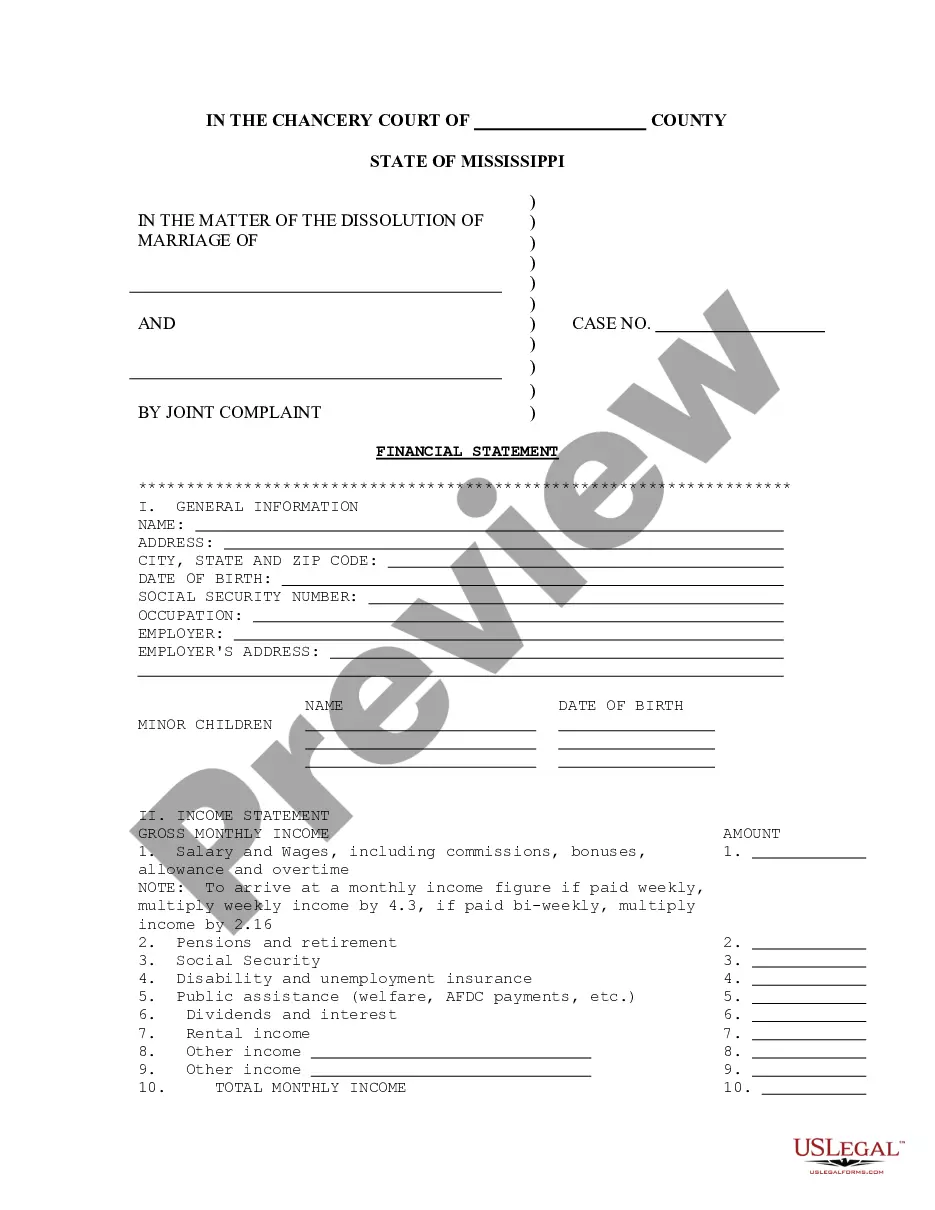

Mississippi Financial Statement required by Rule 8.05

What is this form?

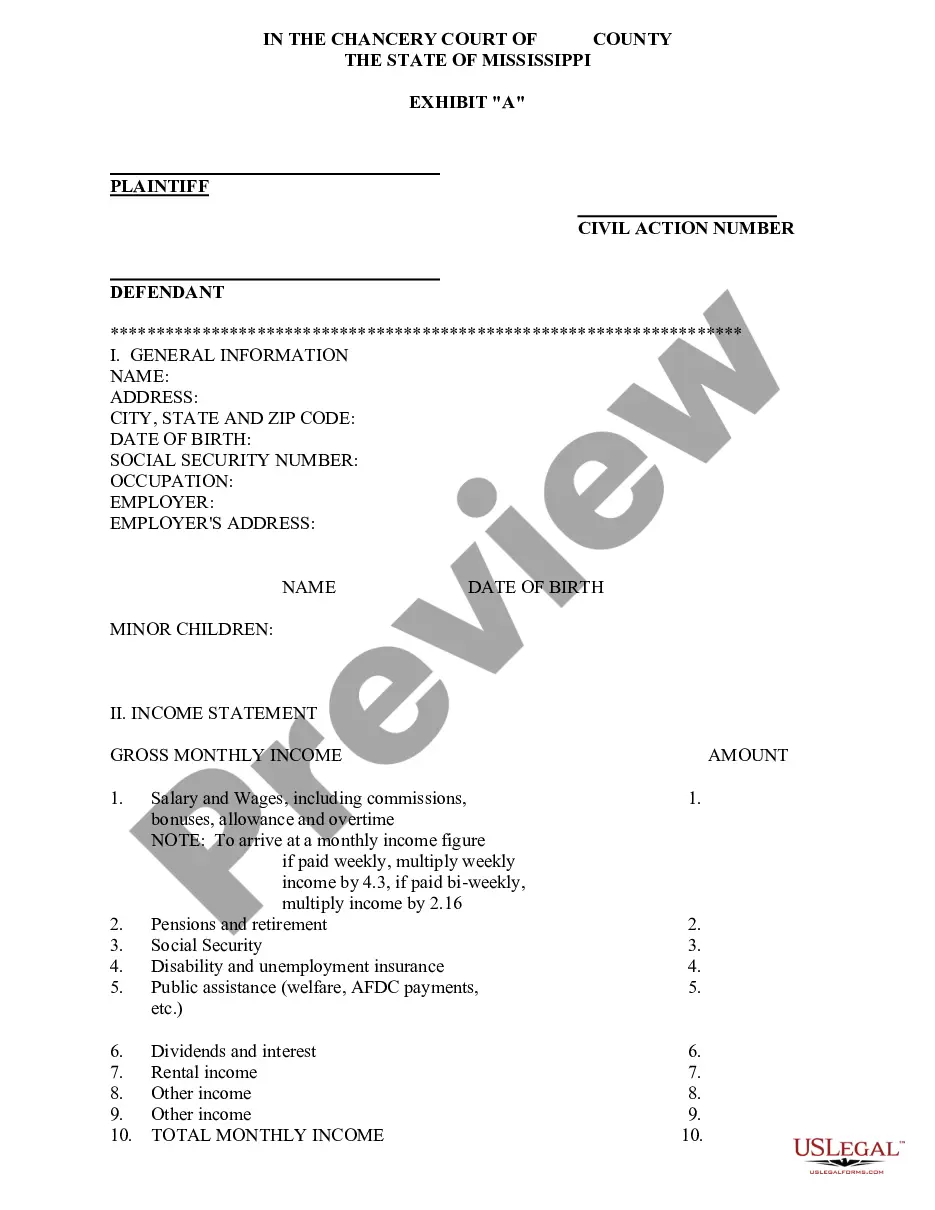

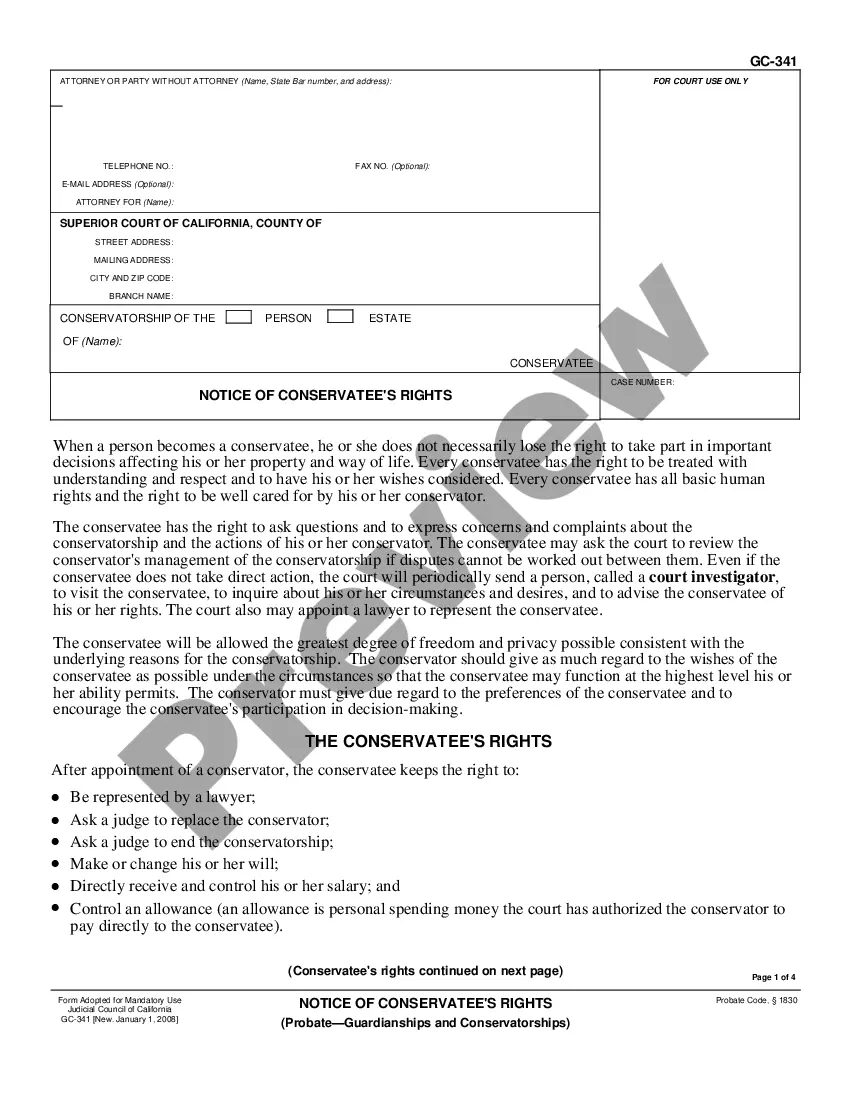

The Financial Statement required by Rule 8.05 is a legal document used in divorce proceedings to outline a couple's financial situation. This form helps ensure a fair distribution of assets and debts between spouses. It differs from other financial documents by its specific requirement in divorce actions, providing essential information needed by the court to make informed decisions.

Key parts of this document

- Personal Information: Includes both spouses' names, addresses, and contact details.

- Income Details: Specifies both parties' income sources and amounts, including salaries and investment earnings.

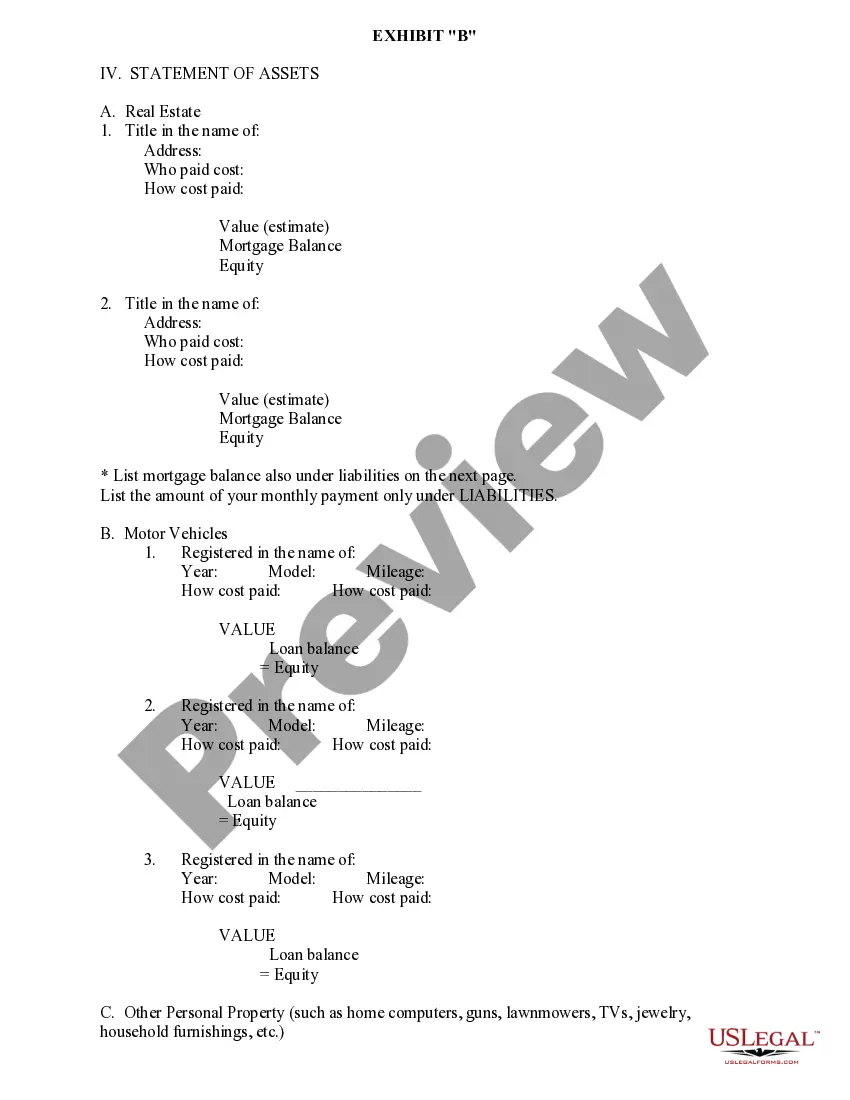

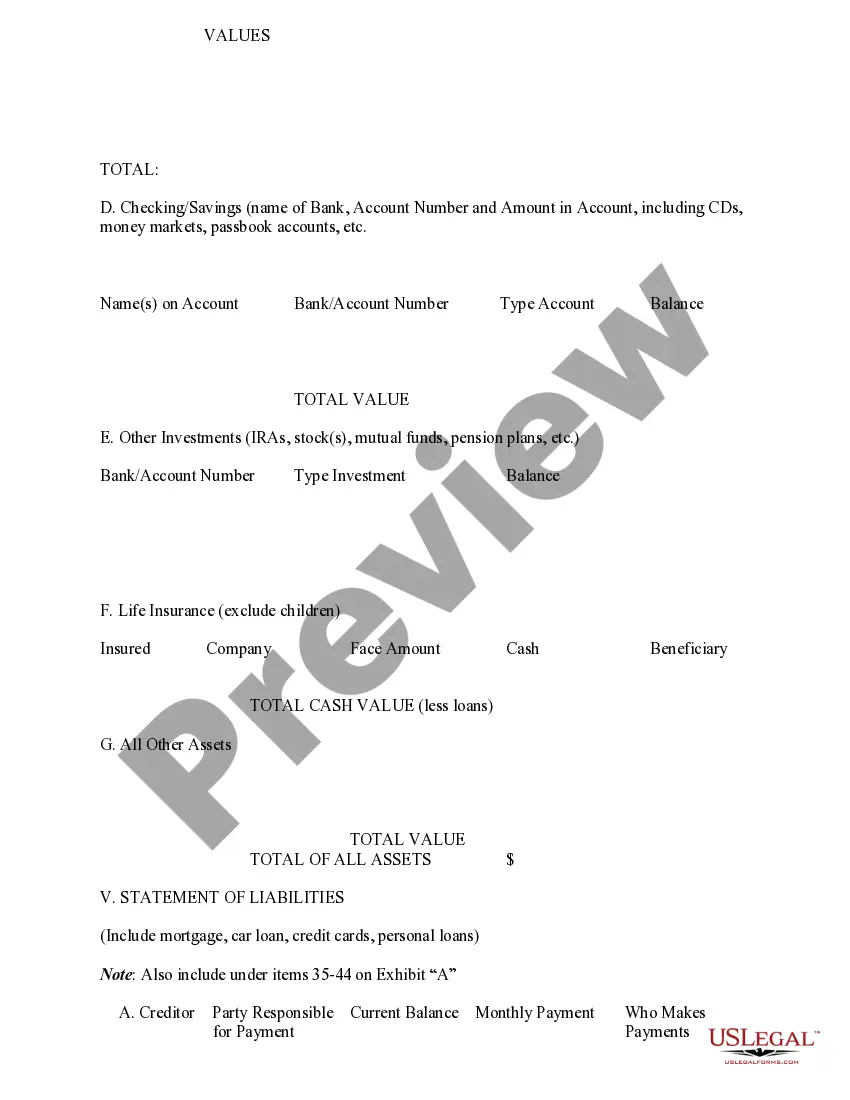

- Asset Listing: Details all marital assets, including real estate, vehicles, savings, and retirement accounts.

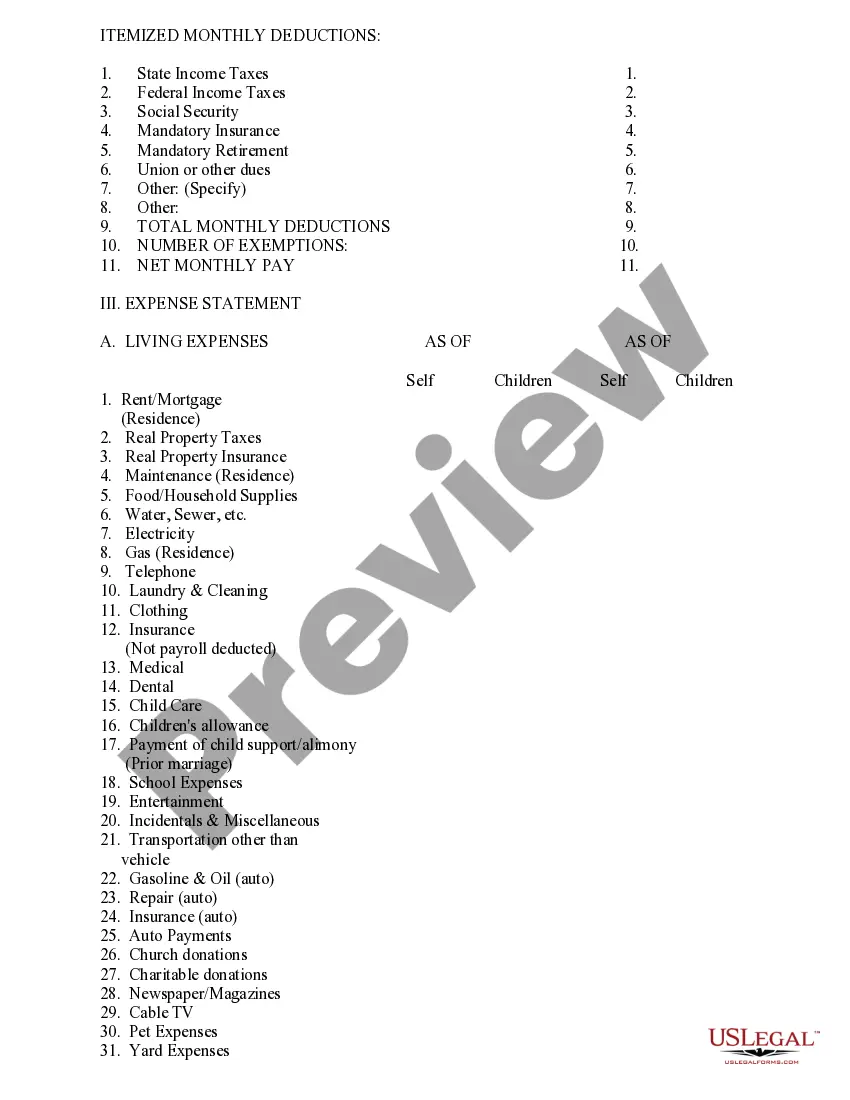

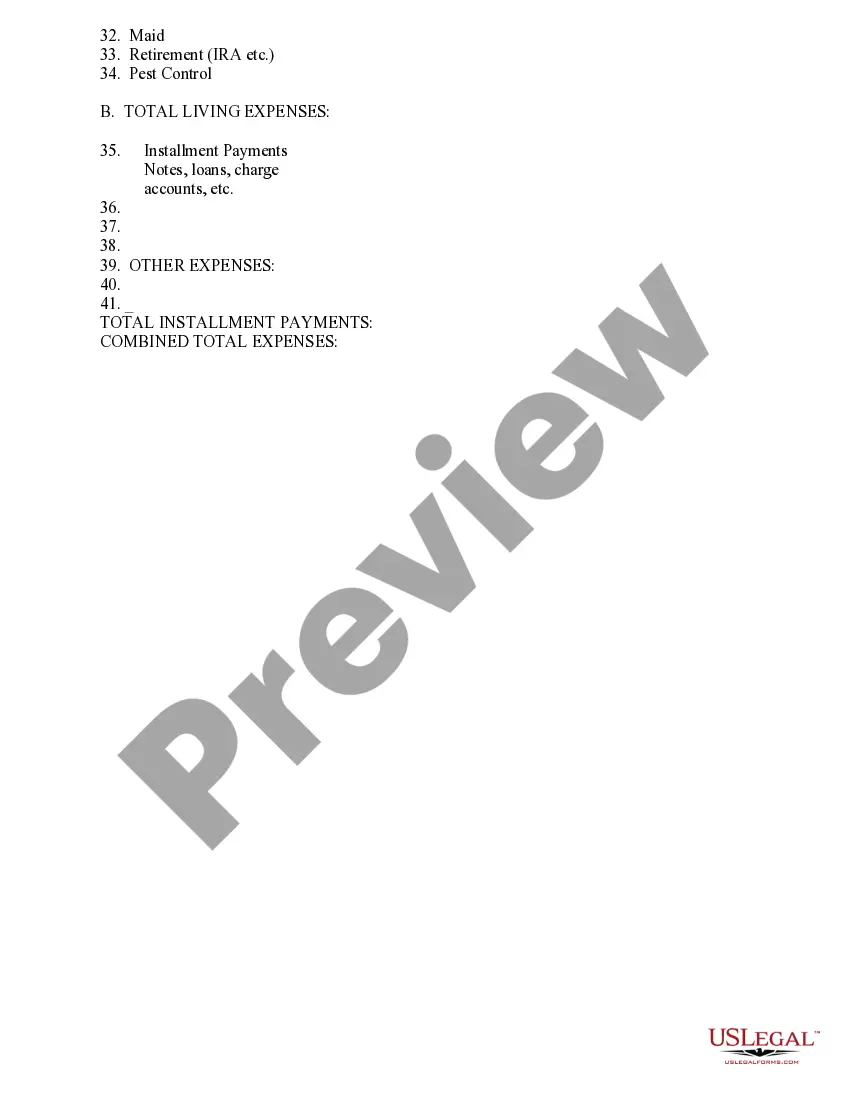

- Debt Disclosure: Lists all marital debts, such as mortgages, credit cards, and loans, along with total amounts owed.

- Monthly Expenses: Outlines recurring monthly expenses for both parties, which the court will consider in asset distribution.

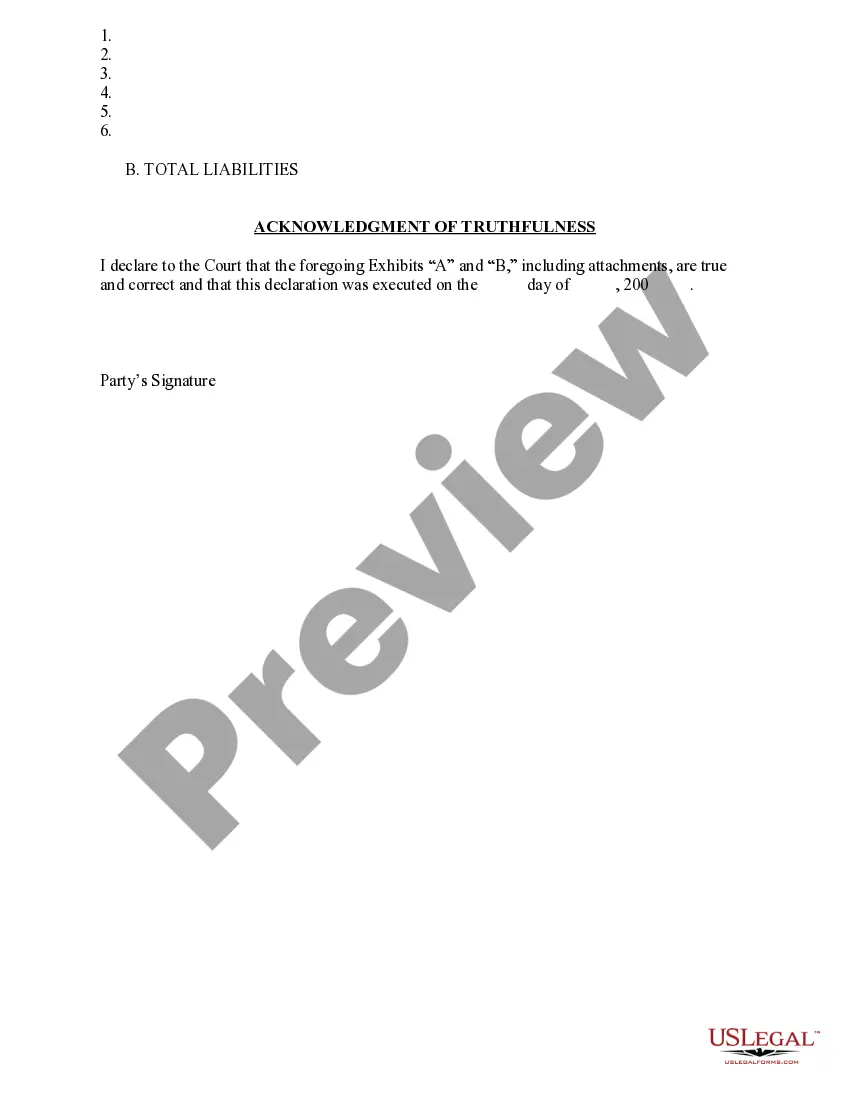

- Signature Block: Requires signatures from both parties to authenticate the information provided.

Situations where this form applies

This form should be used when filing for divorce, as it is a critical part of the divorce proceedings. It is used to disclose financial information to the court, ensuring that both parties have a clear understanding of shared assets and liabilities. This transparency is essential for equitable division during the divorce settlement process.

Who should use this form

- Individuals initiating a divorce process.

- Spouses involved in a divorce who need to provide detailed financial information.

- Attorneys representing clients in divorce cases who require comprehensive financial disclosure for legal purposes.

How to prepare this document

- Identify the parties: Enter the names and contact information for both spouses.

- Detail income: List all sources of income for both parties, including salaries, investments, and any additional earnings.

- Catalog assets: Provide a comprehensive list of all marital assets, categorizing them by type and estimated value.

- Record debts: Disclose all marital debts, ensuring accuracy in amounts that need to be settled.

- Outline monthly expenses: Itemize regular monthly expenses to provide a full picture of financial responsibilities.

- Sign the form: Ensure both parties sign the document to validate the information provided.

Does this form need to be notarized?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete and accurate financial information.

- Not updating the form to reflect significant financial changes before submission.

- Leaving out necessary signatures from both parties, which can lead to delays.

Benefits of completing this form online

- Convenience: Easily fill out and download the form from the comfort of your home.

- Editability: Make necessary changes quickly without physical copies and manual edits.

- Reliability: Use templates drafted by licensed attorneys ensures legal compliance and accuracy.