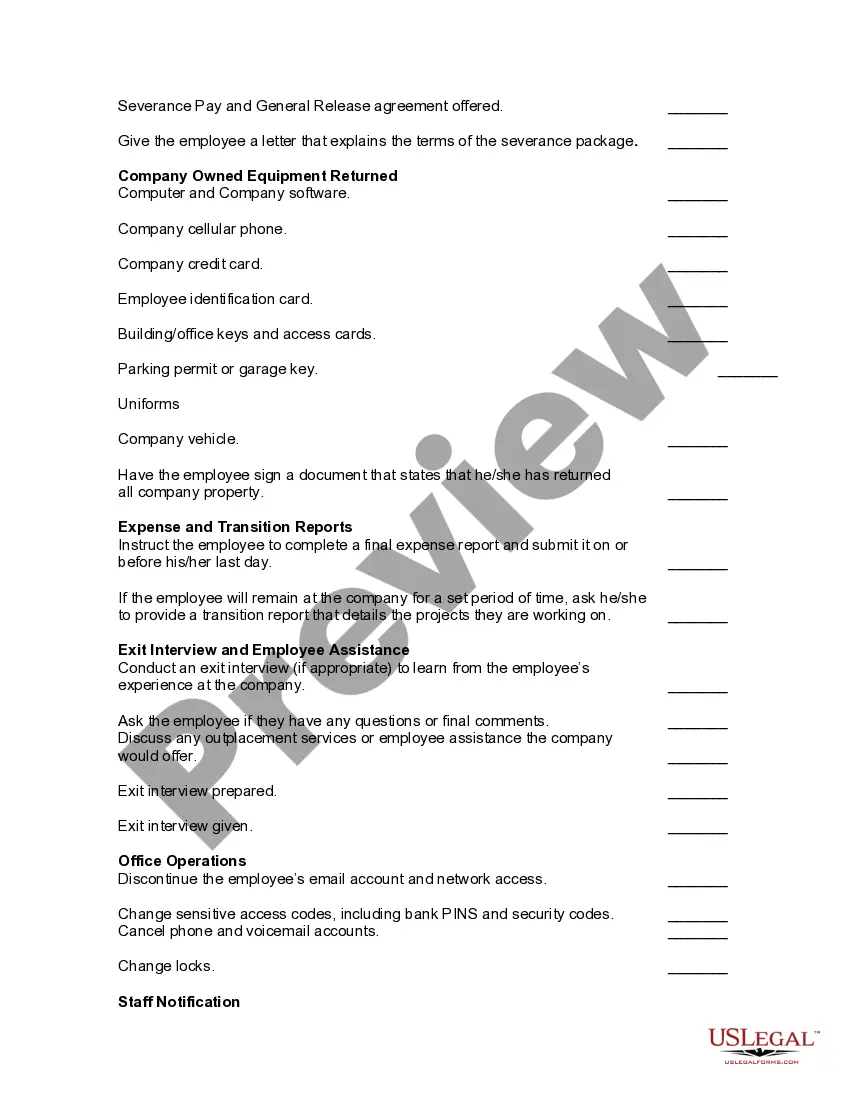

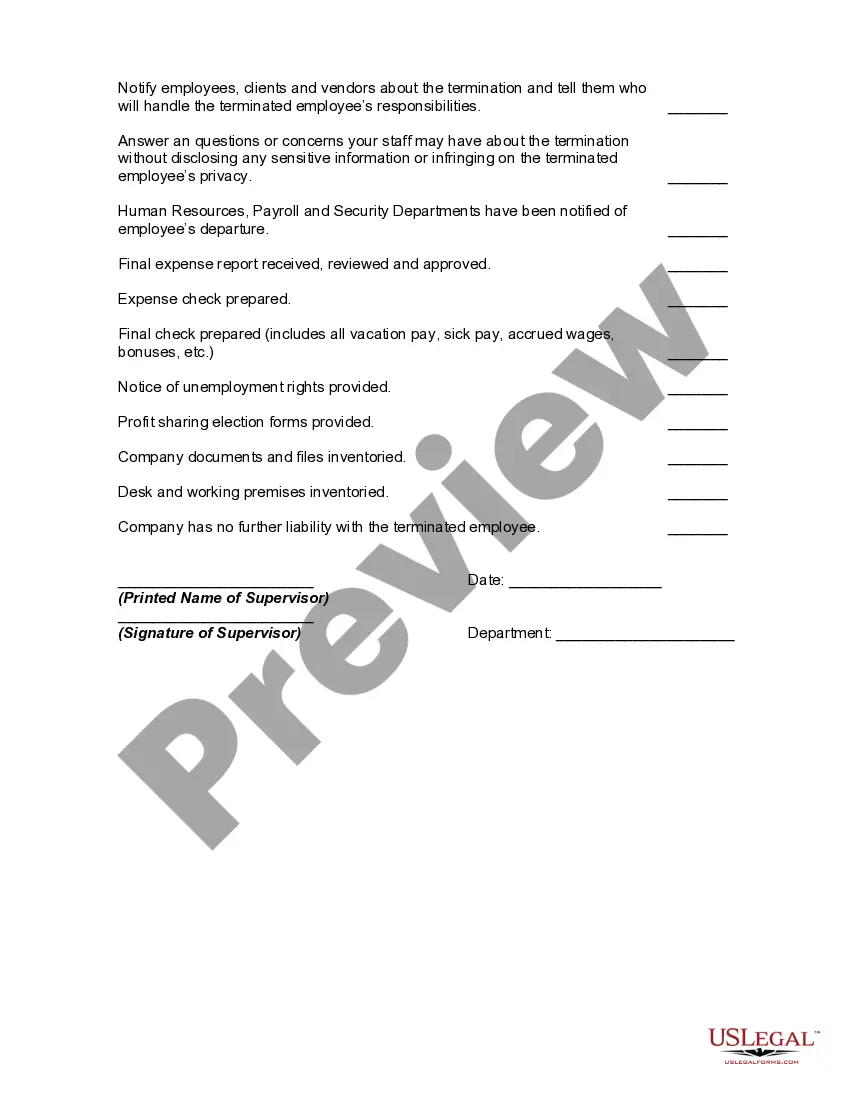

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

South Carolina Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

It is feasible to spend time online searching for the legal document template that fulfills the state and federal criteria you require.

US Legal Forms provides thousands of legal templates that are evaluated by experts.

You can easily download or print the South Carolina Worksheet - Termination of Employment from our services.

If available, utilize the Review option to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Acquire option.

- Subsequently, you can complete, modify, print, or sign the South Carolina Worksheet - Termination of Employment.

- Every legal document template you purchase is yours forever.

- To obtain another copy of a purchased form, visit the My documents section and click on the relevant option.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/area of interest.

- Review the form outline to confirm that you have chosen the correct form.

Form popularity

FAQ

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for 2019. As you may know, Form W-4 is used to determine your withholding allowances based on your unique situation so that your employer can withhold the correct federal income tax from your pay.

How do I fill out a W-4?Step 1: Enter your personal information. In this section you'll enter your name, address, filing status and Social Security number.Step 2: Complete if you have multiple jobs or two earners in your household.Step 3: Claim Dependents.Step 4: Other Adjustments.Step 5: Sign your form.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

South Carolina law requires employers to withhold state income taxes from wages paid to residents and nonresidents for services performed within the state using the formula or withholding tables provided by the state Department of Revenue (SCDOR).

If you are exempt, complete only line 1 through line 4 and line 7. Check the box for the reason you are claiming an exemption and write Exempt on line 7. Your exemption for 2022 expires February 15, 2023.

Yes. Employees claiming exempt from South Carolina Withholding need to submit an SC W-4 every year. If the employer does not receive a new SC W-4 by February 15 each year, they should withhold taxes as if the employee is single and claiming 0 allowances.

Employee instructionsComplete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

Modernizing South Carolina Withholding Over-withholding is all of the money that was taken out of taxpayers' wages that was not needed to pay their state income taxes. In other words, the government took more money than it should have and must return it to taxpayers through Individual Income Tax refunds.

To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.