Oklahoma Pre-Lien Notice - Individual

What is this form?

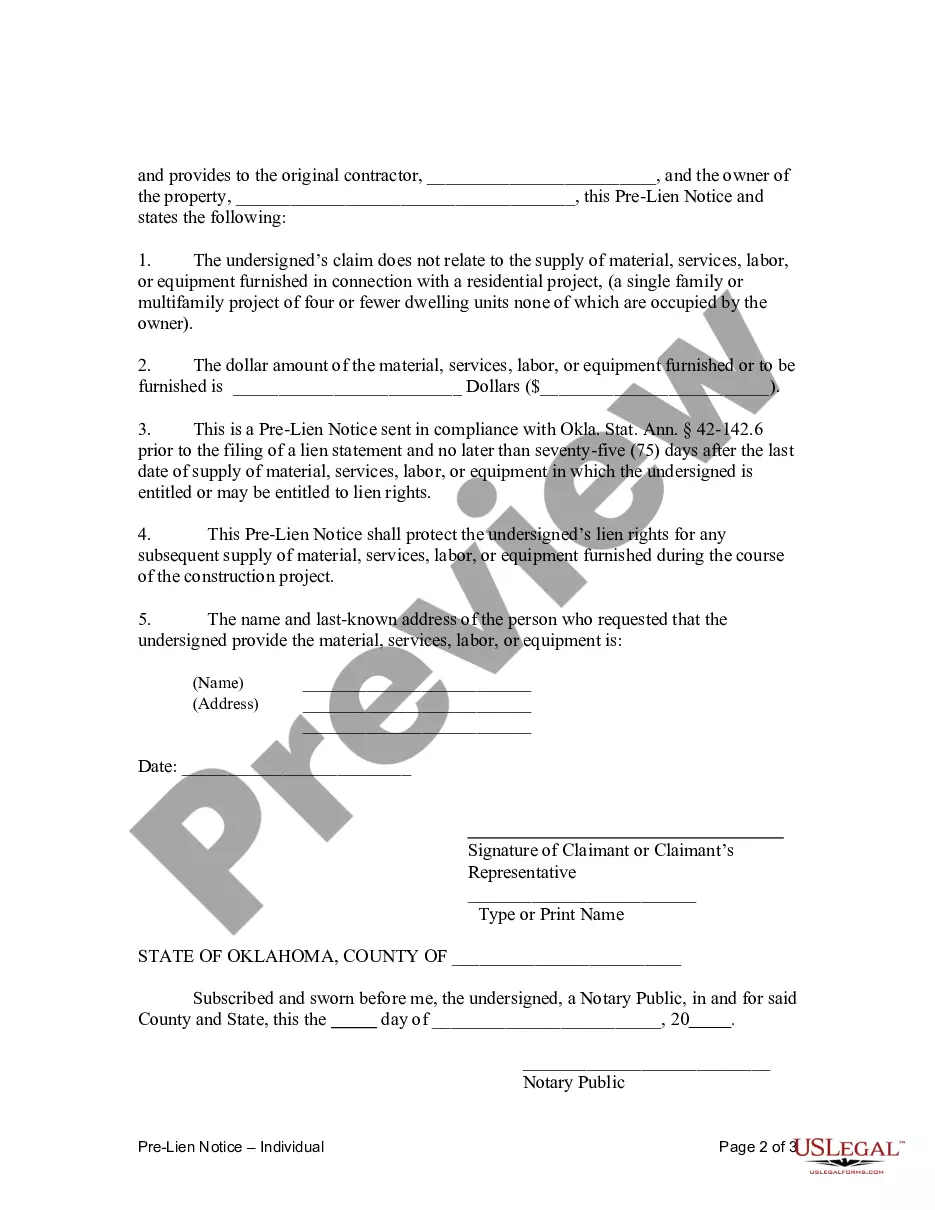

The Pre-Lien Notice - Individual form is a legal document intended for individual claimants seeking to protect their lien rights. It is specifically designed for those entitled to lien rights for the supply of materials, services, labor, or equipment used in property improvement. This form notifies the original contractor and property owner about the claimant's contributions, safeguarding future claims related to the ongoing construction project. Importantly, this notice cannot be used for residential projects involving four or fewer dwelling units or if the total value does not exceed $2,500.

What’s included in this form

- Claimant details: Name and contact information of the individual providing services or materials.

- Description of materials, services, labor, or equipment supplied.

- Last known address of the requester who asked for the services or materials.

- Deadline for submission: Must be sent within 75 days of supplying materials or services.

- Legal disclaimers regarding usage limitations and jurisdictional restrictions.

When to use this form

This form should be utilized when an individual has supplied materials, labor, or equipment that contributes to improvements on a property and wishes to secure their lien rights. It serves as a protective measure before any lien statement is filed against the property, ensuring proper communication of the individual's claim to both the contractor and property owner. Scenarios for use include preparing for potential payment disputes in construction projects where no residential constraints apply.

Who should use this form

- Independent contractors providing services or materials to a construction project.

- Suppliers of equipment used for property improvement.

- Individuals who may be entitled to lien rights based on construction services delivered.

- Claimants involved in projects that do not qualify for residential project exceptions or dollar amount limitations.

Completing this form step by step

- Identify the claimant: Fill in your name and contact details as the individual supplying materials or services.

- Describe the improvements: Clearly state the materials, services, labor, or equipment you have provided.

- Provide the requester's details: Enter the last known address of the person who requested the service or materials.

- Note the supply date: Record the date when the materials or services were supplied to ensure compliance with the 75-day notice requirement.

- Review and sign: Ensure all information is accurate before signing and sending the notice to the appropriate parties.

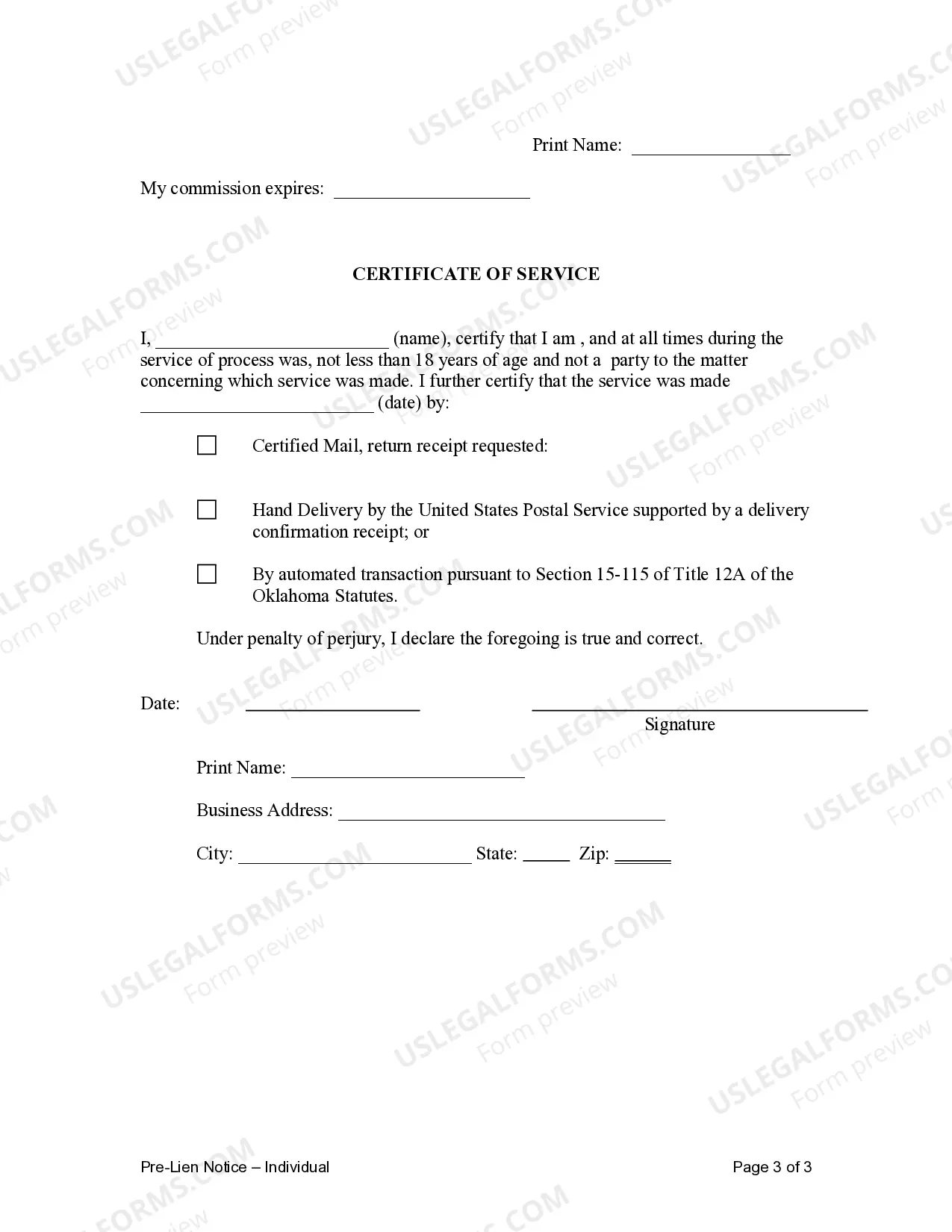

Notarization guidance

In most cases, this form does not require notarization. However, some jurisdictions or signing circumstances might. US Legal Forms offers online notarization powered by Notarize, accessible 24/7 for a quick, remote process.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to send the notice within the acceptable 75-day timeframe.

- Providing incomplete or inaccurate claimant or requester information.

- Not specifying the materials, services, or equipment in sufficient detail.

- Using the form for residential projects with restricted conditions.

Why use this form online

- Accessibility: Easily download and complete the form from your own device.

- Editability: Tailor the form to meet your specific needs without hassle.

- Reliability: Ensure that your form is drafted by licensed attorneys, providing peace of mind regarding legal compliance.

Looking for another form?

Form popularity

FAQ

Any person who performs labor or furnishes material may file a lien on the real estate that received the labor or materials. You must serve a pre-lien notice if the amount is over $10,000. You must serve your pre-lien notice within 75 days. You must file your lien within 120 days.

Any person who performs labor or furnishes material may file a lien on the real estate that received the labor or materials. You must serve a pre-lien notice if the amount is over $10,000. You must serve your pre-lien notice within 75 days. You must file your lien within 120 days.

If you're claiming a lien on real property, it must be filed in the recorder's office of the county where the property is located. Expect to pay a filing fee between $25 and $50 depending on the location where you file.

2. States where the lien law doesn't require a written contract. In these states, contractors and suppliers are generally allowed to file a lien even if they don't have a written contract.These states typically permit parties with verbal, oral, or even implied contracts to claim lien rights.

Oklahoma mechanics' liens on private property must be filed within 120 days after the date upon which material or equipment was last furnished or performed under the contract.

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

For a Lien only: $10.00 Lien fee plus $1.55 Mail fee. 3. The MLA will stamp and record the date, time and receipt number on the face of the titling documentation and attach one copy of the MV-21-A and one copy of the lien fee receipt.

§4223. Limitation of time. A lien is extinguished by the mere lapse of the time within which, under the provisions of civil procedure, an action can be brought upon the principal obligation.