North Dakota Promissory Note in Connection with a Sale and Purchase of a Mobile Home A North Dakota promissory note in connection with a sale and purchase of a mobile home is a legally binding document that outlines the terms and conditions of a financial agreement between a buyer and seller in the state of North Dakota. This type of promissory note is specifically designed for transactions involving the sale and purchase of a mobile home. There are various types of North Dakota promissory notes related to the sale and purchase of a mobile home, including: 1. Installment Promissory Note: This type of promissory note specifies that the buyer will make a series of periodic installment payments to the seller over a specified timeframe until the full purchase price is paid off. The terms of the installment plan, such as the payment amount, frequency, and duration, are detailed in the note. 2. Balloon Promissory Note: A balloon promissory note allows the buyer to make smaller installment payments for a set period, with a larger final "balloon" payment due at the end. This type of promissory note is often used when the buyer anticipates receiving a large sum of money, such as a tax refund or an inheritance, that can be used to make the final payment. 3. Secured Promissory Note: In a secured promissory note, the buyer pledges the mobile home as collateral for the loan. This provides the seller with additional security and allows them to take possession of the mobile home if the buyer defaults on the payments. 4. Unsecured Promissory Note: An unsecured promissory note does not involve any collateral. The buyer agrees to make the payments as specified in the note without providing any additional security. This type of promissory note carries more risk for the seller, as they have no direct recourse if the buyer defaults. Regardless of the type of North Dakota promissory note used, it is important to include essential details such as the names and contact information of both parties, the total purchase price of the mobile home, the interest rate (if any), the payment schedule, late payment penalties, and any terms or conditions specific to the agreement. The note should also be signed and dated by both parties to indicate their acceptance and agreement to the terms outlined. In conclusion, a North Dakota promissory note in connection with a sale and purchase of a mobile home is a critical legal document that facilitates a financial agreement between a buyer and a seller. Different types of promissory notes can be tailored to suit the specific needs and preferences of both parties involved in the transaction.

North Dakota Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

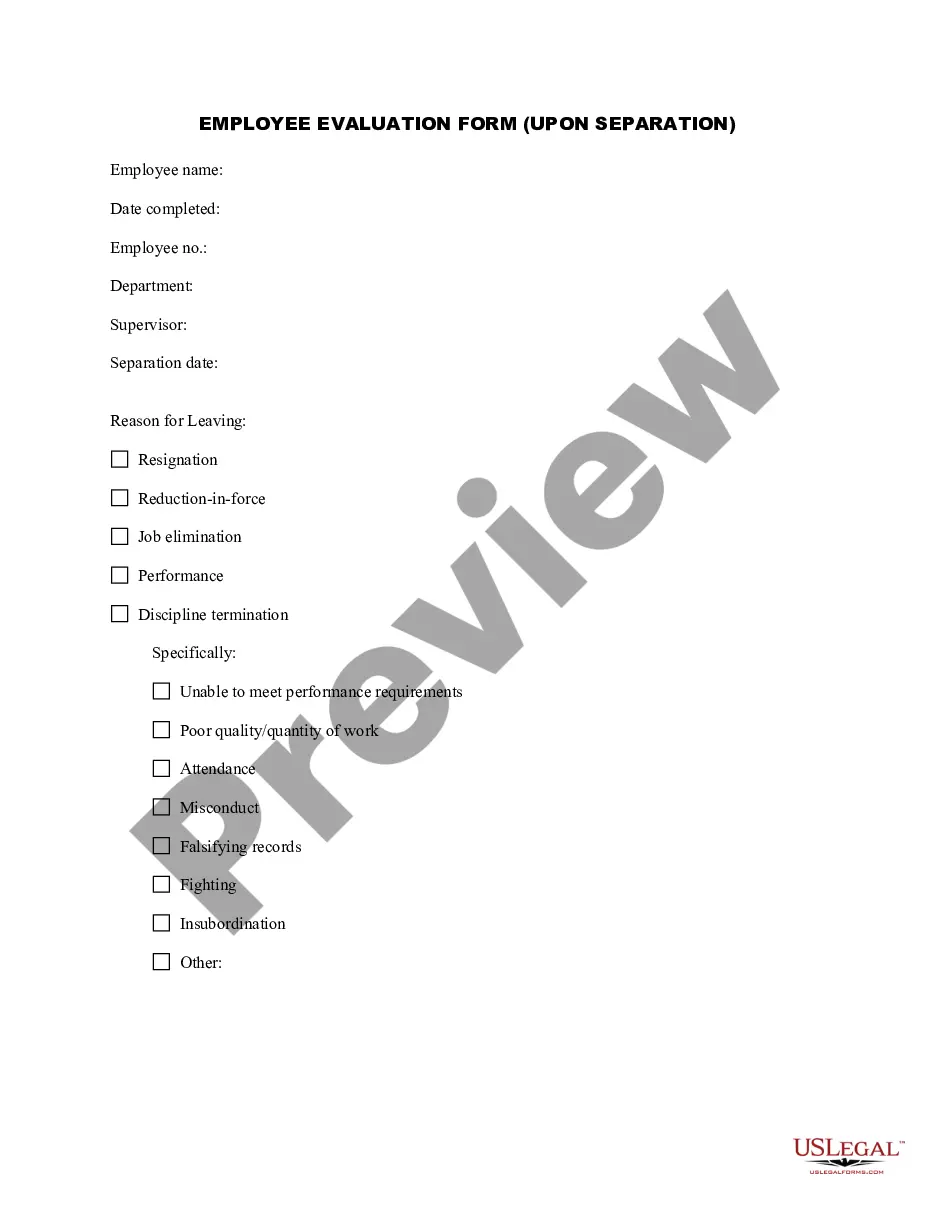

How to fill out North Dakota Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

Locating the appropriate valid document format can be a challenge.

It goes without saying that there are numerous templates accessible online, but how can you find the valid document you require.

Utilize the US Legal Forms platform. This service offers thousands of templates, such as the North Dakota Promissory Note related to the Sale and Purchase of a Mobile Home, which can be used for both business and personal purposes.

First, ensure that you have chosen the correct document for your region/state. You can preview the form using the Preview button and read the form description to confirm it fits your needs.

- All templates are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the North Dakota Promissory Note related to the Sale and Purchase of a Mobile Home.

- You can use your account to browse the legal templates you have previously acquired.

- Go to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

Form popularity

FAQ

In order for a promissory note to be valid and legally binding, it needs to include specific information. "A promissory note should include details including the amount loaned, the repayment schedule and whether it is secured or unsecured," says Wheeler.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

When you write the promissory note, make sure to contain the following information:Name and address of the borrower and lender.Model, year, make, and VIN of the vehicle.Loan amount, interest rate, length of the loan, and maturity date.Late fees and penalties.Collateral information.Odometer reading.More items...

Unlike a promissory note, a loan agreement imposes obligations on both parties, which is why both the borrower and lender must sign the agreement. A loan agreement should state what purpose the loan is used for, and whether the borrower must provide compensation if the lender suffers loss.

To write a promissory note for a personal loan, you will need to include the names of both parties, the principal balance, the APR, and any fees that are part of the agreement. The promissory note should also clearly explain what will happen if the borrower pays late or does not pay the loan back at all.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Executing a note involves signing, dating and having your signature witnessed.Create the promissory note.Create date and signature lines for yourself and a witness.Sign the form in front of a witness.Give the note to the lending party.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.