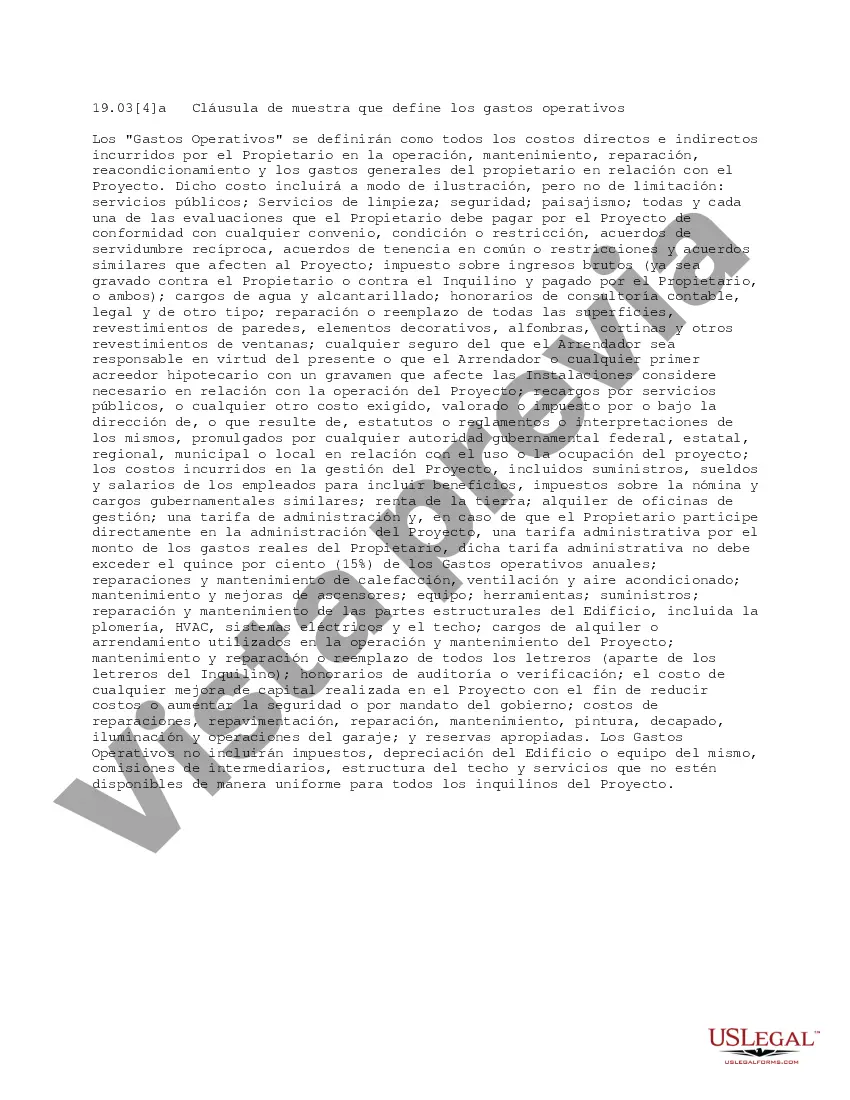

Guam Clause Defining Operating Expenses, commonly known as the Guam Clause, is a contractual provision that outlines the specific expenses for which a tenant is responsible in a commercial lease agreement. This clause is particularly relevant in the commercial real estate industry and plays a crucial role in many lease agreements. The Guam Clause typically specifies the operating expenses that the tenant will be required to pay in addition to the base rent. These expenses are commonly associated with the maintenance and operation of the leased property or commercial space. By including this clause, both parties can clearly define and allocate the financial responsibilities related to operating the property. There are several types of Guam Clause Defining Operating Expenses that may vary depending on the specific lease agreement and negotiation between the landlord and tenant. Some commonly used types include: 1. Triple Net Lease (NNN): This is a type of lease where the tenant is responsible for paying all operating expenses, including property taxes, insurance, and maintenance costs. 2. Modified Gross Lease: In this type of lease, the tenant is responsible for paying a portion of the operating expenses, usually based on their allocated percentage of the leased space. The landlord is responsible for some expenses, such as structural repairs and major capital expenditures. 3. Full-Service Gross Lease: Here, the landlord assumes the responsibility for all operating expenses, and the tenant pays a fixed rent that includes these costs. This type of lease is more common in office buildings, where expenses like utilities, maintenance, and janitorial services are required. 4. Expense Stop Lease: This type of lease sets a cap or limit on the amount of operating expenses that the landlord will cover. If the expenses exceed this limit, the tenant is responsible for paying the excess amount. The Guam Clause Defining Operating Expenses plays a critical role in clearly defining the financial obligations of both the landlord and tenant. It ensures transparency and avoids potential disputes over who is responsible for specific expenses related to the leased space or property. It is crucial for both parties to carefully review and negotiate the terms of the Guam Clause to protect their interests. In summary, the Guam Clause Defining Operating Expenses is an essential provision in a commercial lease agreement. It outlines the specific expenses that the tenant is responsible for, such as property taxes, insurance, and maintenance costs. Different types of the clause, such as NNN, Modified Gross Lease, Full-Service Gross Lease, and Expense Stop Lease, allow for variations in the allocation of operating expenses between the landlord and tenant.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Guam Cláusula que define los gastos operativos - Clause Defining Operating Expenses

Description

How to fill out Guam Cláusula Que Define Los Gastos Operativos?

US Legal Forms - one of several biggest libraries of legitimate varieties in America - gives an array of legitimate record layouts you may download or print out. Utilizing the site, you may get thousands of varieties for organization and person uses, sorted by classes, suggests, or search phrases.You will discover the most up-to-date types of varieties much like the Guam Clause Defining Operating Expenses in seconds.

If you already possess a membership, log in and download Guam Clause Defining Operating Expenses in the US Legal Forms library. The Down load key will show up on each and every form you view. You get access to all earlier delivered electronically varieties inside the My Forms tab of the account.

If you would like use US Legal Forms the very first time, allow me to share straightforward recommendations to get you started out:

- Be sure you have picked out the proper form for your town/county. Click on the Review key to analyze the form`s information. Browse the form information to ensure that you have selected the appropriate form.

- In the event the form doesn`t fit your requirements, utilize the Research area on top of the monitor to get the the one that does.

- Should you be content with the shape, confirm your selection by visiting the Purchase now key. Then, select the rates prepare you prefer and supply your accreditations to sign up for the account.

- Method the purchase. Use your Visa or Mastercard or PayPal account to complete the purchase.

- Choose the file format and download the shape in your device.

- Make modifications. Load, edit and print out and indicator the delivered electronically Guam Clause Defining Operating Expenses.

Each and every template you put into your money lacks an expiration date and is also your own permanently. So, if you would like download or print out one more version, just go to the My Forms section and click on around the form you need.

Obtain access to the Guam Clause Defining Operating Expenses with US Legal Forms, the most comprehensive library of legitimate record layouts. Use thousands of expert and condition-specific layouts that meet up with your business or person requirements and requirements.

Form popularity

FAQ

Operating expenses, also known as selling, general and administrative expenses (SG&A), are the fixed costs your business incurs that are not directly related to production. Operating expenses?also known as selling, general and administrative expenses (SG&A)?are the costs of doing business.

Operating Cost is calculated by Cost of goods sold + Operating Expenses. Operating Expenses consist of : Administrative and office expenses like rent, salaries, to staff, insurance, directors fees etc.

Operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. By contrast, a non-operating expense is an expense incurred by a business that is unrelated to the business's core operations.

The following are common examples of operating expenses: Rent and utilities. Wages and salaries. Accounting and legal fees. Overhead costs such as selling, general, and administrative expenses (SG&A) Property taxes. Business travel. Interest paid on debt. Research and development (R&D) expenses.

Key Takeaways Operating expenses are maintenance costs that ensure the property can produce income, such as property taxes, insurance, and management fees. Mortgages, capital expenses, income taxes, and depreciation are not considered operating costs.

operating expense is a cost from activities that aren't directly related to core, daytoday company operations. Examples of nonoperating expenses include interest payments and onetime expenses related to the disposal of assets or inventory writedowns.

Operating expenses definition Operating expenses?also known as selling, general and administrative expenses (SG&A)?are the costs of doing business. They include rent and utilities, marketing and advertising, sales and accounting, management and administrative salaries.

Operating costs include direct costs of goods sold (COGS) and other operating expenses?often called selling, general, and administrative (SG&A)?which include rent, payroll, and other overhead costs, as well as raw materials and maintenance expenses.