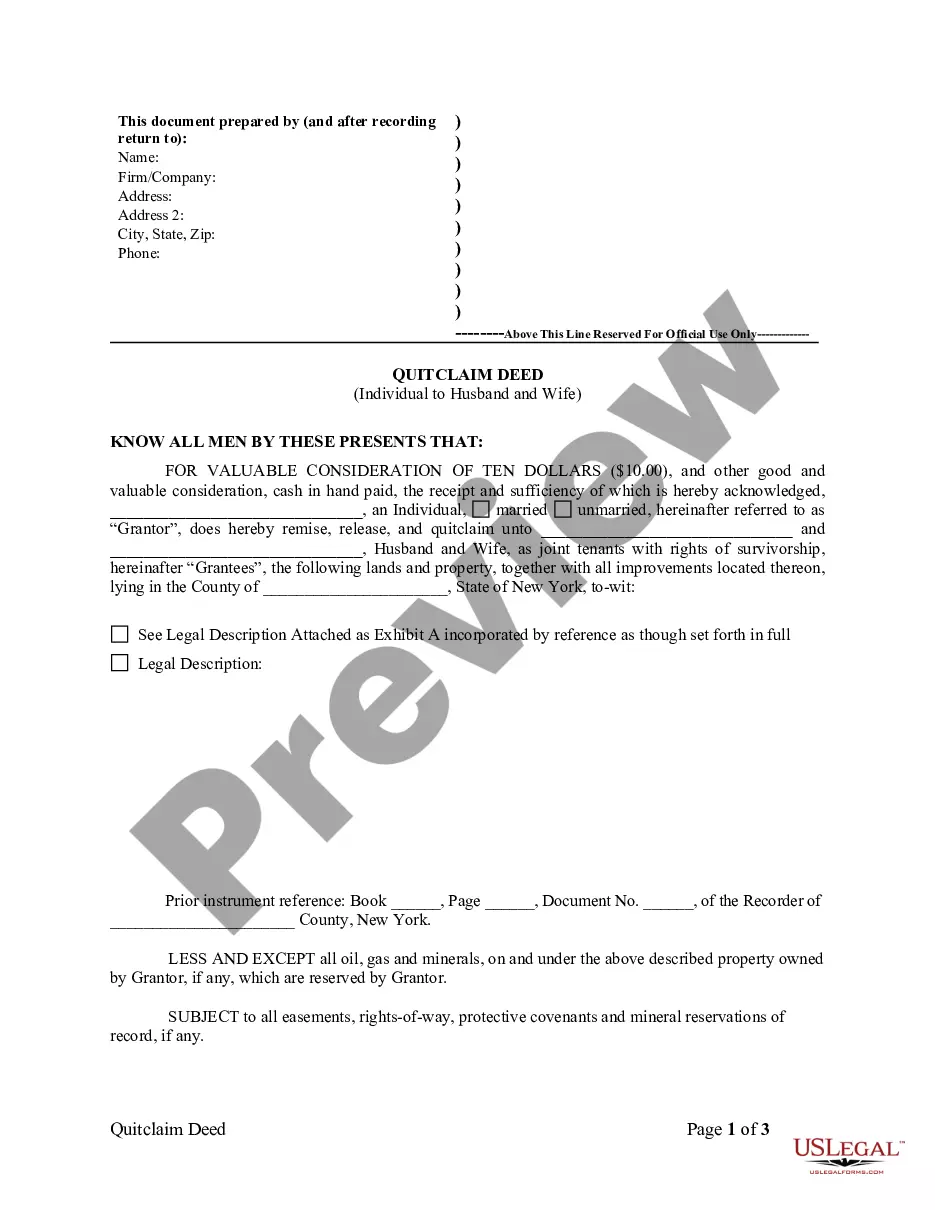

New York Quitclaim Deed from Individual to Husband and Wife

Description

Definition and meaning

A Quitclaim Deed is a legal document used to transfer ownership of real property from one individual to another. In the context of a New York Quitclaim Deed from Individual to Husband and Wife, this form allows an individual to convey their interest in a property to their spouse. This type of deed does not guarantee that the property is free from any claims or liens; instead, it simply relinquishes the grantor's interest in the property to the grantees.

How to complete a form

Completing the New York Quitclaim Deed from Individual to Husband and Wife involves several steps. Start by accurately filling out the names of the grantor (the individual transferring the property) and the grantees (the couple receiving the property). Next, provide a description of the property being transferred, which usually requires a legal description. Additionally, ensure to fill in the county information and other relevant details. Finally, both parties must sign the document, and it needs to be notarized.

Who should use this form

This form is beneficial for married individuals who wish to transfer their property rights to their spouse without going through the more complicated procedures of a warranty deed. It is particularly useful in cases where one spouse wants to remove their interest in the property or in situations such as divorce where property needs to be divided. Anyone looking to streamline the property transfer process between spouses can utilize this form.

Key components of the form

The New York Quitclaim Deed from Individual to Husband and Wife comprises several important components, including:

- Grantor and Grantee Information: Names and details of the individual transferring the property and the couple receiving it.

- Property Description: A detailed legal description of the property involved in the transfer.

- Consideration: The amount of value exchanged, usually a nominal fee.

- Signatures: Signatures of both the grantor and a notary public to affirm the transfer.

Common mistakes to avoid when using this form

While completing the New York Quitclaim Deed, individuals often make several common mistakes. These include:

- Inaccurate Property Descriptions: Failing to provide a clear and precise legal description of the property can lead to complications.

- Missing Signatures: Forgetting to sign the document or to have it notarized can invalidate the deed.

- Improper Grantee Information: Not correctly stating the names of the grantees can result in legal issues.

What to expect during notarization or witnessing

For the New York Quitclaim Deed to be legally binding, it must be notarized. During notarization, the grantor must present valid identification to the notary public. The notary will verify the identity of the grantor, witness their signature on the document, and then affix their seal to make it official. It is important for the grantor to ensure they sign the document in the presence of the notary, as signing beforehand can invalidate the notarization.

How to fill out New York Quitclaim Deed From Individual To Husband And Wife?

US Legal Forms is a unique platform where you can find any legal or tax document for completing, such as New York Quitclaim Deed from Individual to Husband and Wife. If you’re tired with wasting time searching for ideal examples and paying money on file preparation/lawyer service fees, then US Legal Forms is exactly what you’re looking for.

To experience all the service’s benefits, you don't need to download any software but just choose a subscription plan and create an account. If you already have one, just log in and find a suitable sample, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need New York Quitclaim Deed from Individual to Husband and Wife, take a look at the recommendations below:

- Double-check that the form you’re considering is valid in the state you need it in.

- Preview the form its description.

- Simply click Buy Now to get to the register page.

- Pick a pricing plan and keep on registering by entering some info.

- Decide on a payment method to complete the registration.

- Save the file by choosing your preferred format (.docx or .pdf)

Now, complete the document online or print it. If you feel unsure regarding your New York Quitclaim Deed from Individual to Husband and Wife sample, contact a attorney to examine it before you send out or file it. Begin hassle-free!

Form popularity

FAQ

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

You would simply prepare a deed to you and your fiance. You would then have to prepare and execute the other necessary forms take them to the clerks office and file them. I suggest that you consult with a local attorney. They can do this at a modest cost.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Fill in the deed form. Print it out. Have the grantor(s) sign and get the signature(s) notarized. Complete a transfer tax form, Form TP-584. Complete and print out Form RP-5217 (or, if you are in New York City, Form RP-5217NYC).

Fees to File a Quitclaim Deed in New York As of 2018, the basic fee for filing a quitclaim deed of residential or farm property is $125, while the fee for all other property is $250. These fees are for the RP-5217 form.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.