Hawaii Real Estate Tax Rate: An In-Depth Overview In Hawaii, real estate owners are subject to various tax rates that play a pivotal role in property ownership and management. Understanding the different types of Hawaii real estate tax rates is essential for property owners, investors, and prospective buyers. This comprehensive description sheds light on these taxation aspects, offering valuable insight into the intricacies of the Hawaiian real estate market. Primary Tax Types: 1. General Excise Tax (GET): The General Excise Tax applies to nearly all economic activities within Hawaii, including real estate transactions. As of 2021, the GET rate is set at 4% statewide, except on the island of Oahu, where it is 4.5%. For real estate purposes, GET is typically levied on services provided by real estate professionals, such as real estate agents and property managers. 2. Property Taxes: Property taxes in Hawaii are primarily collected at the county level, and the rates can vary based on the county and property classification. The property tax rates are expressed as mill rates, where one mill represents $1 for every $1,000 of assessed property value. The distinctive property tax categories in Hawaii include: a. Residential: Residential properties comprise owner-occupied residences and non-owner-occupied residential properties such as vacation homes and rental properties. The average residential property tax rate in Hawaii ranges from 0.25% to 0.70% based on the specific county. b. Commercial: Commercial properties encompass all types of non-residential real estate used for business activities, including office buildings, retail spaces, and warehouses. The commercial property tax rates depend on the county and can range from 0.25% to 1.25%. c. Industrial: Industrial properties encompass land and buildings primarily used for manufacturing, production, or storage purposes. Similar to commercial properties, industrial property tax rates also vary within a range of 0.25% to 1.25%. d. Agricultural: Agricultural properties include land used for farming, ranching, or other agricultural activities. The property tax rates for agricultural land differ across counties, typically falling between 0.25% and 0.70%. e. Conservation: Conservation lands are those established to preserve natural resources, protect wildlife habitats, or maintain ecological integrity. These properties often benefit from reduced property tax rates, falling between 0.25% and 0.70% across counties. f. Hotel & Resort: Hotels and resorts are subject to special property tax rates that are generally higher than those for residential or commercial properties. These rates are county-specific but typically range from 0.75% to 2.75%. Additional Considerations: It's important to note that Hawaii offers tax exemptions and credits, such as the homeowner's exemption, for eligible residential properties. The availability and criteria for exemptions or credits may vary depending on the county. Furthermore, property tax assessments in Hawaii are based on the property's assessed value, which may not always align with the market value. Property owners or buyers can contest assessments through an appeal process if they believe the valuation is inaccurate. In conclusion, understanding the various types of Hawaii real estate tax rates is crucial for property owners, investors, and buyers alike. Familiarizing oneself with the applicable tax rates, exemptions, and assessment processes can ensure compliance with tax obligations and enable better financial planning within the dynamic Hawaiian real estate market.

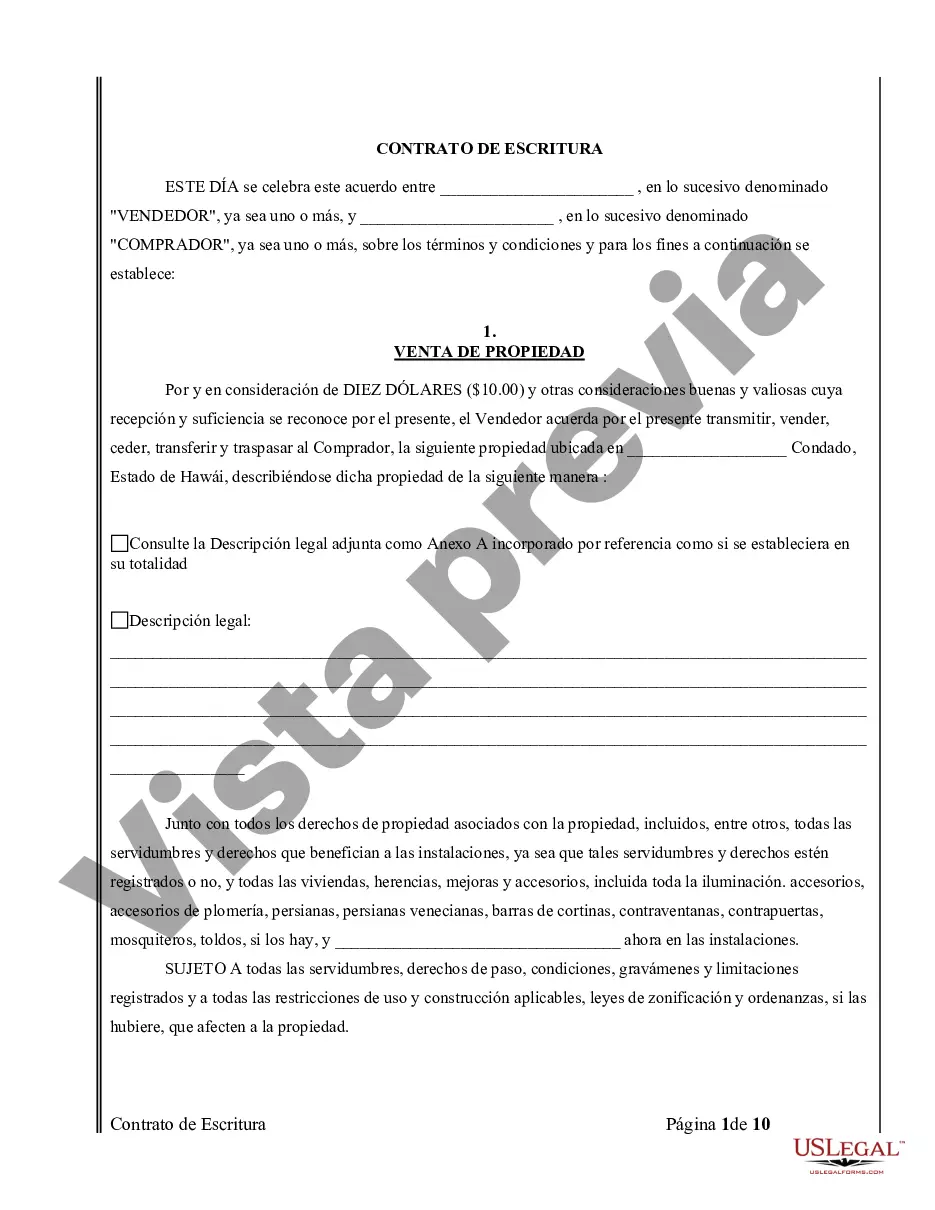

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Escritura Compra Bienes K Terreno - Hawaii Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract

Description

How to fill out Hawaii Acuerdo O Contrato De Escritura De Venta Y Compra De Bienes Raíces A/k/a Terreno O Contrato De Ejecución?

Access the most expansive catalogue of authorized forms. US Legal Forms is actually a solution where you can find any state-specific form in clicks, such as Hawaii Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract samples. No reason to waste hours of your time searching for a court-admissible sample. Our accredited pros ensure that you get up to date documents all the time.

To benefit from the forms library, pick a subscription, and register an account. If you created it, just log in and click Download. The Hawaii Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract file will immediately get saved in the My Forms tab (a tab for every form you download on US Legal Forms).

To register a new account, follow the short guidelines listed below:

- If you're going to utilize a state-specific example, make sure you indicate the proper state.

- If it’s possible, review the description to learn all the ins and outs of the form.

- Take advantage of the Preview option if it’s accessible to check the document's content.

- If everything’s correct, click on Buy Now button.

- Right after selecting a pricing plan, register an account.

- Pay by card or PayPal.

- Downoad the sample to your computer by clicking on Download button.

That's all! You should fill out the Hawaii Agreement or Contract for Deed for Sale and Purchase of Real Estate a/k/a Land or Executory Contract form and check out it. To make certain that things are exact, call your local legal counsel for support. Register and easily look through around 85,000 valuable templates.