This Policy Statement implements procedures to deter the misuse of material, nonpublic information in securities transactions. The Policy Statement applies to securities trading and information handling by directors, officers and employees of the company (including spouses, minor children and adult members of their households).

Oregon Policies and Procedures Designed to Detect and Prevent Insider Trading: A Comprehensive Overview In Oregon, a state in the Pacific Northwest region of the United States, various policies and procedures have been established to detect and prevent insider trading activities. Insider trading refers to the act of trading securities by individuals in possession of non-public, material information about a company. Such trading can lead to unfair advantage and market manipulation, undermining the integrity of the financial system. Key Keywords: Oregon, policies, procedures, detect, prevent, insider trading. 1. Oregon Uniform Securities Act (USA): Under the Oregon Uniform Securities Act, the State of Oregon has implemented a set of regulations and guidelines to combat insider trading. These regulations prohibit the buying or selling of securities while in possession of material non-public information and provide for both civil and criminal penalties to those found guilty of insider trading. 2. Internal Compliance Programs: To further strengthen efforts against insider trading, Oregon-based companies and financial institutions are encouraged to establish and maintain robust internal compliance programs. These programs are designed to educate employees about insider trading laws, monitor trading activities, and implement measures to detect and prevent any unlawful behavior. 3. Insider Trading Policies: Oregon companies are also advised to formulate specific insider trading policies that clearly outline the prohibitions, consequences, and reporting mechanisms related to insider trading. These policies often include guidelines on information sharing, trading restrictions during sensitive periods, and reporting suspicious activities to competent authorities. 4. Compliance Training Programs: To ensure awareness and adherence to insider trading regulations, Oregon-based companies frequently conduct compliance training programs for their employees. These training sessions familiarize individuals with the legal framework, offer real-life case studies, and emphasize the importance of maintaining strict ethical standards in the context of insider trading. 5. Monitoring and Reporting Mechanisms: Oregon's policies and procedures entail the establishment of internal mechanisms to monitor and report any suspicious trading activities. This involves the implementation of systems that track employee trades, flag potential irregularities, and encourage the reporting of any perceived breaches of insider trading rules to the company's designated compliance officer or legal department. 6. Whistleblower Protection: To encourage individuals to come forward with information regarding insider trading, Oregon laws provide certain protections for whistleblowers. Employees who report violations are shielded against retaliation, ensuring their safety and job security. 7. Coordination with Regulatory Authorities: Oregon securities regulators work in collaboration with federal regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC), to ensure effective oversight of insider trading activities. This collaboration includes the exchange of information and joint efforts to investigate potential cases of insider trading within the state. 8. Penalties and Enforcement: Oregon imposes various penalties on individuals or entities found guilty of insider trading. These penalties can include significant fines, disgorgement of ill-gotten gains, and potential imprisonment for those convicted of criminal offenses. Enforcement is carried out through active monitoring, investigation of suspicious activities, and collaboration with law enforcement agencies. Overall, Oregon has established a comprehensive framework of policies and procedures designed to detect and prevent insider trading. These measures aim to protect the integrity of the financial markets, foster a fair and level playing field for investors, and ensure that businesses operate ethically within the state's securities laws.

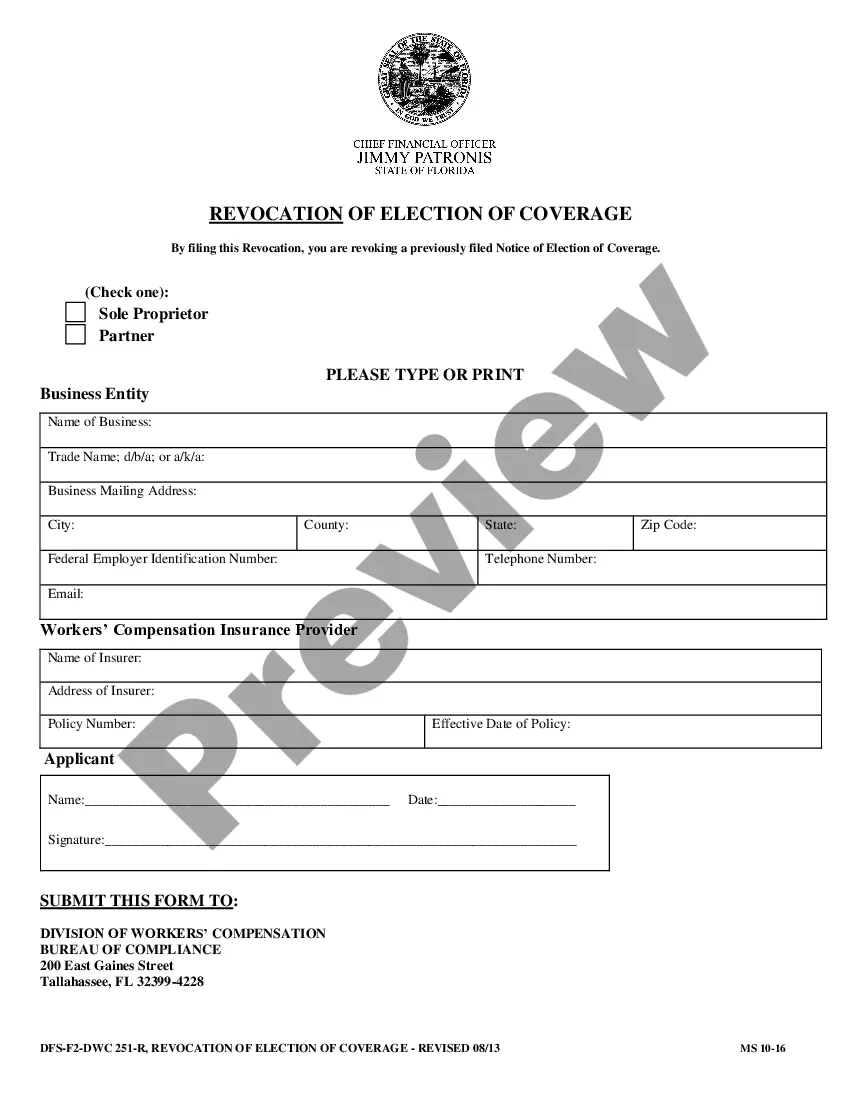

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.