Missouri Assignment and Transfer of Stock refers to the legal process of transferring ownership of stock shares from one party to another in the state of Missouri. It involves the assignment of rights and interests related to the ownership of stock in a corporation or company. In Missouri, the Assignment and Transfer of Stock is governed by specific laws and regulations, which ensure the proper documentation and execution of these transactions. It is essential for both parties involved in the transfer to comply with these legal requirements. Various types of Assignment and Transfer of Stock exist in Missouri, including: 1. Voluntary Transfer: This type of transfer occurs when the stockholder willingly transfers their ownership rights to another individual or entity. It can happen through a sale, gift, or exchange of stock. 2. Involuntary Transfer: In certain situations, stock may be transferred involuntarily, such as in cases of bankruptcy, foreclosure, or court-ordered transfers. These transfers usually occur due to legal proceedings or circumstances beyond the stockholder's control. 3. Intergenerational Transfer: This type of transfer involves the transfer of stock ownership between family members or across generations. It can occur through gifting, inheritance, or during estate planning. 4. Corporate Transfers: Corporations may also engage in stock transfers to restructure or consolidate their ownership. This can happen through mergers, acquisitions, or corporate reorganizations. To initiate a lawful Missouri Assignment and Transfer of Stock, various steps and documentation must be followed. These include: a) Stock Transfer Agreement: The parties involved need to execute a Stock Transfer Agreement, which outlines the terms and conditions of the transfer, including the number of shares, share price, and any other relevant information. b) Stock Certificates: The current stockholder must provide the stock certificates to the transferee. These certificates represent ownership of the specific number of shares being transferred. c) Stock Power Form: A stock power form is needed to authorize and facilitate the transfer of ownership. The stockholder must complete and sign this form, indicating their intent to transfer the shares. d) Shareholder Approval: In certain circumstances, such as when there are restrictions on stock transfers or specific provisions in the company's bylaws, obtaining shareholder approval may be necessary for the assignment and transfer of stock. e) Record keeping: Proper record keeping is crucial to maintain accurate information regarding stock ownership transfers. Both parties should keep copies of all documents related to the transfer, including the Stock Transfer Agreement, stock certificates, and stock power form. It is advisable to consult with legal professionals or financial advisors familiar with Missouri laws and regulations pertaining to the Assignment and Transfer of Stock to ensure compliance and a smooth transfer process.

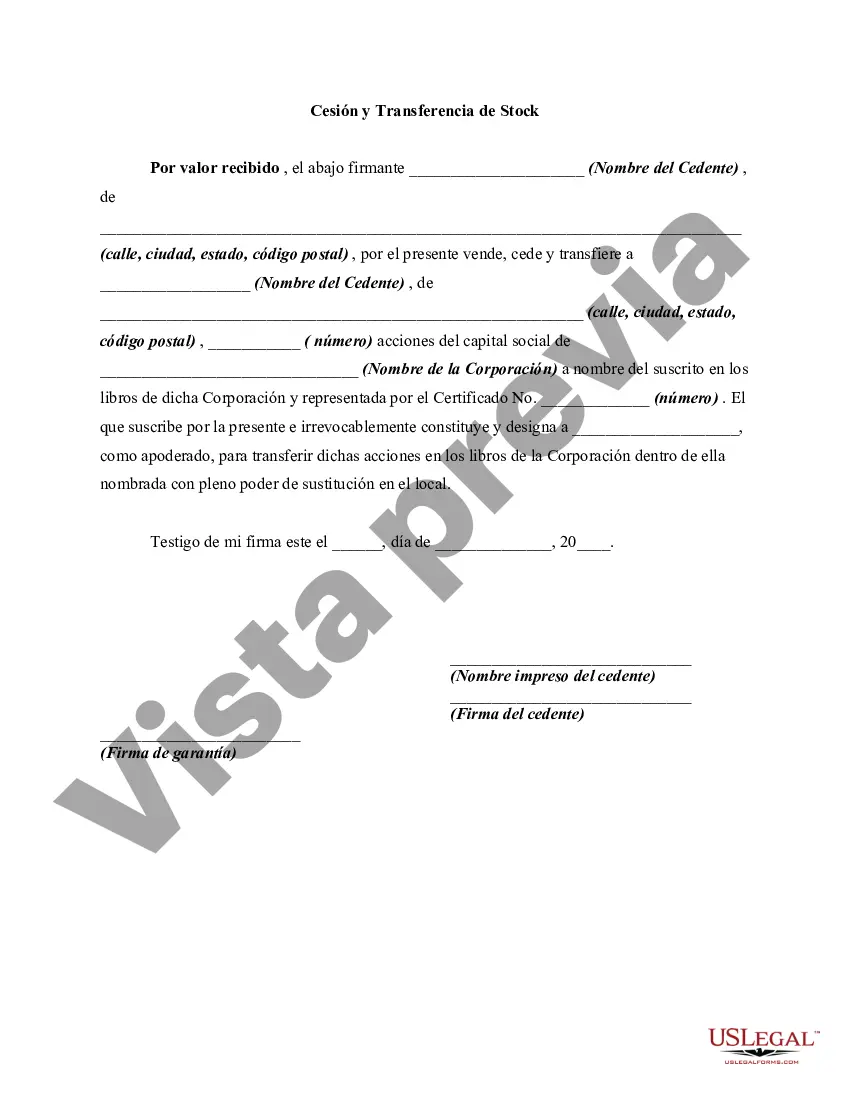

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Missouri Cesión y Transferencia de Stock - Assignment and Transfer of Stock

Description

How to fill out Missouri Cesión Y Transferencia De Stock?

Are you within a placement in which you will need paperwork for sometimes company or specific purposes nearly every working day? There are a variety of legitimate papers themes available on the net, but locating types you can rely on is not easy. US Legal Forms delivers a large number of kind themes, like the Missouri Assignment and Transfer of Stock, that are composed in order to meet federal and state needs.

If you are presently knowledgeable about US Legal Forms internet site and have your account, simply log in. After that, you can down load the Missouri Assignment and Transfer of Stock web template.

Unless you have an profile and would like to begin using US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is for that right city/state.

- Make use of the Preview key to review the form.

- See the explanation to actually have selected the correct kind.

- In the event the kind is not what you are looking for, take advantage of the Look for area to discover the kind that meets your requirements and needs.

- When you get the right kind, just click Purchase now.

- Pick the pricing program you would like, fill in the specified info to produce your account, and pay for the transaction using your PayPal or charge card.

- Pick a hassle-free paper file format and down load your version.

Locate each of the papers themes you might have purchased in the My Forms food list. You can aquire a extra version of Missouri Assignment and Transfer of Stock anytime, if necessary. Just click the necessary kind to down load or print out the papers web template.

Use US Legal Forms, one of the most considerable variety of legitimate types, to save lots of some time and prevent mistakes. The assistance delivers skillfully manufactured legitimate papers themes which you can use for a selection of purposes. Produce your account on US Legal Forms and commence generating your lifestyle a little easier.

Form popularity

FAQ

An assignment of rights causes the designated party to gain new legal benefits from a stock, which may include voting rights and dividends. This shift can impact the management and financial possibilities of both the assignor and assignee. To manage these changes correctly, utilizing platforms like USLegalForms can provide the necessary resources and guidance for a smooth transition.

Consideration in the assignment of rights refers to what one party receives in exchange for transferring their rights, such as stock ownership or financial compensation. This aspect is vital in ensuring that the assignment adheres to legal standards in Missouri Assignment and Transfer of Stock. It helps validate the agreement and prevents future disputes over fairness or intent.

The assignment of rights operates by allowing one party to transfer their benefits from a stock, including dividends or voting rights, to another party. This transfer generally requires documentation and consent to ensure it aligns with legal regulations. In Missouri, it's essential to follow the correct procedures to avoid complications, and tools like USLegalForms can assist you in navigating this process effectively.

The Assignment of rights in Missouri pertains to the legal allowance for individuals to delegate their benefits or interests in a stock to another party. This process must adhere to Missouri law and often involves specific documentation to ensure clarity and legality. Engaging with platforms like USLegalForms can streamline this process by providing the necessary forms and guidance.

In the context of Missouri Assignment and Transfer of Stock, assignment refers to the process of transferring rights to receive dividends or vote, while transfer commonly denotes the actual exchange of stock ownership. An assignment usually maintains the original holder’s title, whereas a transfer entirely shifts the ownership to a new party. Understanding this distinction is crucial for anyone involved in stock transactions.

Consent to assignment of rights is an essential step in the Missouri Assignment and Transfer of Stock process. It involves obtaining permission from the relevant parties before transferring their rights related to stock. Without this consent, the assignment may be considered invalid. Therefore, ensuring proper consent protects all involved parties and upholds legal agreements.

Transferring property from an LLC to a person involves drafting a transfer deed outlining the transaction. This deed must be executed correctly and filed with the appropriate County Recorder's Office. It is essential to follow state laws to ensure the transfer is valid. The Missouri Assignment and Transfer of Stock resources can simplify this process and help you stay compliant.

To change the owner of your LLC in Missouri, start with the operating agreement, outlining the transfer process. You will then need to file any necessary forms with the Secretary of State's office, including the Statement of Change. Keeping records of this transfer is crucial for legal compliance, and the Missouri Assignment and Transfer of Stock can guide you through this journey.

Yes, you can transfer a liquor license in Missouri, but the process requires adherence to specific regulations. Typically, you need to submit a form to the local governing authority along with the required fees. Additionally, the new owner may need to undergo a background check. The Missouri Assignment and Transfer of Stock can help manage related paperwork effectively.

To change the ownership of a company, you should first create a written agreement between the current and new owners. You will often need to update the company's records and notify the appropriate state authorities. Filing the correct documents, such as the Missouri Assignment and Transfer of Stock, ensures that the change is recorded and legally binding.