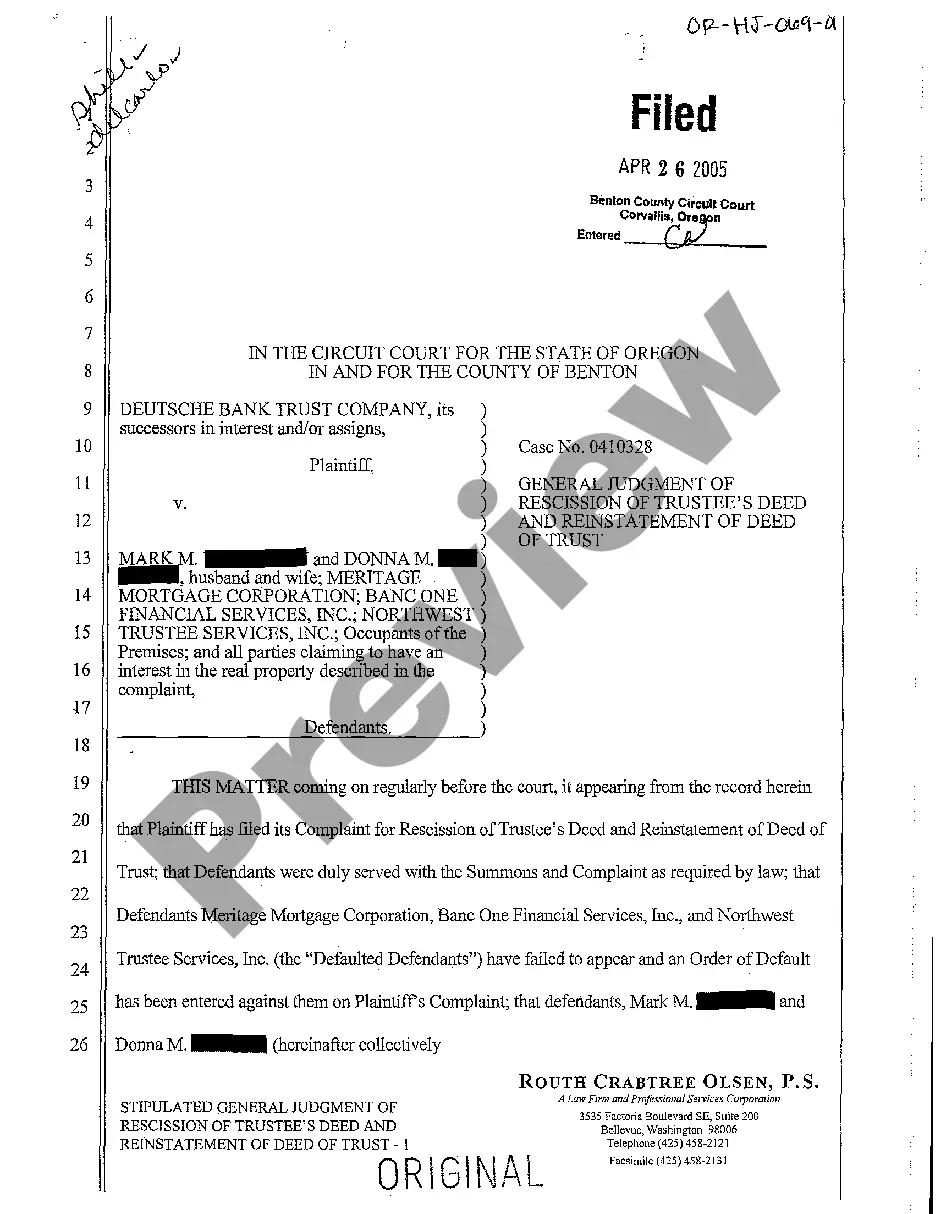

Oregon Complaint for Rescission of Trustee's Deed and Reinstatement of Deed of Trust

Description

How to fill out Oregon Complaint For Rescission Of Trustee's Deed And Reinstatement Of Deed Of Trust?

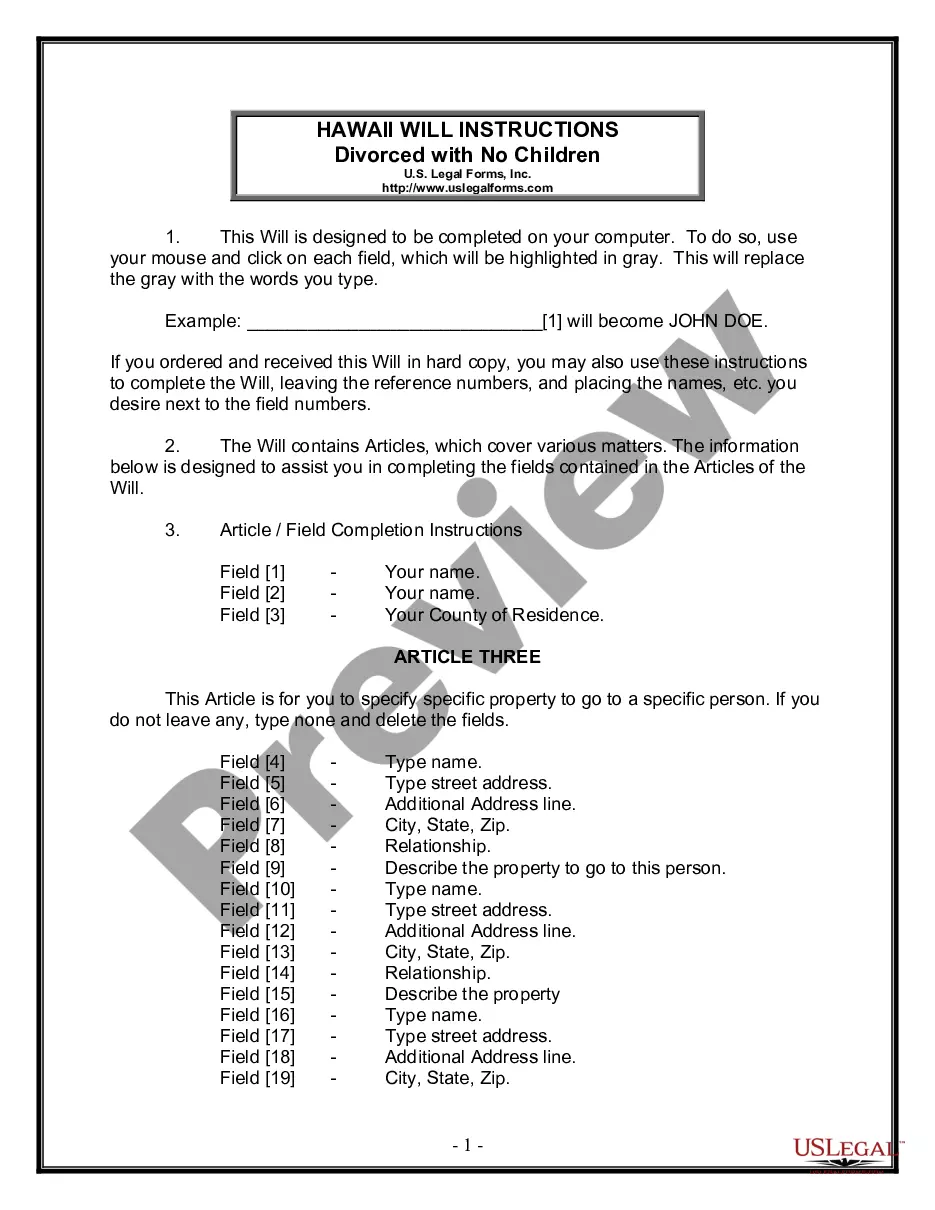

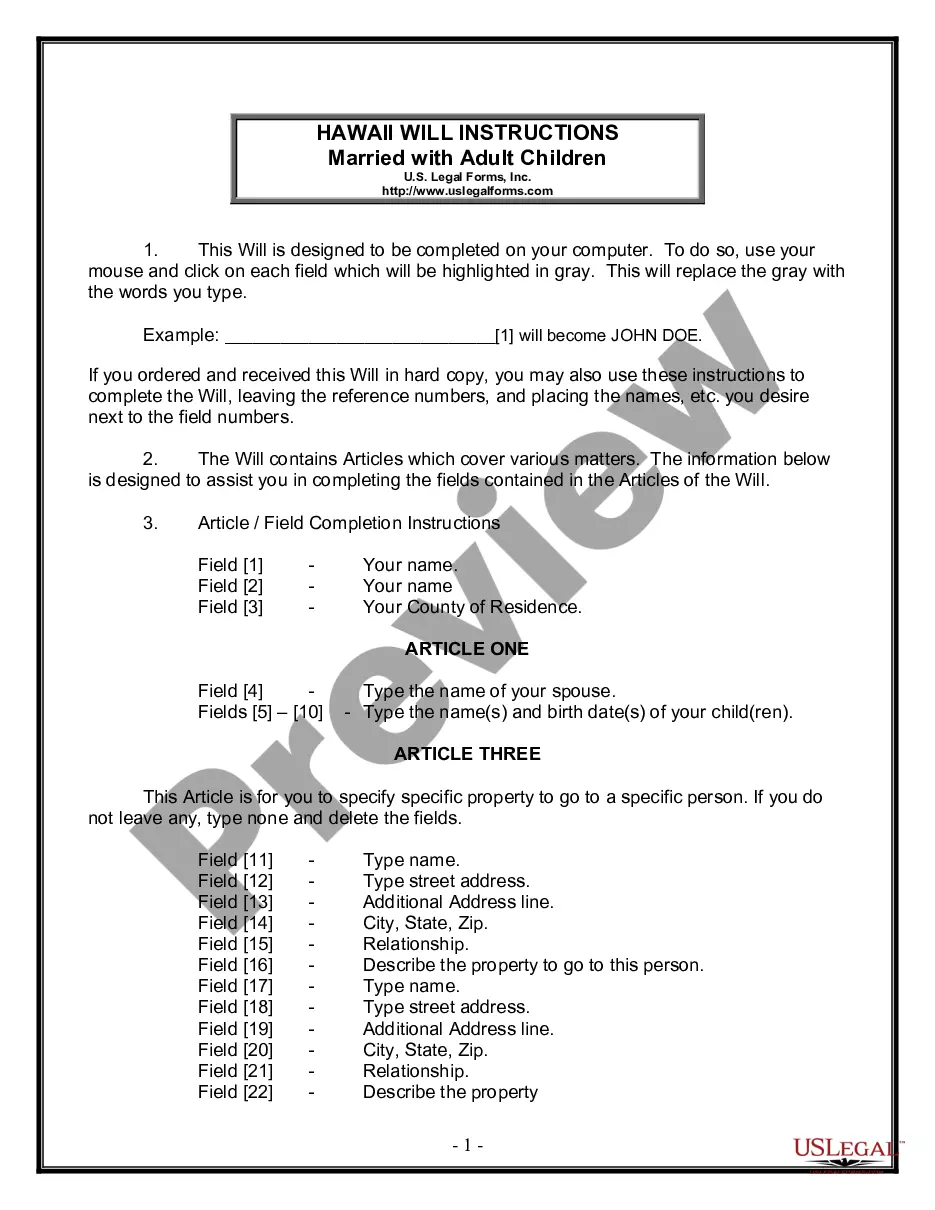

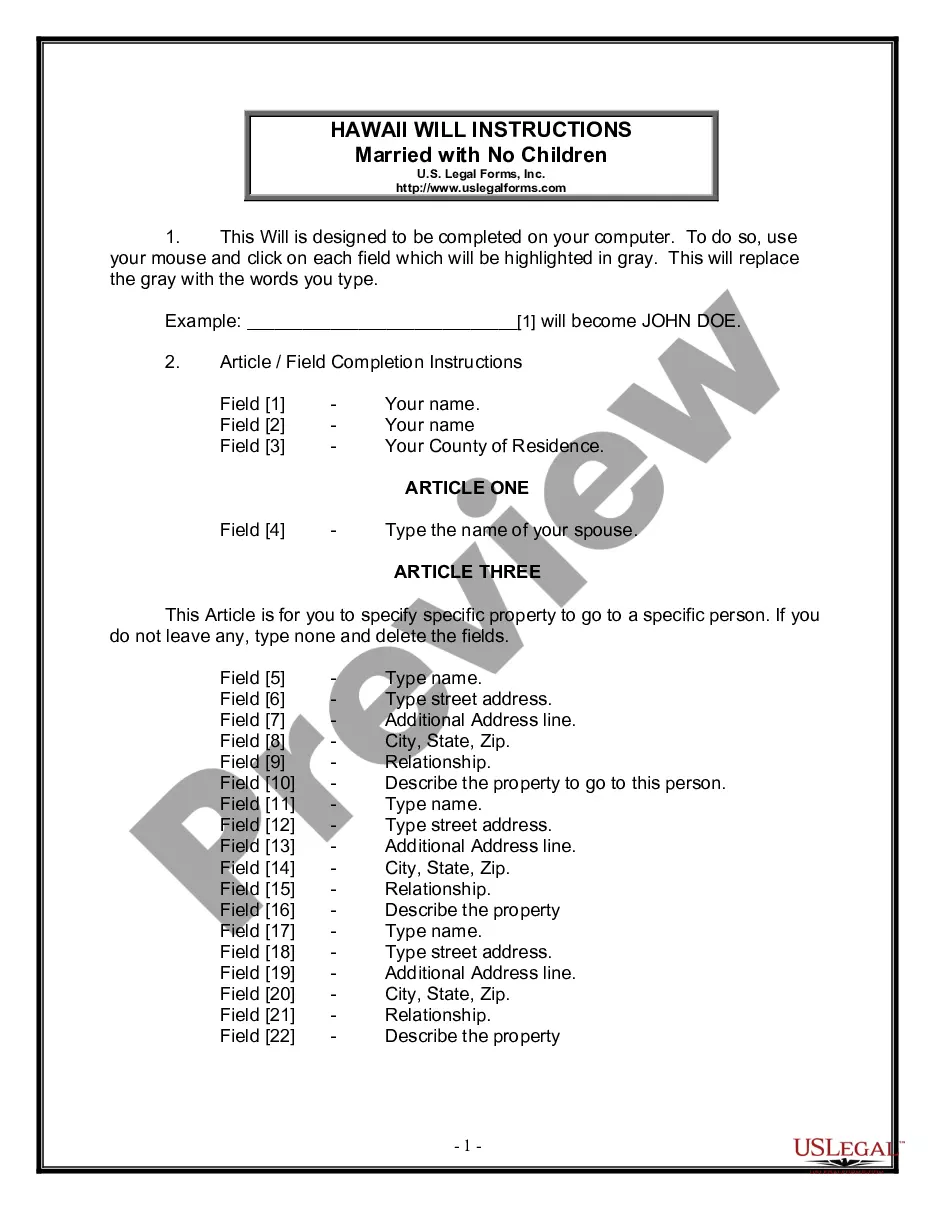

When it comes to filling out Oregon Complaint for Rescission of Trustee's Deed and Reinstatement of Deed of Trust, you almost certainly visualize an extensive process that requires choosing a appropriate sample among countless similar ones and then needing to pay a lawyer to fill it out to suit your needs. In general, that’s a slow and expensive option. Use US Legal Forms and choose the state-specific document within just clicks.

For those who have a subscription, just log in and click Download to find the Oregon Complaint for Rescission of Trustee's Deed and Reinstatement of Deed of Trust sample.

If you don’t have an account yet but want one, follow the point-by-point manual listed below:

- Make sure the document you’re saving applies in your state (or the state it’s needed in).

- Do so by reading the form’s description and by clicking on the Preview function (if available) to see the form’s information.

- Click on Buy Now button.

- Select the proper plan for your budget.

- Sign up for an account and select how you would like to pay out: by PayPal or by credit card.

- Download the file in .pdf or .docx file format.

- Get the file on your device or in your My Forms folder.

Professional legal professionals work on creating our samples so that after downloading, you don't need to bother about editing content material outside of your personal details or your business’s information. Be a part of US Legal Forms and get your Oregon Complaint for Rescission of Trustee's Deed and Reinstatement of Deed of Trust sample now.

Form popularity

FAQ

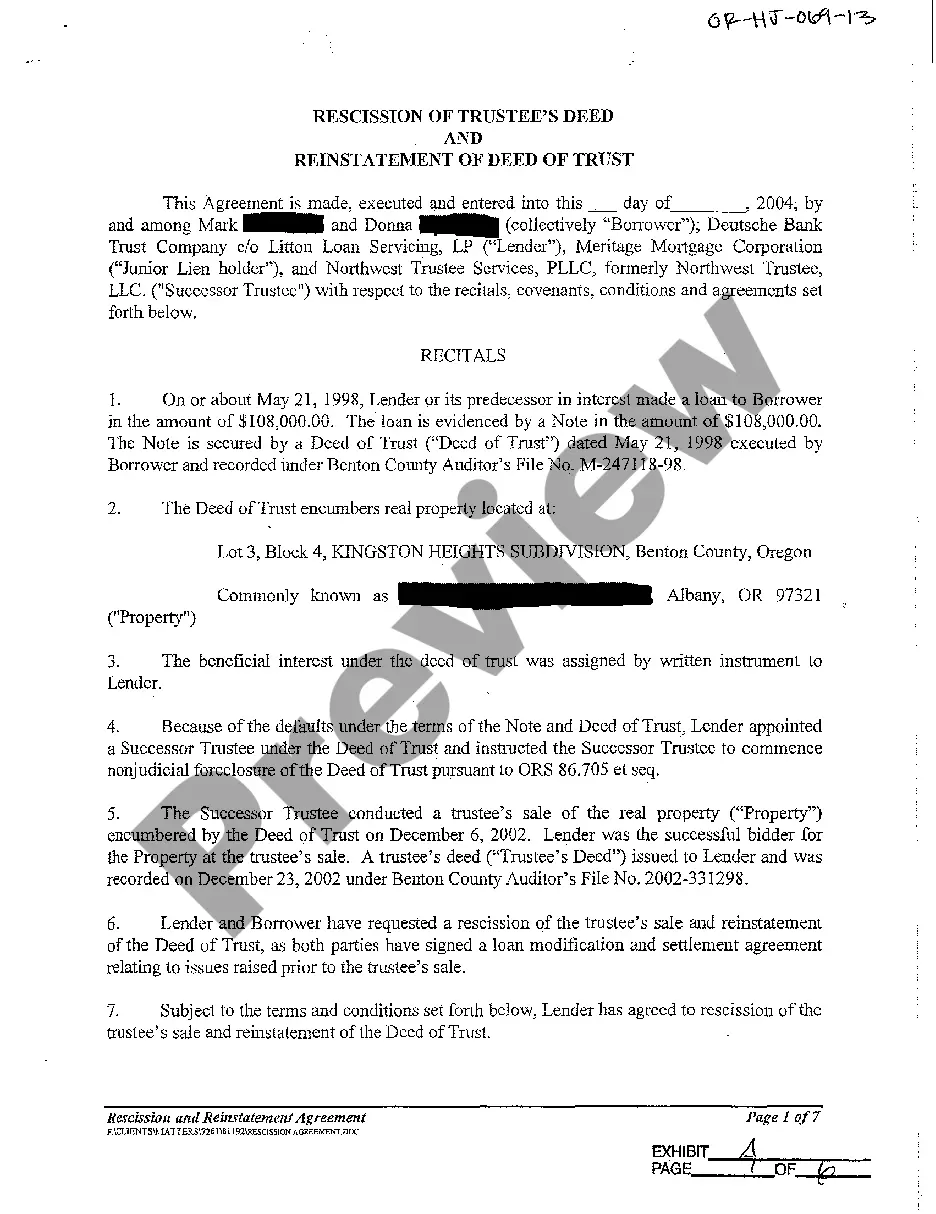

When a mortgage is the security instrument, the lender usually has to go through a court action to foreclose. This is called a judicial foreclosure. Unlike a mortgage, a trust deed (aka deed of trust) involves three parties the borrower (trustor), the lender (beneficiary), and the trustee.

If the borrower defaults on the loan, the trustee has the power to foreclose on the property on behalf of the beneficiary. In most U.S. states, a deed of trust (but not a mortgage) can contain a special "power of sale" clause that permits the trustee to exercise these powers.

When a deed of trust is foreclosed by court sale, the action: Would allow the trustor a redemption period; A trustee has legally begun the process to sell property secured by a trust deed.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

A Trustee's Deed Upon Sale, also known as a Trustee's Deed Under Sale or a Trustee's Deed is a deed of foreclosure. This deed is prepared after a property's foreclosure sale and recorded in the county were the property is located.The property may be in default on taxes, have mechanic's liens and/or other encumbrances.

Step 1 Notice of Default. Record a Notice of Default with the county recorder. Step 2 Notice of Sale. If the borrower does not pay the balance stated in the Notice of Default within the deadline, the lender can go ahead with recording a Notice of Sale. Step 3 Auction. Step 4 Obtain Possession of Property.

Again, most residential foreclosures in Oregon are nonjudicial. Here's how the process works. Before filing a notice of default, the lender provides you (the borrower) with notice about participating in a resolution conference (mediation).