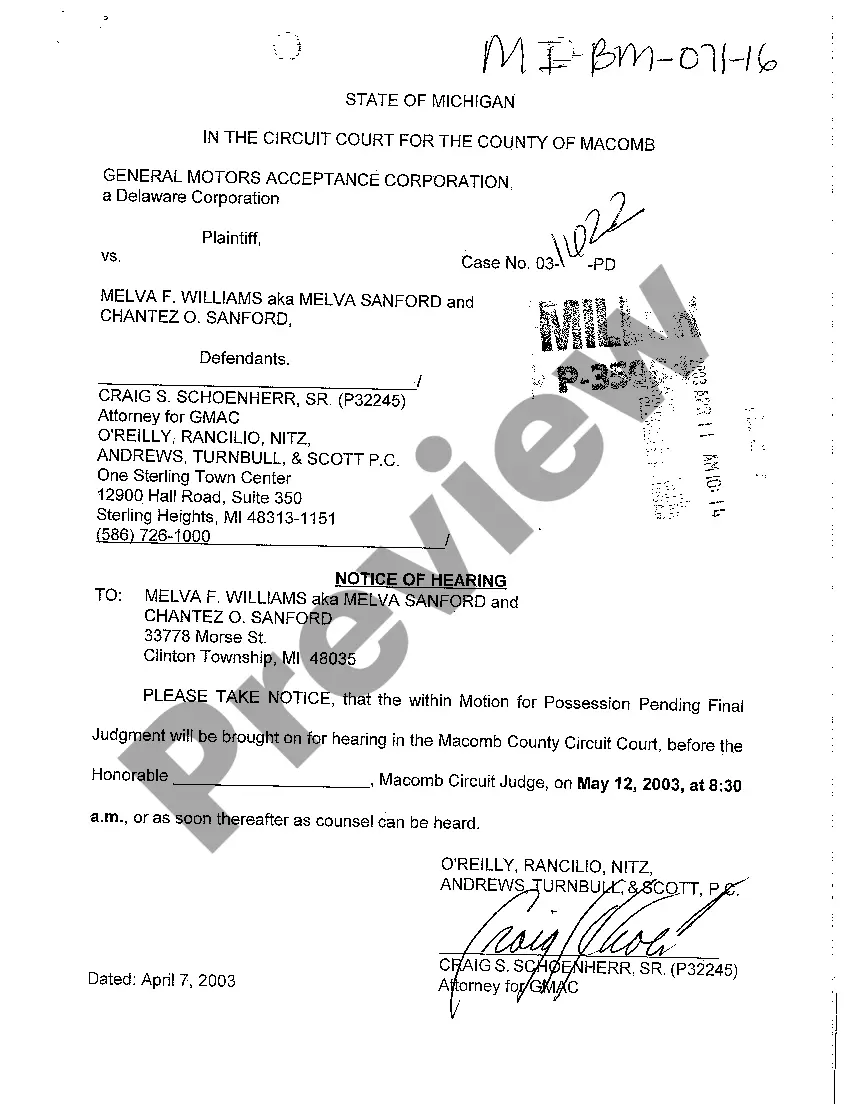

Michigan Objections to Defendants' Motion for Installment Payments And Plaintiff's Request for Hearing

Description

How to fill out Michigan Objections To Defendants' Motion For Installment Payments And Plaintiff's Request For Hearing?

Obtain any template from 85,000 legal documents like the Michigan Objections to Defendants' Motion for Installment Payments and Plaintiff's Request for Hearing online with US Legal Forms. Each template is composed and revised by state-certified lawyers.

If you already possess a subscription, sign in. When you are on the form’s page, hit the Download button and navigate to My documents to retrieve it.

In the event that you have not subscribed yet, follow the guidance provided below.

With US Legal Forms, you will consistently have quick access to the correct downloadable template. The platform offers you access to forms and categorizes them to ease your search. Utilize US Legal Forms to obtain your Michigan Objections to Defendants' Motion for Installment Payments and Plaintiff's Request for Hearing swiftly and easily.

- Verify the state-specific guidelines for the Michigan Objections to Defendants' Motion for Installment Payments and Plaintiff's Request for Hearing you wish to utilize.

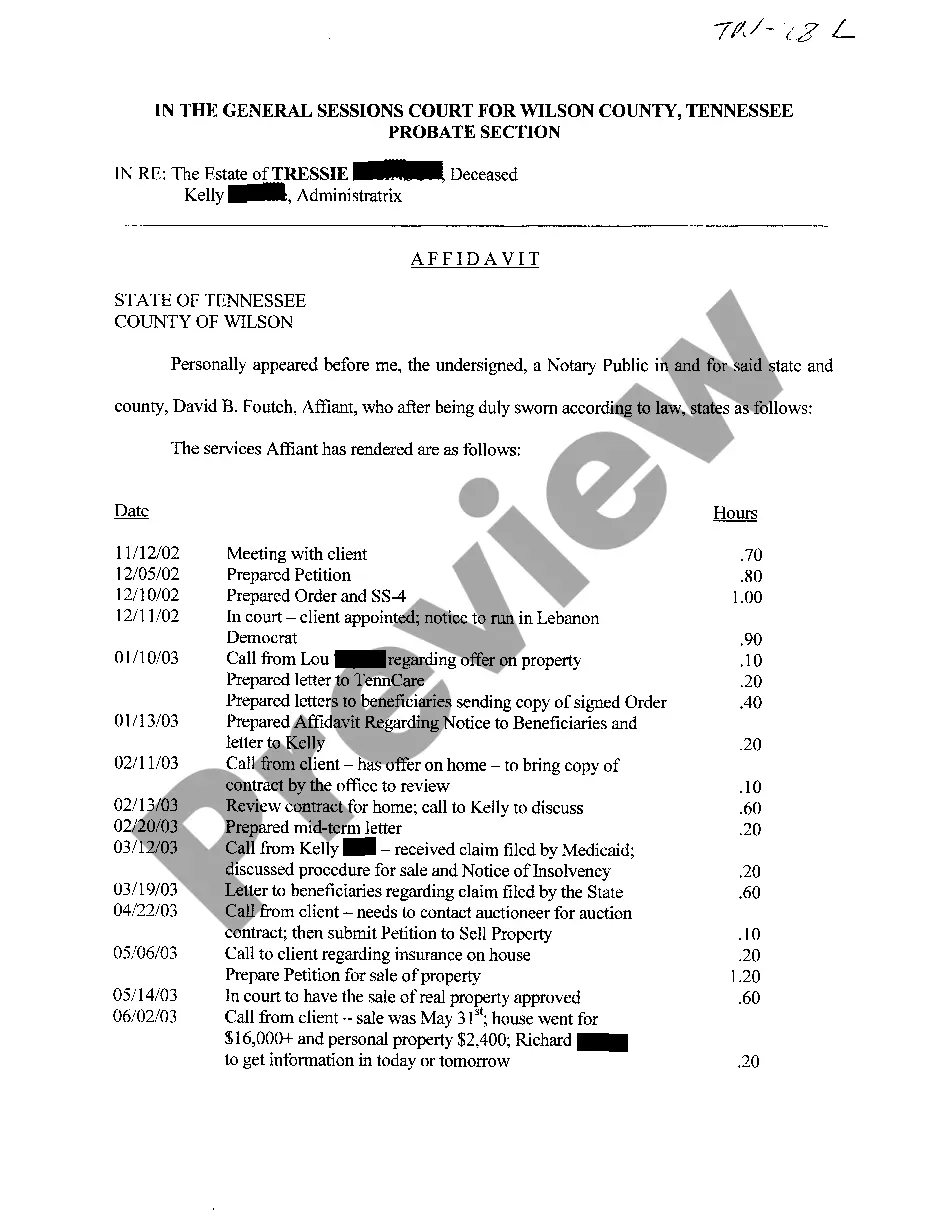

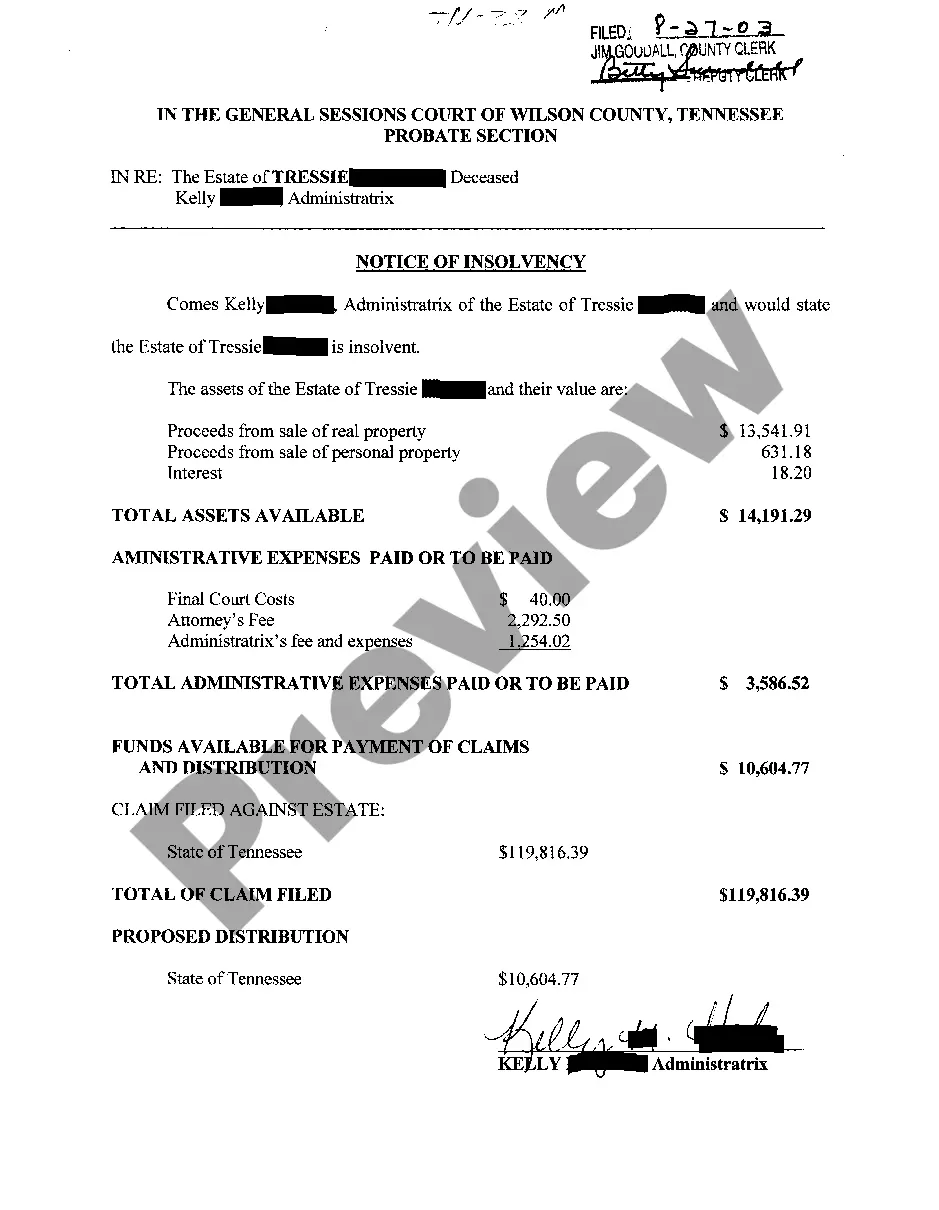

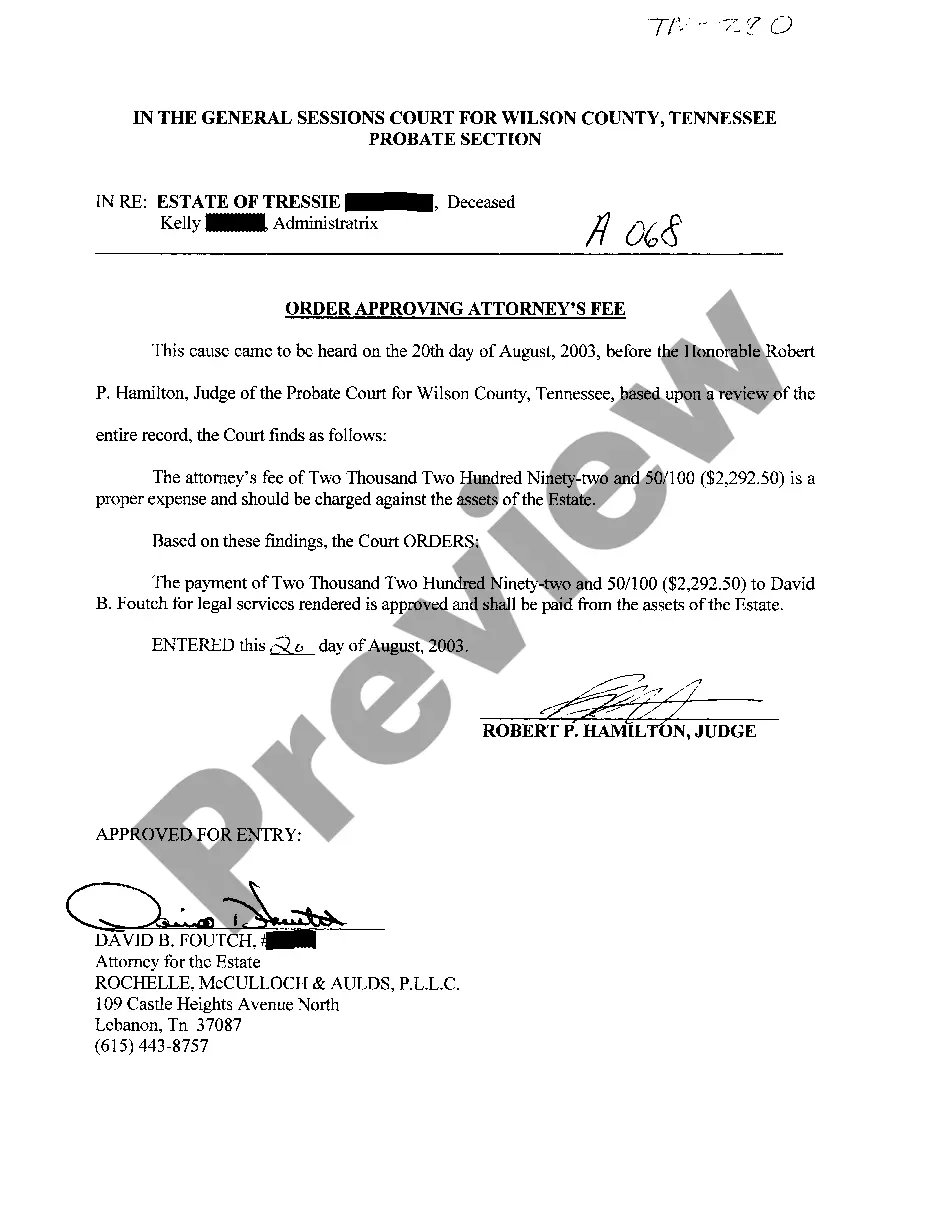

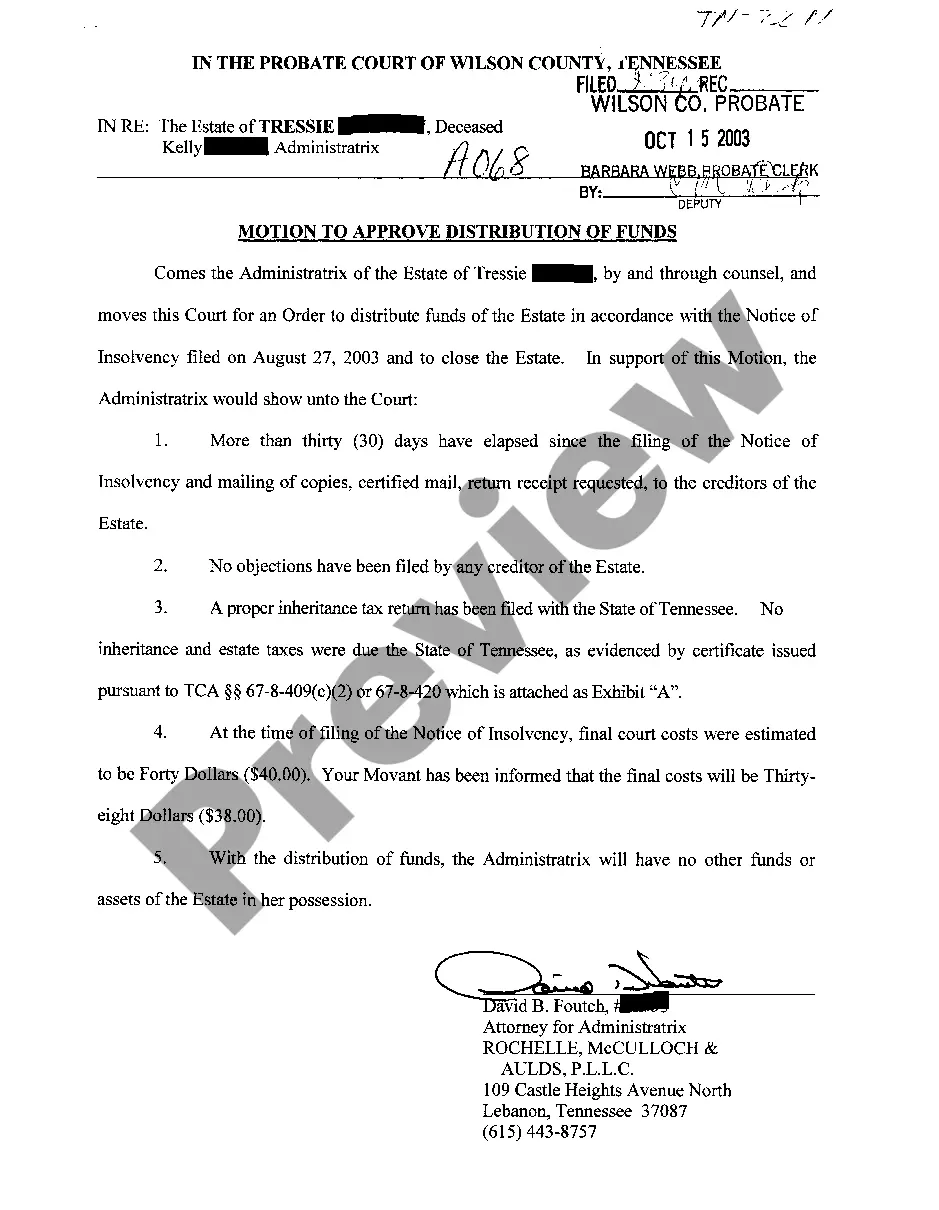

- Examine the description and preview the example.

- Once you confirm the example meets your needs, simply click Buy Now.

- Select a subscription plan that aligns with your financial situation.

- Establish a personal account.

- Complete your payment in one of two convenient methods: by card or through PayPal.

- Choose a format to download the file in; two formats are available (PDF or Word).

- Retrieve the document to the My documents section.

- After your reusable form is downloaded, print it or save it to your device.

Form popularity

FAQ

It is valid for 91 days or until the judgment, interest and costs are paid off, whichever occurs first. As such, the garnishment will continue each pay period for the 91 days or until the debt is paid off. Non-Periodic Garnishment: This is used to remove money from your bank account or other property.

You may be able to pay your judgment in installments or set up a payment plan. First, you can try talking to the creditor and see if they are willing to work out a payment plan with you. Remind the creditor that you want to pay but you just do not have the money to pay the judgment all at once.

Settling Debts Once a judgment is issued and the creditor is able to receive payment through wage garnishment, you have little leverage for negotiating a settlement. At this point, the creditor has sufficiently proven the debt is valid and the court has ordered you to repay it.

To ask a court to set aside (cancel) a court order or judgment, you have to file a request for order to set aside, sometimes called a motion to set aside or motion to vacate. The terms set aside or vacate a court order basically mean to cancel or undo that order to start over on a particular issue.

A series of payments that a buyer makes instead of a lump sum to compensate the seller. Installment payments often, but do not always, include interest to pay the seller for accepting the credit risk that the buyer will not make payments in a timely manner.

You may be able to pay your judgment in installments or set up a payment plan. First, you can try talking to the creditor and see if they are willing to work out a payment plan with you. Remind the creditor that you want to pay but you just do not have the money to pay the judgment all at once.

The wage garnishment continues until the debt is paid in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt. It is difficult to stop a wage garnishment after it begins. The time to fight a it is during the debt collection lawsuit or before the garnishments begin.