Iowa Expense Reimbursement Form for an Employee

Description

How to fill out Expense Reimbursement Form For An Employee?

US Legal Forms - among the most substantial collections of legal forms in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you will have access to numerous forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms like the Iowa Expense Reimbursement Form for an Employee in just seconds.

If you are registered, sign in and download the Iowa Expense Reimbursement Form for an Employee from the US Legal Forms repository. The Download button will be visible on each form you view.

Complete the transaction. Use a credit card or PayPal account to finish the payment.

Select the format and download the form onto your device. Make modifications. Complete, edit, print, and sign the downloaded Iowa Expense Reimbursement Form for an Employee. Each template added to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Iowa Expense Reimbursement Form for an Employee through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are new to US Legal Forms, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/state.

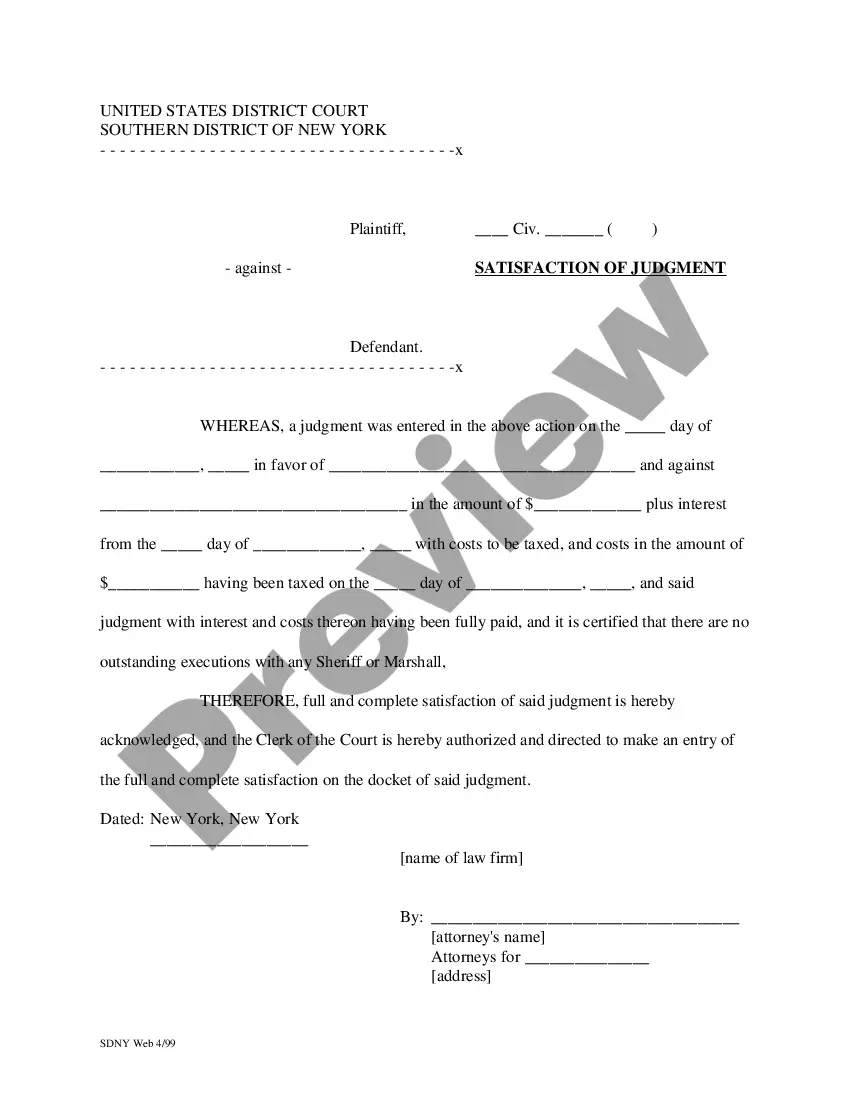

- Click the Review button to examine the form's content.

- Check the summary of the form to confirm you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select the pricing plan you prefer and submit your details to create an account.

Form popularity

FAQ

An expense reimbursement claim report should be filed and completed by the employee and submitted to their HR department for approval after the costs have been incurred. As per your company's policy guidelines, communicate what information is needed when submitting expense claims and reports.

A necessary expense is anything required for the performance of an employees' job. This depends on the work performed, but reasonable reimbursable expenses will likely include: internet services, mobile data usage, laptop computers or tablets, and equipment such as copiers and printers.

The federal Fair Labor Standards Act (FLSA) generally does not require employers to reimburse home-office expenses accrued by employees. The exception is that the FLSA does apply to employer reimbursements when the worker's earnings fall beneath the minimum wage.

If your employees incur any expenses while doing their work, they might get reimbursed for the actual costs. Before getting too far into the definition of an expense claim, it's important to recognize which expenses can get deducted. Because not every purchase is eligible for reimbursement.

Expense reimbursements aren't employee income, so they don't need to be reported as such. Although the check or deposit is made out to your employee, it doesn't count as a paycheck or payroll deposit.

Reimbursement is money paid to an employee or customer, or another party, as repayment for a business expense, insurance, taxes, or other costs. Business expense reimbursements include out-of-pocket expenses, such as those for travel and food.

Is my employer required to cover my expenses if I work from home? The federal Fair Labor Standards Act (FLSA) generally does not require that an employee be reimbursed for expenses incurred while working from home.

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee's wages on Form W-2. Instead, report it in Form W-2 box 12 with code L.

Among people who believe employers should cover home internet costs, 26% believed employers should pay some of the bill directly, 40% believed employers should pay the full bill directly and 34% felt this should be covered via a routine stipend.

You expense reimbursements are probably not reported on your W-2, as they are not considered income. The good new is that the difference between the IRS mileage rate and the amount your were actually reimbursed may be deductible as job-related expenses.