Kentucky Agreement to Participate in Fitness and Dietary Program

Description

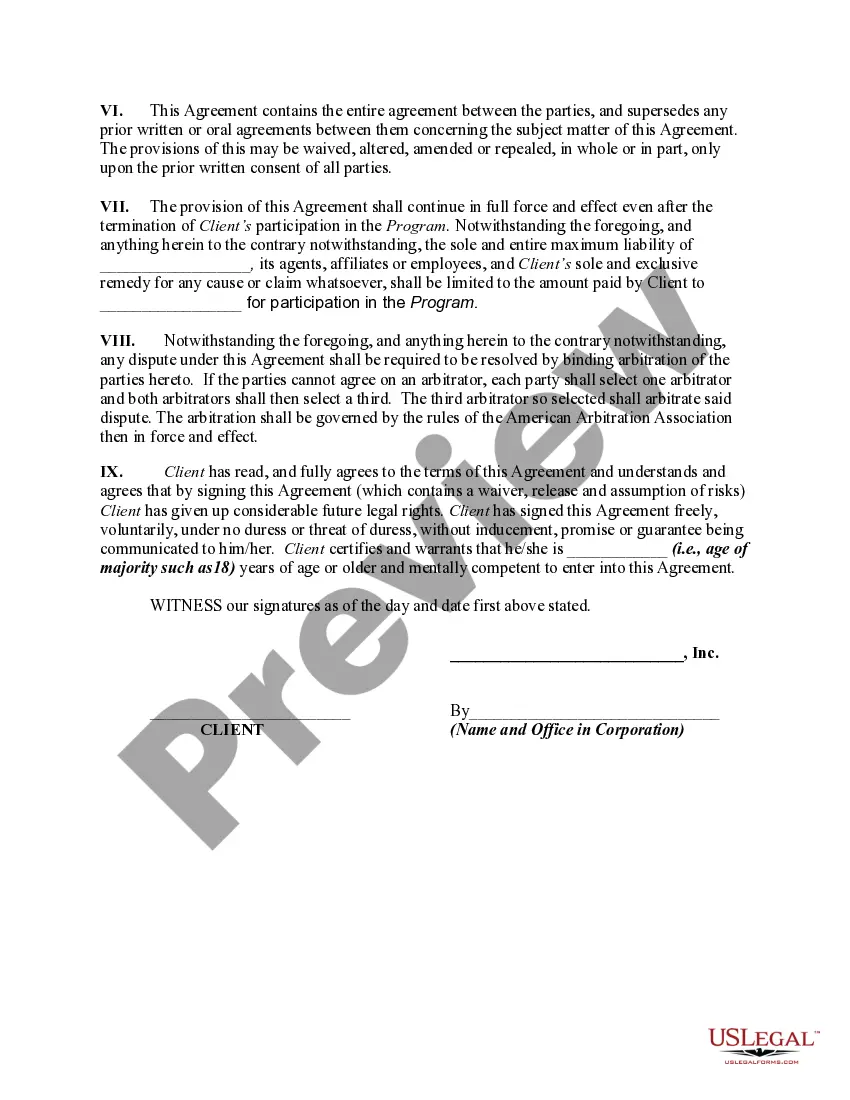

How to fill out Agreement To Participate In Fitness And Dietary Program?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the best variety of legal forms, available online.

Employ the site’s easy and efficient search to find the documents you require. Various templates for commercial and personal purposes are categorized by groups, suggestions, or keywords.

Utilize US Legal Forms to secure the Kentucky Agreement to Participate in Fitness and Dietary Program in just a few clicks.

Every legal document template you acquire remains your property indefinitely. You can access every form you downloaded through your account. Go to the My documents section and select a form to print or download again.

Stay competitive and download, and print the Kentucky Agreement to Participate in Fitness and Dietary Program with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- When you are already a US Legal Forms customer, sign in to your profile and click the Obtain button to get the Kentucky Agreement to Participate in Fitness and Dietary Program.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Kentucky Agreement to Participate in Fitness and Dietary Program.

Form popularity

FAQ

Yes, Kentucky has a pass-through entity (PTE) tax system that allows certain business income to be passed directly to individual owners for tax reporting purposes. This tax structure supports partnerships, S-corporations, and LLCs. If you are involved in wellness programs, such as the Kentucky Agreement to Participate in Fitness and Dietary Program, your health-related expenses may have favorable tax treatment under this system.

In Kentucky, partnerships file Form 740 to report their income, credits, and deductions. This form helps to distribute the partnership's profits or losses to each partner based on their share. If your partnership involves health and wellness initiatives, the Kentucky Agreement to Participate in Fitness and Dietary Program might provide avenues for additional tax benefits or expense deductions.

Kentucky paycheck tax refers to the individual income tax withheld from your earnings by employers. This tax is calculated based on your income rate and must be reported on your annual tax return. If you actively engage in the Kentucky Agreement to Participate in Fitness and Dietary Program, some associated costs may help reduce your taxable income, optimizing your paycheck deductions.

Kentucky Form PTE is a tax form used by pass-through entities to report income, deductions, and credits allocated to their owners. This includes partnerships and S-corporations, allowing them to pass profits to individual owners for tax purposes. By participating in the Kentucky Agreement to Participate in Fitness and Dietary Program, you may leverage certain deductions that can be beneficial when reporting income from such entities.

You can access the Form 740 Kentucky PDF through the Kentucky Department of Revenue's official website. It is readily available for download, making it easy for residents to file their state taxes. If you’re also interested in health and wellness, consider the Kentucky Agreement to Participate in Fitness and Dietary Program while completing your tax forms, as certain expenses could be deductible.

In 2024, the Kentucky pass-through entity (PTE) tax rate is set at 5% on income distributed to the partners or shareholders of the entity. This rate applies to profits passed through from partnerships, S-corporations, and LLCs to their owners. If you are actively involved in a fitness or dietary program, you might find that the Kentucky Agreement to Participate in Fitness and Dietary Program enhances your overall wellness, which can help in managing financial wellness too.

The Kentucky state tax form is a document required by the state for residents to report income, claim deductions, and calculate taxes owed. The primary form used by individuals is the Kentucky Form 740. Engaging in the Kentucky Agreement to Participate in Fitness and Dietary Program might help you maximize certain deductions related to health and wellness, leading to potential tax savings.

Form 725 in Kentucky is a tax form specifically designed for reportable income from a pass-through entity. It is important to understand that this form assists in calculating your share of income or loss from partnerships or S-corporations. Utilizing the Kentucky Agreement to Participate in Fitness and Dietary Program could potentially reduce taxable income when deducting health and wellness expenses associated with fitness and dietary programs.