Ohio Domestic Partnership Dependent Certification Form

Description

How to fill out Domestic Partnership Dependent Certification Form?

If you wish to thorough, acquire, or generating legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Take advantage of the site’s straightforward and user-friendly search to obtain the documents you require.

Various templates for business and personal purposes are organized by categories, states, or keywords.

Step 4. After locating the form you need, select the Purchase now option. Choose the pricing plan you prefer and add your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Ohio Domestic Partnership Dependent Certification Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to obtain the Ohio Domestic Partnership Dependent Certification Form.

- You can also retrieve forms you previously acquired from the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, refer to the instructions listed below.

- Step 1. Ensure you have chosen the form for the correct region/state.

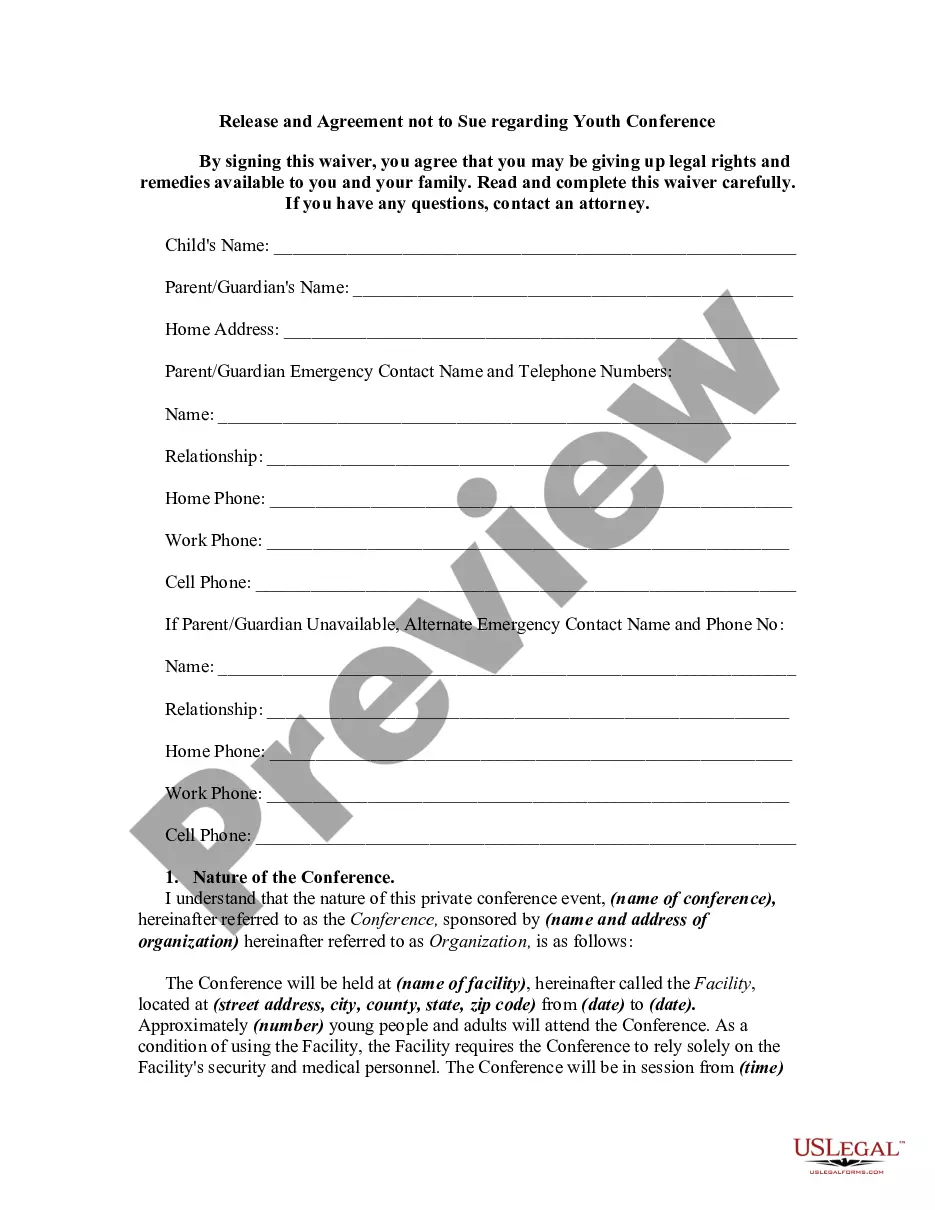

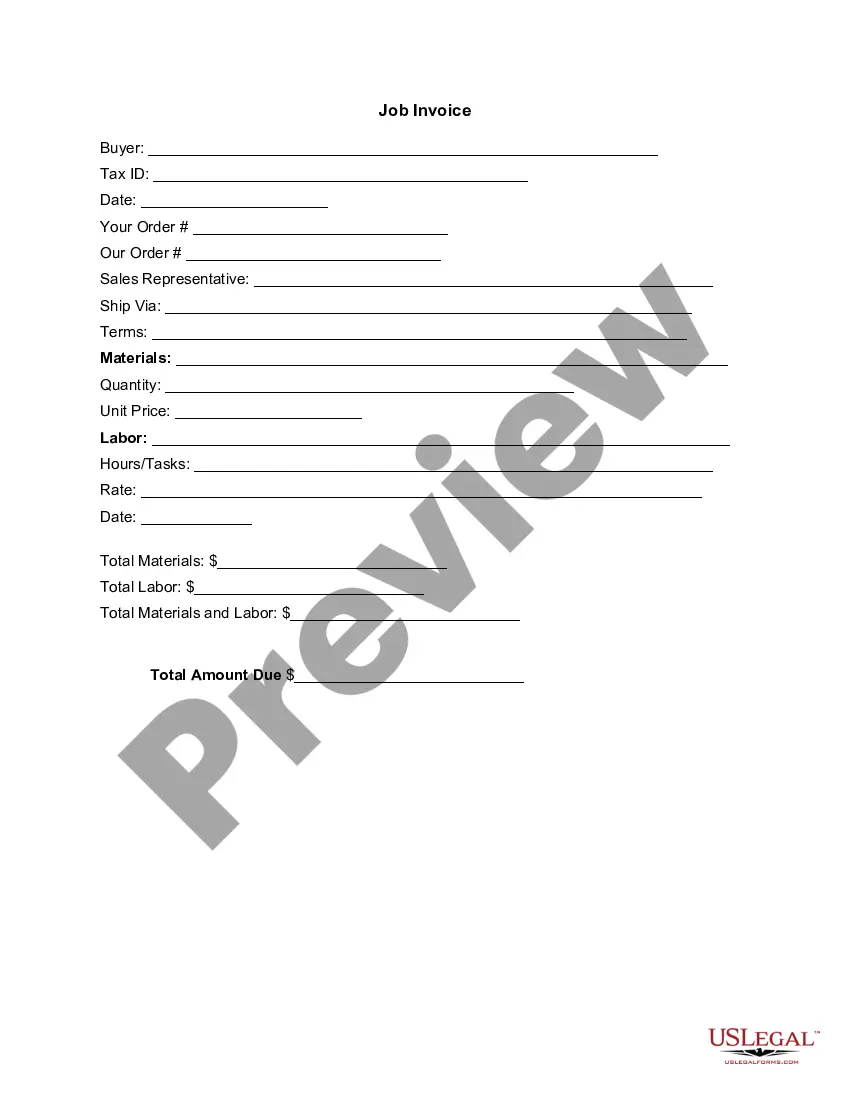

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find other variations in the legal form template.

Form popularity

FAQ

When unmarried couples live together, they do not have the same legal rights as married couples. For example, unmarried partners in Ohio do not have legal rights to visitation or custody with respect to their unmarried partner's children even when both parents intended to raise and care for the children together.

What are the criteria for a Domestic Partnership? statutory or common law, as recognized by the state of Ohio; and 2. we share responsibility for each others' common welfare; and 3. we are not related by blood in a manner that would bar our marriage in the State of Ohio; and 4.

You must have paid more than half of your partner's living expenses during the calendar year for which you want to claim that person as a dependent. When calculating the total amount of support, you must include money received from: You and other people.

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

The State of Ohio will recognize a common law marriage when all of the elements of such a marriage are present. First, there must be a contract to marry per verba de praesenti; that is, the parties must have a present intent to be married and not an intent to marry in the future.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

General Qualifications to Register a Domestic Partnership The individuals are over 18 years old; The individuals aren't related in a way that would prevent them from marrying; The individuals aren't already married to or in a similar legal relationship with someone else; and. The individuals share a common residence.

There are no state laws addressing domestic partnerships in Ohio.