Provide The Buyer With A Lien Release

Description

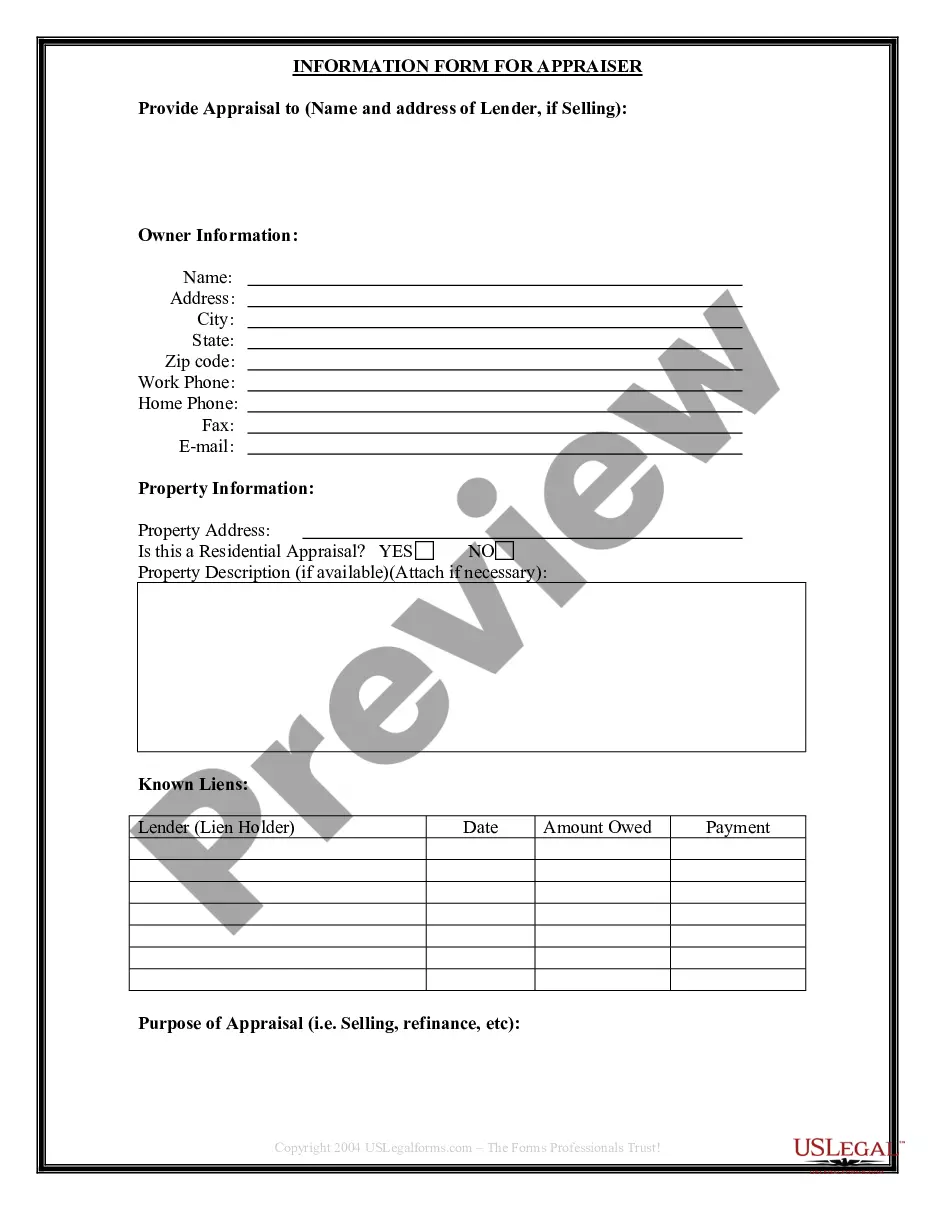

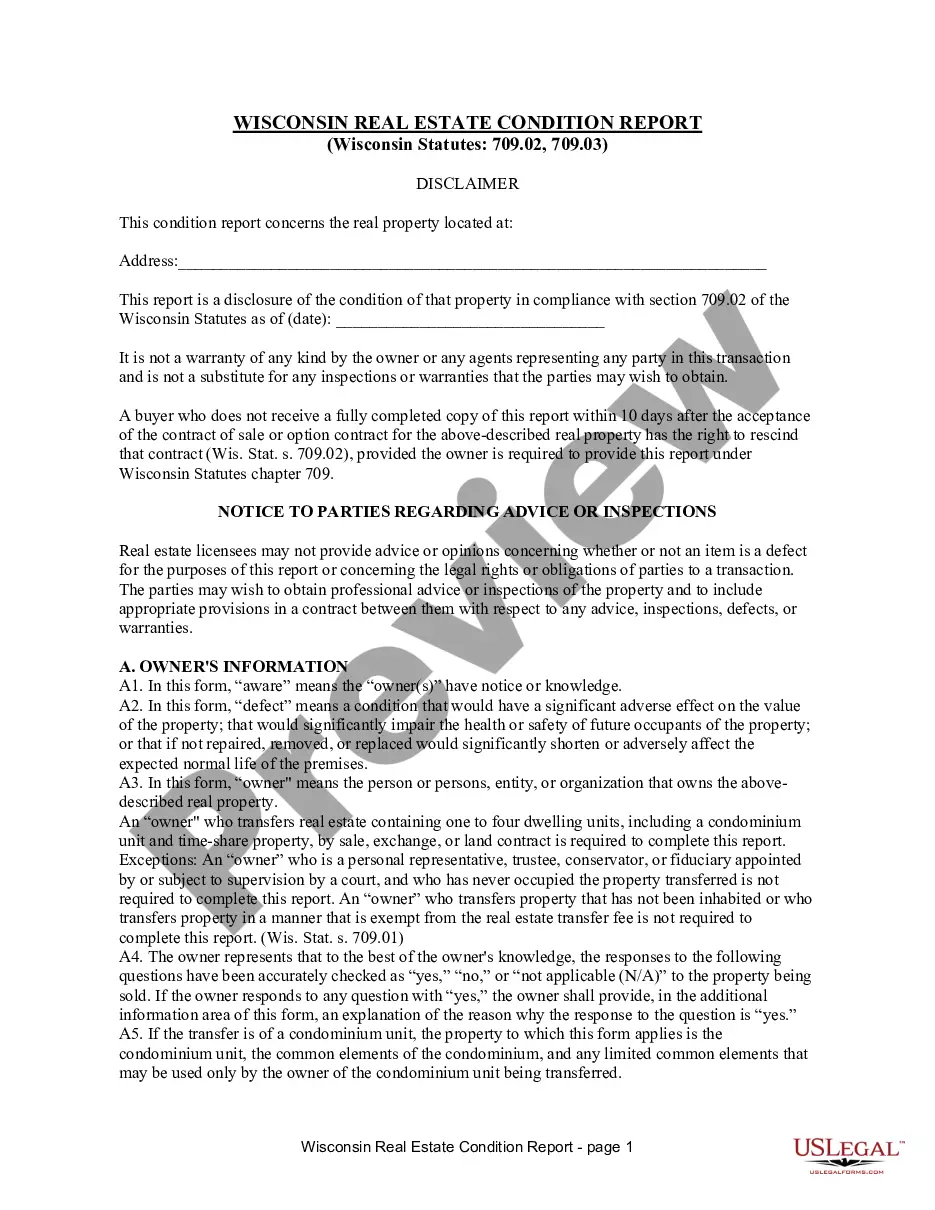

How to fill out Wisconsin Seller's Information For Appraiser Provided To Buyer?

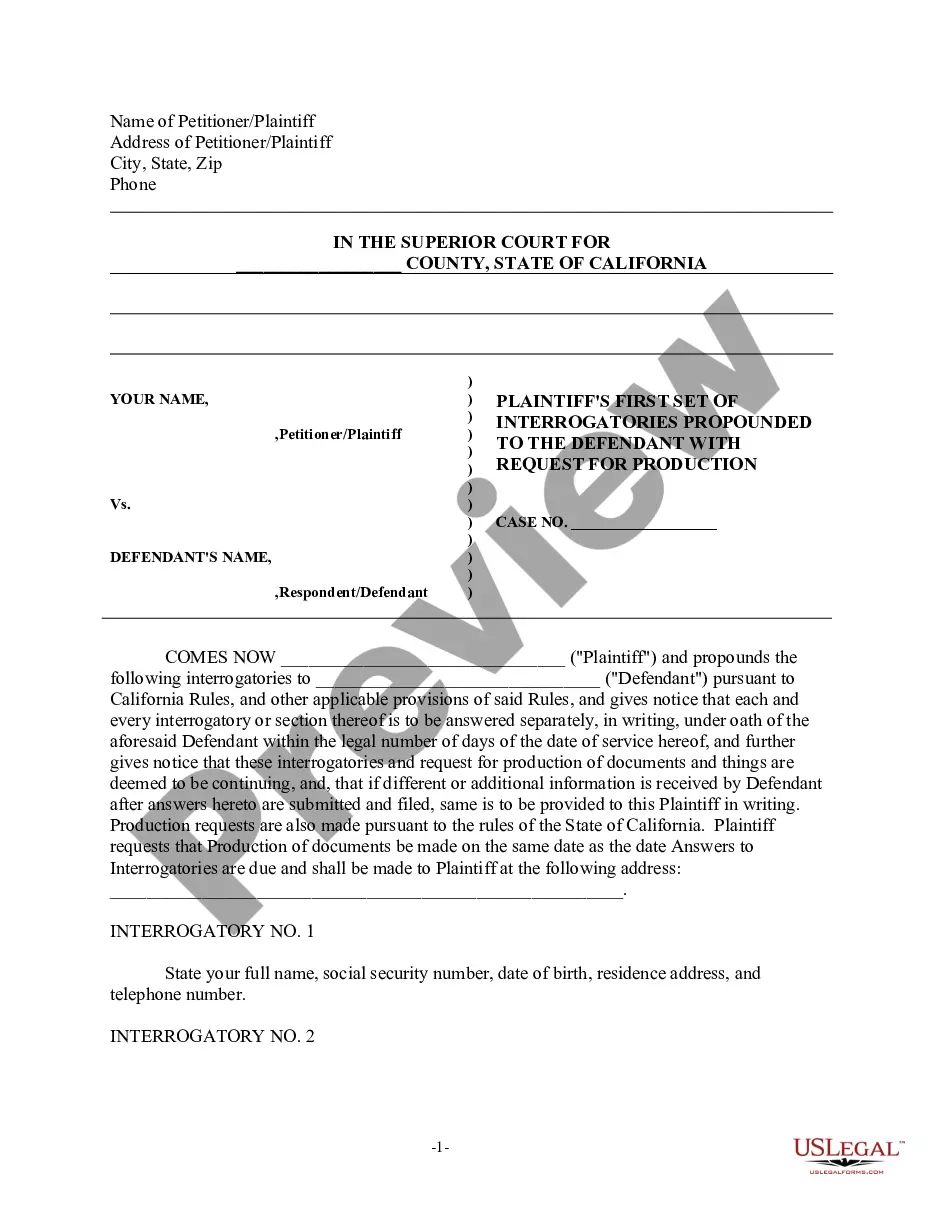

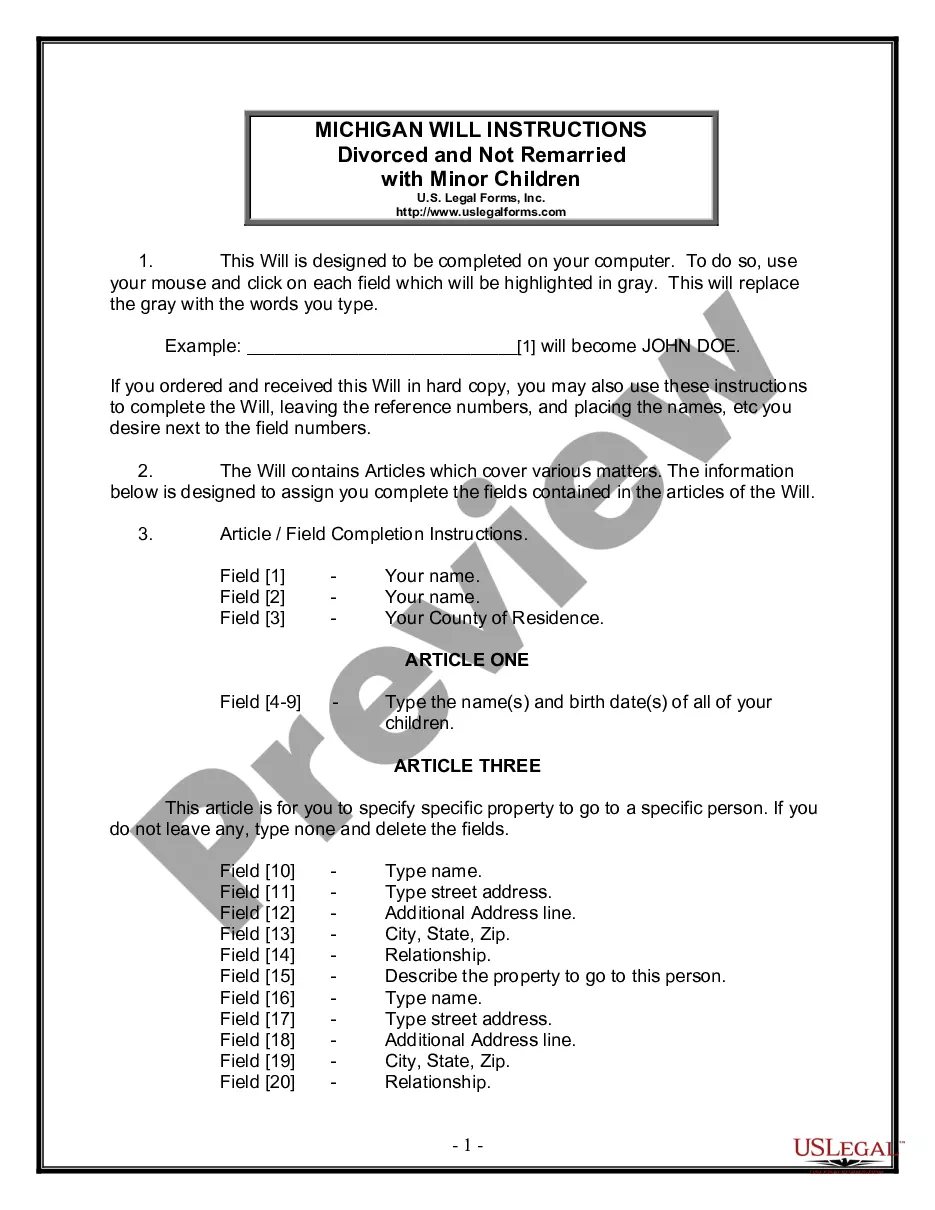

Maneuvering through the red tape of official paperwork and formats can be challenging, particularly for those who do not engage in it professionally.

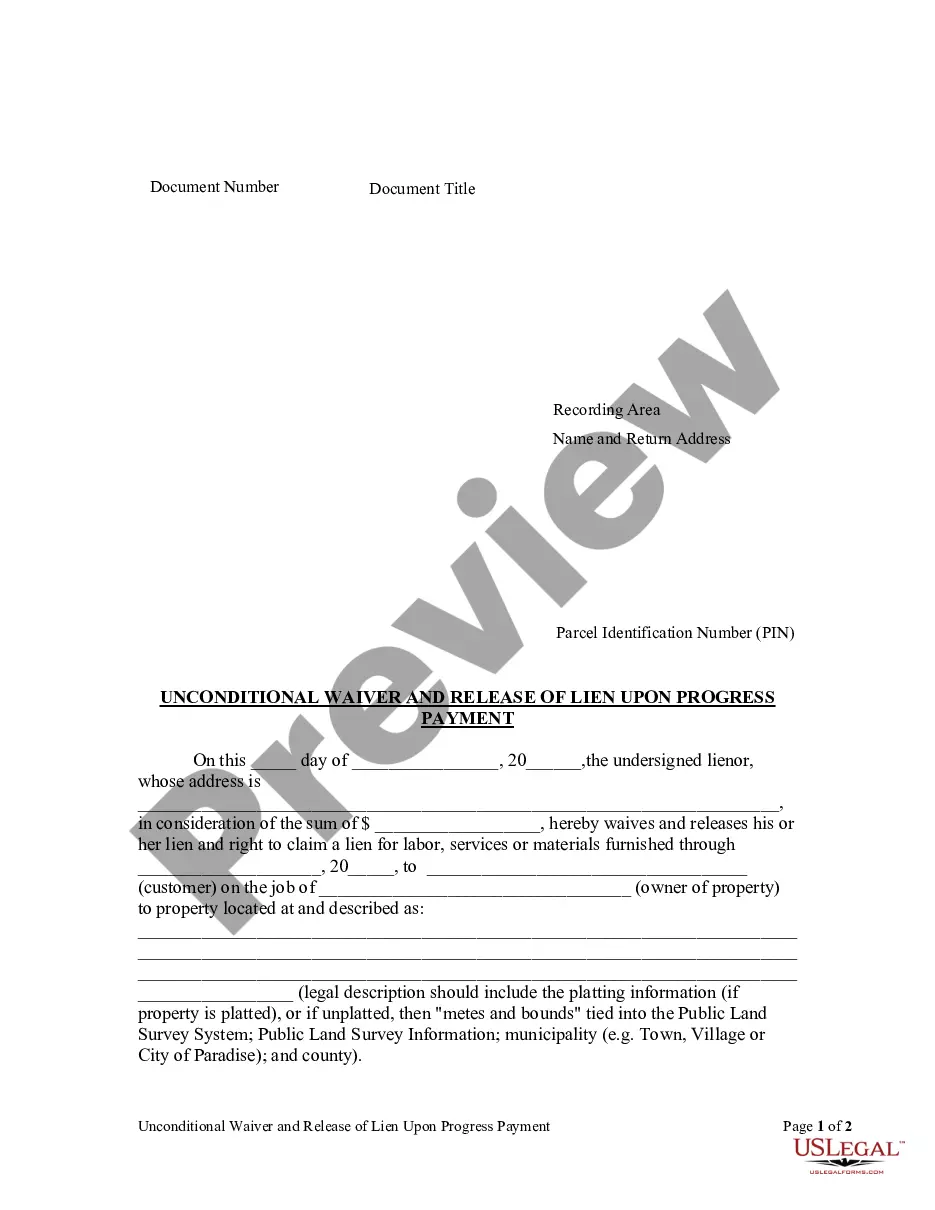

Finding the appropriate template to provide the buyer with a lien release can also prove to be laborious, as it must be accurate down to the last character.

However, you will be able to allocate considerably less time on locating a proper template from a reputable source.

Follow these straightforward steps to acquire the correct form: Enter the document title in the search field. Locate the fitting template to provide the buyer with a lien release from the search results. Review the sample outline or view its preview. If the template meets your needs, click Buy Now. Then, select your subscription plan. Use your email to create a password and register with US Legal Forms. Choose a payment method via credit card or PayPal. Save the template document to your device in your preferred format. US Legal Forms will assist you in saving time and energy in verifying whether the form you found online is appropriate for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a service that streamlines the task of locating the right forms online.

- US Legal Forms is a centralized platform where one can retrieve the most recent samples of paperwork, verify their usage, and download these templates for completion.

- It boasts a repository of over 85,000 forms applicable across different work sectors.

- When searching for a template to provide the buyer with a lien release, you'll have no doubts about its authenticity as all documents are validated.

- Having an account with US Legal Forms guarantees that you have essential samples readily available.

- You can save them in your account history or include them in your My documents collection.

- Access your saved forms from any device by simply clicking Log In on the library site.

- If you do not possess an account yet, you can always initiate a new search for the template you require.

Form popularity

FAQ

To add or remove a lien on your vehicle title, visit your local county tax office. The title fee is $28 or $33, depending on your county, and must be paid at time of application. Please contact your local county tax office for the exact cost.

If there is a lien, it must be released by the lienholder in the appropriate signature space or by attaching a lien termination statement from the financial institution to the title. Never take possession of a vehicle without the title signed by the owner or owners named on the front of the title.

Sellers must also provide a signed lien release card or notarized lien release form, if applicable.

To remove a lien from a title, the vehicle title must be submitted with the Lien Notification card from the lien holder, properly signed by the lender or with a notarized Notification of Assignment Release or Grant of Secured Interest (PS2017) signed by the lender.

O If the lienholder is an individual, a notice of release (lien release section of DOR-4809) must be completed, signed, and notarized. An estate executor may release the lien by submitting the above with an original or certified copy of the probate court order. information is legible.