Minnesota Authorization to Release Financial Records and Information - 2 Samples

Description

Key Concepts & Definitions

Authorization to release financial records is a formal consent given by an individual or organization allowing a third party access to their confidential financial information. This process involves using forms such as sample financial forms and requests which often come in different file formats like PDF, Microsoft Word, and Excel. The primary purpose is for the individual to authorize a recipient to use their protected financial details for specific reasons, promoting transparency while ensuring privacy is maintained. The size and details of such forms (e.g., pdf size kb) and the security measures on privacy details file(s) are critical aspects.

Step-by-Step Guide

- Identify the need for releasing financial records and specify the type of financial information to be released.

- Choose appropriate sample financial forms or create one using templates available in formats like download format PDF or use MS Word.

- Complete the form ensuring all fields including the information release request and authorize recipient use sections are duly filled.

- Ensure all privacy details are correctly filled and the files security features like protected financial details are activated.

- Submit the form to the designated recipient or authorized entity, as per the requested file format, typically file format Excel, PDF, or Word.

Risk Analysis

Releasing financial records carries inherent risks primarily related to privacy and data breaches. Unauthorized access and misuse of sensitive financial data can lead to significant financial loss and reputational damage. Ensuring that the forms used, such as pdf size kb and privacy details file, comply with current data protection laws is essential. Moreover, it is vital to ensure that the entities authorized to receive such information are trustworthy and use the data solely for the purpose stated in the information release request.

Key Takeaways

- Using standardized forms in familiar file formats like PDF or MS Word can streamline the process of financial records release.

- It is crucial to maintain the integrity and confidentiality of financial data by adhering to data privacy laws and selecting reputable recipients.

- Regularly update and review the security measures related to financial data handling and transfer.

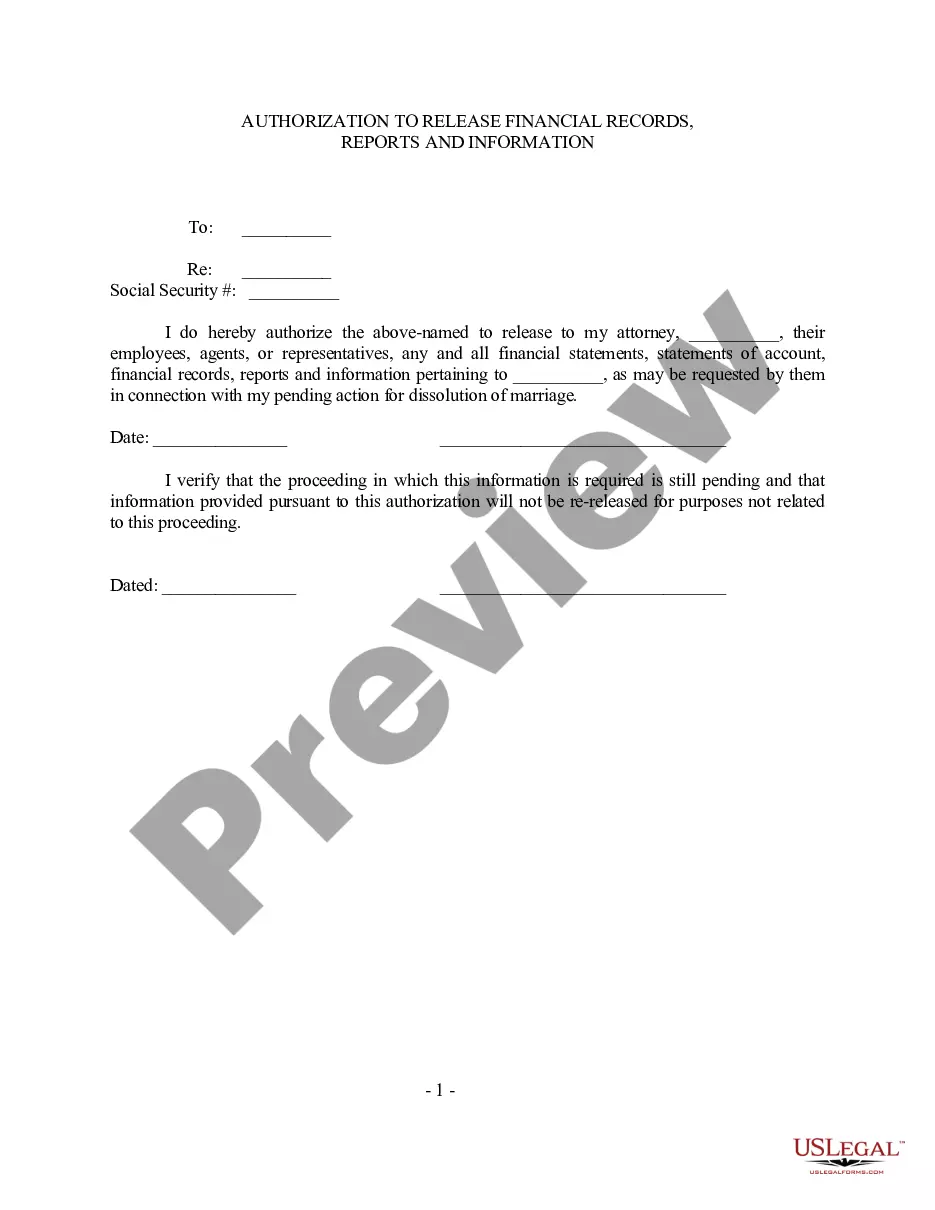

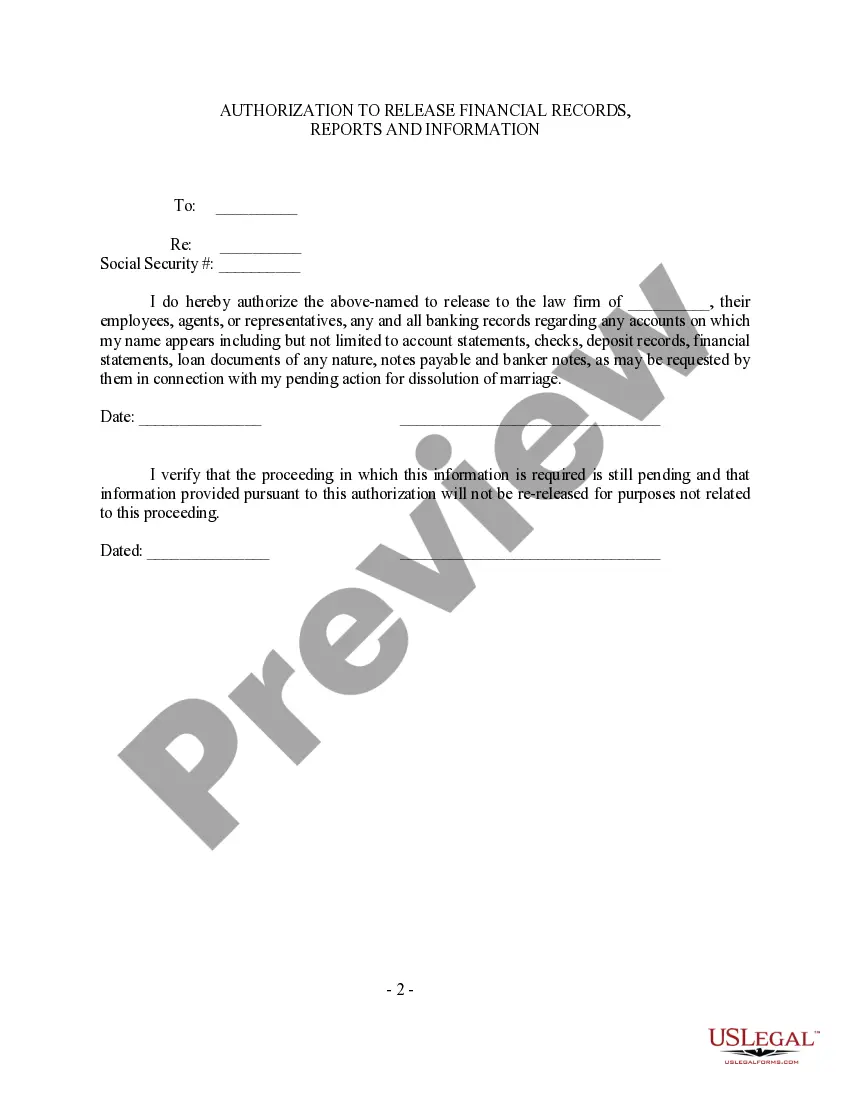

How to fill out Minnesota Authorization To Release Financial Records And Information - 2 Samples?

Get any template from 85,000 legal documents including Minnesota Authorization to Release Financial Records and Information - 2 Samples online with US Legal Forms. Every template is drafted and updated by state-licensed attorneys.

If you already have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the tips below:

- Check the state-specific requirements for the Minnesota Authorization to Release Financial Records and Information - 2 Samples you want to use.

- Read through description and preview the template.

- When you are sure the template is what you need, simply click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay in one of two suitable ways: by credit card or via PayPal.

- Choose a format to download the document in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- Once your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the right downloadable sample. The platform will give you access to documents and divides them into groups to simplify your search. Use US Legal Forms to get your Minnesota Authorization to Release Financial Records and Information - 2 Samples fast and easy.

Form popularity

FAQ

By signing an authorization to release information, a party is consenting to provide another party with access to otherwise confidential information or records about an individual. However, signing a release doesn't mean the complete loss of confidentiality because most authorization forms are subject to limitations.

Written statement by a creditor to the effect that a debtor has either paid off the debt or the debt is otherwise discharged. A creditor may release a lien if the loan has been paid or if other collateral has been offered.

Under the law, agencies enforce the Financial Privacy Rule, which governs how financial institutions can collect and disclose customers' personal financial information; the Safeguards Rule, which requires all financial institutions to maintain safeguards to protect customer information; and another provision designed

Government agencies like the Consumer Financial Protection Bureau and the Federal Trade Commission provide enforcement for financial privacy regulations.

The RFPA contains a large loophole, which is to accommodate financial institution reporting under the Bank Secrecy Act. 12 U.S.C. § 3413(d).

Identify the releasor. Describe the photo, image, likeness, or video. Address any payment the model receives for the release. Address royalties. Address whether the model has the ability to revoke their authorization. The parties sign and date the release.

The RFPA does not apply to bank records of corporations, associations, or larger partnerships.Person is an individual or partnership of five or fewer individuals. The RFPA does not apply to bank records of corporations, trusts, associations, or larger partnerships.

? 3401-22 (2012). The RFPA protects customer records, maintained by financial institutions, from improper disclosure to officials or agencies of the federal government.

Financial Information Release Authorization Forms are forms that are specifically used whenever someone requires the authorization to release any kind of financial information to the right companies or people who need to make use of such info.