Mississippi Receipt for Money Paid on Behalf of Another Person

Description

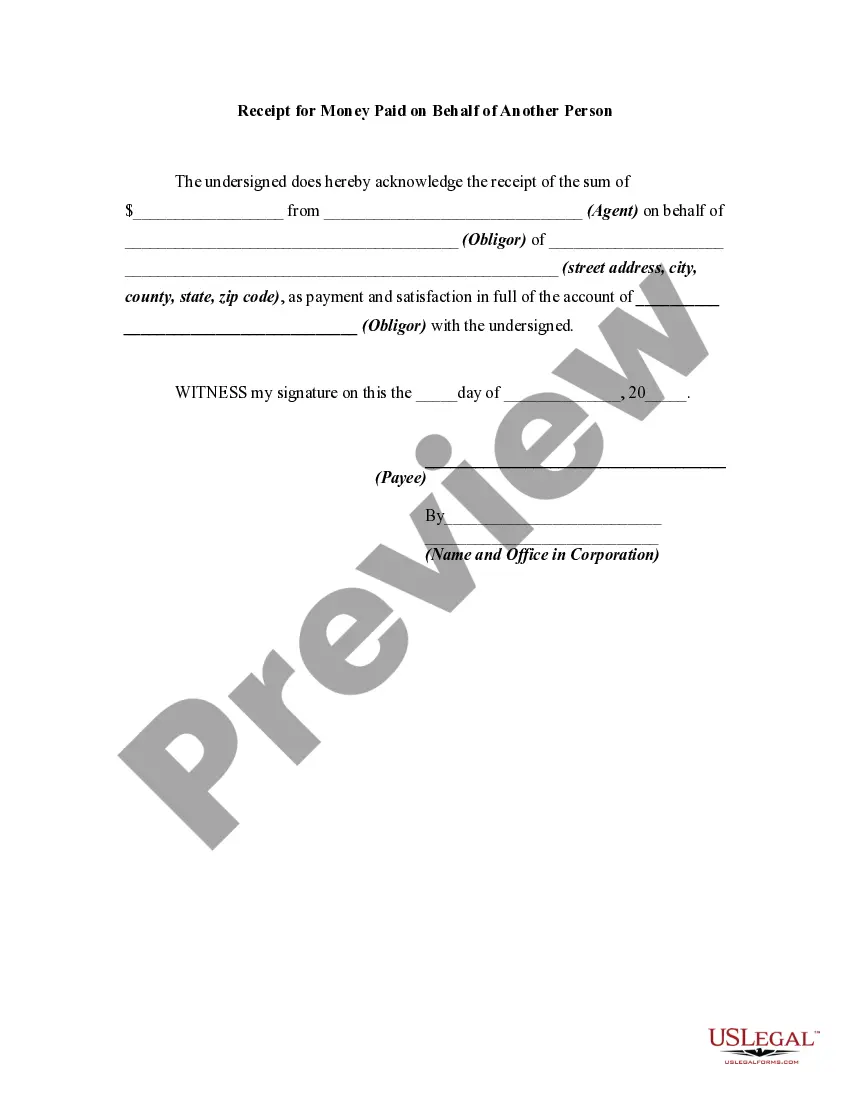

How to fill out Receipt For Money Paid On Behalf Of Another Person?

Are you at the location where you need documents for both business or personal reasons almost all the time.

There are numerous legitimate document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms provides thousands of form templates, including the Mississippi Receipt for Money Paid on Behalf of Another Person, which are designed to meet federal and state requirements.

Once you find the correct form, click on Buy now.

Choose the pricing plan you'd like, fill out the necessary information to process your payment, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Mississippi Receipt for Money Paid on Behalf of Another Person template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/county.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)

According to California Penal Code 496, the charge of receipt of stolen property can be either a misdemeanor or a felony and can carry fines or imprisonment, or both.

If you are an employee, you report your cash payments for services on Form 1040, line 7 as wages. The IRS requires all employers to send a Form W-2 to every employee. However, because you are paid in cash, it is possible that your employer will not issue you a Form W-2.

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

They pay you with cash at the point of sale. You need to give them a receipt since you made a sale and accepted the cash payment.

Every case is different, but here are some potential ways to prove you paid for something with cash:Save Receipts. This seems like a no-brainer... and it is.Cashier's Checks or Money Orders.Bank Statements and ATM Receipts.Find a Witness.

Cash receipts procedureRecord Checks and Cash. When the daily mail delivery arrives, record all received checks and cash on the mailroom check receipts list.Forward Payments.Apply Cash to Invoices.Record Other Cash (Optional)Deposit Cash.Match to Bank Receipt.

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)

Generally, paying wages in cash is as legal as a paycheck or direct deposit as long as the employer adheres to federal and SALT compliance laws. An employee should expect a stub or statement along with the cash payment indicating that all withholding payments are being deducted.