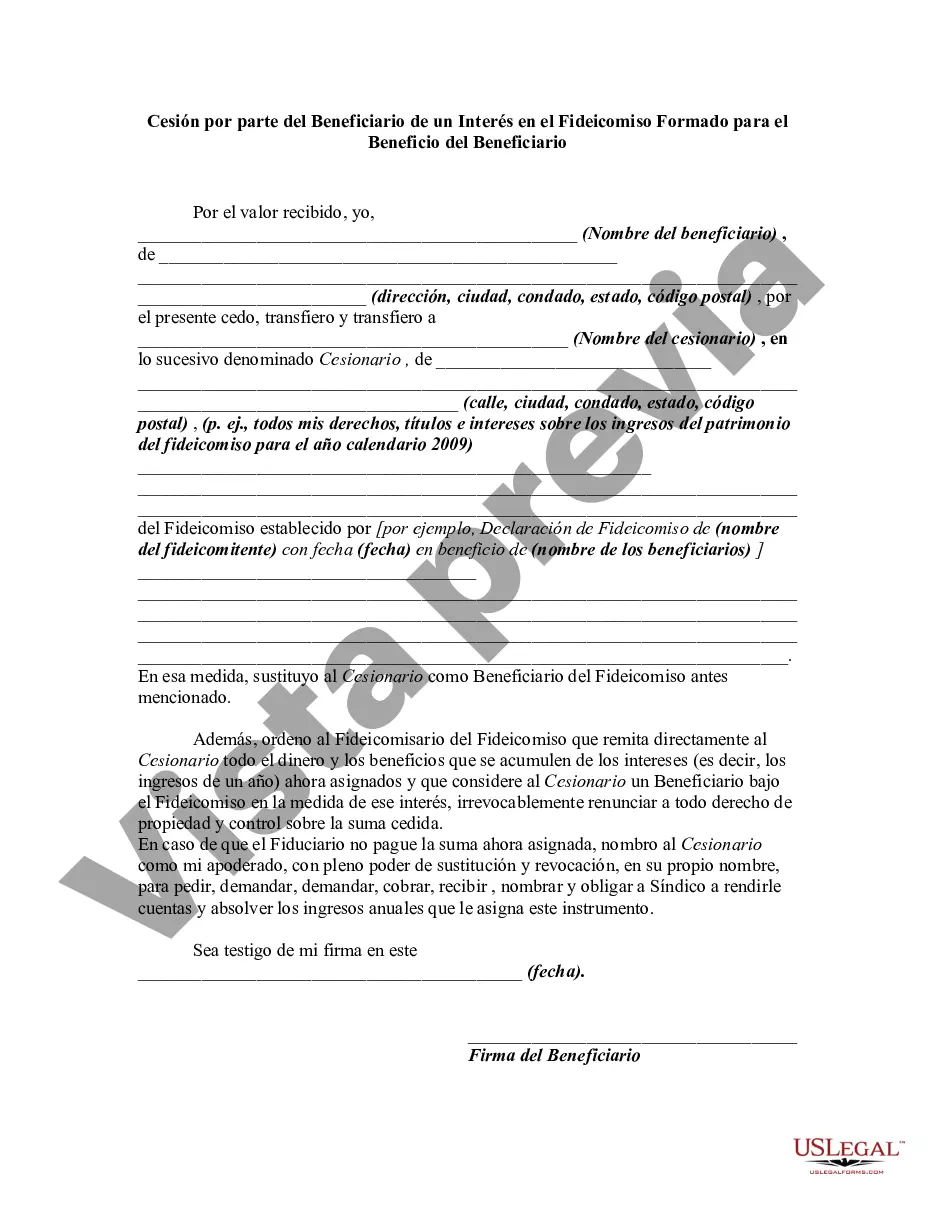

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Understanding Kentucky Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary Introduction: Kentucky Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document that allows a trust beneficiary to transfer their interest in a trust to another individual or entity. This assignment can be crucial for various reasons, such as estate planning, changing beneficiaries, or satisfying financial obligations. Keywords: Kentucky Assignment by Beneficiary, Interest in the Trust, Trust Formed, Benefit of Beneficiary, legal document, transfer, estate planning, changing beneficiaries, financial obligations. 1. What is a Kentucky Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary? The Kentucky Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legally recognized agreement that enables a beneficiary of a trust to transfer their interest, rights, and benefits in the trust to another person or entity. 2. Importance of Kentucky Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: — Estate Planning: This document allows beneficiaries to plan and manage their assets efficiently by transferring their interest in a trust to specific individuals or organizations. — Changing Beneficiaries: Beneficiaries can use this assignment to change the designated beneficiaries of a trust, ensuring the assets pass on to the intended individuals. — Settling Financial Obligations: Transfer of interest can be used to satisfy debts or fulfill financial obligations by transferring the trust's benefits to creditors. 3. Different Types of Kentucky Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: — Outright Assignment: The beneficiary assigns their entire interest in the trust to another party, relinquishing all their rights and benefits. — Partial Assignment: The beneficiary transfers only a portion of their interest in the trust while retaining the remaining stake for themselves. — Conditional Assignment: The assignment is subject to specific conditions, such as the occurrence of a particular event, before the transfer becomes effective. 4. Key Elements in a Kentucky Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary: — Identification: Clearly identify the trust, beneficiary, and assignee involved in the assignment. — Purpose: State the purpose and reason for the assignment. — Terms and Conditions: Outline any conditions or limitations associated with the assignment. — Legal Compliance: Ensure that the assignment adheres to all relevant Kentucky state laws, trust agreements, and any applicable federal regulations. — Signatures and Witnesses: The assignment must be signed by the beneficiary, assignee, and witnesses to make it legally valid. Conclusion: A Kentucky Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a powerful legal tool that allows trust beneficiaries to transfer their interests to other parties. Whether for estate planning purposes or settling financial obligations, this assignment can play a pivotal role in managing and distributing trust assets effectively. It is essential to understand the various types and key elements within this form to ensure compliance with Kentucky laws and adequately protect the rights of all involved parties. Keywords: Kentucky Assignment by Beneficiary, Interest in the Trust, Trust Formed, Benefit of Beneficiary, estate planning, changing beneficiaries, financial obligations, outright assignment, partial assignment, conditional assignment, legal compliance, signatures, witnesses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.