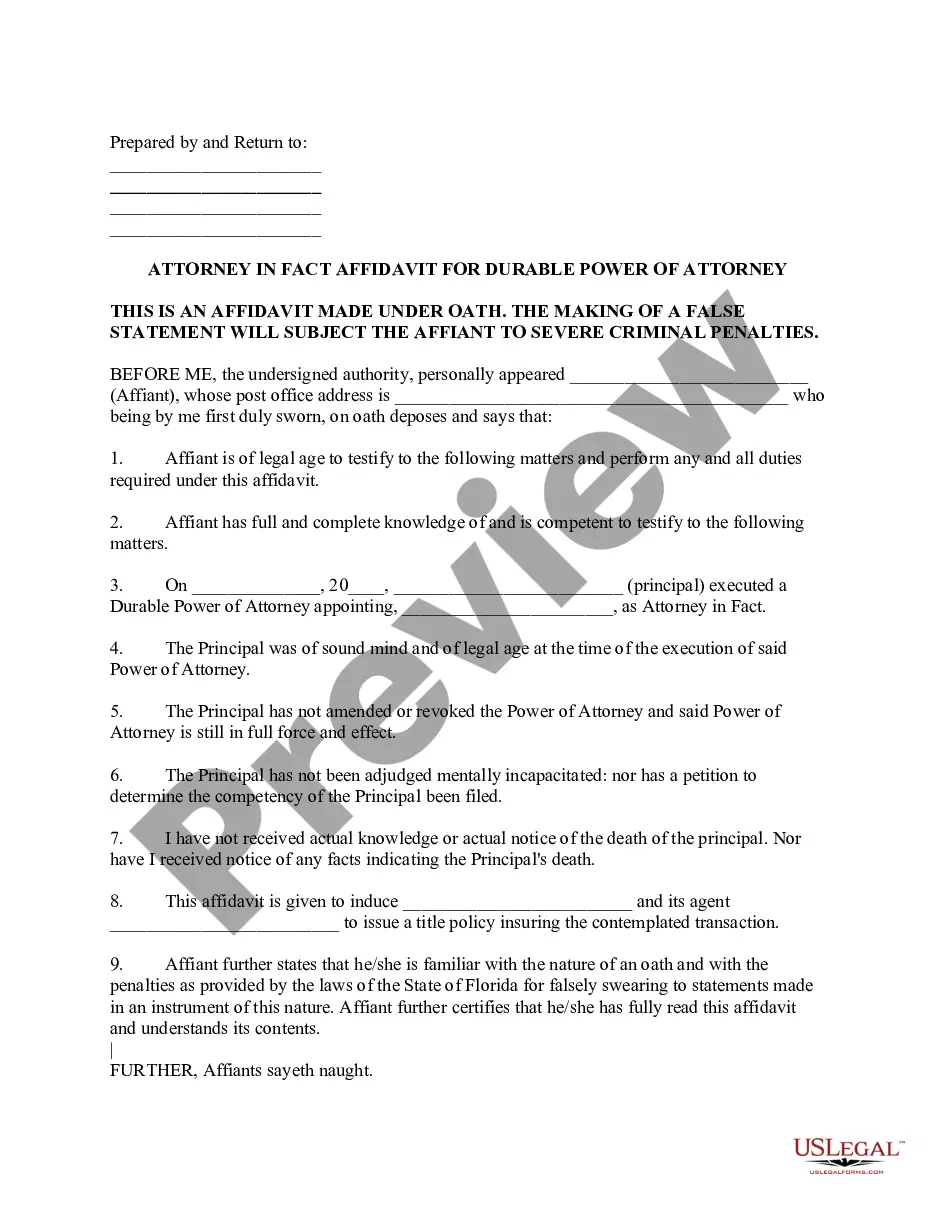

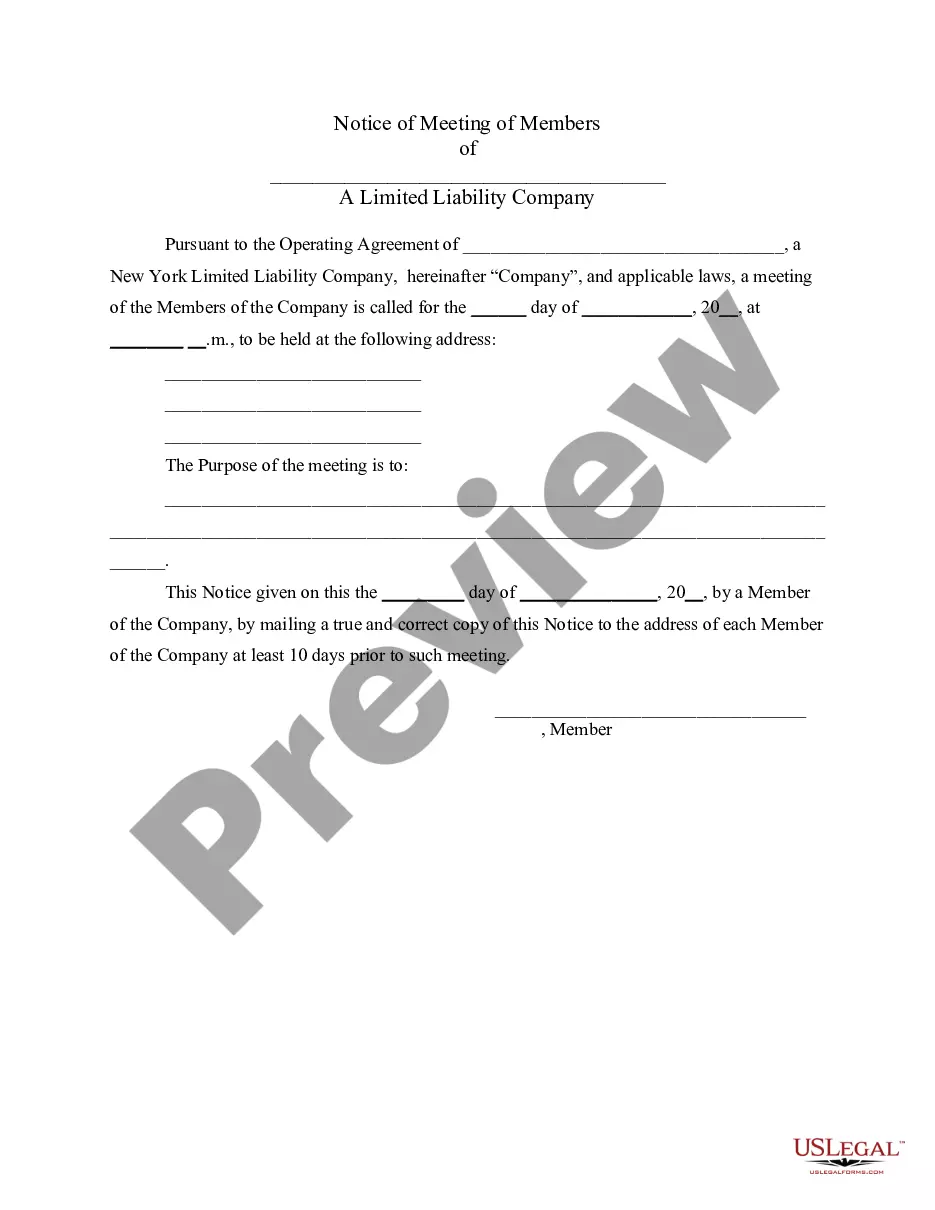

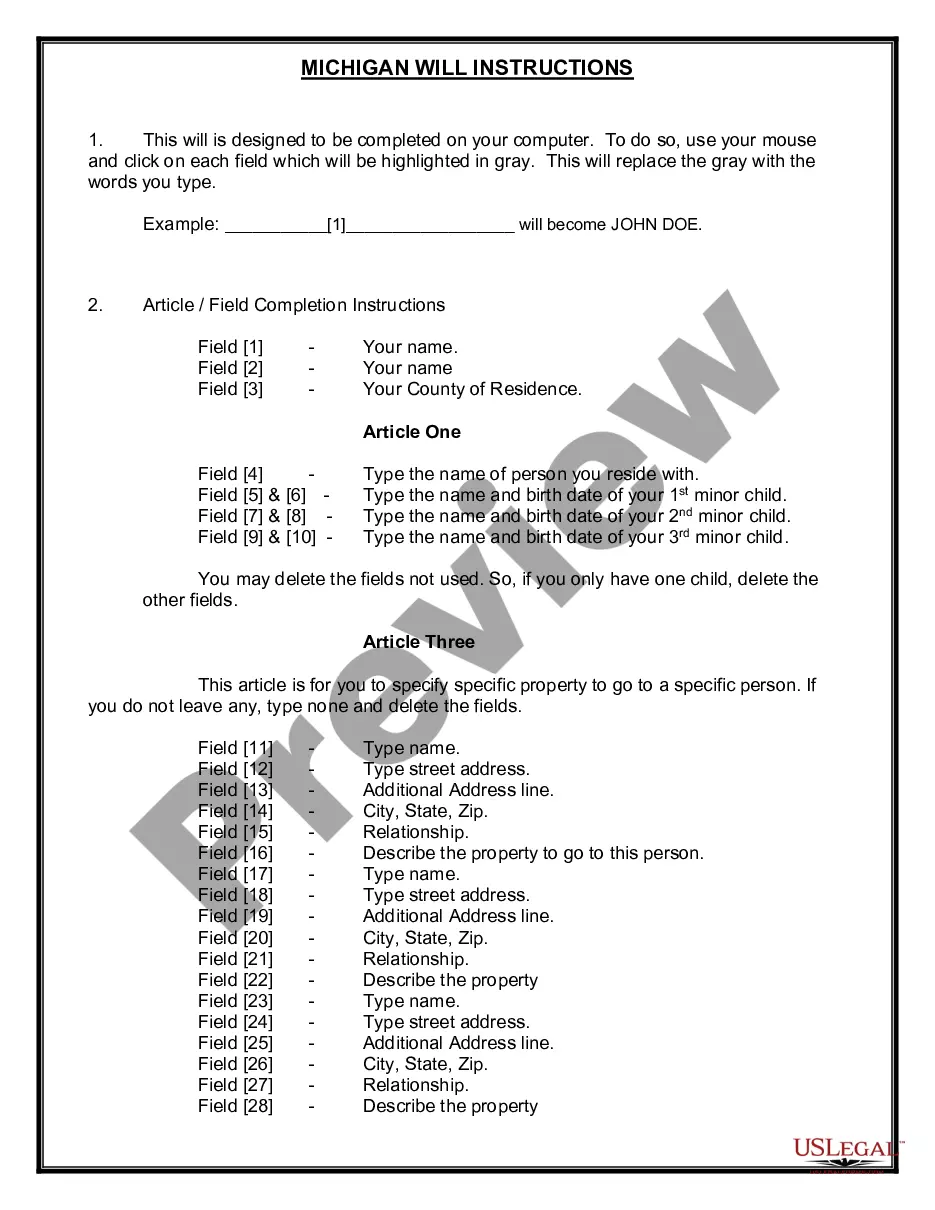

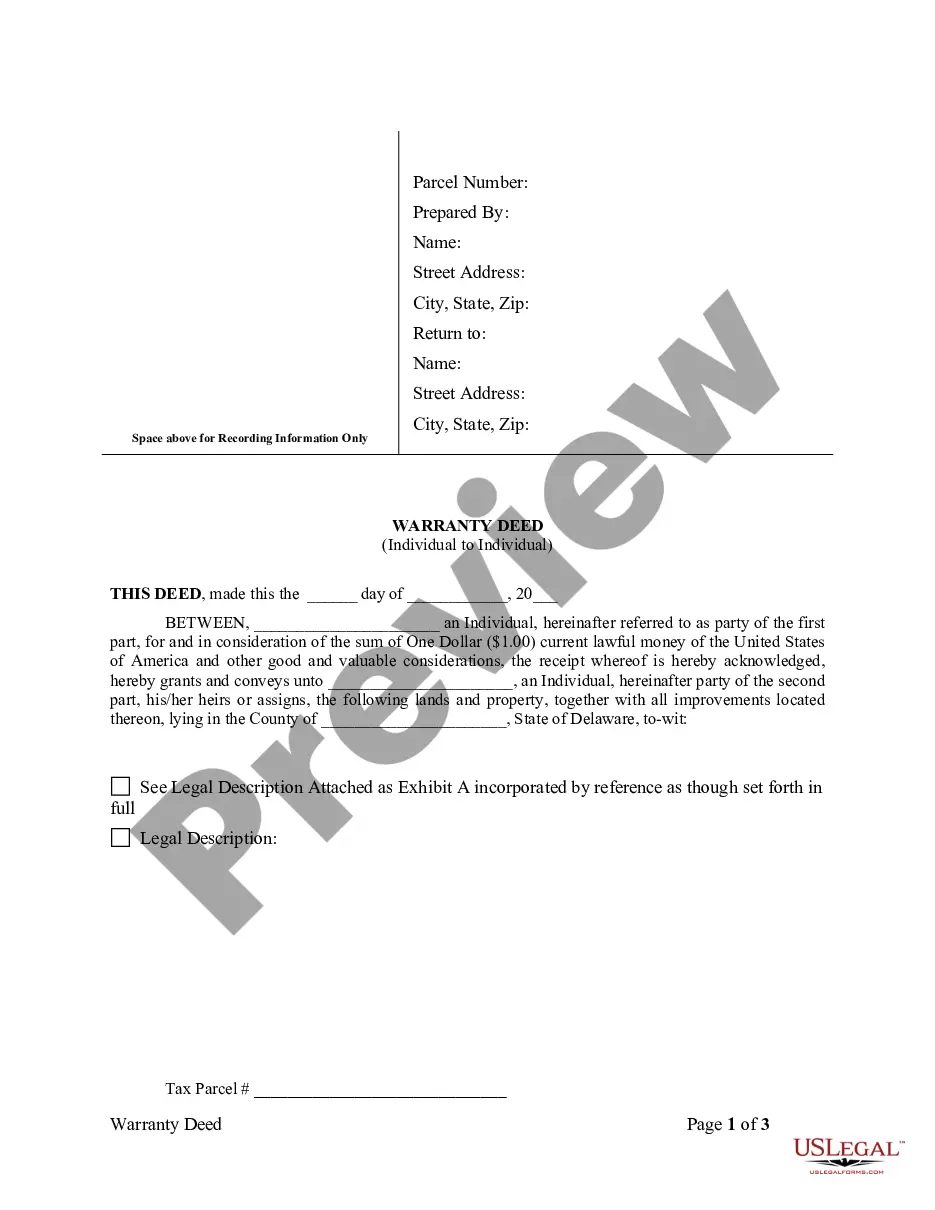

- Step 2. Use the Preview button to review the form's content. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Get it now button. Choose the pricing plan you prefer and provide your details to register for the account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Texas Credit Memo Request Form.

Form popularity

FAQ

A debit memo is common in the banking industry in several situations. For example, a bank may issue a debit memo when it assesses fees. The fee will be debited (or deducted) from the customer's account and recorded as a debit memorandum to indicate that it is an adjustment rather than a transaction.

A few examples of a bank credit memo appearing in a company's bank account include: The bank adding interest that was earned for having money on deposit. The bank having collected a note for the company. A refund of a previous bank charge.

In a buyer's double-entry accounting system, a credit memo is recorded as a debit under Accounts Payable (Creditors) and a credit under the appropriate Expense account, which is the exact opposite of the original purchase entry as the memo reduces the balance that the buyer now owes to the seller.

Two Ways to Issue Credit MemosOpen the invoice that you need to create a credit for or issue a refund check.Make sure you are in the Main tab and click the Refund/Credit button.The Credit Memo opens with a credit already created that mimics the original invoice.More items...

Definition of Credit Memo One type of credit memo is issued by a seller in order to reduce the amount that a customer owes from a previously issued sales invoice. Another type of credit memo, or credit memorandum, is issued by a bank when it increases a depositor's checking account for a certain transaction.

A transaction that reduces Amounts Receivable from a customer is a credit memo. For eg. The customer could return damaged goods. A debit memo is a transaction that reduces Amounts Payable to a vendor because; you send damaged goods back to your vendor.

A credit memo is a posting transaction that can be applied to a customer's invoice as a payment or reduction. A delayed credit is a non-posting transaction that you can include later on a customer's invoice. A refund is a posting transaction that is used when reimbursing a customer's money.

A credit memo is a posting transaction that can be applied to a customer's invoice as a payment or reduction. A delayed credit is a non-posting transaction that you can include later on a customer's invoice. A refund is a posting transaction that is used when reimbursing a customer's money.

The credit memorandum definition or memo is a form or document, sometimes called a credit memo invoice, that informs a buyer that the seller will be decreasing or crediting the amount that the buyer owes in accounts payable, thus decreasing the amount of accounts receivable in the seller's account.

A credit memo is a posting transaction that can be applied to a customer's invoice as a payment or reduction. A delayed credit is a non-posting transaction that you can include later on a customer's invoice. A refund is a posting transaction that is used when reimbursing a customer's money.