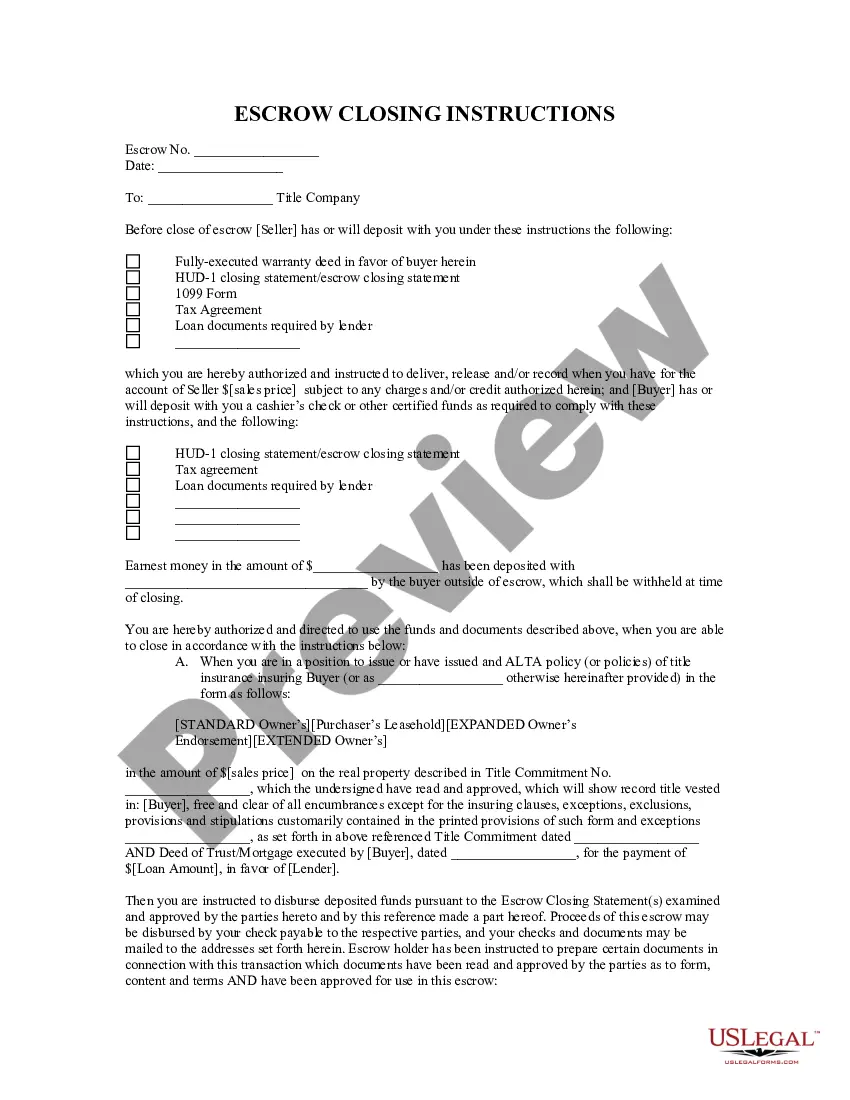

California Escrow Closing Instructions are legal documents used to facilitate a real estate sale in the state of California. These instructions provide the details of the real estate transaction, including the buyer and seller's rights and responsibilities. They cover topics such as title transfer, legal fees, escrow deposits, loan documents, and taxes. There are two types of California Escrow Closing Instructions: residential and commercial. Residential escrow instructions include details such as title search and transfer, loan documents, escrow deposits, closing costs, and taxes. Commercial escrow instructions include details such as title search and transfer, loan documents, escrow deposits, closing costs, and taxes, as well as details regarding tenant rights and obligations. Both types of escrow instructions provide information on how to handle the title transfer process, answer questions about the loan documents, and provide details on the closing costs and taxes.

California Escrow Closing Instructions

Description

Key Concepts & Definitions

Escrow: A legal arrangement in which a third party temporarily holds money or property until a particular condition has been met (e.g., the fulfillment of a purchase agreement). Escrow Closing Instructions: Detailed directives for an escrow company to follow to ensure all conditions of a real estate transaction are met before disbursing funds. Title Insurance: Insurance that protects the buyer and lender from losses due to disputes over property ownership.

Step-by-Step Guide to Escrow Closing Instructions

- Review the Purchase Agreement: Understand the agreed terms including the purchase price, conditions, and contingencies.

- Select an Escrow Company: Choose a reliable company experienced in real estate transactions.

- Submit Required Documents: Provide documents such as property inspection reports and proof of title insurance.

- Compliance with Legal Requirements: Ensure all legal aspects such as land title verification are clear.

- Final Review and Signing: Both buyer and seller review the escrow instructions and sign off for a successful closing.

Risk Analysis

Conducting a thorough property inspection is crucial to identify any potential issues that could invalidate the escrow process. Developing clear and comprehensive escrow closing instructions minimizes risks like disputes over land title or errors in the handling of the purchase price.

Common Mistakes & How to Avoid Them

- Neglecting Proper Documentation: Always ensure all required documents are submitted on time to avoid delays.

- Failing to Review Escrow Instructions: Carefully read and understand all instructions to prevent misunderstandings.

- Overlooking Title Insurance Importance: Ensure the title insurance covers all possible ownership disputes.

How to fill out California Escrow Closing Instructions?

If you’re looking for a method to appropriately prepare the California Escrow Closing Instructions without enlisting a legal expert, then you’ve landed in the right place.

US Legal Forms has established itself as the most comprehensive and dependable repository of official templates for every personal and business circumstance. Each document you discover on our online platform is crafted in compliance with national and state laws, ensuring that your paperwork is properly arranged.

Another advantage of US Legal Forms is that you will never lose the documents you bought - you can access any of your downloaded forms in the My documents section of your profile whenever you need them.

- Ensure the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its text description or examining the Preview mode.

- Enter the document title in the Search tab at the top of the page and choose your state from the list to find an alternative template in case of any discrepancies.

- Repeat the content review and click Buy now when you are confident that the paperwork meets all requirements.

- Log In to your account and click Download. If you do not have an account, register for the service and choose a subscription plan.

- Utilize your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be accessible for download immediately afterward.

- Select the format in which you would like to receive your California Escrow Closing Instructions and download it by clicking the corresponding button.

- Import your template into an online editor for swift completion and signing, or print it out to prepare your physical copy manually.

Form popularity

FAQ

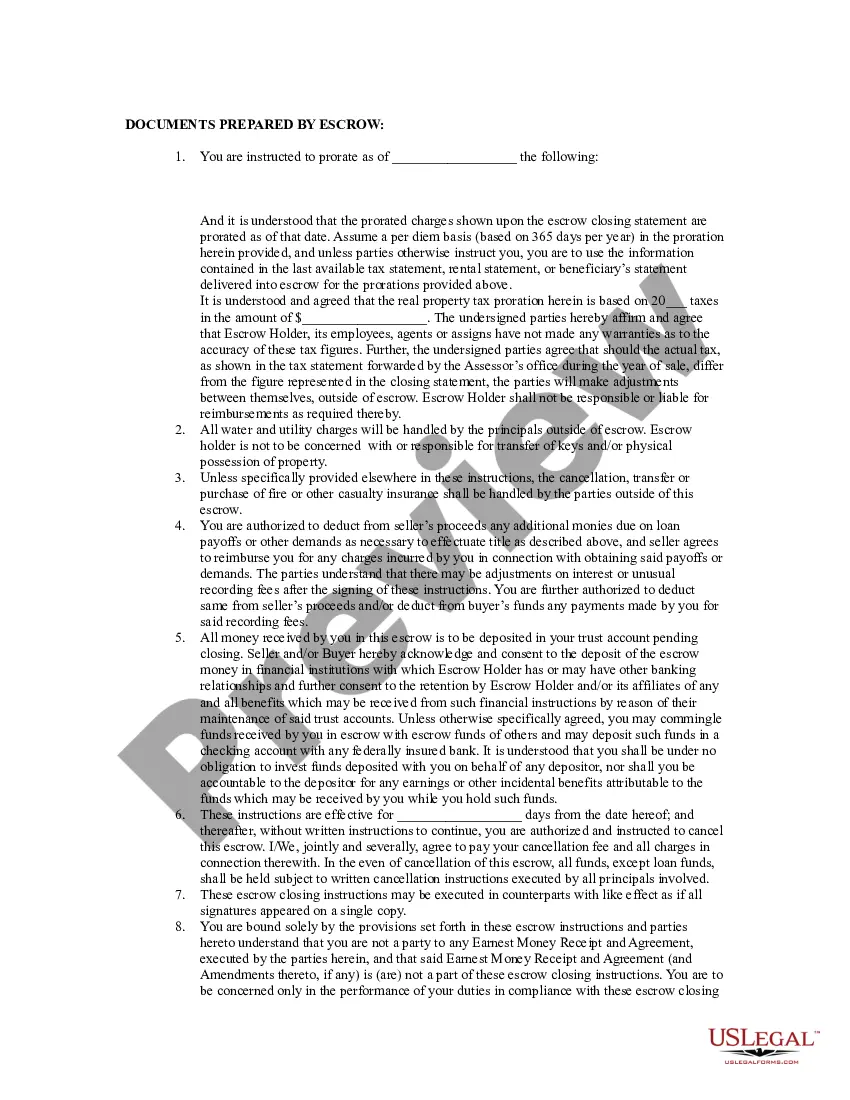

The processes of escrow include opening an account, depositing funds, verifying terms of the agreement, and carrying out instructions until the transaction is complete. Throughout this process, the escrow agent acts as a neutral party to facilitate communication between buyers and sellers. Following California Escrow Closing Instructions ensures that each of these steps is handled correctly and efficiently.

For an escrow to be valid, it must meet three essential requirements: there must be a valid contract, the escrow must have a neutral third party, and it must involve the delivery of funds or documents per the agreement. These requirements ensure that both parties are protected and the transaction proceeds smoothly. Utilizing California Escrow Closing Instructions can guide you through meeting these requirements effectively.

The close of escrow process involves several key steps to ensure a smooth transaction. First, the escrow agent collects all necessary documents and funds from both parties. Then, they verify that all conditions of the sale have been met before disbursing funds and transferring ownership. By following California Escrow Closing Instructions, you can navigate this process with confidence and clarity.

Closing escrow involves several key steps to ensure a successful transaction. First, parties must review and sign the California Escrow Closing Instructions, which set the stage for the entire process. After that, the escrow agent collects the necessary documents and funds, conducts any required inspections, and ensures all conditions are fulfilled. Finally, once all obligations are met, the escrow officially closes, and ownership of the property transfers to the buyer.

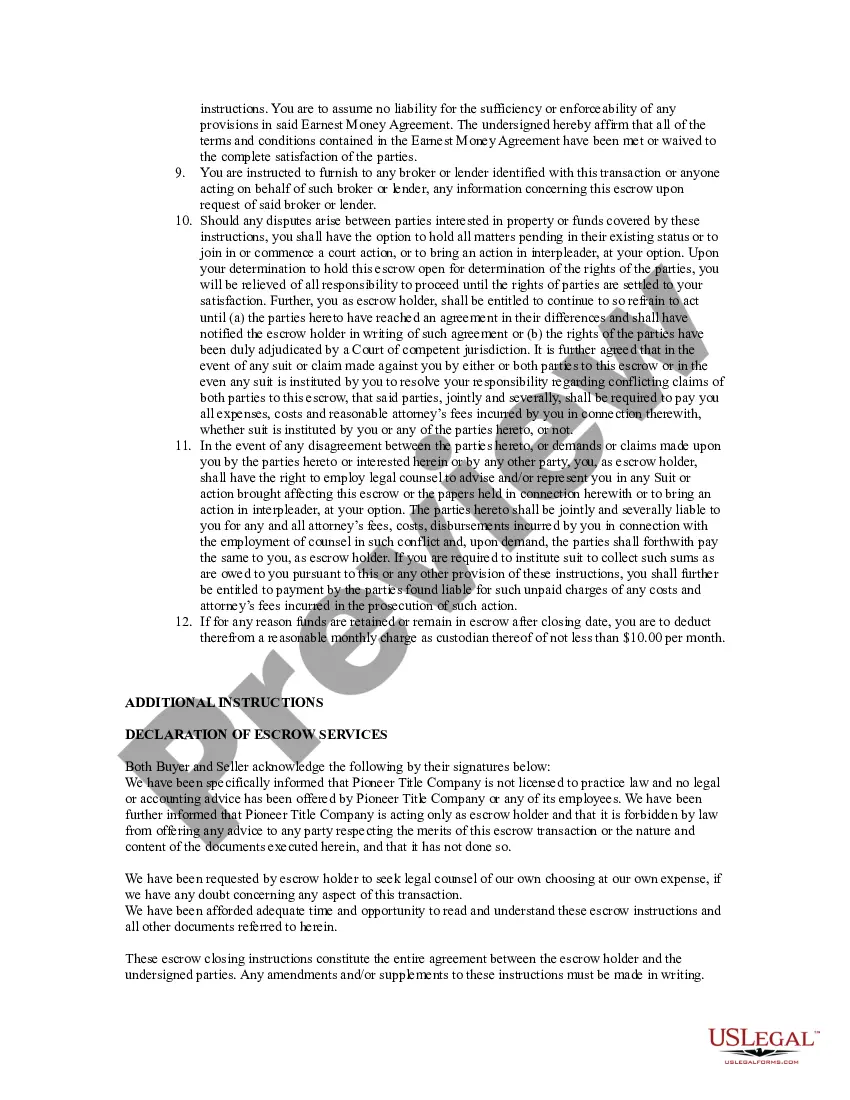

An escrow agent typically uses the California Escrow Closing Instructions as the primary document. This document outlines the responsibilities of all parties involved in the transaction. It serves as a guide for the agent to follow and ensures that specific conditions are met before the closing occurs. By using the right escrow instructions, all parties can feel secure that the process will proceed smoothly and according to plan.

Typically, the escrow instructions are provided by the buyer and seller, often with the assistance of their real estate agents or attorneys. This collaboration ensures that the California Escrow Closing Instructions reflect the agreed terms of the transaction. Additionally, escrow companies may offer templates and guidelines to help streamline this process. Using a reliable platform like uslegalforms can simplify your experience by providing easy-to-use forms that meet your needs.

The main document that serves as escrow instructions is the escrow agreement. This document outlines the specific California Escrow Closing Instructions for the escrow agent, detailing how to manage the funds and the property involved in the transaction. It clearly defines each party's obligations and duties throughout the closing process. By using a well-prepared escrow agreement, you ensure transparency and clarity in your real estate transaction.

Escrow closing instructions are detailed documents that outline the specific terms and conditions for closing a real estate transaction. These instructions provide clarity on the responsibilities of each party and the process for transferring funds and property ownership. Understanding the components of California Escrow Closing Instructions is vital for a successful real estate transaction.

Escrow instructions are usually provided by the parties involved in the transaction, particularly the buyer and seller. In many cases, real estate professionals may draft these instructions to accurately reflect the agreement. Ensuring clarity in the California Escrow Closing Instructions promotes adherence to the transaction's terms.

Escrow instructions can be executed by the parties that signed them, including the buyer, seller, and their representatives. Typically, the escrow company or agent oversees the execution process to ensure it adheres to all legal requirements. Proper execution of the California Escrow Closing Instructions sets the stage for a successful closing.