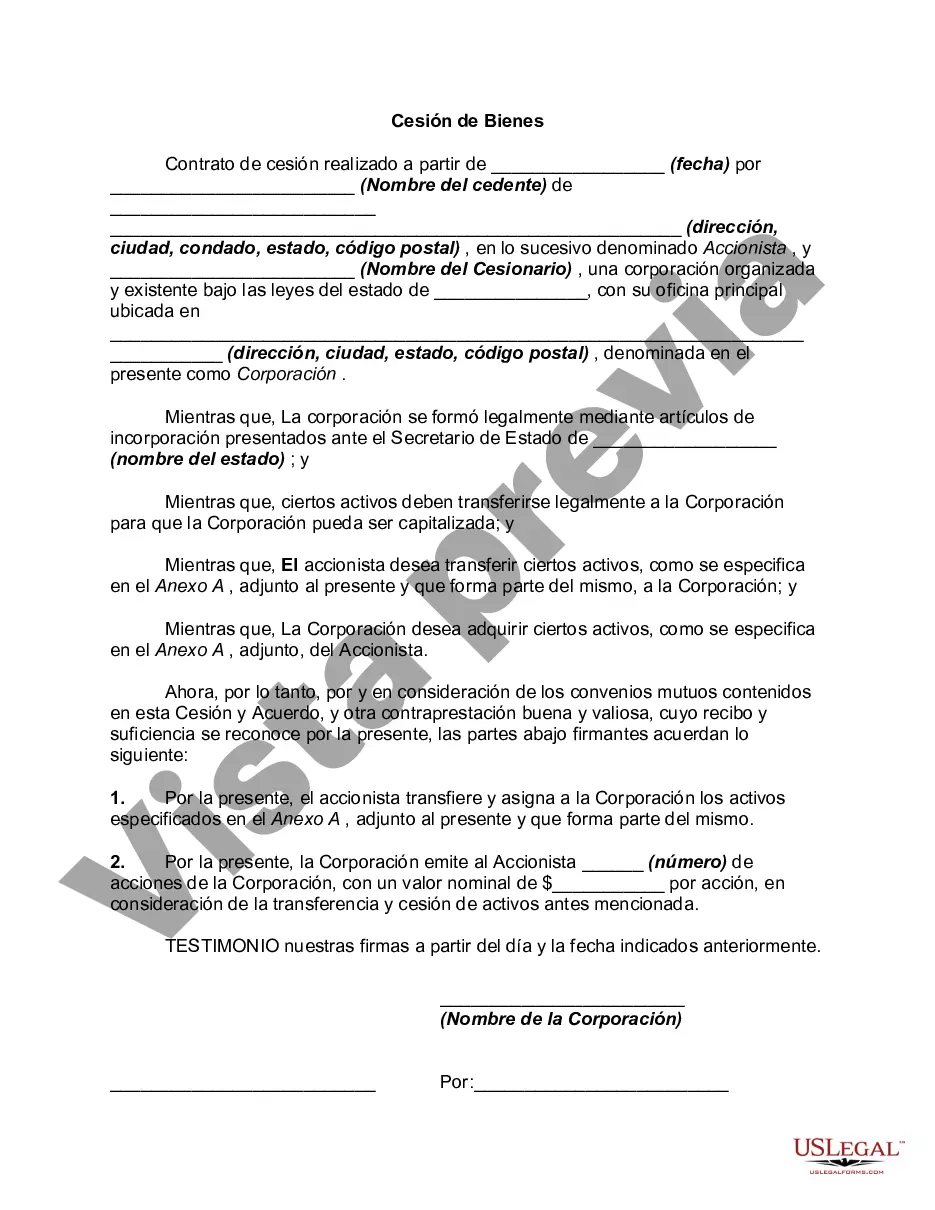

Colorado Assignment of Assets is a legal document used to transfer ownership rights of specific assets from one party to another. This agreement is commonly utilized in various business transactions, estate planning, divorce settlements, and debt collection processes. In the state of Colorado, there are several types of Assignment of Assets, each serving different purposes and catering to specific needs. Some notable types include: 1. General Assignment of Assets: This type of agreement involves the transfer of all or a majority of an individual or entity's assets to another party. It outlines the details of the transfer, including the specific assets being assigned, their respective values, and any conditions or limitations imposed on the transfer. 2. Specific Assignment of Assets: This form of asset transfer involves the assignment of specific identified assets from one party to another. It may include properties, funds, vehicles, or any other tangible or intangible assets. This type of assignment allows for a more focused transfer, ensuring precise ownership transfer. 3. Intellectual Property Assignment: This particular assignment of assets pertains to the transfer of intellectual property rights, such as patents, trademarks, copyrights, or trade secrets. It ensures the legal transfer of ownership and provides clarity on the extent of rights being assigned. 4. Assignment of Debt: This type involves the transfer of debt obligations from one party, known as the assignor, to another party, known as the assignee. The assignor relinquishes their rights and responsibilities pertaining to a debt, and the assignee assumes full ownership of the debt, enabling them to collect or revise the terms of repayment. 5. Assignment of Lease: Primarily used in real estate transactions, this assignment involves the transfer of a lease agreement from one tenant to another. It allows the initial tenant (assignor) to transfer their rights and obligations under the lease to a new tenant (assignee), providing a mechanism for tenant substitution. When drafting a Colorado Assignment of Assets, it is crucial to include essential terms and clauses relevant to the specific type of assignment being executed. Some critical components include a detailed description of the assets being transferred, any warranties or representations provided by the assignor, consideration or compensation involved, and a clear statement outlining the legality and enforceability of the agreement. Overall, a Colorado Assignment of Assets provides an effective means for parties to legally transfer ownership rights and obligations and is an essential tool in various legal and financial transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Colorado Cesión de Bienes - Assignment of Assets

Description

How to fill out Colorado Cesión De Bienes?

It is possible to commit hrs on the Internet trying to find the lawful document design which fits the state and federal demands you need. US Legal Forms gives 1000s of lawful types that happen to be evaluated by specialists. You can actually obtain or produce the Colorado Assignment of Assets from the service.

If you already possess a US Legal Forms account, you may log in and then click the Download switch. After that, you may full, edit, produce, or indication the Colorado Assignment of Assets. Each and every lawful document design you purchase is your own property permanently. To obtain one more version for any acquired develop, visit the My Forms tab and then click the related switch.

If you are using the US Legal Forms website for the first time, follow the basic guidelines under:

- First, make sure that you have chosen the proper document design for that state/metropolis of your choosing. Read the develop description to ensure you have picked the proper develop. If readily available, use the Preview switch to check with the document design at the same time.

- In order to get one more edition from the develop, use the Search discipline to discover the design that meets your needs and demands.

- When you have identified the design you need, click on Get now to proceed.

- Choose the costs strategy you need, key in your qualifications, and register for an account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal account to pay for the lawful develop.

- Choose the formatting from the document and obtain it for your system.

- Make alterations for your document if needed. It is possible to full, edit and indication and produce Colorado Assignment of Assets.

Download and produce 1000s of document templates while using US Legal Forms Internet site, that offers the greatest collection of lawful types. Use specialist and express-particular templates to tackle your company or individual demands.

Form popularity

FAQ

In Colorado, certain exemptions apply to the real property transfer tax, which can significantly affect your Colorado Assignment of Assets. For instance, transfers between spouses, transfers related to divorce settlements, and transfers of property for public purposes are commonly exempt. Additionally, when the property is transferred as part of a sale for less than market value, it may also qualify for an exemption. Understanding these exemptions can help you navigate your asset transfers more efficiently and potentially save on costs.

General assignment means transferring all or part of an individual's rights, properties, or interests to another entity, usually for specific legal or financial purposes. This concept is commonly used to resolve financial obligations and can affect how assets are categorized during estate planning. Understanding general assignment is essential for anyone considering a Colorado Assignment of Assets, as it provides clarity on the management and distribution of your estate.

In estate planning, a general assignment refers to the transfer of assets to an executor or trustee to manage according to the deceased’s wishes. This process ensures that your estate is handled properly, reducing confusion for heirs and minimizing potential disputes. A well-documented general assignment is vital, especially when organizing a Colorado Assignment of Assets, as it clarifies responsibilities and intentions.

A general assignment of assets is a legal document where an individual transfers their assets to another party, often to settle debts or manage affairs. This transfer can include property, financial accounts, and personal belongings. It plays a crucial role in estate planning and can significantly impact a Colorado Assignment of Assets when aligning with your overall financial goals.

To fill out a Colorado quit claim deed, start by obtaining the correct form from a reliable source or legal platform. You need to provide details like the names of the grantor and grantee, a clear legal description of the property, and any necessary signatures. Using a service such as US Legal Forms can simplify this process, especially when dealing with a Colorado Assignment of Assets.

People often place assets in a trust for various reasons, including protection from creditors, avoiding probate, and ensuring that their wishes are followed after their passing. A trust can help manage and distribute your assets efficiently, making it easier for your beneficiaries. It also provides flexibility in how assets are handled, which is essential when considering a Colorado Assignment of Assets.

The 2% withholding in Colorado refers to a tax requirement for certain real estate transactions. Specifically, sellers may be required to withhold 2% of the sale proceeds to ensure that taxes are collected on capital gains. This process is particularly relevant within the scope of Colorado Assignment of Assets, as it ensures compliance with tax regulations. For more detailed guidance, UsLegalForms can assist you with understanding these requirements.

A TD 1000 form Colorado is a critical document used during real estate transactions to declare the transfer of property. This form contains vital information that assists local assessors in determining property taxes. Filling out the TD 1000 correctly is an important step for those involved in the Colorado Assignment of Assets. UsLegalForms can provide the necessary tools to simplify this task.

The TD 1000 form in Colorado is a Transfer Declaration form that supports the transfer of real property ownership. This document helps assessors evaluate property value for tax assessments. For individuals engaging in the Colorado Assignment of Assets, understanding and completing the TD 1000 is essential to ensure compliance with state regulations. UsLegalForms offers templates and guidance to make this process easy for you.

Colorado Form DR 1083 is known as the Real Property Transfer Declaration. It helps document details about real estate transactions in Colorado, facilitating the assessment process for property taxes. Completing this form accurately is crucial for anyone involved in the Colorado Assignment of Assets process. If you need assistance, UsLegalForms provides resources to help you navigate this requirement seamlessly.