New York Corrective Quitclaim Deed of Right-of-Way

About this form

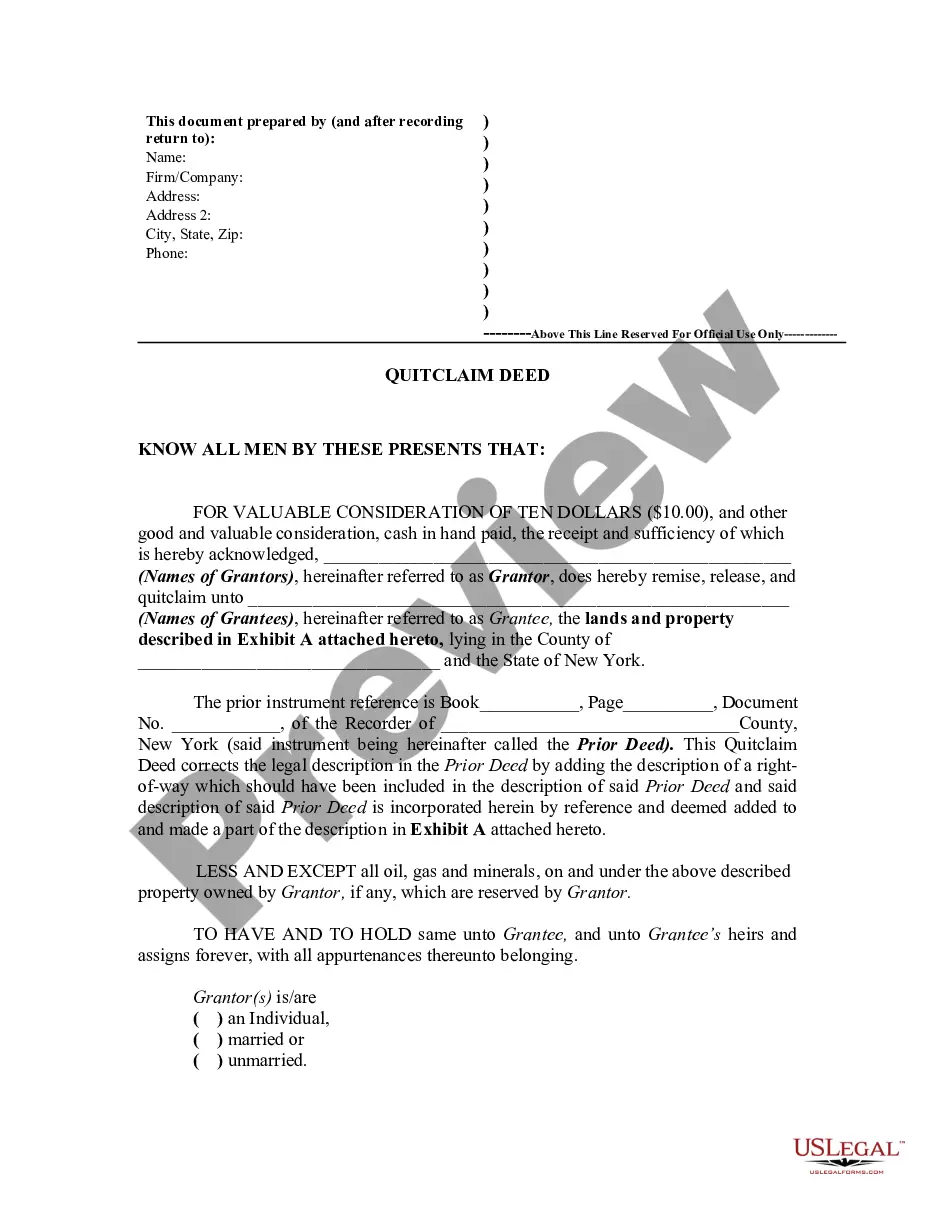

The Corrective Quitclaim Deed of Right-of-Way is a legal document used to amend a previous quitclaim deed by adding a description of a right-of-way that was omitted. Unlike other real estate transfer documents, a quitclaim deed conveys only the interest held by the grantor without any warranties of ownership. This form specifically addresses errors in a prior deed's legal description, ensuring that all relevant property details are accurately documented.

Key parts of this document

- The parties involved: Names of the grantor(s) and grantee(s).

- Legal description of the property: Details including the right-of-way to be added.

- Reference to the prior deed: Book, page, and document number for tracking.

- Consideration amount: Acknowledgment of value exchanged.

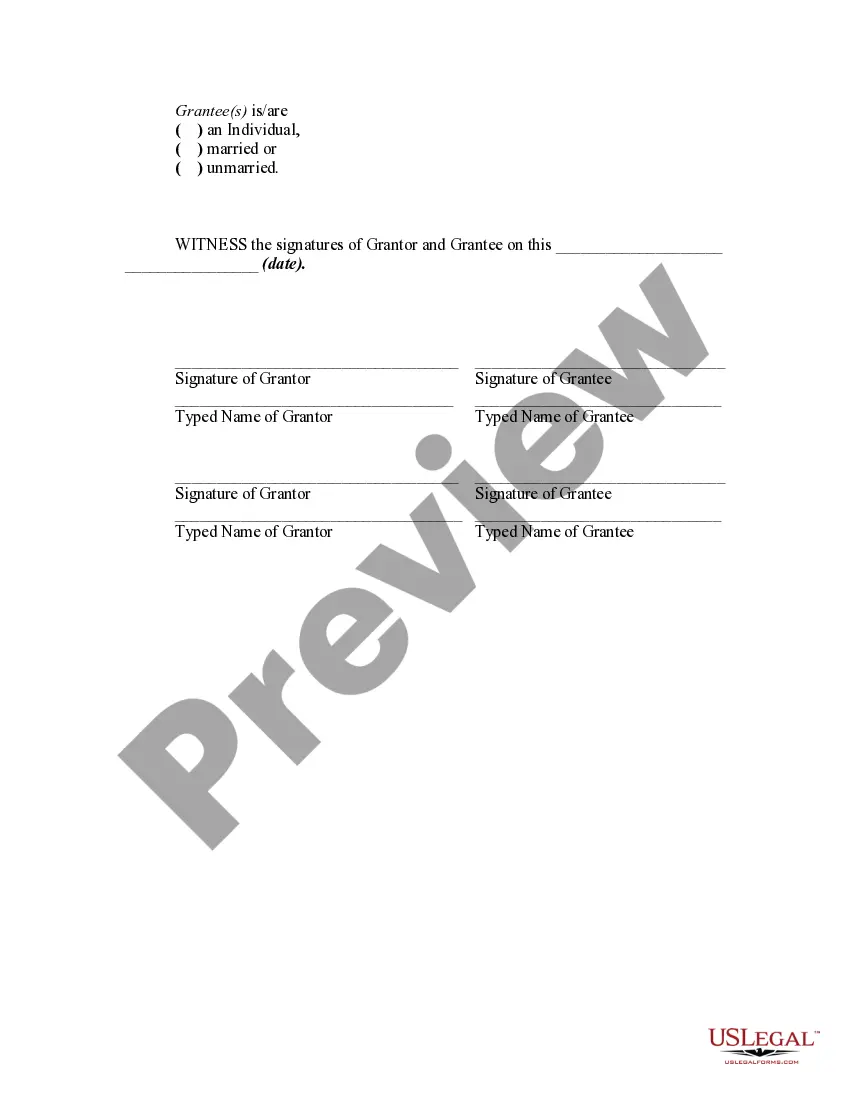

- Signatures of all parties: Required for validity.

State law considerations

This form is suitable for use in New York, where specific real estate laws govern the execution of quitclaim deeds and their required disclosures. Consult local regulations to ensure compliance with any regional requirements.

Common use cases

This form is typically used when a property transfer has been recorded with an incomplete or incorrect legal description. If a right-of-way had to be included in the previous quitclaim deed and was overlooked, this form serves to correct that and ensure that all necessary property rights are accurately represented.

Who this form is for

- Property owners who need to clarify property boundaries or rights of way.

- Real estate professionals assisting clients with property transfers.

- Attorneys handling estate or property legal matters.

- Anyone involved in a transaction where a prior deed needs correction.

How to complete this form

- Identify the parties involved: List the names of the grantor(s) and grantee(s).

- Specify the property: Provide a detailed legal description in Exhibit A, including the right-of-way.

- Enter relevant prior deed information: Fill in the book, page, and document number.

- Sign and date the document: Ensure all parties provide signatures and the date of execution.

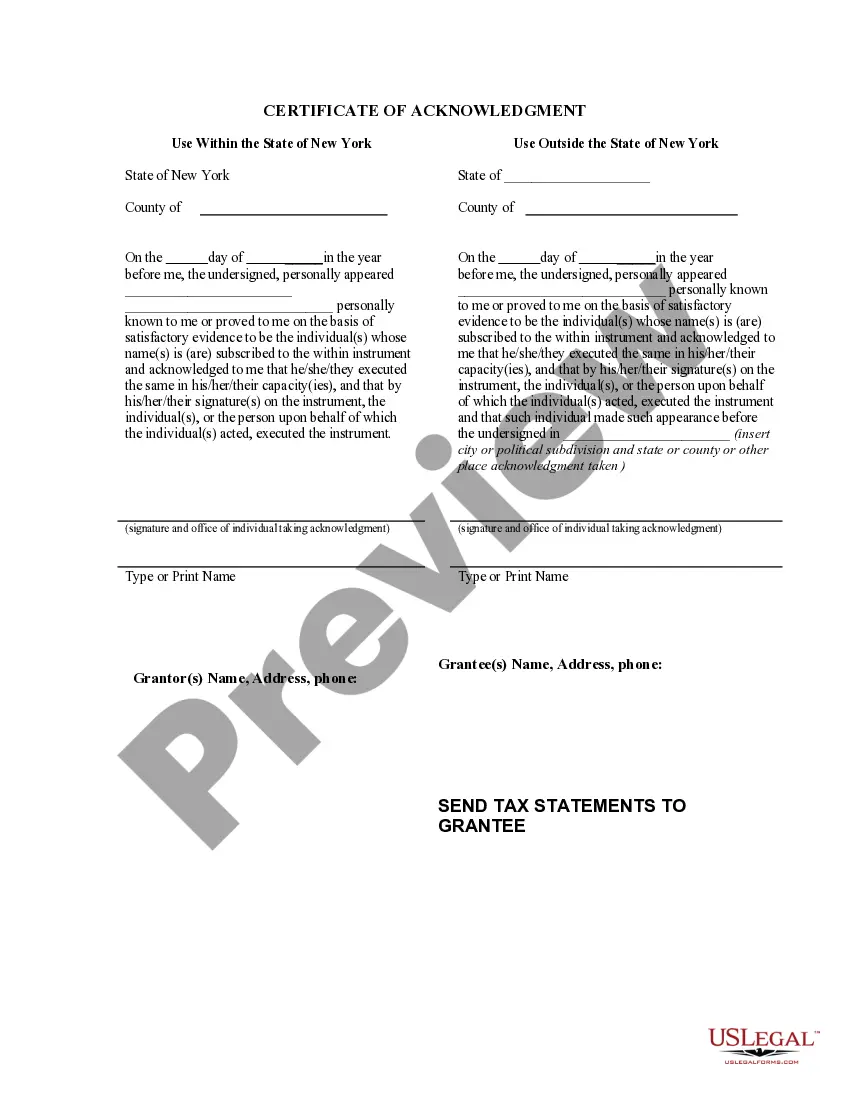

- Consider acknowledgment: Verify whether a notary is needed based on your local jurisdiction.

Does this form need to be notarized?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Mistakes to watch out for

- Failing to include the correct legal description of the right-of-way.

- Omitting signatures from either grantor or grantee.

- Not providing the complete reference to the prior deed.

- Incorrectly identifying the parties (e.g., mismatched names or statuses).

Why complete this form online

- Convenient access: Download and complete the form at your own pace.

- Editability: Fill in the necessary information easily with digital tools.

- Reliability: Forms are drafted by licensed attorneys to ensure legal compliance.

Form popularity

FAQ

Determine if the error is harmless or fatal to the transfer of title. Decide what instrument is best suited to the error. Draft a corrective deed, affidavit, or new deed. Obtain the original signature(s) of the Grantor(s). Re-execute the deed with proper notarization and witnessing.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Fees to File a Quitclaim Deed in New York As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

If a deed is to have any validity, it must be made voluntarily.If FRAUD is committed by either the grantor or grantee, a deed can be declared invalid. For example, a deed that is a forgery is completely ineffective. The exercise of UNDUE INFLUENCE also ordinarily serves to invalidate a deed.

For a quitclaim deed to be valid, it has to be recorded at the county recorder's office in the county where the property is located. If you're using an attorney, paralegal or title company to handle the transaction for you, they will take care of this.

If however, this is not your debt and the lien has wrongfully been placed on your property, then you should first seek to get the creditor/lender to voluntarily release the lien. If they refuse, you could then file a lawsuit to get the lien removed and possibly obtain damages for slander of title.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

You can correct an error on a California deed through a Correction Deed or Corrective Deed. Usually deed errors are as a result of someone attempting to prepare a deed without proper knowledge or professional help.

When you sign a deed transferring your interest in real property, you cannot reverse it simply because you regret your decision. Assuming you are on congenial terms with the person who was the grantee of your deed, he can sign a similar deed transferring the property interest back to you.