New York Partnership Agreement for LLC

Description

How to fill out Partnership Agreement For LLC?

US Legal Forms - one of many most significant libraries of lawful types in the United States - gives a wide range of lawful record layouts it is possible to acquire or print. Utilizing the website, you will get a huge number of types for organization and individual uses, categorized by classes, says, or search phrases.You will discover the most up-to-date models of types like the New York Partnership Agreement for LLC in seconds.

If you have a subscription, log in and acquire New York Partnership Agreement for LLC through the US Legal Forms collection. The Down load option will show up on each and every type you see. You have access to all formerly saved types inside the My Forms tab of the account.

If you want to use US Legal Forms the first time, listed here are easy instructions to get you began:

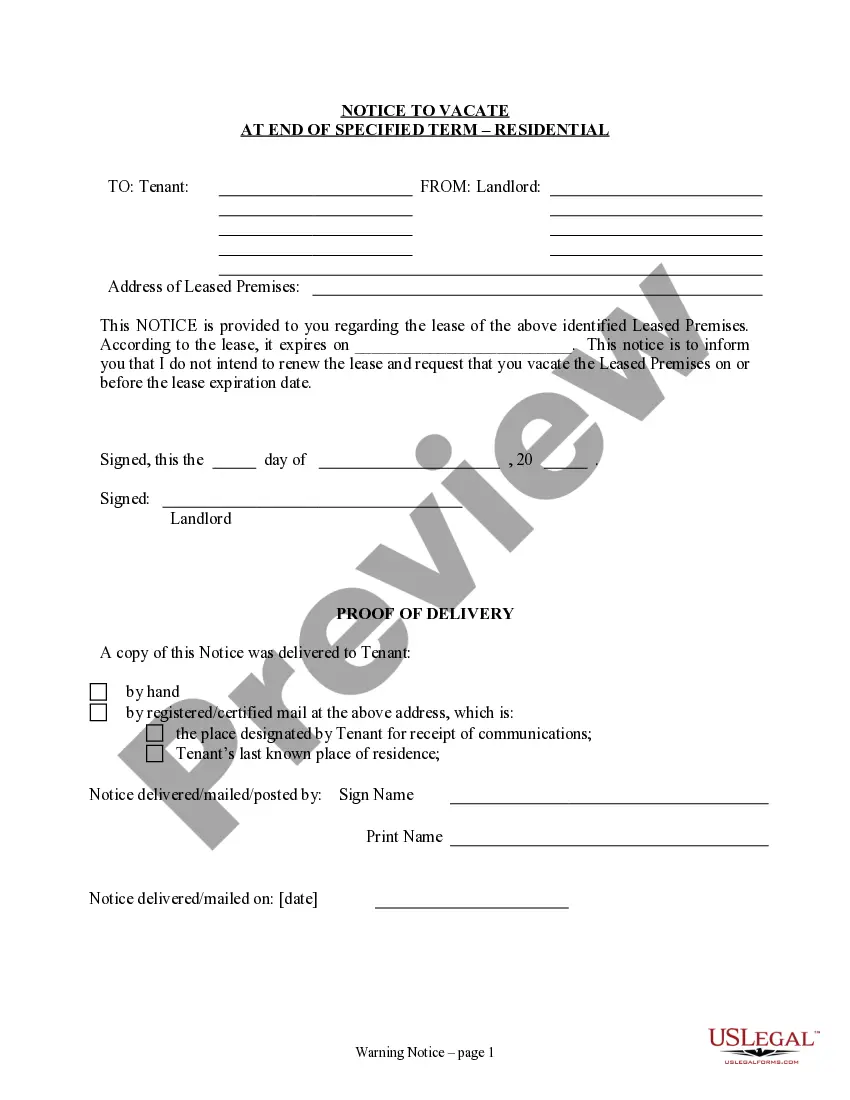

- Be sure you have selected the right type to your town/region. Click on the Review option to analyze the form`s articles. Look at the type information to ensure that you have chosen the appropriate type.

- In case the type does not match your needs, make use of the Look for discipline towards the top of the monitor to obtain the one which does.

- If you are happy with the form, verify your option by clicking the Acquire now option. Then, select the costs prepare you favor and provide your accreditations to register on an account.

- Process the financial transaction. Use your credit card or PayPal account to complete the financial transaction.

- Find the structure and acquire the form in your device.

- Make changes. Fill up, revise and print and sign the saved New York Partnership Agreement for LLC.

Each format you added to your bank account lacks an expiration date and it is the one you have forever. So, if you would like acquire or print an additional duplicate, just proceed to the My Forms section and click about the type you will need.

Gain access to the New York Partnership Agreement for LLC with US Legal Forms, probably the most substantial collection of lawful record layouts. Use a huge number of professional and express-distinct layouts that meet your organization or individual requires and needs.

Form popularity

FAQ

How to Set up a Partnership LLCCreate an operating agreement specifying each member's role in the company.Choose a name for your partnership LLC and either register it or file a DBA form with your secretary of state.Publish a notice in local newspapers announcing your intent to form an LLC if your state requires it.More items...

How to Form an LLC in New York (7 steps)Step 1 Agent for Service of Process.Step 2 Choose LLC Type.Step 3 Filing Fee.Step 4 Publish the Articles.Step 5 Certificate of Publication.Step 6 Operating Agreement.Step 7 Employer Identification Number (EIN)

This information can generally be found on your Secretary of State website. Tip: It is unwise to operate without an operating agreement even though most states do not require a written document. Regardless of your state's law, think twice before opting out of this provision.

Unlike most states, New York's LLC law requires LLC members to adopt a written operating agreement. The Operating Agreement may be entered into before, at the time of, or within 90 days after filing the Articles of Organization.

How to Form a New York Limited Partnership (in 6 Steps)Step One) Choose an LP Name.Step Two) Designate a Registered Agent.Step Three) File the Certificate of Limited Partnership.Step Four) Create a Limited Partnership Agreement.Step Five) Handle Taxation Requirements.Step Six) Obtain Business Licenses and Permits.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

New York requires all SMLLCs to have an operating agreement. An SMLLC operating agreement is usually made between the SMLLC's sole member and the SMLLC itself. You must enter into the agreement before, at the time of, or within 90 days after the filing of the Articles of Organization.

The state of New York does not have a general business license that all general partnerships are required to obtain. However, depending on what industry you operate in, your business may need licenses or permits to enable you to run your company in a compliant fashion.

To form a partnership in New York, you should take the following steps:Choose a business name.File a fictitious business name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

An LLC partnership agreement (also called an LLC Operating Agreement) lays the ground rules for operating a Limited Liability Company and protects the legal rights of its owners (called members). It's written by the LLC's members and describes the plans and provisions for the company.