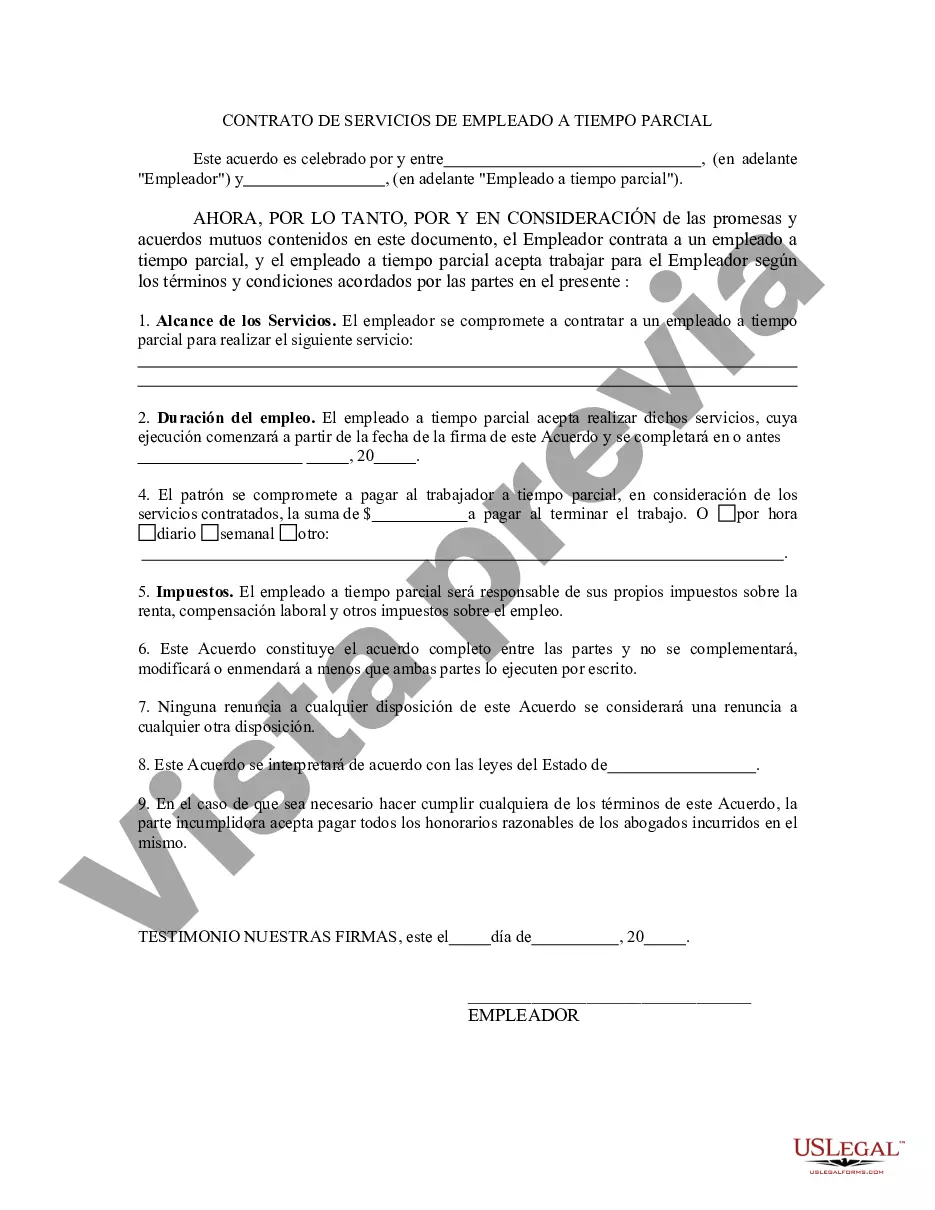

A North Dakota self-employed part-time employee contract is a legally binding agreement between a self-employed individual and an employer for part-time work. This contract outlines the terms and conditions of the employment relationship, including the scope of work, compensation, responsibilities, and other important provisions. It serves as a mutually agreed-upon document that protects the rights and expectations of both parties involved. In North Dakota, there are several types of self-employed part-time employee contracts, each tailored to specific needs and circumstances. These contracts may vary depending on the nature of the work, industry, and specific terms agreed upon by the parties involved. Some common types of North Dakota self-employed part-time employee contracts include: 1. Independent Contractor Agreement: This type of contract is suitable for individuals who provide their services or expertise on a part-time basis to a client or business. It outlines the scope of work, expected deliverables, payment terms, timelines, intellectual property ownership, and termination clauses. 2. Freelancer Agreement: This contract is designed for self-employed professionals who offer specialized services or creative work on a part-time basis. It covers areas such as project details, milestones, payment terms, revisions, confidentiality, and dispute resolution. 3. Consultant Agreement: Suitable for individuals providing expert advice or guidance in a specific field, this contract defines the consultant's role, responsibilities, and deliverables. It often includes terms related to compensation, confidentiality, ownership of work, termination, and any additional provisions as required. 4. Gig Worker Contract: This type of contract is commonly used by individuals who engage in short-term or task-based work on a part-time basis, such as delivery drivers, handyman services, or event staff. It outlines the specific tasks, duration, payment terms, expectations, and any legal requirements related to the work. Regardless of the specific type of self-employed part-time employee contract, it is crucial for both parties to carefully review and understand the terms outlined in the agreement. Seeking legal advice or consultation before entering into such contracts can provide clarity and ensure compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.North Dakota Contrato de Trabajador Autónomo a Tiempo Parcial - Self-Employed Part Time Employee Contract

Description

How to fill out North Dakota Contrato De Trabajador Autónomo A Tiempo Parcial?

If you need to complete, down load, or print out lawful document layouts, use US Legal Forms, the biggest collection of lawful types, that can be found on the web. Take advantage of the site`s simple and easy hassle-free look for to obtain the paperwork you need. Different layouts for company and individual reasons are sorted by categories and suggests, or search phrases. Use US Legal Forms to obtain the North Dakota Self-Employed Part Time Employee Contract in a number of clicks.

Should you be presently a US Legal Forms consumer, log in in your bank account and then click the Acquire key to get the North Dakota Self-Employed Part Time Employee Contract. You can even entry types you earlier saved inside the My Forms tab of your own bank account.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for that correct town/region.

- Step 2. Utilize the Review method to examine the form`s content. Don`t overlook to see the information.

- Step 3. Should you be not satisfied with all the type, make use of the Look for area at the top of the display to find other models of your lawful type design.

- Step 4. After you have discovered the shape you need, click on the Purchase now key. Opt for the pricing program you prefer and include your qualifications to sign up for the bank account.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal bank account to perform the purchase.

- Step 6. Pick the format of your lawful type and down load it on the product.

- Step 7. Total, modify and print out or indication the North Dakota Self-Employed Part Time Employee Contract.

Every single lawful document design you buy is your own forever. You possess acces to each and every type you saved inside your acccount. Select the My Forms portion and decide on a type to print out or down load yet again.

Compete and down load, and print out the North Dakota Self-Employed Part Time Employee Contract with US Legal Forms. There are many skilled and status-specific types you can utilize for your company or individual demands.

Form popularity

FAQ

Generally, Employers define full-time Employees as those who work at least 35-40 hours during a seven-day workweek. Employers may choose to provide benefits, such as paid time off, only to full time Employees.

How Many Hours Is Considered Full-Time? Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed.

Part-time hours can be anywhere from a few hours a week, right up to 35 hours. As with full-time hours, there's no official classification. But no matter how many hours you work, employers must treat you the same as a full-time employee.

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

In addition, 14 and 15 year-old workers are limited to a maximum of 3 hours of work on a school day and 8 hours on a non-school day; and 18 hours in a school week and 40 hours in a non-school week.

Unlike independent contractors, fixed-term contract employees are usually still considered full-time or part-time employees and are entitled to the same benefits. Contractor and client agree on hours to work to complete a task. Usually has the expectation of ongoing work. Usually hired for a specific task.

Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

A contract position fills holes in a client's workforce, and is an increasingly popular element of staffing management plans for employers. Usually, a contract worker does work for a company and is legally employed by a staffing agency or employer of record partner.