Maryland Sale of Goods, Buyers Specs

Description

How to fill out Sale Of Goods, Buyers Specs?

Selecting the appropriate official document template can be challenging.

Clearly, there is a multitude of templates available online, but how can you find the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Maryland Sale of Goods and Buyers Specs, suitable for business and personal purposes.

You can preview the document using the Preview button and read the document description to confirm it meets your needs.

- All forms are vetted by specialists and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Obtain button to download the Maryland Sale of Goods and Buyers Specs.

- Leverage your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

No, a sales and use tax number is not the same as an Employer Identification Number (EIN). While the sales and use tax number is specific to collecting sales tax in Maryland, an EIN is used primarily for tax reporting to the IRS. Both numbers are important for businesses dealing with the Maryland Sale of Goods, Buyers Specs, but they serve different purposes.

Obtaining a sales and use tax number in Maryland is a streamlined process through the Maryland Comptroller’s online portal. You will need to provide your business information and details about your products or services related to the Maryland Sale of Goods, Buyers Specs. Once approved, this number helps you in compliance with collecting and remitting sales tax.

Getting a tax ID number in Maryland involves applying through the IRS website or by contacting their office directly. This number is essential for businesses dealing with the Maryland Sale of Goods, Buyers Specs, as it allows you to file taxes and manage employee payroll effectively. Ensure you have your business details ready to expedite the process.

To obtain a CRN, or Central Registration Number, in Maryland, complete the online application provided on the Comptroller’s website. This unique number is important for businesses engaging in the Maryland Sale of Goods, Buyers Specs, as it allows you to handle various tax-related processes efficiently. Upon successful submission, you will receive your CRN promptly.

In Maryland, the sales threshold typically refers to the minimum sales amount a business must reach to collect and remit sales tax. As of the latest updates, businesses must exceed $100,000 in annual sales to be subject to Maryland Sale of Goods, Buyers Specs. This information is crucial for small business owners to understand their tax obligations.

To obtain a Maryland sales and use tax number, start by applying online through the Maryland Comptroller's website. The application process is straightforward and usually involves filling out your business details. After submission, you will receive your number, which is essential for the Maryland Sale of Goods, Buyers Specs, ensuring compliance with state regulations.

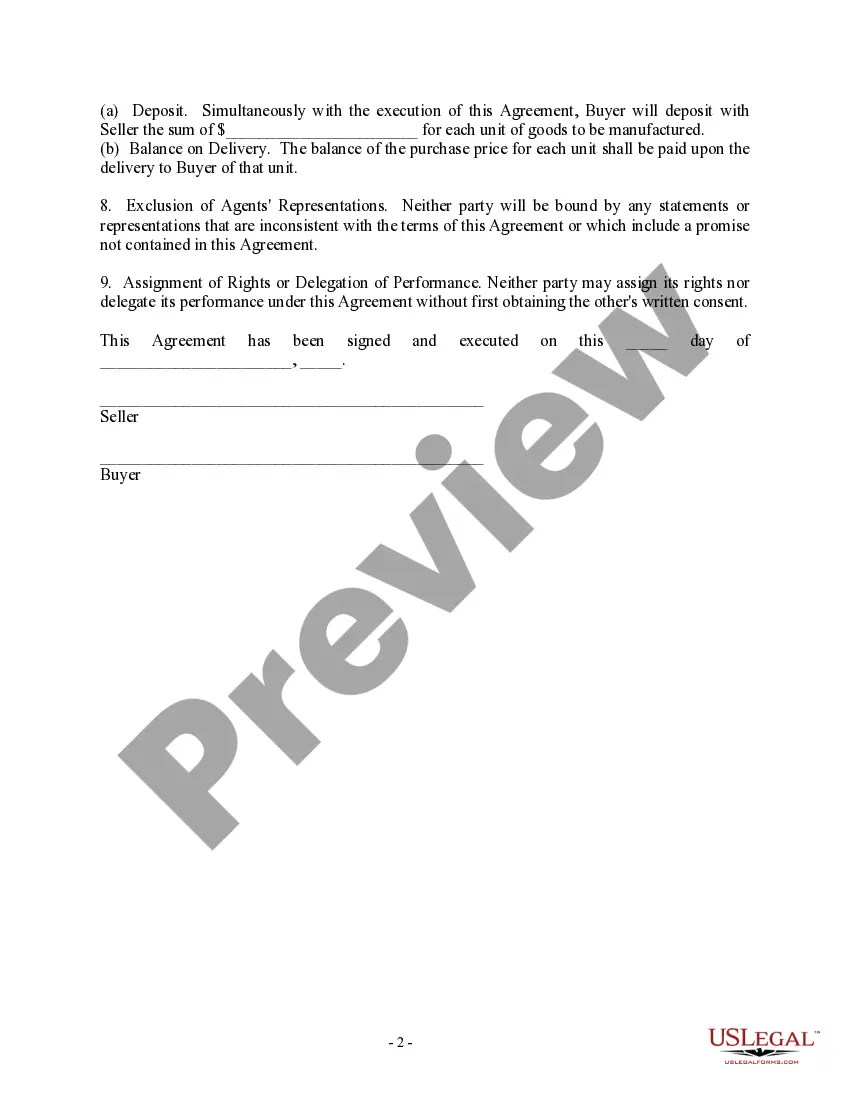

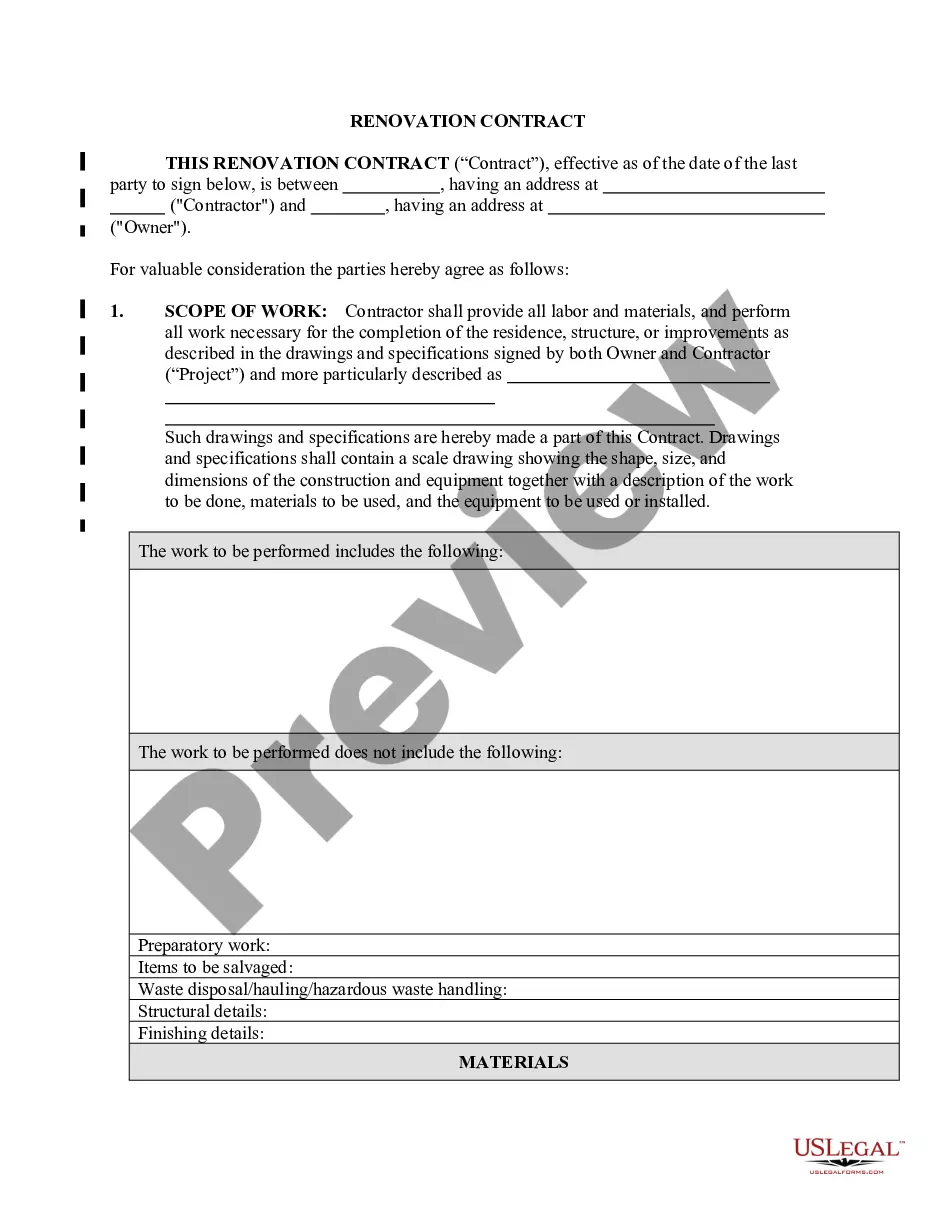

In a sales contract, both the buyer and seller have distinct obligations. The seller is responsible for delivering goods that meet the agreed-upon specifications. On the other hand, the buyer must make the payment as agreed. Understanding these obligations is crucial for a smooth transaction and compliance with Maryland Sale of Goods, Buyers Specs. For detailed guidance, US Legal Forms can be an invaluable resource.

Three primary components make a contract valid are an offer, acceptance, and consideration. An offer lays the groundwork for the agreement, while acceptance signifies that both parties agree to the terms. Consideration refers to the exchange of value between the parties. If you want to ensure your contract follows Maryland Sale of Goods guidelines, it's beneficial to consult with legal experts.

In Maryland, the timeframe for canceling a contract varies depending on the type of contract. Generally, buyers may have a period of three days to cancel certain types of contracts, such as those involving door-to-door sales. However, it's important to review your specific contract for cancellation terms. If you need assistance understanding cancellation times, consider using the resources available at US Legal Forms.

A valid contract in Maryland must meet several criteria outlined in the Maryland Sale of Goods, Buyers Specs. First, both parties must agree on the terms and conditions of the contract. Second, it must involve consideration where both parties exchange value. Lastly, the purpose of the contract must be lawful. Without these elements, a contract may be deemed void.