New Jersey Renuncia y renuncia de propiedad del testamento por testamento - New Jersey Renunciation And Disclaimer of Property from Will by Testate

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

Key Concepts & Definitions

Renunciation and Disclaimer of Property from Will: This legally binding act involves a beneficiary choosing to reject their inheritance as laid out in a deceased's will. This is often used to adjust the distribution of estate to meet the beneficiary's personal or tax-related goals.

Intestate Succession Rules: Refers to the guidelines by which assets are distributed when someone dies without a will. Different rules apply depending on state laws, such as those in South Carolina.

Disclaimed Interest Tax: This refers to the tax implications that arise when a beneficiary disclaims an interest in an inherited property. Tax regulations can vary.

Step-by-Step Guide to Renouncing an Inheritance

- Contact an attorney experienced in estate planning or probate law to discuss the implications of your decision.

- Prepare a formal renunciation document, depicting your intent to renounce the property, aligned with 'South Carolina probate' laws if applicable.

- File the renunciation document with the probate court handling the estate.

- Notify the executor of the will or the court about the disclaimer.

- Ensure all necessary tax filings are handled, in regards to 'disclaimed interest tax'.

Risk Analysis of Renouncing an Inheritance

Renouncing an inheritance can protect against potential liabilities, such as those related to unwanted 'real estate deeds' or problematic 'landlord tenant agreements'. Additionally, it may aid in 'protecting against attacks' such as creditors. However, once renounced, the decision is irrevocable and eliminates any future claim to the property.

Best Practices for Renunciation and Disclaimer

- Ensure you are fully informed about all legal implications and potential 'disclaimed interest tax' consequences before proceeding.

- Use 'online security tools' to protect sensitive information exchanged during the process.

- Consider consultation with 'small business resources' when the estate involves business assets.

- Always process a 'name change service' if the renunciation alters your position in family business documents.

Common Mistakes & How to Avoid Them

- Failing to file the renunciation in a timely manner within the specified deadlines can result in unintended acceptance of the inheritance.

- Not understanding the full scope of 'intestate succession rules' can lead to unexpected outcomes in the absence of a will.

- Overlooking potential benefits such as 'disclaimer property inheritance' can result in missed tax advantages.

FAQ

What is 'renunciation and disclaimer of property from will'? It's the act of formally rejecting an inheritance as outlined in a will.

How does rejecting an inheritance impact taxes? It may allow the estate to bypass your estate for tax purposes, thus not increasing your taxable estate.

Can renunciation be reversed? No, once completed, it is irrevocable.

How to fill out New Jersey Renuncia Y Renuncia De Propiedad Del Testamento Por Testamento?

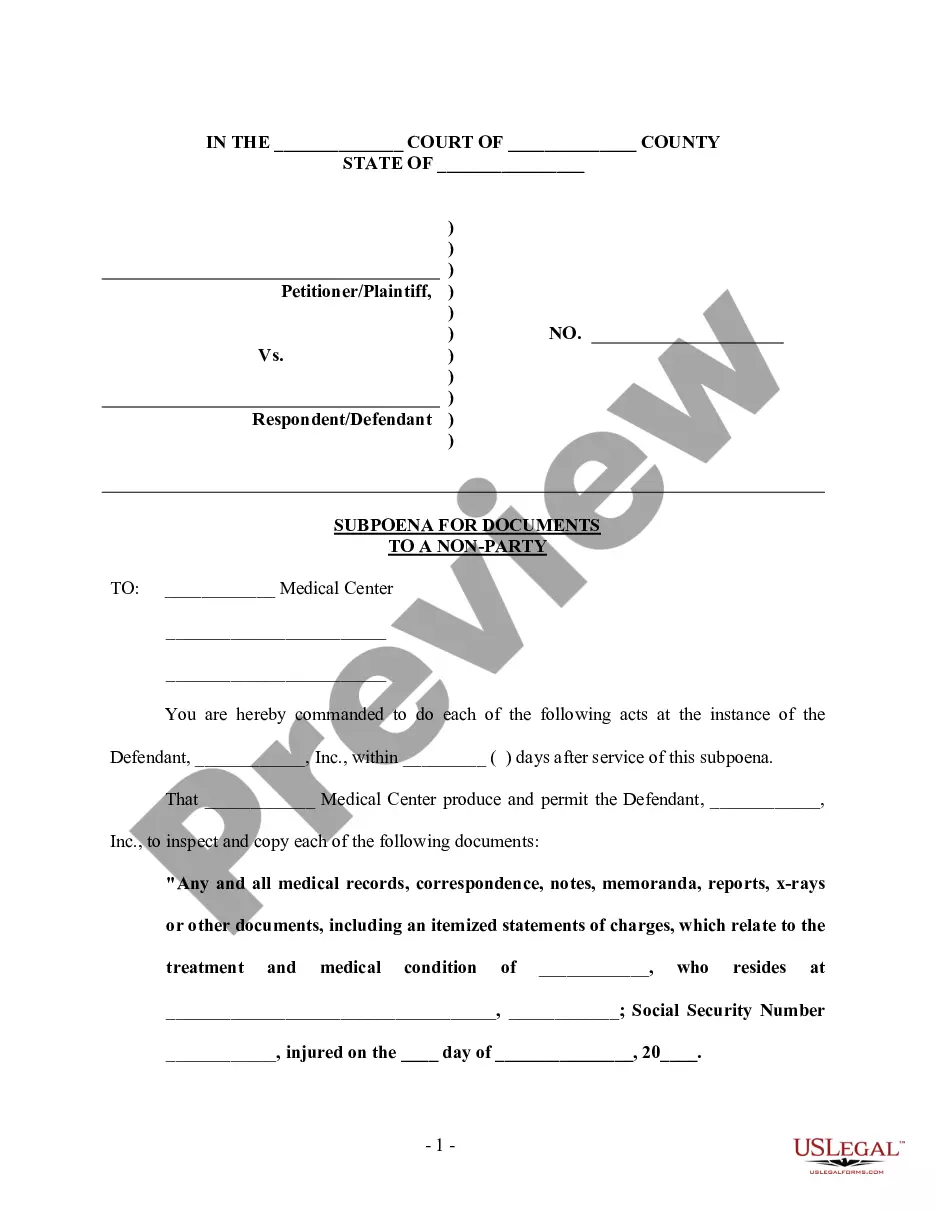

US Legal Forms is actually a special platform where you can find any legal or tax template for submitting, such as New Jersey Renunciation And Disclaimer of Property from Will by Testate. If you’re tired of wasting time searching for suitable samples and paying money on record preparation/attorney charges, then US Legal Forms is precisely what you’re seeking.

To experience all of the service’s advantages, you don't have to download any application but simply pick a subscription plan and register your account. If you have one, just log in and find an appropriate sample, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need New Jersey Renunciation And Disclaimer of Property from Will by Testate, check out the recommendations listed below:

- check out the form you’re taking a look at is valid in the state you want it in.

- Preview the example and look at its description.

- Click Buy Now to reach the sign up page.

- Choose a pricing plan and carry on signing up by entering some info.

- Choose a payment method to complete the registration.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, complete the document online or print out it. If you are uncertain concerning your New Jersey Renunciation And Disclaimer of Property from Will by Testate form, contact a lawyer to review it before you decide to send out or file it. Get started hassle-free!