California Certificate of Delinquent Personal Property Tax

Description

How to fill out California Certificate Of Delinquent Personal Property Tax?

If you are seeking precise California Certificate of Delinquent Personal Property Tax forms, US Legal Forms is exactly what you require; access documents crafted and reviewed by state-authorized legal professionals.

Utilizing US Legal Forms not only shields you from concerns regarding official paperwork; you also save time, effort, and money!

And that's it. In just a few simple steps, you have an editable California Certificate of Delinquent Personal Property Tax. Once you create your account, all future requests will be handled even more easily. After you have a US Legal Forms subscription, just Log In to your profile and click the Download option available on the form’s page. Then, when you need to access this template again, you will always find it in the My documents section. Don't waste your time and energy sifting through hundreds of forms across various websites. Acquire professional templates from a single secure platform!

- To begin, complete your registration by entering your email and creating a password.

- Follow the steps below to set up your account and locate the California Certificate of Delinquent Personal Property Tax form to address your situation.

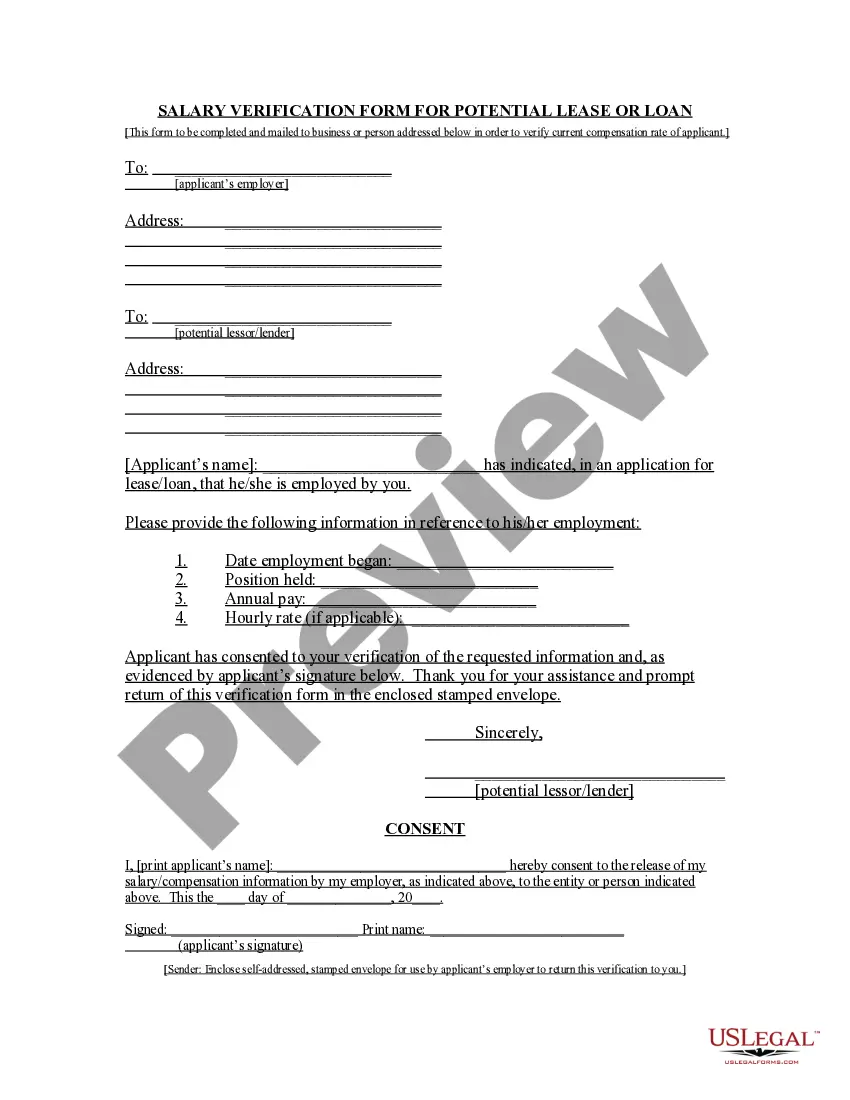

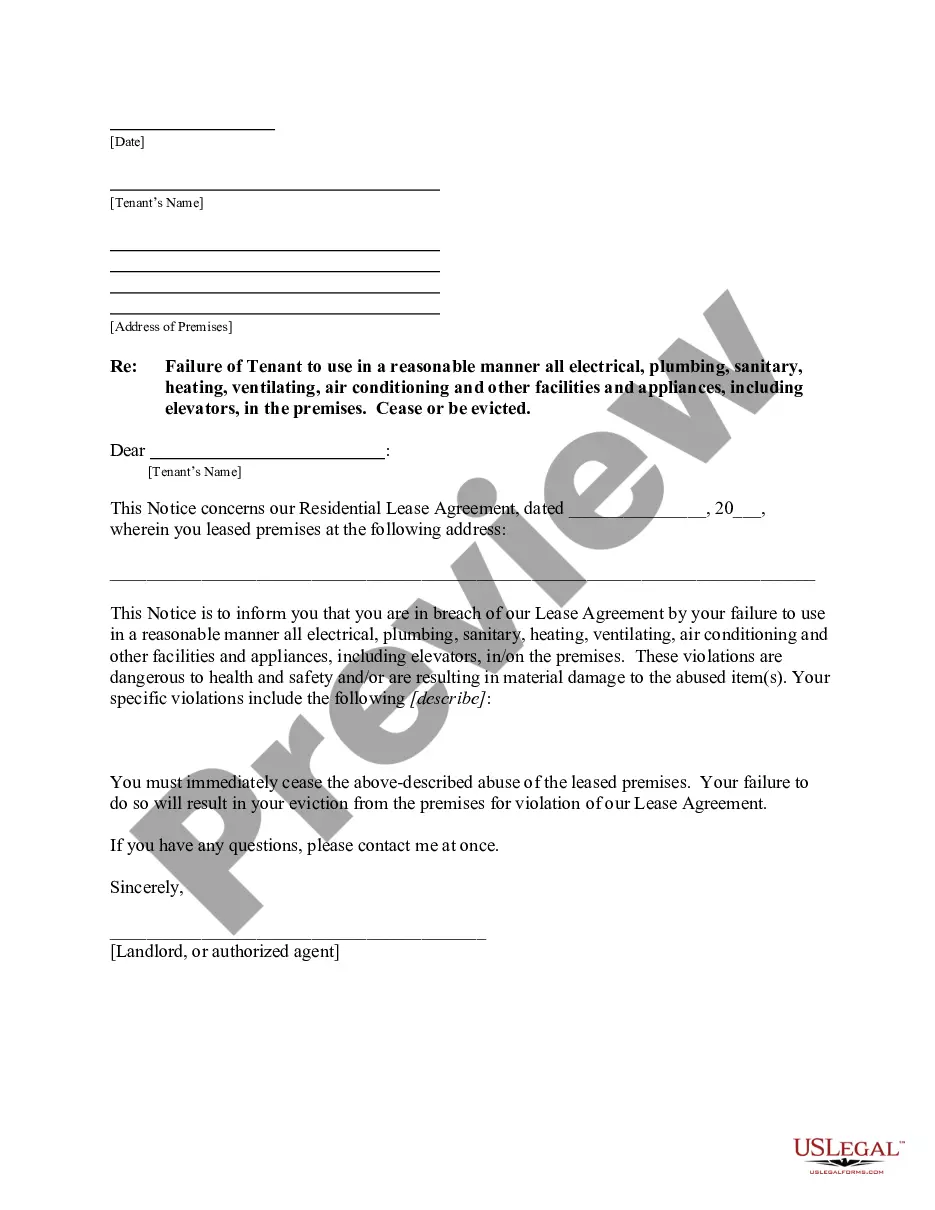

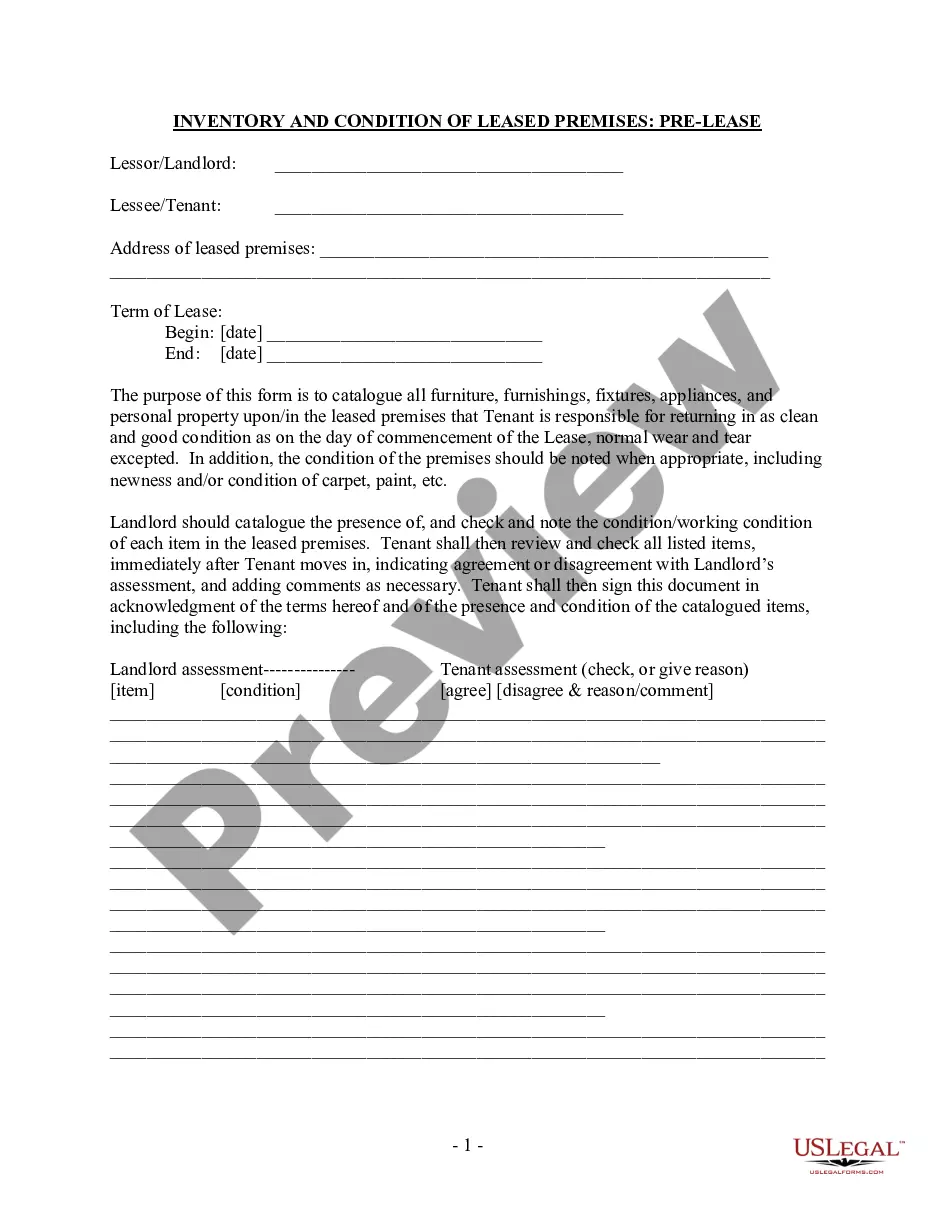

- Utilize the Preview feature or review the document description (if available) to ensure that the template is the right one for you.

- Verify its relevance in your state.

- Click on Buy Now to place an order.

- Select a preferred pricing plan.

- Create an account and make a payment using a credit card or PayPal.

- Pick a suitable format and download the document.

Form popularity

FAQ

Certification of seriously delinquent tax debt indicates that the tax authority has officially recognized the debt as seriously overdue. This designation can lead to property liens, collections, and other enforcement actions. If you find yourself facing a California Certificate of Delinquent Personal Property Tax, it’s essential to consult legal resources or platforms like uslegalforms for guidance on resolving such issues.

Delinquent tax status refers to property taxes that remain unpaid after their due date. It places a financial burden on the property owner and may lead to further legal actions, such as liens. If you encounter a California Certificate of Delinquent Personal Property Tax, it's crucial to address it promptly to avoid additional penalties.

A certificate of delinquency is an official document issued by a tax authority when property taxes are unpaid. In California, this certificate registers that the property has delinquent personal property taxes, identifying it as a subject of tax lien. Understanding the California Certificate of Delinquent Personal Property Tax can help you navigate potential liens more effectively.

In California, you can be delinquent in property taxes for up to five years before the property may be auctioned. After three years of delinquency, the county can initiate the tax sale process. The California Certificate of Delinquent Personal Property Tax is then issued to owners, alerting them of the outstanding balance. It is crucial to address delinquent taxes promptly to avoid losing your property.

In California, paying property taxes does not automatically grant ownership of the property; ownership is established through legal title. However, paying taxes is an important aspect of maintaining your legal title and avoiding complications like liens. Therefore, keeping your California Certificate of Delinquent Personal Property Tax up to date is crucial for retaining your rights as a property owner.

The property tax loophole in California primarily refers to Proposition 13, which limits property tax increases to a maximum of 2% annually. This allows property owners to maintain lower tax bills, even as property values rise. Understanding this loophole can help you navigate your responsibilities regarding your California Certificate of Delinquent Personal Property Tax more effectively.

When property taxes are delinquent in California, the county may impose penalties and interest on the unpaid amount. If taxes remain unpaid, the county could initiate a lien on your property and eventually auction it off to recover the owed taxes. This process emphasizes the importance of managing your California Certificate of Delinquent Personal Property Tax to avoid severe consequences.

To obtain a copy of your property tax bill in California, you can visit your local county assessor's office or their website. Most counties provide online access to property tax records, allowing you to easily download a copy. Alternatively, you can call the office and request a copy to be mailed to you. It's crucial to have your property details handy to expedite the process.

When your taxes are delinquent, it signifies that you have not fulfilled your tax payment obligations by the due date. This can lead to penalties, interest accrual, and potential legal ramifications. To avoid receiving a California Certificate of Delinquent Personal Property Tax, it’s important to stay informed about your tax responsibilities and seek solutions, such as using the US Legal Forms platform.

In Georgia, personal property tax on vehicles is determined by the fair market value and is assessed annually. Vehicle owners must report their vehicles to the county tax office, where the applicable tax rates are applied. Understanding these tax obligations can help prevent issues like obtaining a California Certificate of Delinquent Personal Property Tax if you possess property in California.