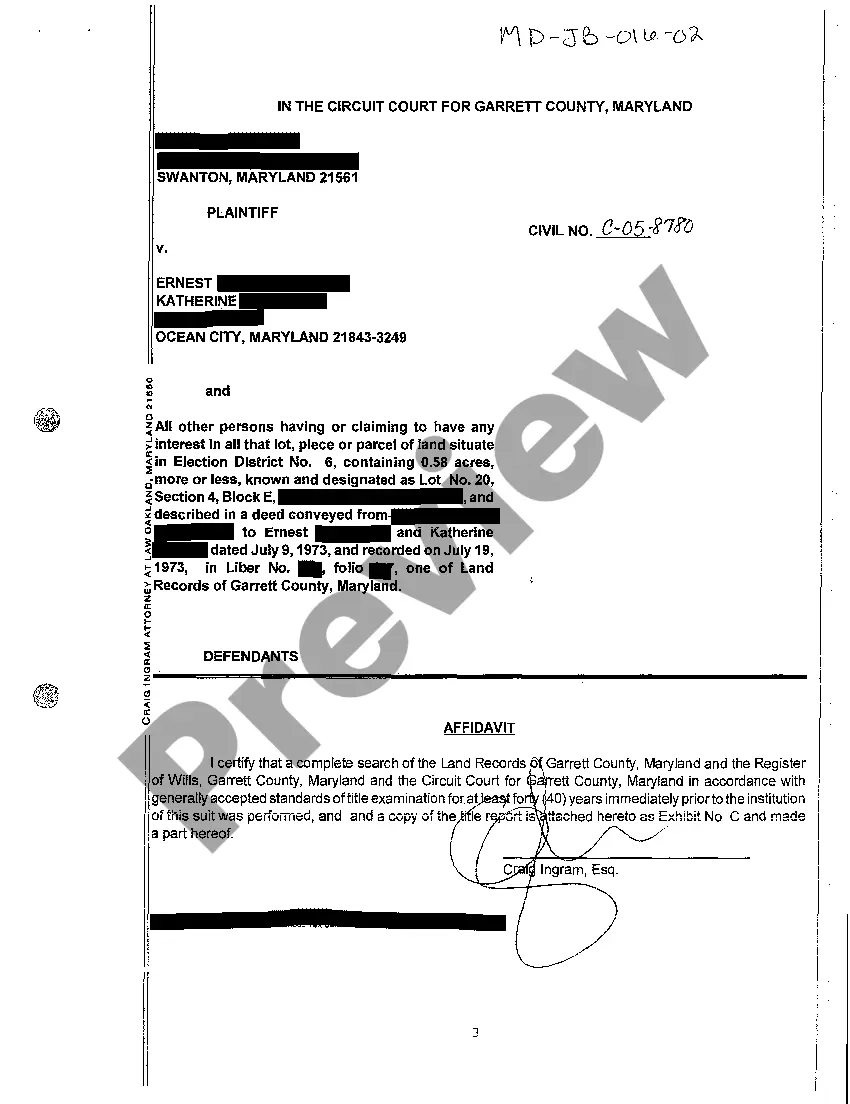

Attorney Regarding Va Foreclosure

Description

How to fill out Virginia Attorney Opinion Letter Regarding Revocable Living Trust?

Getting a go-to place to take the most recent and relevant legal templates is half the struggle of handling bureaucracy. Discovering the right legal files calls for accuracy and attention to detail, which is the reason it is vital to take samples of Attorney Regarding Va Foreclosure only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the information about the document’s use and relevance for your situation and in your state or region.

Take the following steps to complete your Attorney Regarding Va Foreclosure:

- Utilize the catalog navigation or search field to find your template.

- View the form’s description to check if it matches the requirements of your state and county.

- View the form preview, if there is one, to ensure the form is definitely the one you are searching for.

- Return to the search and find the right template if the Attorney Regarding Va Foreclosure does not suit your needs.

- If you are positive about the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that fits your requirements.

- Go on to the registration to complete your purchase.

- Complete your purchase by selecting a transaction method (credit card or PayPal).

- Pick the document format for downloading Attorney Regarding Va Foreclosure.

- When you have the form on your gadget, you may modify it using the editor or print it and complete it manually.

Remove the headache that comes with your legal documentation. Explore the extensive US Legal Forms catalog to find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

For a VA mortgage assumption to take place, the following conditions must be met: The existing loan must be current. ... The buyer must qualify based on VA credit and income standards. The buyer must assume all mortgage obligations, including repayment to the VA if the loan goes into default.

A: If foreclosure unavoidable, it may directly affect your VA loan entitlement. If the government suffers any loss as a result of your delinquency, the amount of entitlement that was used for the VA loan cannot be restored until the loss is paid back.

VA loan entitlement cannot be regained after foreclosure without repaying the VA in full. The good news is that many borrowers are able to purchase again using their second-tier entitlement.

VA loan entitlement cannot be regained after foreclosure without repaying the VA in full. The good news is that many borrowers are able to purchase again using their second-tier entitlement.

VA foreclosure works similarly to any mortgage foreclosure process. There are limited cases in which you could be foreclosed upon much more quickly (for example, triggering due-on sale provisions).