Actas anuales para una corporación profesional de Connecticut - Annual Minutes for a Connecticut Professional Corporation

Description

How to fill out Actas Anuales Para Una Corporación Profesional De Connecticut?

The larger quantity of documents you are required to complete - the more anxious you become.

You can discover numerous Annual Minutes for a Connecticut Professional Corporation templates online, yet you are uncertain which ones to trust.

Eliminate the inconvenience of finding examples by using US Legal Forms.

Click Buy Now to initiate the registration process and select a pricing plan that suits your requirements. Provide the required information to create your profile and pay for the order via PayPal or credit card. Choose a convenient document format and download your copy. Locate each template you acquire in the My documents section. Simply go there to generate a new version of the Annual Minutes for a Connecticut Professional Corporation. Even when using well-prepared forms, it is still crucial to consider consulting a local attorney to verify that your form is filled out correctly. Achieve more for less with US Legal Forms!

- Obtain precisely crafted documents that comply with state requirements.

- If you're already a subscriber of US Legal Forms, Log In to your account, and you will find the Download button on the Annual Minutes for a Connecticut Professional Corporation’s webpage.

- If you haven't used our site before, complete the registration process by following these guidelines.

- Check to ensure that the Annual Minutes for a Connecticut Professional Corporation is applicable in your state.

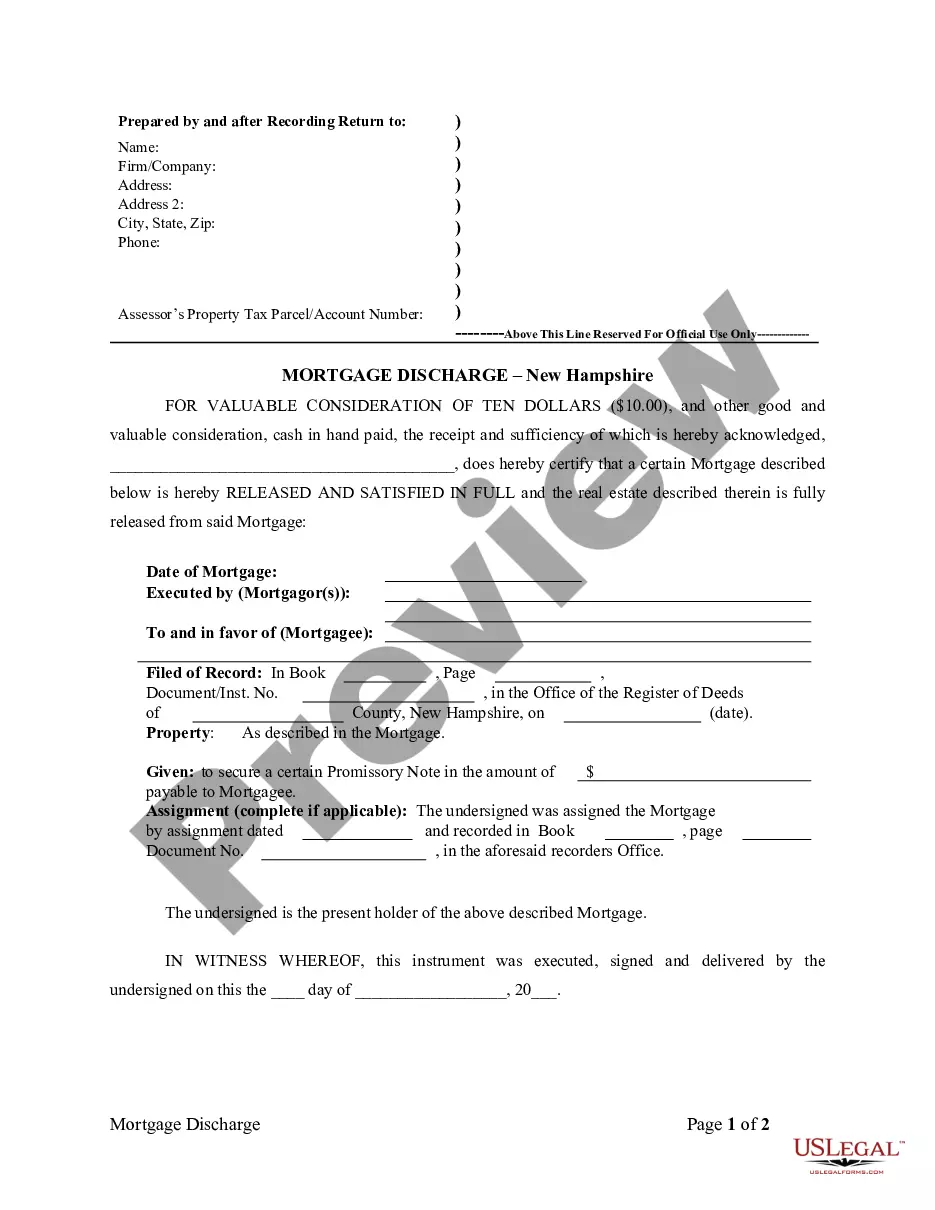

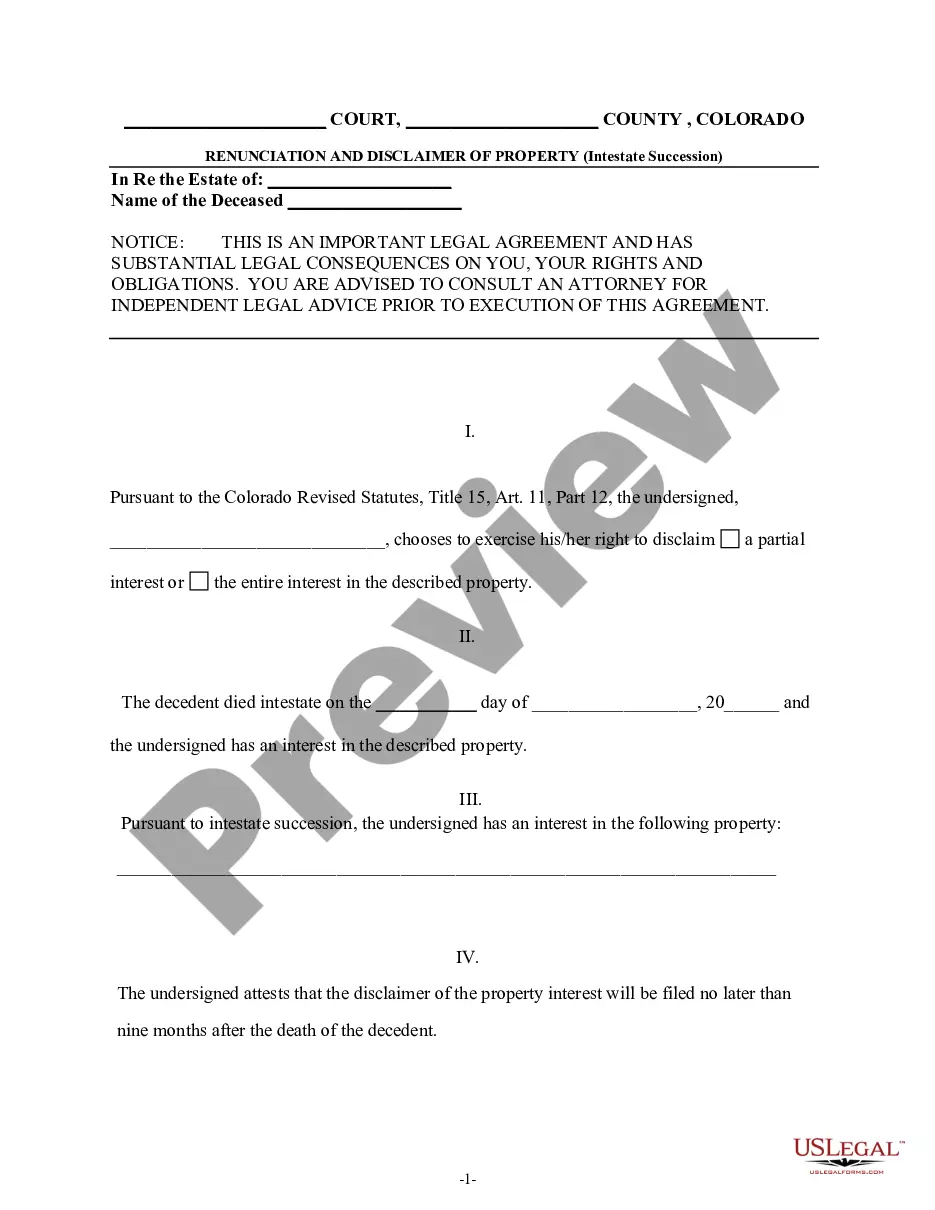

- Verify your selection by reviewing the description or utilizing the Preview feature if available for the chosen document.