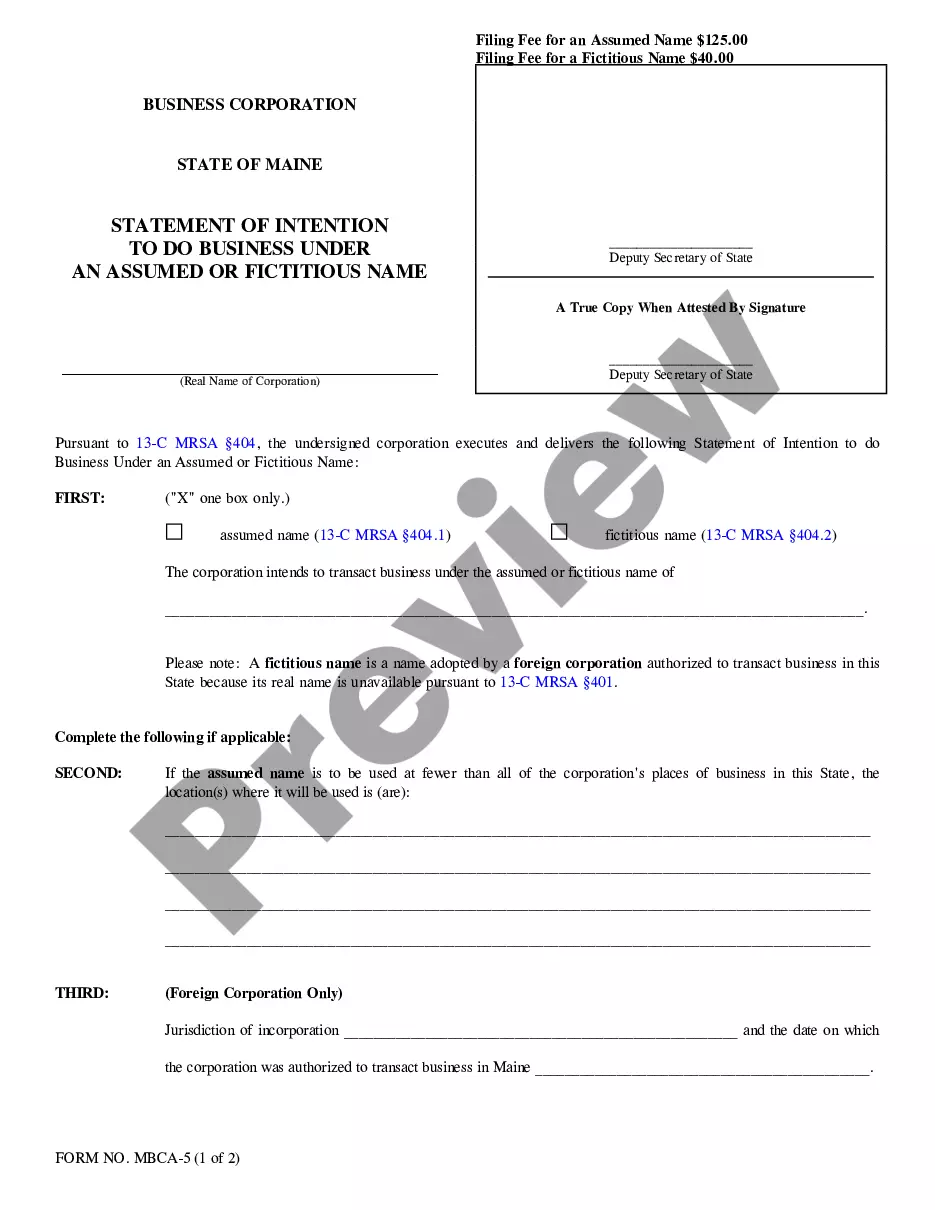

Maine Statement of Intention to Do Business Under an Assumed or Fictitious Name by a Corporation

Definition and meaning

The Maine Statement of Intention to Do Business Under an Assumed or Fictitious Name by a Corporation is a legal document that allows corporations to operate under a name that is different from their registered corporate name. This process is essential for businesses that want to create a market presence under a brand name that may be more recognizable or relevant to their target audience.

An assumed name refers to a name that a corporation chooses to conduct business under, while a fictitious name is used when the actual name of the corporation is not available, requiring the use of an alternative name.

Who should use this form

This form is intended for corporations that wish to operate in the state of Maine under an assumed or fictitious name. Specifically, it is beneficial for:

- Corporations wanting to use a business name that reflects their branding.

- Foreign corporations that require an alternative name to comply with name availability rules.

- Businesses planning to expand their operations in Maine under a different name.

Key components of the form

The Maine Statement of Intention includes several important components, including:

- Corporation name: The real name of the corporation as registered.

- Type of name: Selection between an assumed or fictitious name.

- Business locations: Specification of where the name will be used, if it's not utilized at all corporate locations.

- Jurisdiction of incorporation: Information concerning where the corporation is legally incorporated.

State-specific requirements

In Maine, there are specific requirements for filing the Statement of Intention:

- A filing fee of $125.00 for assumed names and $40.00 for fictitious names.

- The document must be signed by an authorized officer or the clerk.

- Corporations must submit the completed form to the Corporate Examining Section of the Secretary of State's office.

Common mistakes to avoid when using this form

To ensure successful submission, avoid these common mistakes:

- Failing to select the proper name type (assumed or fictitious).

- Omitting necessary signatures from the authorized personnel.

- Not including the correct filing fee.

- Submitting the form without specifying business locations when applicable.

Form popularity

FAQ

You can only file your personal and business taxes separately if your company it is a corporation, according to the IRS.Corporations file their taxes using Form 1120. Limited liability companies (LLCs) can also choose to be treated as a corporation by the IRS, whether they have one or multiple owners.

To do business under a DBA, you must complete and file the appropriate DBA forms and pay a filing fee, after which point you receive a DBA certificate. Depending on the state you may be able to file with a local or county clerk's office, with a state agency, or both.

The DBA has to be filled out and notarized with no errors due to the fact that it is recorded with the County. Filing for a DBA allows you to do business under a different name.The name of your business is up to you, but it needs to be properly registered with the state of California.

Regarding doing business as form concerns, as a self-employed individual listed as doing business as (DBA), you only have to file these forms if appropriate to your self-employment business: Form 1040. Schedule C.

A DBA Is Reported on Schedule C The DBA is reported on your personal 1040 tax return. The business income and expenses will be entered in Schedule C. All profits from the DBA are subject to self-employment tax.

1Step 1 Obtain the Form. Get the Assumed Business Name registration form from the Municipal or Town Clerk.2Step 2 Fill out the Form.3Step 3 Notarize the Form.4Step 4 Submit the Form.

It is NOT a separate entity. A Sole Proprietor fills out Schedule C as part of your Form 1040. You will also fill out Schedule SE for your employment taxes on your net profit.

Depending on the jurisdiction, most DBA filings take 1-4 weeks with some exceptions. Is filing a DBA the same thing as filing for a Trademark? many jurisdictions, more than one applicant can file the exact same DBA. The only way to legally ensure exclusive rights to the use of a name is to register a trademark.

No Special Tax Benefits: Unlike a corporation, filing a DBA that is not part of an LLC or another 'corporate umbrella' will not give you any special tax benefits. Your business' revenues will be passed on to your individual tax return and taxed accordingly.