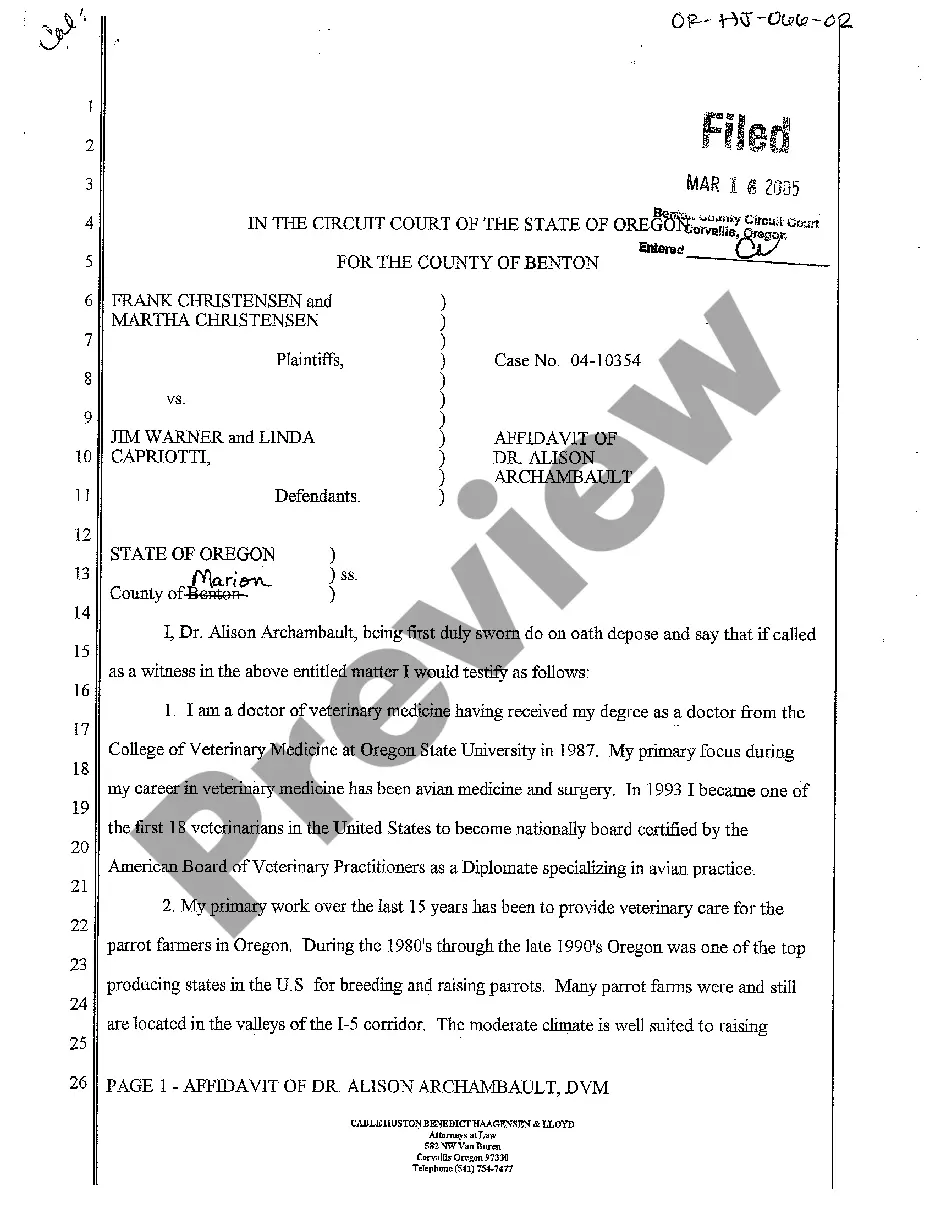

Colorado Assignment and Transfer of Stock involves the process of legally transferring ownership of stocks or shares from one party to another. This is a crucial transaction that occurs within the field of corporate law and involves various parties such as shareholders, companies, and potential investors. By exploring the different types of Colorado Assignment and Transfer of Stock, one gains a comprehensive understanding of the specific contexts within which these transfers occur. The first type of Colorado Assignment and Transfer of Stock is known as a direct transfer which involves the sale or transfer of stock from one individual to another. This type of transfer is commonly seen when an individual wishes to sell their holding or when a party wants to invest in a specific company by purchasing existing shares from an existing stockholder. In this case, the process typically includes drafting an agreement or contract that outlines the terms and conditions of the transfer including the purchase price, transfer date, and any additional provisions that the parties may agree upon. Another type is an assignment of stock which occurs when an individual assigns or transfers their stock to someone else, without a sale or exchange taking place. While this may seem similar to a direct transfer, the main difference lies in the absence of a monetary transaction. Assignments of stock often happen in situations where a shareholder wants to gift or donate their stock to another person, enabling them to enjoy the benefits of ownership without any direct monetary consideration. Additionally, companies may assign the stock of an employee to an employee stock ownership plan (ESOP) as part of a company benefit program. In Colorado, all types of Assignment and Transfer of Stock require compliance with the applicable state and federal security laws. Parties involved must ensure that they adhere to the guidelines specified by the Colorado Uniform Securities Act and the regulations set forth by the U.S. Securities and Exchange Commission (SEC). Furthermore, it is essential to include provisions for any necessary approvals or consents from the company or other shareholders to validate the transfer seamlessly. Overall, Colorado Assignment and Transfer of Stock consist of direct transfers and assignments, catering to different scenarios and intentions of the involved parties. By understanding the various types and the legal requirements associated with these transfers, shareholders, investors, and companies can ensure smooth and legally compliant transactions.

Colorado Assignment and Transfer of Stock

Description

How to fill out Colorado Assignment And Transfer Of Stock?

You can dedicate hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

It is easy to download or print the Colorado Assignment and Transfer of Stock from the services.

If available, use the Review button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Colorado Assignment and Transfer of Stock.

- Each legal document template you obtain is yours to keep for a long time.

- To acquire another copy of any purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the appropriate document template for the area/city you choose.

- Check the form description to confirm you have selected the correct form.

Form popularity

FAQ

To obtain a certificate of good standing in Colorado, you must first ensure that your business complies with all state requirements. This includes filing necessary documents and paying applicable fees. Once your business is in compliance, you can request the certificate from the Colorado Secretary of State's office online. Using our US Legal platform simplifies this process, providing easy access to forms and guidance related to the Colorado Assignment and Transfer of Stock.

An assignment of stock refers to the legal process of transferring ownership rights of stock from one party to another. This assignment typically requires a signed document that confirms the terms of the transfer. In the context of your Colorado Assignment and Transfer of Stock, this document is vital for establishing new ownership rights. US Legal Forms offers templates that simplify creating an assignment of stock, ensuring compliance with legal standards.

To transfer ownership of stock, you must complete a stock transfer form and submit it alongside any required documents, like the current stock certificate. After submission, the company may need to update their records to reflect the new ownership. This process can vary depending on the corporation's policies, so understanding these rules is integral to your Colorado Assignment and Transfer of Stock. US Legal Forms can provide the necessary resources to help facilitate your transfer.

Filling out a stock certificate involves providing specific details, including the name of the company, the number of shares, and the name of the shareholder. You will also need to include the date of issuance and any restrictions on transfer, if applicable. Understanding these details is vital for ensuring clarity in your Colorado Assignment and Transfer of Stock. With US Legal Forms, you can find step-by-step instructions for accurately completing a stock certificate.

The primary document used to transfer stock is the stock assignment form or stock power. This document indicates the transfer of ownership from the seller to the buyer. Completing this document accurately is crucial to avoid any legal complications during the Colorado Assignment and Transfer of Stock process. Utilizing templates available through US Legal Forms can simplify this task significantly.

For a stock transfer, you generally need a properly executed stock certificate, a stock transfer form, and possibly a seller's declaration. Each document serves a purpose in ensuring the transfer is legal and recognized. Additionally, it's important to check if the company has any specific requirements. Tools from US Legal Forms can help guide you through obtaining the necessary documents for your Colorado Assignment and Transfer of Stock.

To transfer shares, one typically uses a stock transfer agreement or a stock assignment form. These documents effectively allow you to assign ownership from one party to another. In Colorado, preparing these documents correctly is essential for a smooth transfer process. Using resources like US Legal Forms ensures that you have the right template for your Colorado Assignment and Transfer of Stock.

Changing the ownership of an LLC with the IRS requires you to update the IRS records with the new owner’s information. You'll need to complete Form 8832 if you are changing the classification or adding new members. Additionally, ensure to notify the IRS about any changes in your business’s structure, as this often impacts tax obligations. For assistance, consider USLegalForms as a valuable resource for managing these updates correctly.

To change your business address in Colorado, you must submit a change of address form to the Colorado Secretary of State. Ensure the new address is valid and meets state requirements. It’s essential to update any relevant records and inform your clients or vendors about the change to maintain communication. Platforms like USLegalForms provide easy navigation through this process.

Changing the ownership of an LLC in Colorado involves notifying the current members and reviewing the operating agreement for any stipulations on ownership changes. Next, document the transfer with a formal agreement that details the new ownership structure. Once this is settled, file any necessary forms with the Colorado Secretary of State to update their records. Consider using USLegalForms for reliable guidance and resources during this process.