New Hampshire Small Estate Affidavit for Estates under 10,000

Description

How to fill out New Hampshire Small Estate Affidavit For Estates Under 10,000?

US Legal Forms is really a unique system to find any legal or tax document for filling out, such as New Hampshire Small Estate Affidavit for Estates under 10,000. If you’re fed up with wasting time looking for perfect samples and paying money on document preparation/attorney fees, then US Legal Forms is precisely what you’re trying to find.

To reap all of the service’s advantages, you don't have to download any application but simply pick a subscription plan and create an account. If you have one, just log in and look for a suitable sample, save it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need New Hampshire Small Estate Affidavit for Estates under 10,000, have a look at the recommendations listed below:

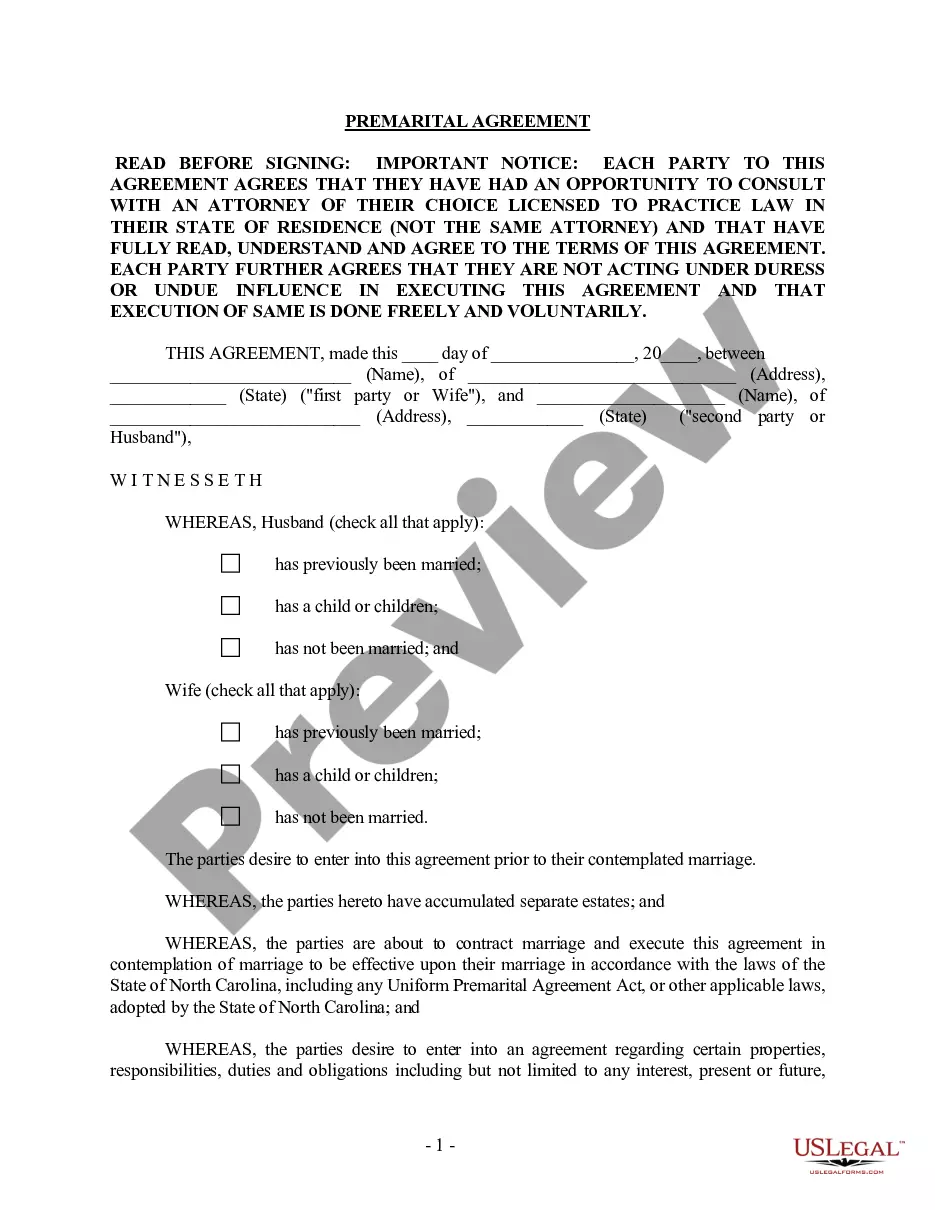

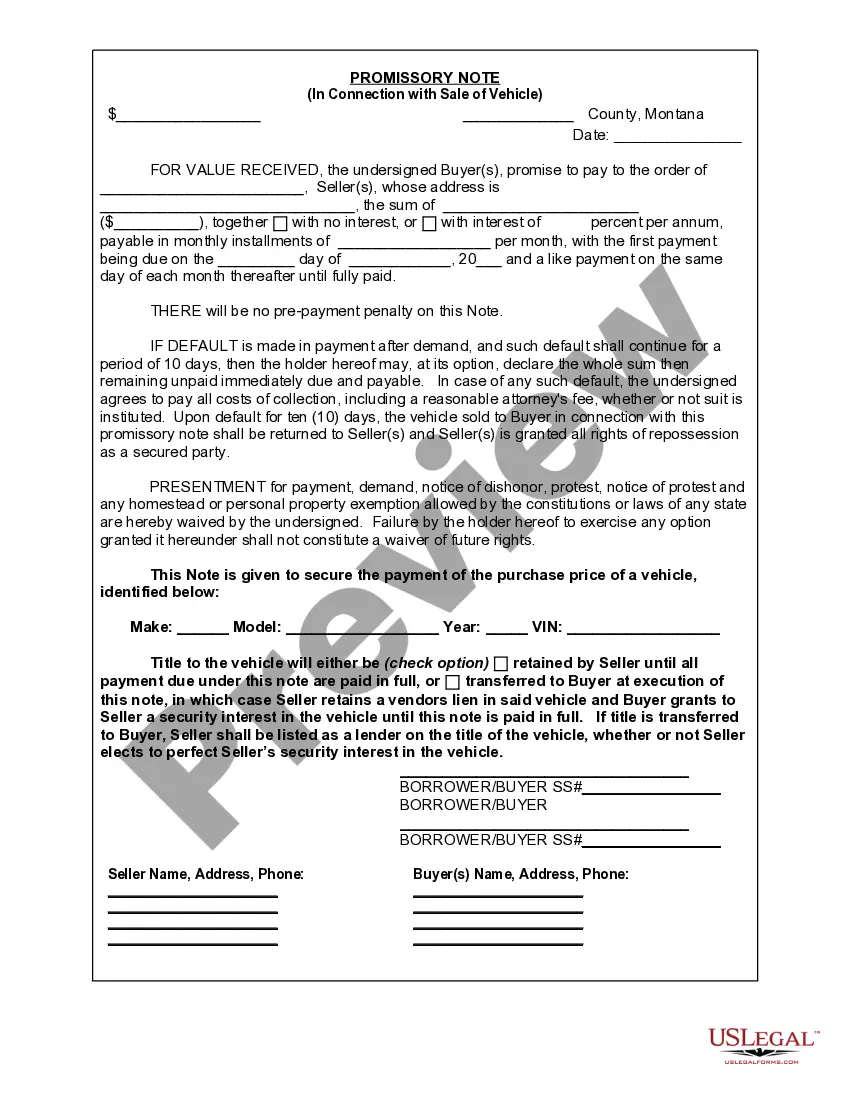

- Double-check that the form you’re looking at applies in the state you need it in.

- Preview the sample and look at its description.

- Simply click Buy Now to access the sign up webpage.

- Select a pricing plan and keep on signing up by providing some info.

- Choose a payment method to complete the sign up.

- Download the document by selecting your preferred format (.docx or .pdf)

Now, submit the document online or print it. If you are uncertain concerning your New Hampshire Small Estate Affidavit for Estates under 10,000 form, contact a legal professional to review it before you send or file it. Start hassle-free!

Form popularity

FAQ

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Small estates involving only personal property with a value of $10,000 or less are eligible for a simplified form of administration called Voluntary or Small Estate Administration, if the decedent died prior to January 1, 2006.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

In New Hampshire, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.