Puerto Rico Minutes for Corporation

Description

How to fill out Minutes For Corporation?

You might invest numerous hours online attempting to locate the legal document template that complies with the state and federal requirements you have. US Legal Forms offers a vast array of legal documents that are verified by professionals.

You can download or print the Puerto Rico Minutes for Corporation through the service.

If you possess a US Legal Forms account, you can sign in and press the Download button. After that, you can complete, modify, print, or sign the Puerto Rico Minutes for Corporation. Every legal document template you acquire remains your property indefinitely.

Complete the transaction. You can use your credit card or PayPal account to purchase the legal template. Obtain the format of the document and download it to your system. Make changes to the document if necessary. You can complete, modify, sign, and print the Puerto Rico Minutes for Corporation. Download and print a multitude of document templates using the US Legal Forms website, which provides the largest selection of legal documents. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of a purchased form, go to the My documents section and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice. Read the form details to confirm you have selected the accurate one.

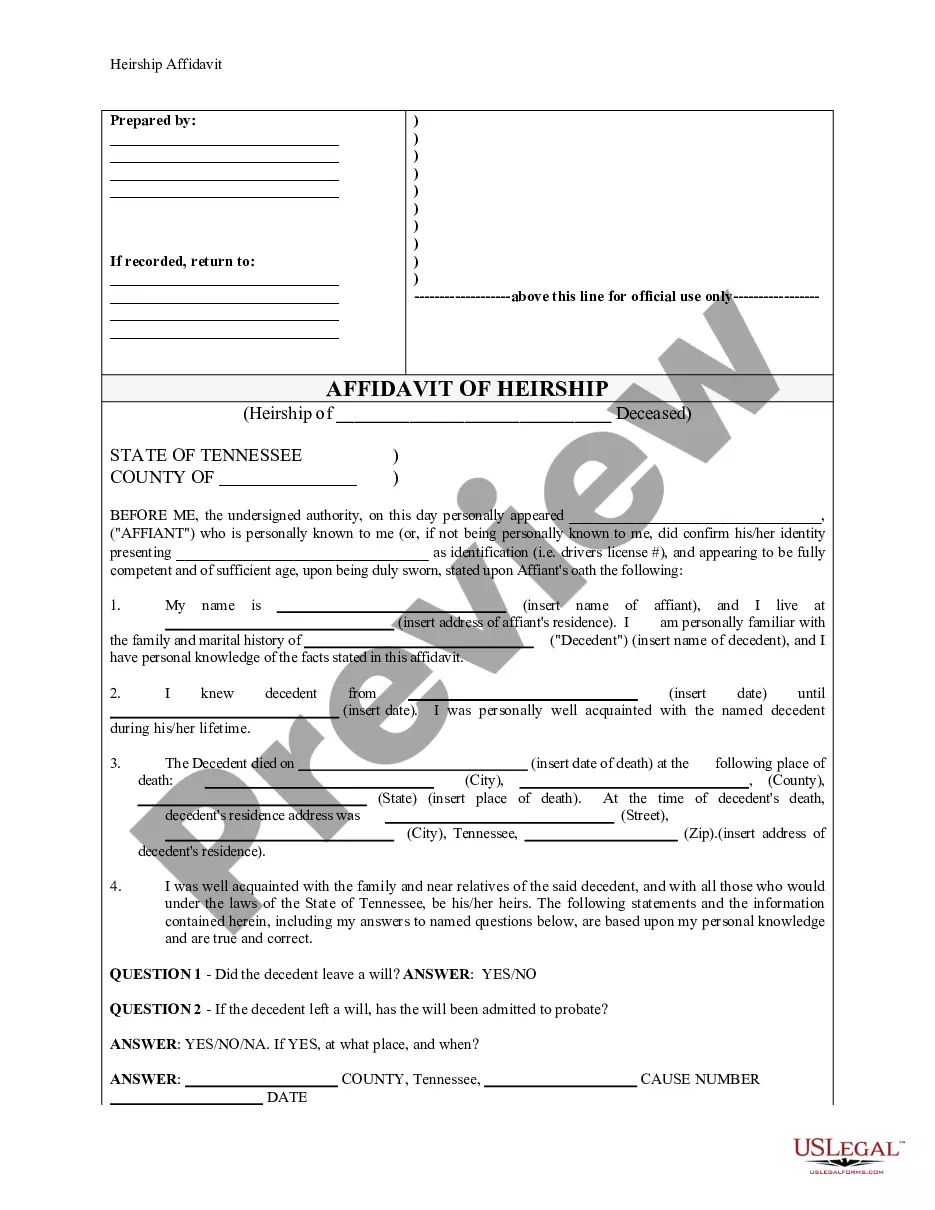

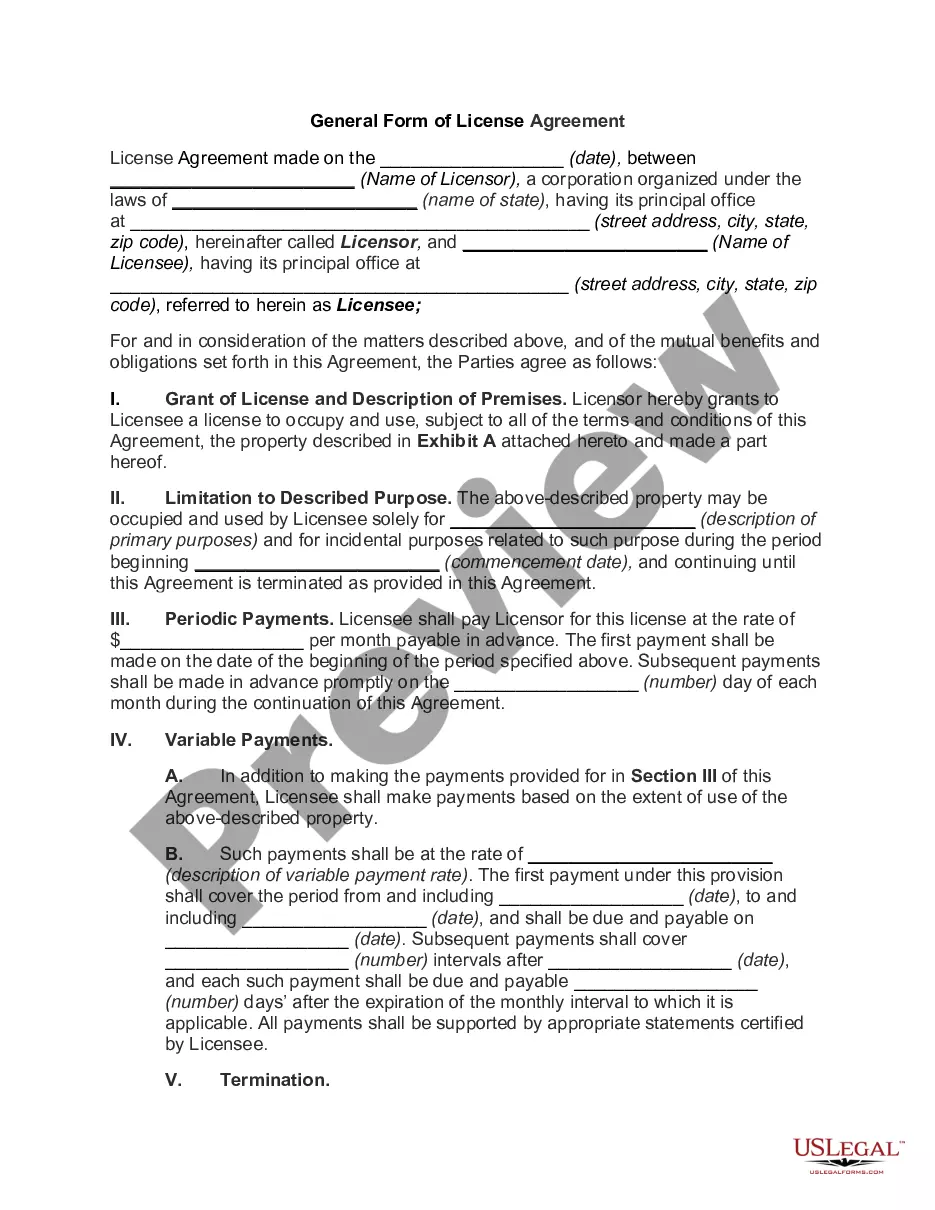

- If available, utilize the Review button to examine the document template as well.

- If you wish to obtain another version of the form, use the Search field to locate the template that suits your needs and requirements.

- Once you have identified the template you desire, click Order now to proceed.

- Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms.

Form popularity

FAQ

Puerto Rico offers various corporate tax incentives aimed at attracting new businesses and promoting economic growth. Notable incentives include reduced tax rates for eligible businesses and the potential for exemptions on certain income types. These programs can substantially lower your overall tax obligations, making it appealing to establish your corporation here. Leverage resources like uslegalforms to understand how to navigate these incentives and properly document your corporate activities with Puerto Rico Minutes for Corporation.

Puerto Rico does not have a flat 0% tax rate; however, certain tax incentives can significantly reduce your corporate tax burden. Many businesses can qualify for reduced rates under specific tax incentives if they meet eligibility criteria. Understand the benefits of incorporating in Puerto Rico since these incentives can offer considerable savings. Consulting with professionals can give you the insights needed regarding the use of Puerto Rico Minutes for Corporation to maximize these incentives.

Filing an annual report in Puerto Rico involves completing the required forms and submitting them to the Department of State. You typically need to gather important documents, including your Puerto Rico Minutes for Corporation, to accurately reflect your business activities. It's essential to ensure that you file on time to avoid penalties. Consider using uslegalforms as a resource to streamline the process and access the necessary forms.

Yes, US companies can operate in Puerto Rico without any restriction. They can take advantage of the local business environment while adhering to federal regulations. Maintaining accurate Puerto Rico Minutes for Corporation is crucial for corporate governance, ensuring that U.S. companies not only meet local requirements but also preserve their operational integrity.

Incorporating in Puerto Rico provides several benefits, including access to local tax incentives and a favorable business environment. Businesses can enjoy lower corporate taxes while benefiting from a strategic location for both U.S. and international markets. Utilizing Puerto Rico Minutes for Corporation aids in maintaining legally required records, which can enhance credibility and streamline operations.

To incorporate a company in Puerto Rico, start by choosing a unique business name and submitting the Articles of Incorporation to the Department of State. Next, you’ll need to draft the Puerto Rico Minutes for Corporation, which document your corporate meetings and decisions. This process ensures that you meet all legal requirements and establish your business successfully.

Yes, Puerto Rico is often considered a corporate tax haven, offering significant tax incentives for businesses. Under specific conditions, corporations can benefit from reduced tax rates, making it an appealing jurisdiction for incorporation. The strategic use of Puerto Rico Minutes for Corporation helps businesses navigate these tax benefits while maintaining compliance with local regulations.

Yes, a US citizen can easily start a business in Puerto Rico. The process involves registering your business with the Puerto Rico Department of State and completing the necessary requirements. You will need to prepare and maintain Puerto Rico Minutes for Corporation to document your meetings and decisions. This ensures compliance with local laws and gives your business a solid legal foundation.

Filing your Puerto Rico annual report online is easy and efficient. You will need essential corporate information, including your business registration details. Platforms like USLegalForms can guide you through the process, helping to ensure your Puerto Rico Minutes for Corporation are properly documented and up to date.

The IRS is a part of the United States government, specifically under the Department of the Treasury. It is responsible for collecting federal taxes and enforcing tax laws across the United States and its territories. Understanding how the IRS operates can be beneficial for ensuring compliance in matters like your Puerto Rico Minutes for Corporation.