California Request for Full Reconveyance

Definition and meaning

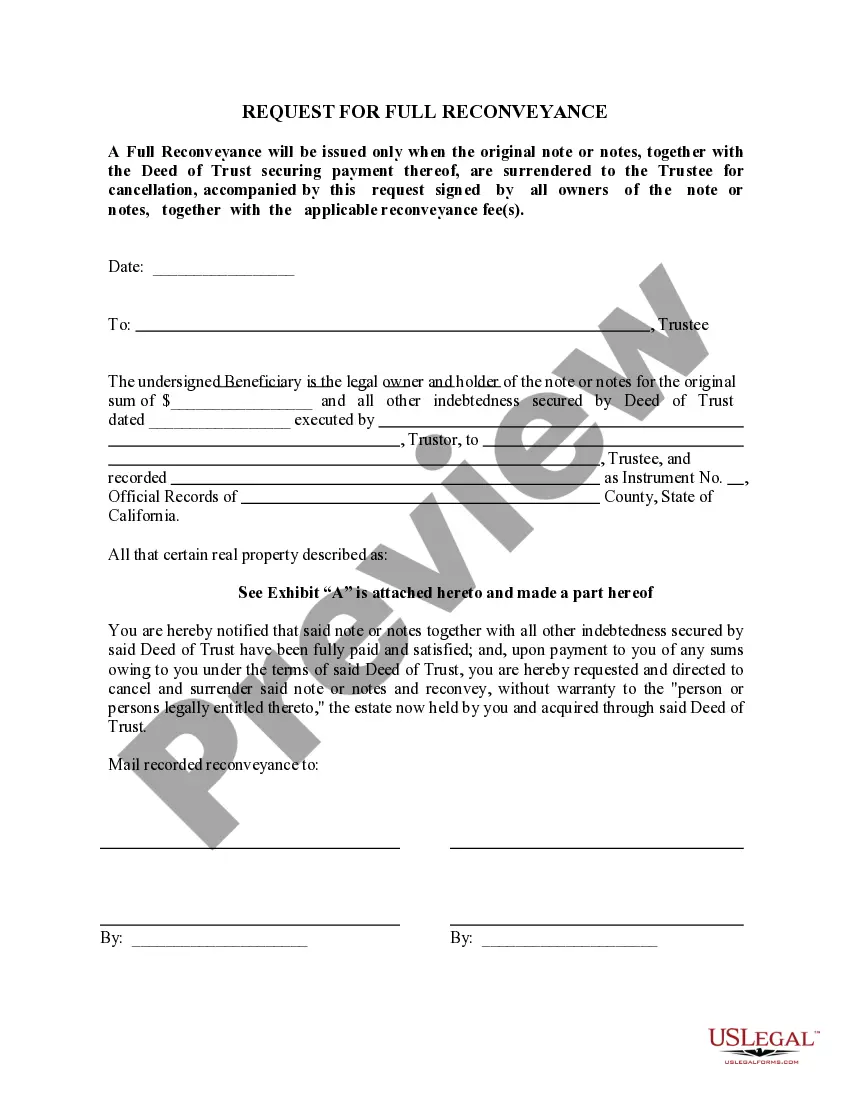

The California Request for Full Reconveyance is a legal document used to instruct a trustee to cancel a deed of trust and return title to the property owner. This form signifies that all debts secured by the deed of trust have been fully paid, allowing the trustee to reconvey ownership of the property.

How to complete a form

To fill out the Request for Full Reconveyance, follow these steps:

- Write the date at the top of the form.

- Identify the trustee by name.

- Provide the sum of the original note and any additional debts.

- Include the date the Deed of Trust was executed.

- Add details about the recorded deed's instrument number and the county.

- Attach a description of the property in Exhibit "A".

- Sign the document as the beneficiary and ensure all co-owners sign as well.

Who should use this form

This form is suitable for property owners in California who have completed their mortgage payments and need to request the reconveyance of their property. It is typically used by individuals or entities listed as beneficiaries in a deed of trust.

Key components of the form

The essential elements of the California Request for Full Reconveyance include:

- The date of the request.

- Name of the trustee.

- Original loan amount.

- Details of the Deed of Trust.

- Property description attached as Exhibit "A".

- Signatures of all beneficiaries.

- Mailing address for the recorded reconveyance.

State-specific requirements

In California, when submitting the Request for Full Reconveyance, it is essential to ensure the following:

- The form must be signed by all owners of the note.

- The original deed of trust and note must be surrendered to the trustee.

- All applicable reconveyance fees must be paid.

Common mistakes to avoid when using this form

Be mindful of these common errors when completing the California Request for Full Reconveyance:

- Failing to include all necessary signatures from co-owners.

- Incorrectly filling out property details or the deed of trust information.

- Not attaching Exhibit "A" with the property description.

- Forgetting to pay the required reconveyance fees.

What documents you may need alongside this one

Along with the Request for Full Reconveyance, you should prepare:

- The original Deed of Trust.

- The original loan note.

- Proof of identity for all signatories.

- Payment for any reconveyance fees, if applicable.

Form popularity

FAQ

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

Legal Definition: The Trustee or Substitute Trustee is the authorized individual, acting as an agent of the court, who oversees the sale process and makes certain the property is sold in a fair and equitable manner.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien. Most importantly, a deed of full reconveyance, known as a satisfaction of mortgage in some states, transfers title back to the borrower.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

Once a loan has been paid off, and at the express direction of the lender (called the beneficiary), the trustee executes and delivers the deed of reconveyance to the trustor along with the original note (marked ?canceled? or ?paid in full?) and deed of trust.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!