This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

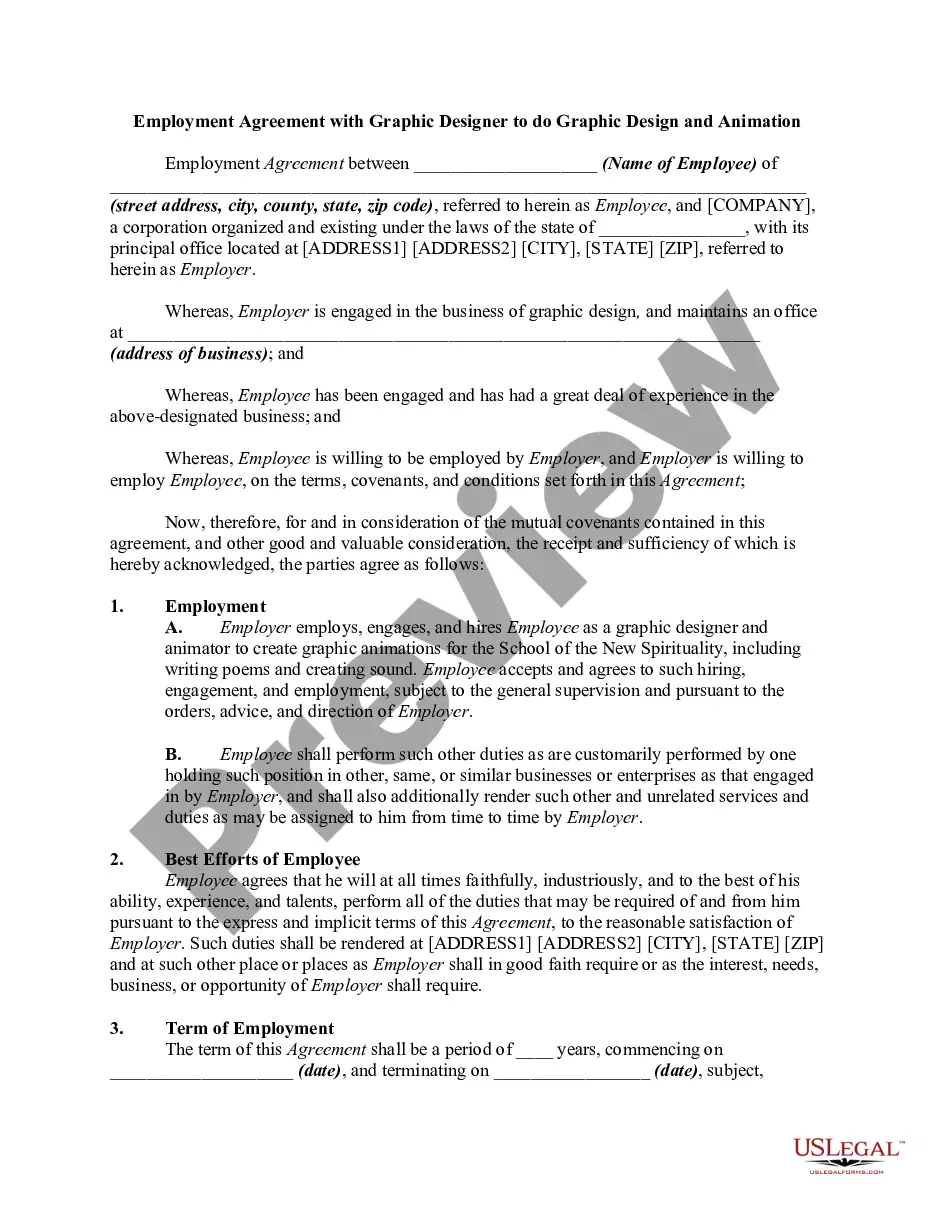

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

You can spend time online looking for the legal document template that satisfies the federal and state requirements you need.

US Legal Forms provides a wide variety of legal documents that are evaluated by experts.

You can conveniently download or print the New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities from your services.

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Get button.

- After that, you can complete, modify, print, or sign the New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Check the document description to confirm that you have chosen the right form.

Form popularity

FAQ

You generally are not responsible for debts your new spouse accrued prior to your marriage. The New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities reinforces this concept, giving you peace of mind regarding separate financial histories. Transparency with partners about finances can make these situations easier.

In most cases, you do not inherit your spouse's debts unless you co-signed or were joint holders on the account. The New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities supports this protection clause, saving you from potential financial distress. Consider professional advice if unsure, as state laws may have nuances regarding obligation.

Creditors usually cannot pursue you for your spouse's debts unless you jointly incurred the debt. The New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities helps safeguard against such claims, allowing you to maintain your own financial standing. Seek legal support if you encounter pressure from creditors, as they may not fully understand your rights.

Similar to tax debt, a new spouse generally is not liable for debts that existed before the marriage. The New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities can clarify this point and help ensure you are not held accountable for your spouse's financial burdens from previous commitments. It’s wise to document your understanding of finances with your partner.

A new spouse typically is not responsible for a partner's past tax debt incurred before marriage. The New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities provides protection against any claim from creditors related to your spouse's financial history. Always consider consulting a legal professional to fully understand your responsibilities in these situations.

Yes, the IRS can garnish your wages if you filed jointly and your husband owes taxes. However, if you are a non-liable spouse, you may have grounds to contest such actions. The New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities can protect you in these situations. It is wise to explore your rights promptly and consult a legal expert for tailored advice.

The four types of innocent spouse relief include Innocent Spouse Relief, Traditional Spouse Relief, Separation of Liability Relief, and Equitable Relief. Each type addresses different circumstances where one spouse may seek exemption from liability. Knowing your options is vital, and referring to the New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities can help in the decision-making process. Seeking legal advice may also be beneficial.

liable spouse is someone who is not financially responsible for the debts or liabilities incurred by their partner. This status is crucial when navigating tax responsibilities, especially under joint filings. The New Mexico Notice of NonResponsibility of Wife for Debts or Liabilities helps clarify this concept, providing legal protection to nonliable spouses. It can be instrumental in defending your financial rights.

To submit Form 8857, you should first ensure that you meet the criteria for innocent spouse relief. Then, complete the form accurately and clearly explain your situation. Once completed, mail the form to the address specified in the instructions on the form. Utilizing the New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities may also aid in your application process.

The IRS generally cannot pursue your wife for your individual debt if she is not a co-signer or does not file jointly with you. Your debts remain your legal responsibility unless she is directly connected to them. The New Mexico Notice of Non-Responsibility of Wife for Debts or Liabilities can provide a clear framework for understanding these protections. Always seek expert advice when dealing with such matters.