New Jersey Agreement to Sell Real Property Owned by Partnership to One of the Partners

Description

carry on as co-owners of a business for profit.

How to fill out Agreement To Sell Real Property Owned By Partnership To One Of The Partners?

Finding the appropriate authentic documents format can be quite challenging.

Of course, there are numerous templates accessible online, but how can you secure the legitimate template you require.

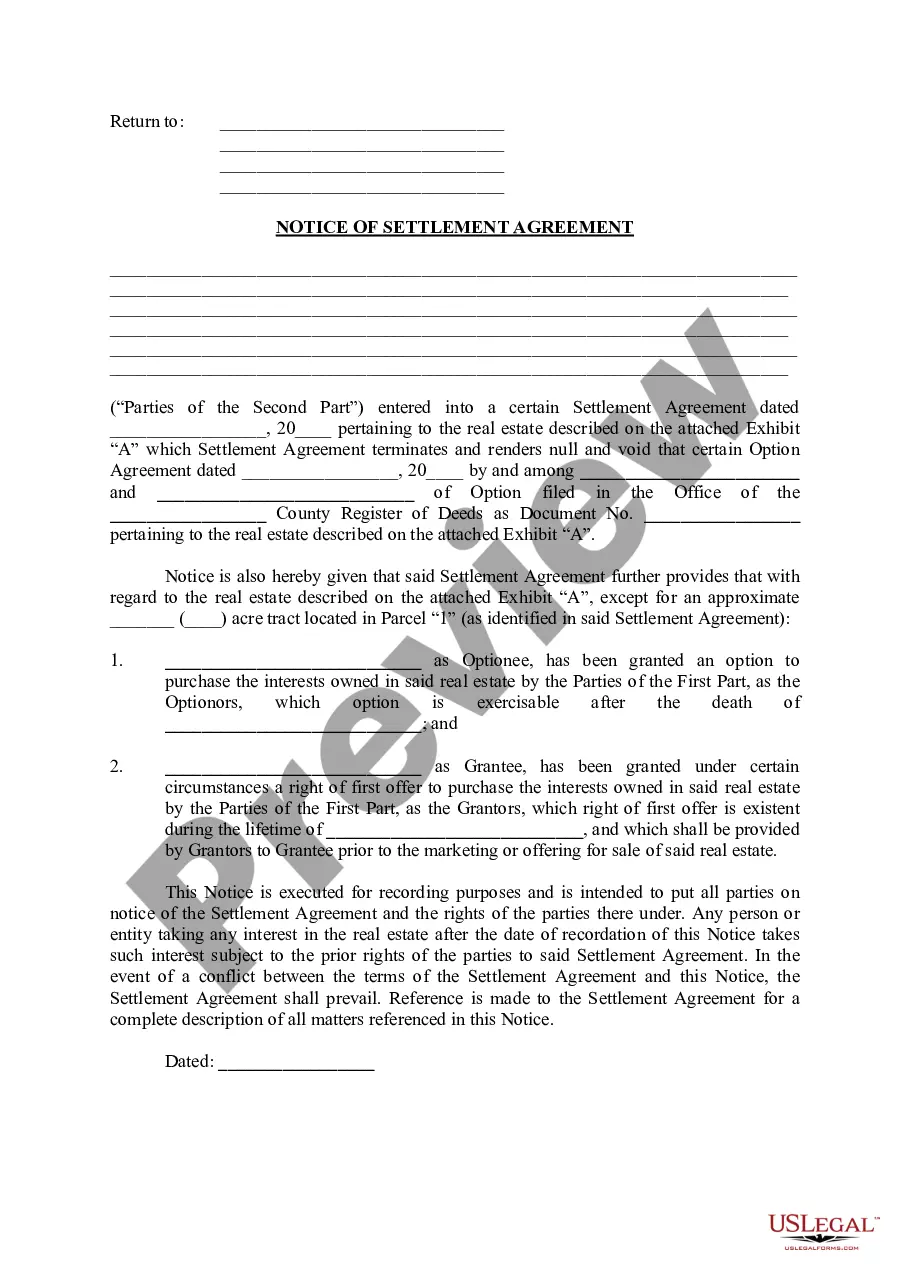

Utilize the US Legal Forms platform. The service offers thousands of templates, including the New Jersey Agreement to Sell Real Property Owned by Partnership to One of the Partners, which you can employ for business and personal purposes.

You can review the form using the Review button and read the form description to confirm it is suitable for you.

- All forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the New Jersey Agreement to Sell Real Property Owned by Partnership to One of the Partners.

- Utilize your account to search for the legal forms you may have previously purchased.

- Navigate to the My documents tab in your account to get an additional copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

Form PART-200-T is to request an extension of time to file Form NJ-1065 if the entity has a filing fee due. Exemptions include a partnership that has no New Jersey source income, expenses, or loss. To qualify for this exception, all of the partnership's operations and facilities must be located outside New Jersey.

Every partnership that has income or loss derived from sources in the State of New Jersey, or has a New Jersey resident partner, must file Form NJ-1065. A partnership must file even if its principal place of business is outside the State of New Jersey. Form NJ-1065 is no longer solely an information return.

NJ TaxationThere is no extension of time to pay your taxes; You must pay at least 80% of any owed taxes no later than April 18, 2022, to avoid a late filing penalty; You will have until October 15, 2022, to file your New Jersey return.

(Form NJ-1065) State of New Jersey. Partner's Share of Income.

A partnership must file an annual information return to report the income, deductions, gains, losses, etc., from its operations, but it does not pay income tax. Instead, it "passes through" profits or losses to its partners.

If all requirements are satisfied, an extension of 6 months will be granted for filing Forms NJ-1040, NJ-1040NR, and NJ-1080C. A 5½ month extension of time will be granted for filing Form NJ-1041 and NJ-1041SB.

month extension of time to file your NJ1065 may be granted if at least 80% of the total fee reported on your NJ1065 when filed is paid in the form of an install ment payment or other payment made by the original due date.

Every partnership that has income or loss derived from sources in the State of New Jersey, or has any type of New Jersey resident partner, must file Form NJ-1065. A partnership must file even if its principal place of busi- ness is outside the State of New Jersey.

New Jersey partnership payments made on behalf of out-of-State corporate and noncorporate partners are based on taxable income whether the income is distributed or undistributed and are designated as a tax at a rate of 9% for nonresident corporate partners and 6.37% for noncorporate partners.