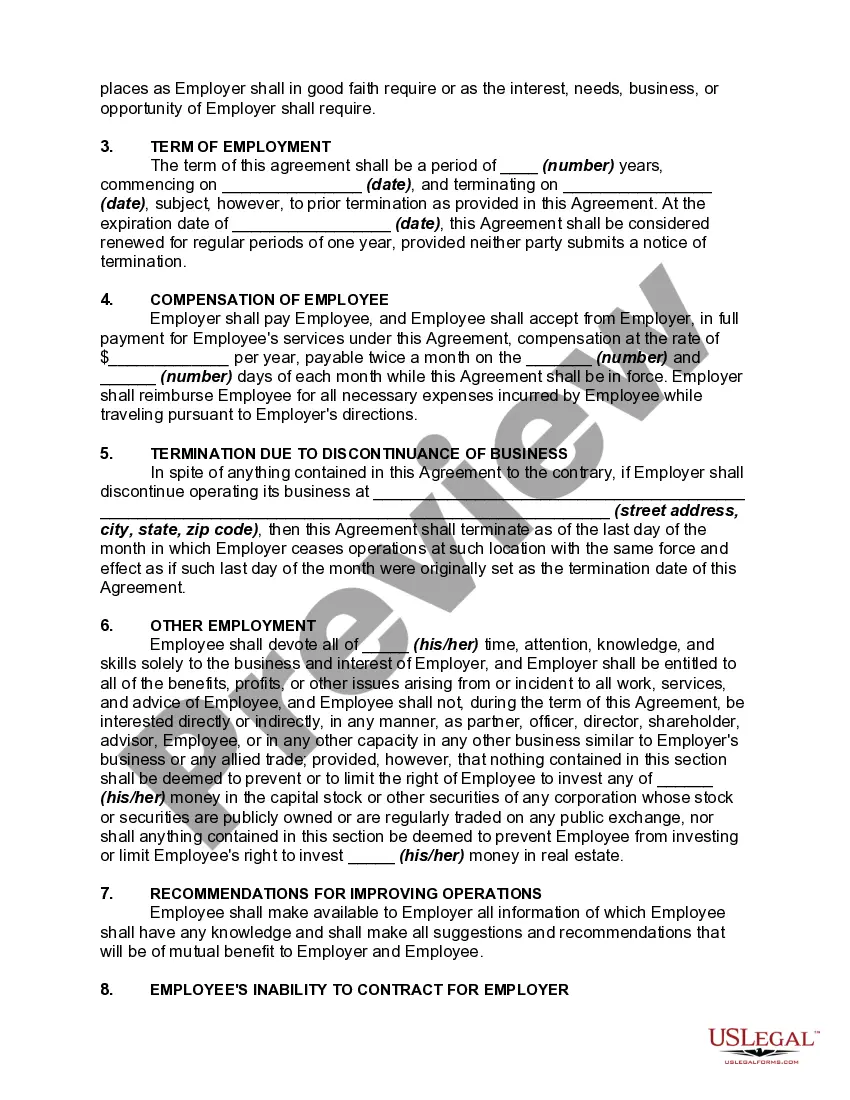

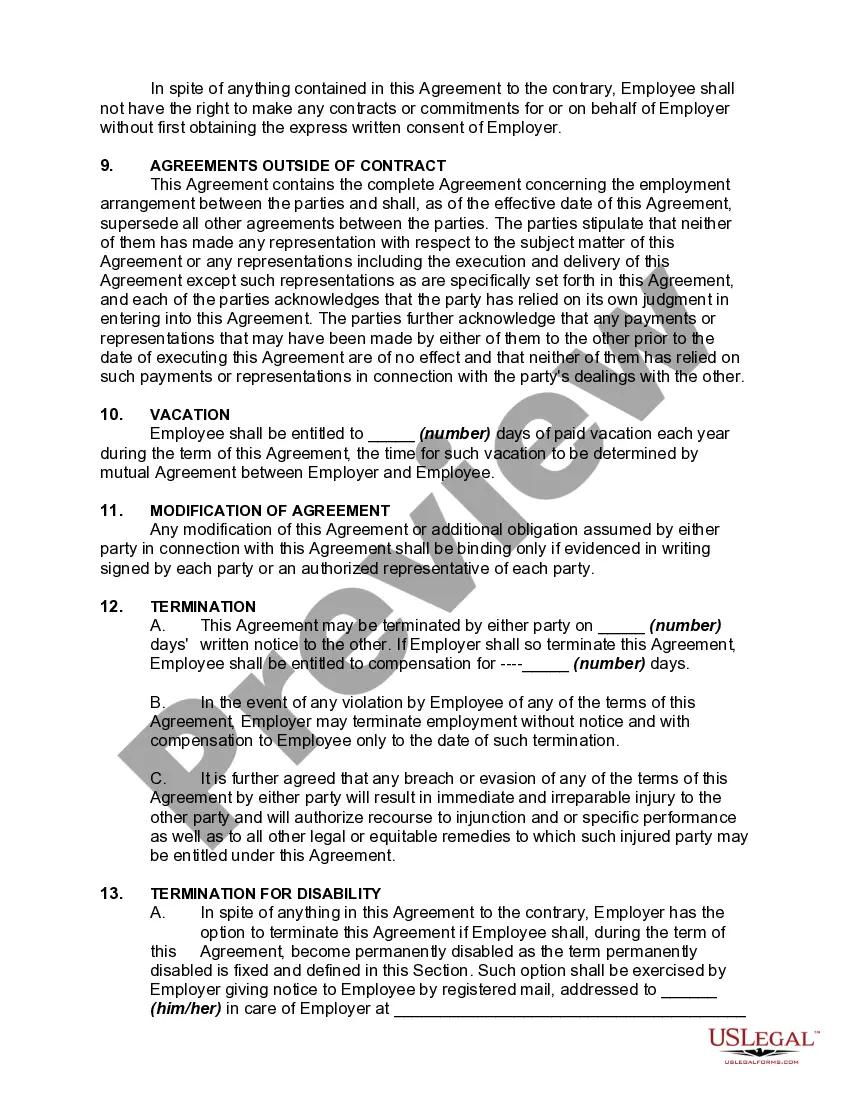

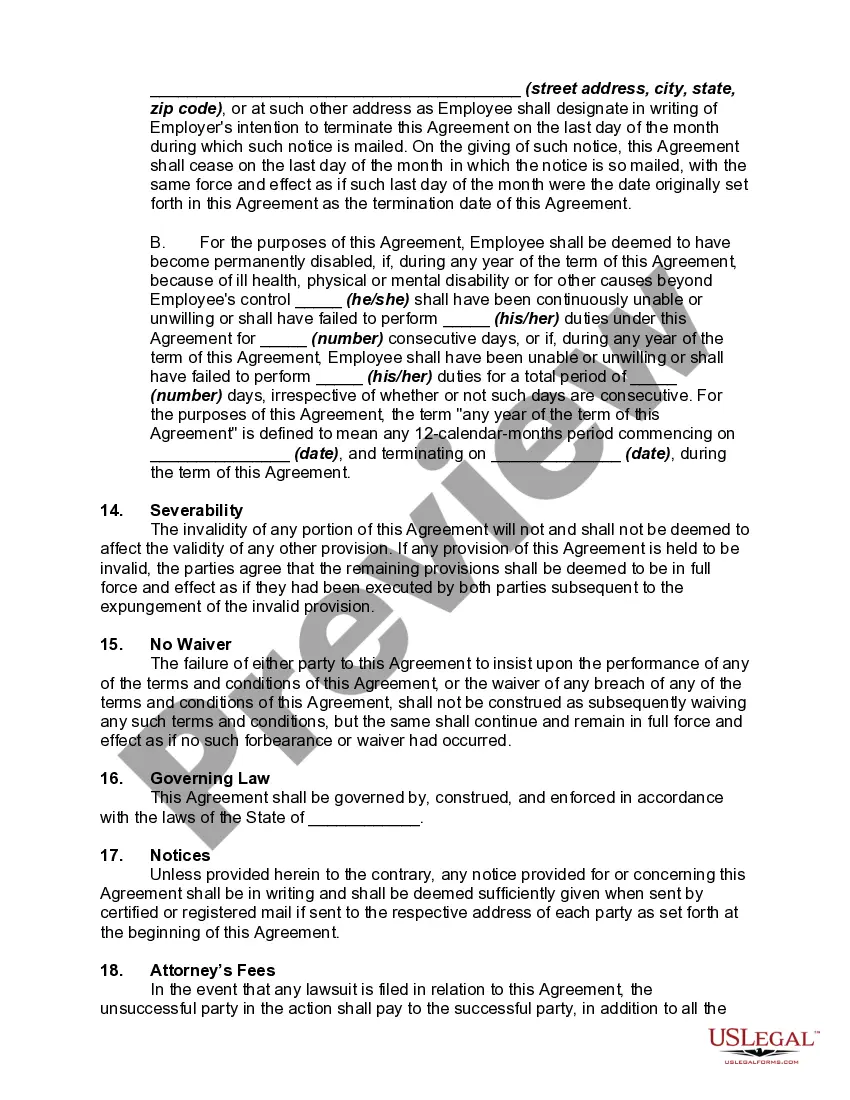

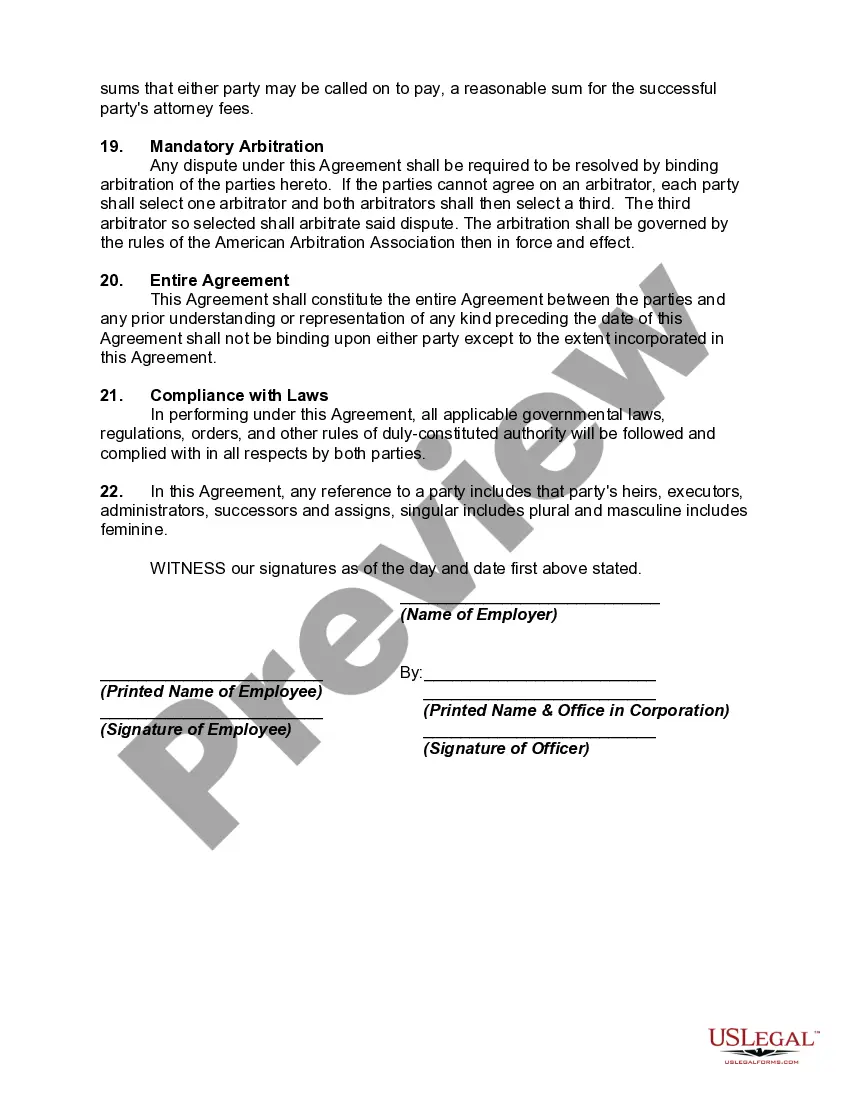

This form is a generic employment agreement.

Oregon General Form of Employment Agreement

Description

How to fill out General Form Of Employment Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal documents templates that you can obtain or create.

Utilizing the website, you can discover a vast number of documents for business and personal purposes, organized by categories, claims, or keywords. You can find the most recent versions of documents similar to the Oregon General Form of Employment Agreement within seconds.

If you already have a subscription, Log In and obtain the Oregon General Form of Employment Agreement from your US Legal Forms library. The Download button will be visible on every document you view. You can access all previously saved documents in the My documents tab of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and obtain the document on your device. Modify. Fill out, edit, and print and sign the saved Oregon General Form of Employment Agreement. Each template you add to your account has no expiration date and is yours forever. Thus, if you wish to obtain or print another copy, simply navigate to the My documents section and click on the document you need. Access the Oregon General Form of Employment Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize a plethora of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct document for your city/state.

- Click the Preview button to review the document's details.

- Examine the document details to verify that you have chosen the right document.

- If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Acquire now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Contracts are illegal when the written content therein causes those involved in the contract to act illegally. The illegality being considered should be directly related to the content of the contract and not to some outlying concept. An illegal contract is not enforceable in a court of law.

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

In Oregon, ORS 15.320 provides that Oregon law will apply to a contract for services to be performed primarily in Oregon by an Oregon resident. Many aspects of the Oregon employment relationship may be implied, including the terms of compensation and benefits as well as job duties and responsibilities.

Specific Contract Terms To IncludeIdentification: The parties must be identified completely, including full name, address, and other information. Effective date: The effective date is the date both parties have signed. Pay and benefits: Give details of pay rate, pay dates, and benefits provided by the company.

Types of Employment Contracts: Permanent employment, temporary employment and independent contractors.

A contract of employment is a legally binding agreement between you and your employer. A breach of that contract happens when either you or your employer breaks one of the terms, for example your employer doesn't pay your wages, or you don't work the agreed hours. Not all the terms of a contract are written down.

Definitions as they pertain to Oregon Employment Department Law. An employer is subject to unemployment insurance taxes when the employer pays wages of $1,000 or more in a calendar quarter, or employs one or more individuals in any part of 18 separate weeks during any calendar year.

Qualifications for EUC:Your base year wages must equal or exceed 40 times your weekly benefit amount. (If your claim pays 26 weeks of benefits, you have met this qualification.) Your most recent claim must have tired regular benefits or be expired.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

An employment contract is a signed agreement between an individual employee and an employer or a labor union. It establishes both the rights and responsibilities of the two parties: the worker and the company.