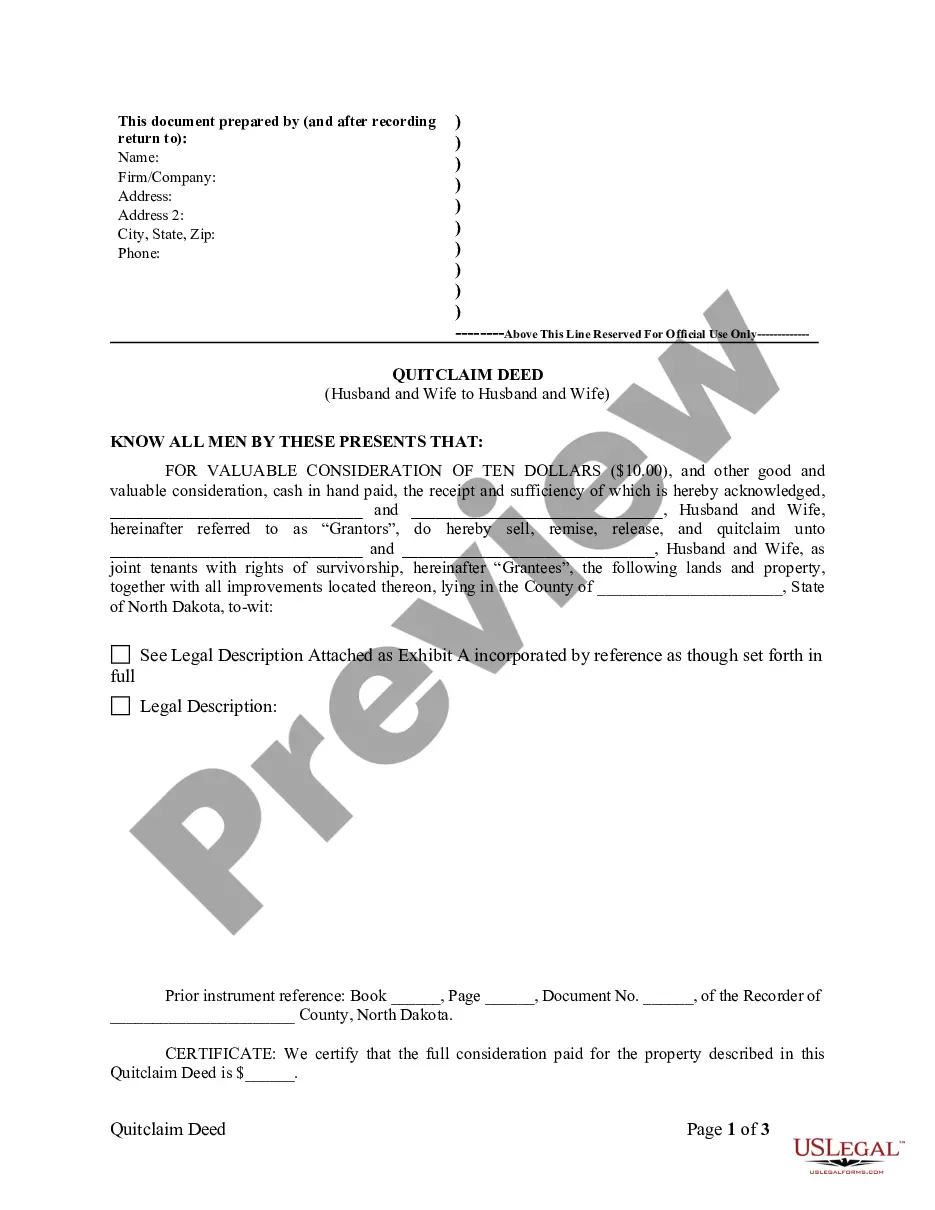

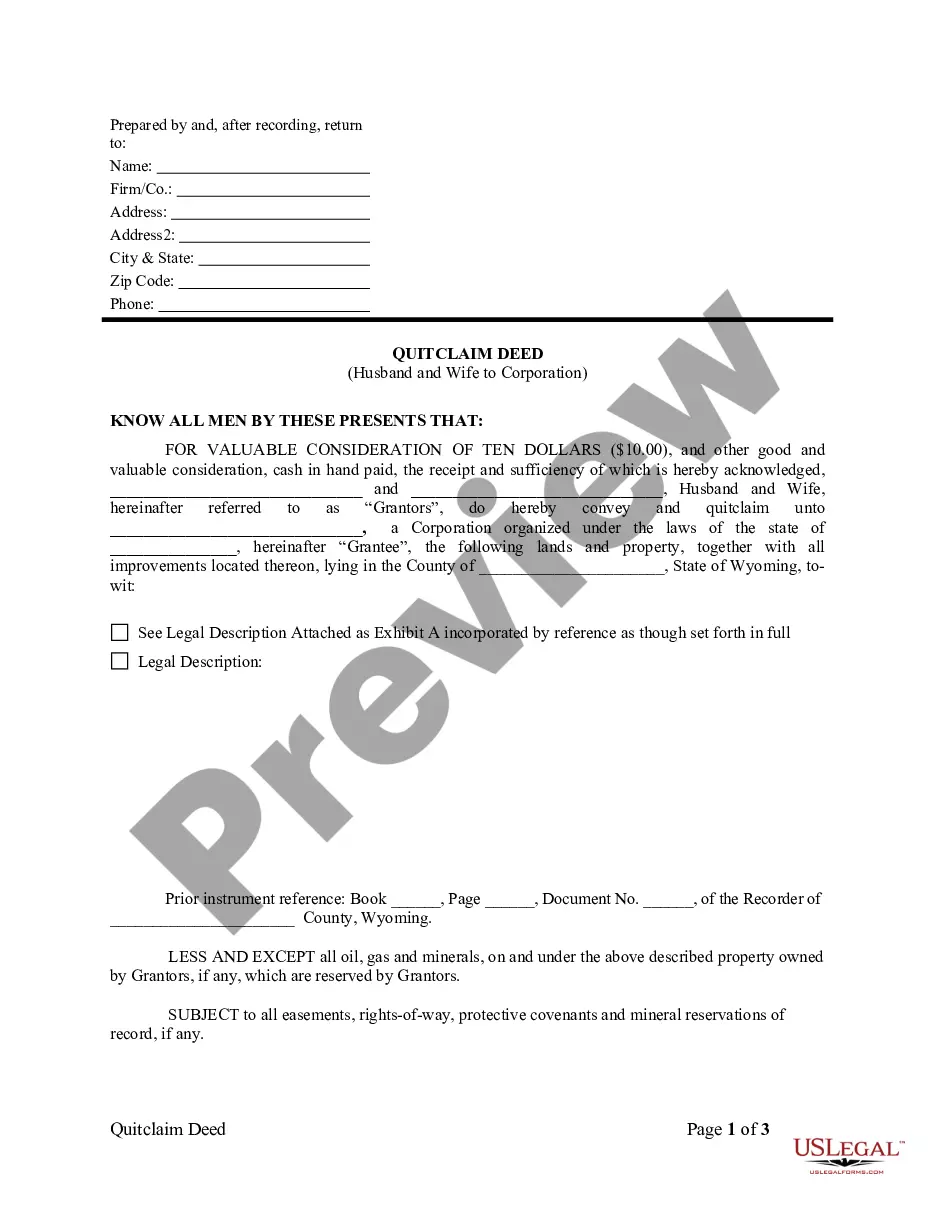

This form is a Quitclaim Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

North Dakota Quitclaim Deed from Husband and Wife to Husband and Wife

Description

How to fill out North Dakota Quitclaim Deed From Husband And Wife To Husband And Wife?

Avoid expensive lawyers and find the North Dakota Quitclaim Deed from Husband and Wife to Husband and Wife you want at a reasonable price on the US Legal Forms website. Use our simple groups function to search for and download legal and tax files. Go through their descriptions and preview them well before downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to obtain and complete each and every template.

US Legal Forms customers merely need to log in and get the specific document they need to their My Forms tab. Those, who have not obtained a subscription yet need to follow the tips below:

- Make sure the North Dakota Quitclaim Deed from Husband and Wife to Husband and Wife is eligible for use in your state.

- If available, read the description and make use of the Preview option well before downloading the templates.

- If you’re sure the document is right for you, click on Buy Now.

- In case the template is incorrect, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Select download the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, it is possible to fill out the North Dakota Quitclaim Deed from Husband and Wife to Husband and Wife manually or an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

Two of the most common ways to transfer property in a divorce are through an interspousal transfer deed or quitclaim deed. When spouses own property together, but then one spouse executes an interspousal transfer or a quitclaim deed, this is known as transmutation.

When it comes to reasons why you shouldn't add your new spouse to the Deed, the answer is simple divorce and equitable distribution. If you choose not to put your spouse on the Deed and the two of you divorce, the entire value of the home is not subject to equitable distribution.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

You may be able to transfer your interest in the property through a quitclaim deed, where you relinquish all ownership of the property to someone else. Your lender may also agree to add another name to the mortgage. In this case, someone else would be able to legally make payments on the mortgage.

You can gift property to spouse, child or any relative and register the same. Under section 122 of the Transfer of Property Act, 1882, you can transfer immovable property through a gift deed. The deed should contain your details as well as those of the recipient.