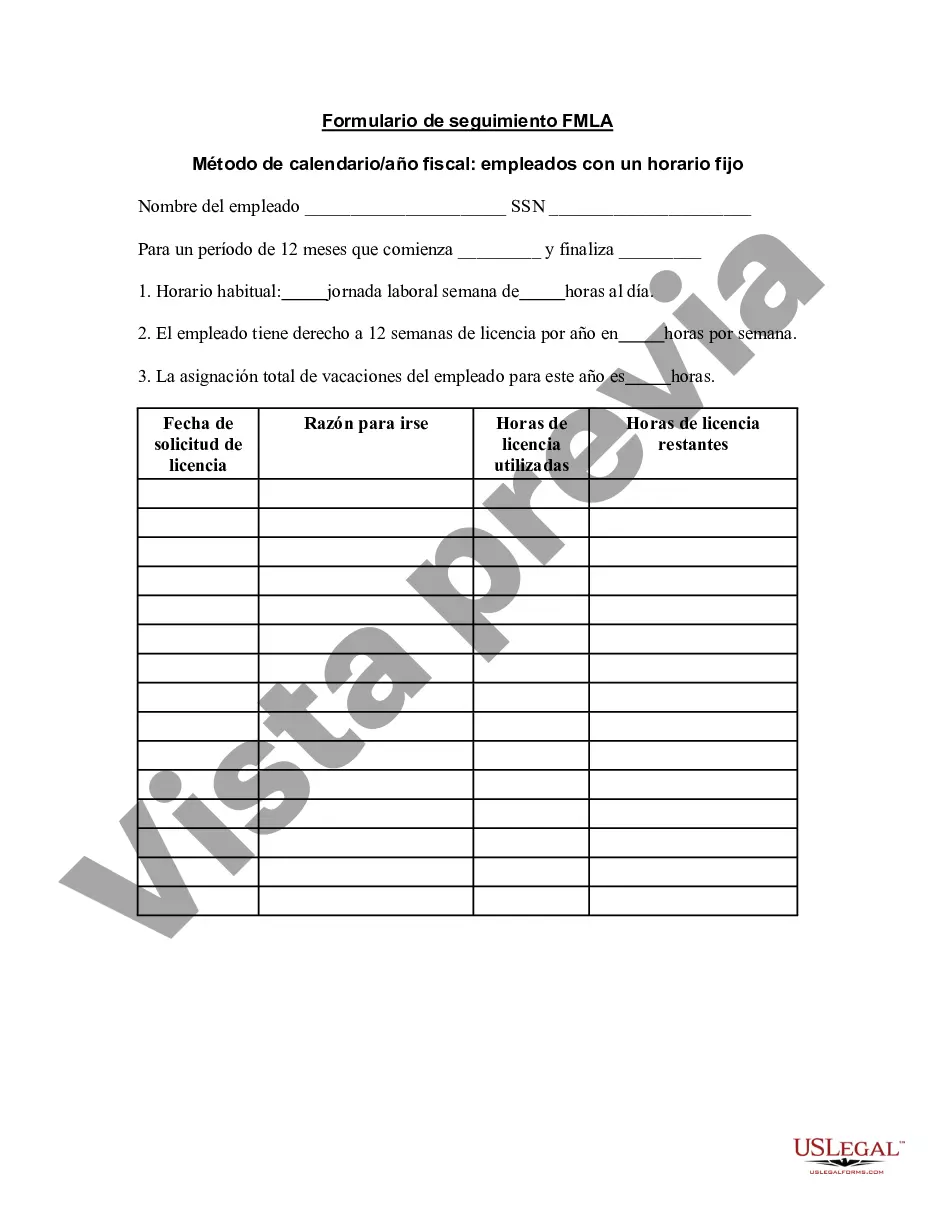

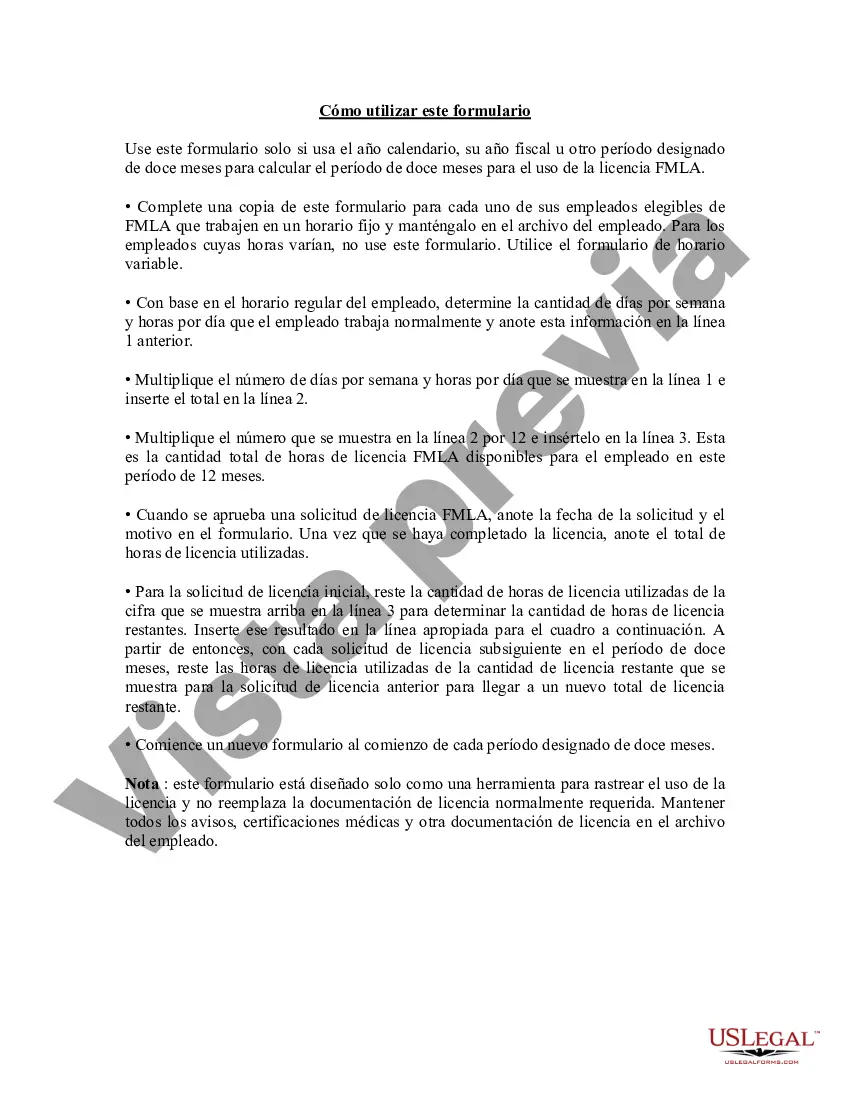

The Kansas FMLA Tracker Form Calendarda— - Fiscal Year Method - Employees with Set Schedule is a comprehensive tool designed to assist employers in effectively tracking and managing their employees' leave under the Family and Medical Leave Act (FMLA) in the state of Kansas. This useful form eliminates the complexities often associated with managing employee schedules and ensures compliance with FMLA regulations, while streamlining the leave management process. The form is specifically tailored for employees with a pre-determined set schedule, providing an organized approach for keeping track of their FMLA leave throughout the fiscal year. It helps businesses to accurately monitor and record employees' leave patterns, ensuring that they don't exceed their entitled FMLA leave hours, and preventing any potential violations or conflicts. This Kansas FMLA Tracker Form utilizes a calendar-based format, making it easy for employers to record and account for each day of FMLA leave taken by their employees within a fiscal year period. The fiscal year method aligns with the employer's predetermined fiscal year, making it ideal for businesses that follow this time-frame for budgeting and reporting purposes. Employers can utilize the Kansas FMLA Tracker Form Calendarda— - Fiscal Year Method - Employees with Set Schedule to document various types of FMLA leaves, including: 1. Medical Leave: This type of leave is taken when an employee needs to tend to their own serious health condition, including pregnancy-related issues, recoveries from surgeries, chronic illnesses, or other medical treatments. 2. Family Care Leave: This category covers situations where employees need to take leave to care for their immediate family members with serious health conditions. This includes caring for a child, spouse, or parent with a severe illness, injury, or disability. 3. Military Family Leave: Employees who have family members serving on active duty in the Armed Forces, or are required to care for an injured/veteran family member, may qualify for this type of leave under the FMLA. This could involve providing care, attending military events, or handling certain related matters. The Kansas FMLA Tracker Form assists employers in maintaining accurate records and calculations, such as the number of hours utilized by employees for each FMLA leave category. This valuable information can be vital for budgeting, planning, and ensuring adequate workforce coverage during the absence of employees on FMLA leave. By using the Kansas FMLA Tracker Form — Calendar — FisYODAYODT ODt—od - Employees with Set Schedule, employers can efficiently manage their workforce's FMLA leave, reduce administrative burdens, and ensure compliance with the state of Kansas FMLA regulations. This form is an invaluable resource for businesses striving to maintain a well-organized and seamless approach to employee leave management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kansas Formulario de seguimiento de FMLA - Calendario - Método de año fiscal - Empleados con horario establecido - FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule

Description

How to fill out Kansas Formulario De Seguimiento De FMLA - Calendario - Método De Año Fiscal - Empleados Con Horario Establecido?

Are you currently within a position in which you need to have documents for both enterprise or person uses nearly every time? There are plenty of legal papers web templates accessible on the Internet, but discovering types you can trust is not easy. US Legal Forms provides a huge number of form web templates, much like the Kansas FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule, that are created to satisfy state and federal demands.

If you are currently knowledgeable about US Legal Forms internet site and possess an account, simply log in. After that, you are able to down load the Kansas FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule web template.

Should you not come with an profile and want to start using US Legal Forms, adopt these measures:

- Obtain the form you need and ensure it is for the proper area/area.

- Use the Review switch to examine the shape.

- Look at the description to ensure that you have chosen the correct form.

- If the form is not what you are trying to find, utilize the Research field to get the form that meets your requirements and demands.

- When you find the proper form, just click Purchase now.

- Choose the prices strategy you need, submit the necessary details to create your money, and buy an order with your PayPal or credit card.

- Decide on a handy paper formatting and down load your copy.

Find every one of the papers web templates you might have bought in the My Forms menus. You can obtain a further copy of Kansas FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule whenever, if required. Just click on the needed form to down load or print the papers web template.

Use US Legal Forms, the most comprehensive variety of legal varieties, to conserve time and avoid errors. The assistance provides skillfully created legal papers web templates which can be used for a selection of uses. Generate an account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months.

The amount of FMLA leave taken is divided by the number of hours the employee would have worked if the employee had not taken leave of any kind (including FMLA leave) to determine the proportion of the FMLA workweek used.

One of the easiest methods by which an employer can track FMLA leave is to place all employees on a calendar year track. This means that each employee can take 12 weeks of FMLA leave anytime between January and December, and the calculations reset on January 1 of each year.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.

Records pertaining to FMLA leave Intermittent leave can be tracked by recording the employee's work schedule and subtracting from it the number of hours they took for FMLA leave. If the employee was scheduled to work 7 hours and only worked 3 hours, then 4 hours of FMLA leave can be counted.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022 Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.