California Substitution of Trustee and Deed of Re conveyance are legal documents that are used in the state of California to transfer the ownership of a mortgaged property from one lender to another. The Substitution of Trustee document transfers the responsibility of managing the loan from the original lender to the new lender, while the Deed of Re conveyance document is used to transfer the legal title of the property from the original lender to the new lender. There are two types of California Substitution of Trustee and Deed of Re conveyance: Non-judicial and Judicial. Non-judicial Substitution of Trustee and Deed of Re conveyance are used when the property owner is in default on their mortgage and the loan is secured by a Deed of Trust. The Non-judicial process requires the parties to the transaction to sign the documents, and then they are recorded in the county recorder's office. Judicial Substitution of Trustee and Deed of Re conveyance are used when the property owner is in default on their mortgage and the loan is secured by a mortgage. The Judicial process requires the lender to go to court and obtain a court order authorizing the transfer of the loan to the new lender. Once the court order is obtained, the documents are recorded in the county recorder's office.

California Substitution of Trustee and Deed of Reconveyance

Description

Definition and meaning

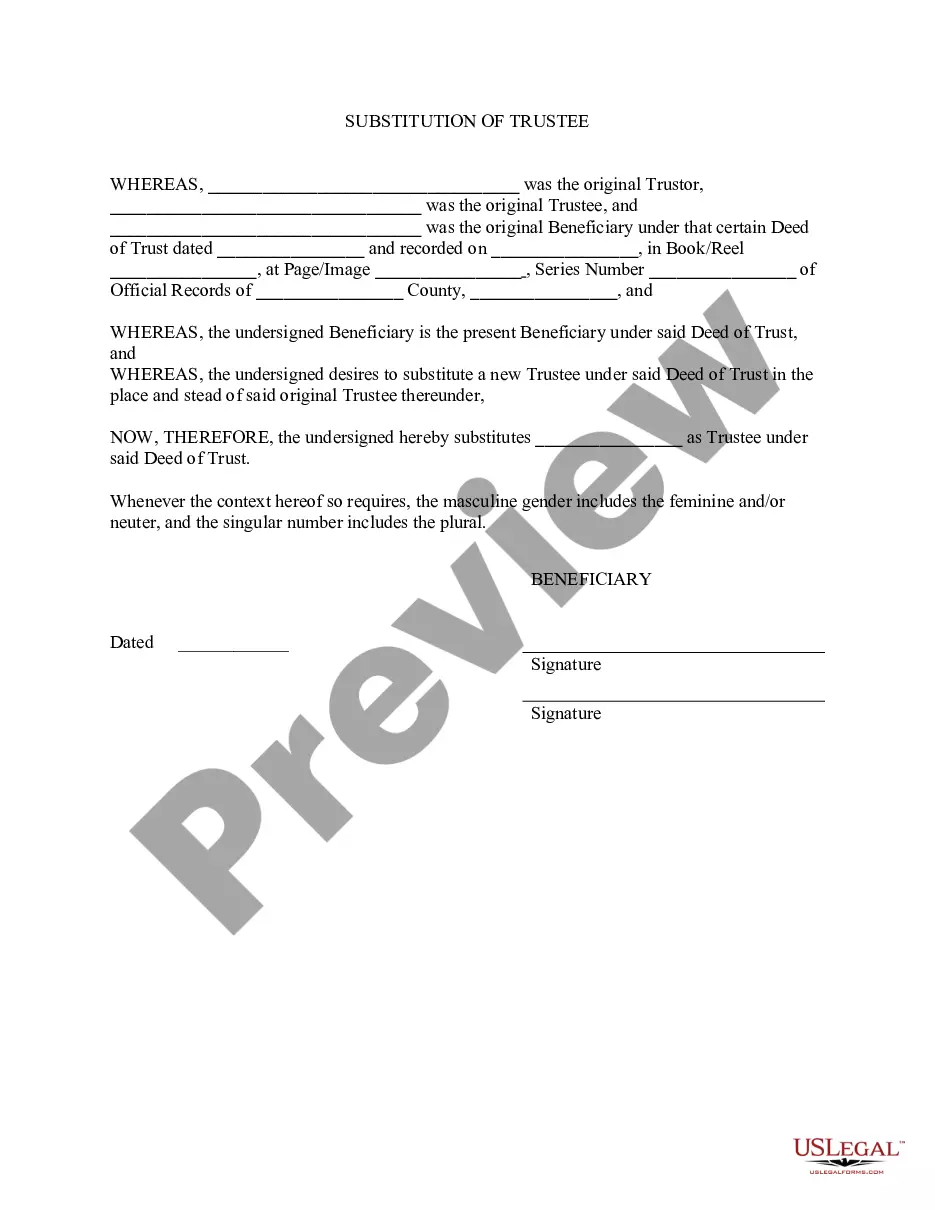

The California Substitution of Trustee and Deed of Reconveyance is a legal document used when the original trustee of a deed of trust needs to be replaced. This form is crucial in cases where the beneficiary of the deed wishes to appoint another individual or entity as the new trustee. The deed of reconveyance signifies that the original trustee has completed their obligation under the deed of trust, transferring the rights and interest back to the beneficiary or an approved entity.

Who should use this form

This form is intended for individuals or entities who are beneficiaries of a deed of trust in California. It is particularly useful for those who need to change trustees due to various circumstances, such as a trustee's retirement, incapacity, or if the beneficiary prefers a different trustee for administrative efficiency. Anyone involved in real estate transactions or property management may find this form applicable.

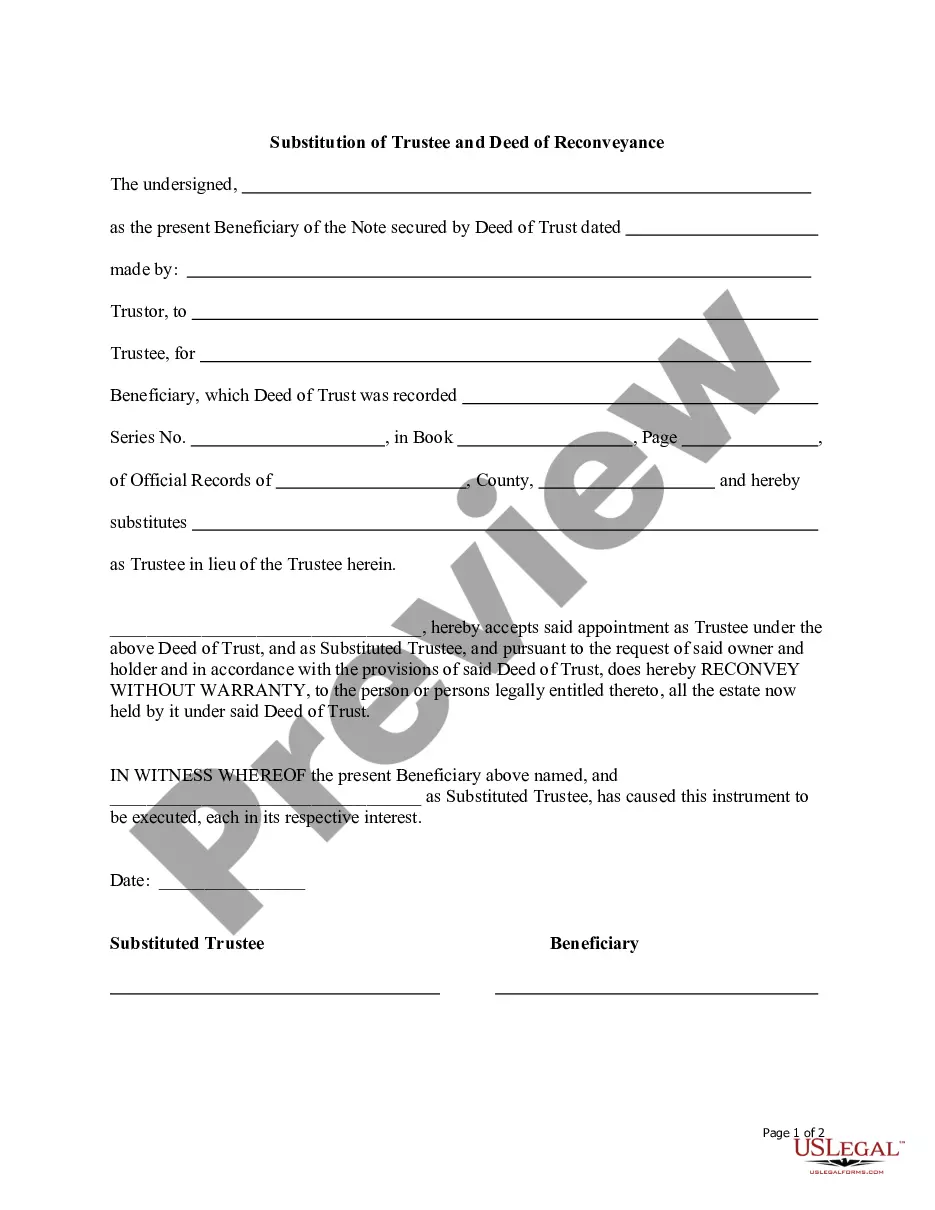

How to complete a form

To properly complete the California Substitution of Trustee and Deed of Reconveyance, follow these steps:

- Provide the name of the original trustee and the beneficiary of the deed.

- Fill in the date the original deed of trust was recorded.

- Specify the new trustee’s name.

- Ensure to have the required signatures of the substituted trustee and the beneficiary.

- Include the date the form is executed.

- Obtain notarization to validate the document.

Make sure to review all sections for accuracy, as errors or omissions could delay the recording process.

Legal use and context

The California Substitution of Trustee and Deed of Reconveyance is often used in real estate legal contexts, particularly when handling deeds of trust. It is significant in ensuring that the new trustee assumes the responsibilities outlined in the original deed. The form is also effective during property sales or refinancing when a new trustee may be required to manage the process legally and effectively. Understanding its legal implications is vital to ensure compliance with California state laws.

What to expect during notarization or witnessing

During the notarization process, the person(s) signing the California Substitution of Trustee and Deed of Reconveyance must present valid identification to the notary public. The notary will verify the identity of the signer and may require the signer to affirm that the contents of the document are accurate and they are signing willingly. It’s crucial to have all parties present for notarization to ensure the document is legally binding. The notary will then sign and stamp the document, adding a layer of authenticity to the agreement.

Common mistakes to avoid when using this form

When filling out the California Substitution of Trustee and Deed of Reconveyance, individuals should be cautious of:

- Failing to provide complete information, including names and dates.

- Not obtaining notarization, which is required for the document to be valid.

- Leaving out critical signatures from all necessary parties.

- Confusing the roles of the original and substituted trustees.

By being aware of these common pitfalls, users can ensure proper execution and recording of the form.

How to fill out California Substitution Of Trustee And Deed Of Reconveyance?

US Legal Forms is the most straightforward and affordable way to find appropriate legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and checked by legal professionals. Here, you can find printable and fillable blanks that comply with federal and local regulations - just like your California Substitution of Trustee and Deed of Reconveyance.

Obtaining your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the document on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted California Substitution of Trustee and Deed of Reconveyance if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one meeting your demands, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and choose the subscription plan you prefer most.

- Register for an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your California Substitution of Trustee and Deed of Reconveyance and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it out and sign more effectively.

Take full advantage of US Legal Forms, your reputable assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized. Full Reconveyance form can be purchased at most office supply or stationery stores. Usually the trustee named on your Deed of Trust will also have forms available and will issue the Full Reconveyance.

Practically, lenders and servicers may want to consider including in payoff demand statements an additional $150 in recording fees for a Substitution of Trustee and Full Reconveyance ($75.00 for each document ?title?), necessary for the release of the loan.

A deed of reconveyance is a legal document that indicates the transfer of a property's title from lender to borrower ? legally referred to as the trustor ? in deed of trust states. The deed of reconveyance is typically issued after the borrower has paid off their mortgage in full.

File the deed of trust modification in the county courthouse in the county where the property is located. There may be a filing fee for this service, which you can find by contacting your county clerk. This information also may be posted on the county's official website.

A Substitution of Trustee is a form filed when a successor trustee takes the place of a previous trustee. A successor is a person or entity who takes over and continues the role or position of another. For example, many grantors and their respective spouses act as the initial trustees of a revocable living trust.

A deed of reconveyance is a legal document that indicates the transfer of a property's title from lender to borrower ? legally referred to as the trustor ? in deed of trust states. The deed of reconveyance is typically issued after the borrower has paid off their mortgage in full.

Understanding a Deed of Reconveyance A deed of trust is an agreement that puts the title of the property in trust, with the trustee as the beneficiary. Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property.