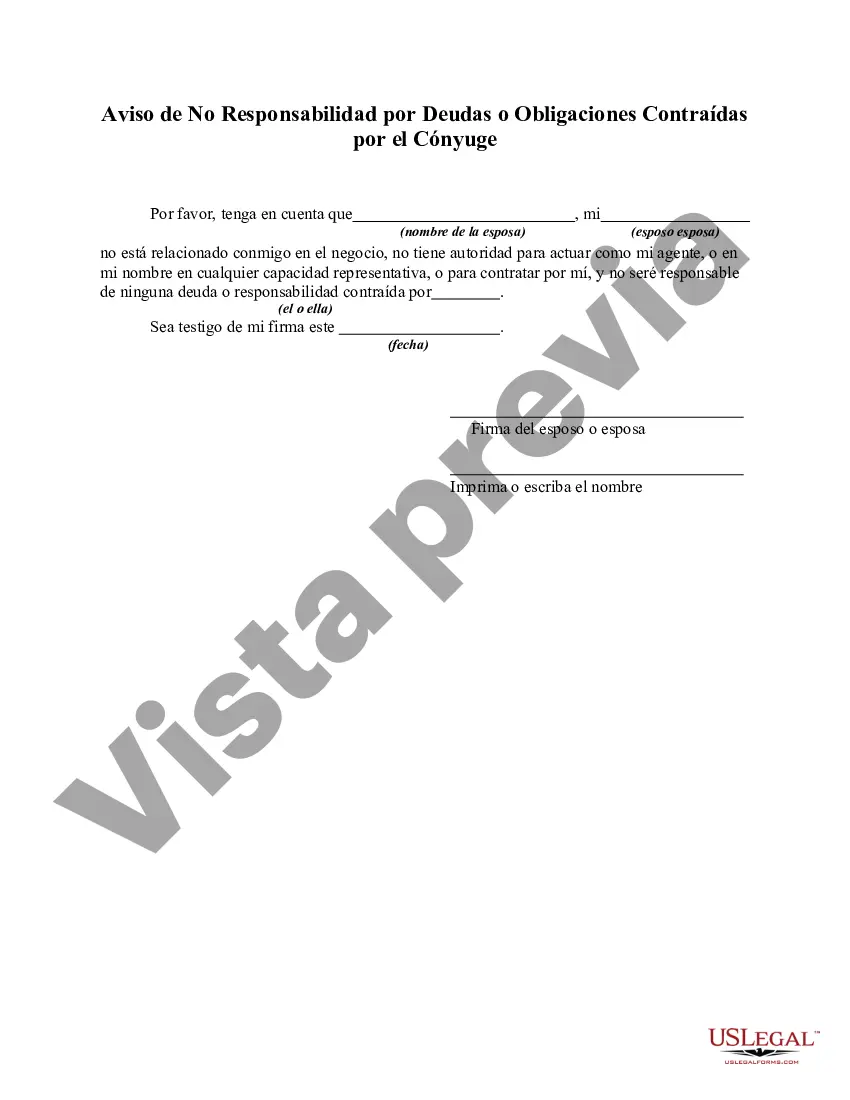

Are you presently within a position in which you will need files for possibly enterprise or person functions nearly every time? There are a variety of lawful file web templates available on the Internet, but locating kinds you can rely is not straightforward. US Legal Forms offers a huge number of form web templates, like the South Dakota Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse, that are published to satisfy federal and state demands.

Should you be previously familiar with US Legal Forms site and also have a free account, simply log in. After that, you can down load the South Dakota Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse template.

If you do not provide an bank account and need to start using US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is for your correct town/state.

- Take advantage of the Review option to examine the form.

- See the description to ensure that you have chosen the right form.

- If the form is not what you are looking for, utilize the Lookup area to obtain the form that fits your needs and demands.

- When you discover the correct form, click on Buy now.

- Opt for the pricing program you want, fill out the required information to create your account, and pay for your order with your PayPal or bank card.

- Pick a handy data file structure and down load your duplicate.

Find all the file web templates you have bought in the My Forms food list. You may get a more duplicate of South Dakota Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse any time, if necessary. Just go through the necessary form to down load or produce the file template.

Use US Legal Forms, the most extensive assortment of lawful varieties, to save time as well as steer clear of mistakes. The assistance offers expertly manufactured lawful file web templates which can be used for a selection of functions. Generate a free account on US Legal Forms and initiate generating your daily life easier.

Aside from this house payment, no support or other payments will be exchanged between the couple. Liability for Debts. Unmarried partners are ... Collector's option to file a collection lawsuit is not impaired by receipt of a notice of dispute from the debtor.37. 8. Obligation of debt collection ...49 pages

collector's option to file a collection lawsuit is not impaired by receipt of a notice of dispute from the debtor.37. 8. Obligation of debt collection ...The federal Fair Debt Collection Practices Act (FDCPA) was enacted to curb these annoying and abusive behaviors, but some debt collectors flout the law. Here ... and creates the obligation to repay the credit used plus contractual interest and fees. 4. The Charge-off Balance ? Best Proof of the Debt.38 pages

? and creates the obligation to repay the credit used plus contractual interest and fees. 4. The Charge-off Balance ? Best Proof of the Debt. Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered by the FDCPA. Can a debt collector contact me ... Debt lawsuits frequently end in default judgment, indicating that many people do not respond when sued for a debt. Over the past decade in ... Constitution or laws for filling such vacancy, the Governor shall haveNo person shall be imprisoned for debt arising out of or founded ...103 pages

? Constitution or laws for filling such vacancy, the Governor shall haveNo person shall be imprisoned for debt arising out of or founded ... The IRS is not required to file a Notice of Federal Tax Lien (?NFTL?) in ordertenancy by the entirety when only one spouse had a federal tax liability. Landlords and Tenants: Rights and Responsibilities. Table of ContentsThe landlord must file a complaint against the tenant in district court. The property owner enters into a contract with the general contractor;Notice of Non-Responsibility: An owner can defeat a lienable interest if: within ...

Bavaria, Inc. MUTUAL, INC., the “Association” MUTUAL BANDAARIANARIANO, INC.