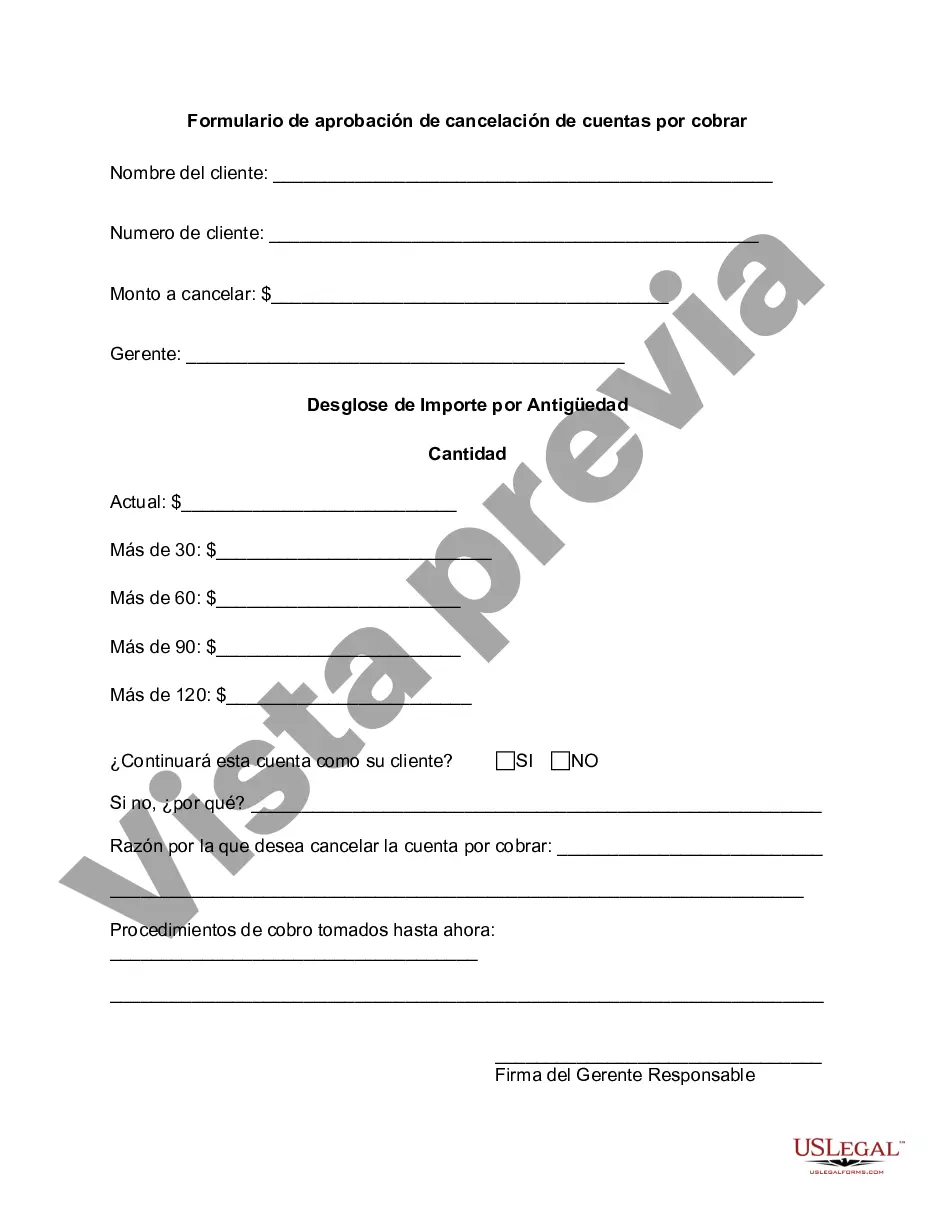

Massachusetts Accounts Receivable Write-Off Approval Form is a document used by businesses in Massachusetts to seek approval for writing off uncollectible or bad debts from their accounts receivable balance. This form is crucial as it ensures proper documentation and authorization for the removal of non-recoverable debts from the financial records. The Massachusetts Accounts Receivable Write-Off Approval Form serves as a written request, outlining the reasons for the write-off, the specific customer accounts, and the respective amounts to be written off. This form is typically submitted to the relevant department within an organization, such as the finance or accounting department, for review and approval. When completing the Massachusetts Accounts Receivable Write-Off Approval Form, several key details need to be provided. These details may include: 1. Business Information: The name, address, and contact details of the company seeking the write-off. 2. Customer Details: The name, account number, and contact information of the customer whose debt is being written off. 3. Debt Details: The specific amount of the debt to be written off and the date when it was deemed uncollectible. 4. Justification: A detailed explanation as to why the debt cannot be recovered. This may include customer bankruptcy, insolvency, or any other factors that render the debt uncollectible. 5. Internal Approval: The necessary internal approvals, such as the signature of the accounts receivable manager or supervisor. It is important to note that there might be different types of Massachusetts Accounts Receivable Write-Off Approval Forms based on the industry or organization's specific requirements. For example, there could be forms tailored for healthcare providers, government entities, or educational institutions. Each form may have slight variations in terms of fields to be completed or additional documentation needed for supporting the write-off request. Efficient management of accounts receivable is crucial for businesses' financial health, and the Massachusetts Accounts Receivable Write-Off Approval Form plays a vital role in ensuring transparency and accountability throughout the debt write-off process. By adhering to proper protocols, businesses can maintain accurate financial records, mitigate potential fraud risks, and comply with audit requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Massachusetts Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

US Legal Forms - among the most significant libraries of legitimate varieties in the USA - gives a wide range of legitimate papers web templates you can obtain or produce. Making use of the internet site, you will get thousands of varieties for organization and personal purposes, sorted by groups, states, or keywords and phrases.You can find the most recent variations of varieties just like the Massachusetts Accounts Receivable Write-Off Approval Form in seconds.

If you have a registration, log in and obtain Massachusetts Accounts Receivable Write-Off Approval Form through the US Legal Forms library. The Down load option will show up on every kind you see. You get access to all earlier downloaded varieties inside the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, allow me to share straightforward directions to obtain started out:

- Be sure to have selected the best kind for the metropolis/area. Click the Preview option to check the form`s content material. Read the kind outline to actually have chosen the correct kind.

- In the event the kind doesn`t satisfy your needs, make use of the Search field at the top of the display screen to discover the one which does.

- If you are content with the shape, validate your option by simply clicking the Purchase now option. Then, pick the pricing program you like and supply your accreditations to sign up for an profile.

- Approach the transaction. Make use of your charge card or PayPal profile to accomplish the transaction.

- Pick the formatting and obtain the shape on your own device.

- Make modifications. Fill out, edit and produce and sign the downloaded Massachusetts Accounts Receivable Write-Off Approval Form.

Every single template you put into your bank account does not have an expiration date and is also your own property forever. So, if you want to obtain or produce one more version, just go to the My Forms portion and click on on the kind you need.

Obtain access to the Massachusetts Accounts Receivable Write-Off Approval Form with US Legal Forms, by far the most considerable library of legitimate papers web templates. Use thousands of expert and express-particular web templates that fulfill your company or personal needs and needs.

Form popularity

FAQ

When a specific customer's account is identified as uncollectible, the journal entry to write off the account is:A credit to Accounts Receivable (to remove the amount that will not be collected)A debit to Allowance for Doubtful Accounts (to reduce the Allowance balance that was previously established)

When a specific customer's account is identified as uncollectible, the journal entry to write off the account is:A credit to Accounts Receivable (to remove the amount that will not be collected)A debit to Allowance for Doubtful Accounts (to reduce the Allowance balance that was previously established)

Accounts uncollectible are receivables, loans, or other debts that have virtually no chance of being paid. An account may become uncollectible for many reasons, including the debtor's bankruptcy, an inability to find the debtor, fraud on the part of the debtor, or lack of proper documentation to prove that debt exists.

off is a request to remove any uncollected receivable from the sale of a good or services that is at least one year old or if the customer has filed bankruptcy from a unit's account and recognize it as a bad debt expense.

Behind every written off balance is a decision to extend credit. Usually small accounts are written off because their value does not justify the resources required to collect them. However, their volume is often so substantial that the cumulated balance could exert mounting pressure on your working capital.

off is an elimination of an uncollectible accounts receivable recorded on the general ledger. An accounts receivable balance represents an amount due to Cornell University. If the individual is unable to fulfill the obligation, the outstanding balance must be written off after collection attempts have occurred.

When the company writes off accounts receivable, such accounts will need to be removed from the balance sheet. Usually, a write-off will reduce the balance of accounts receivable together with the allowance for doubtful accounts.

off is an elimination of an uncollectible accounts receivable recorded on the general ledger. An accounts receivable balance represents an amount due to Cornell University. If the individual is unable to fulfill the obligation, the outstanding balance must be written off after collection attempts have occurred.

Write-offs over $500 must be approved by the Controller or designee. ARS will process the write-off transaction in EFS and a bad debt expense will be charged to the department.

Write-off of Uncollectible Accounts the process to remove an amount owed to the University from the receivable balance after a thorough collection process is followed and it is determined the balance will not be paid. The balance is no longer considered an asset and is not reflected in the financial statements.