Uniform Commercial Code File For Liens

Description

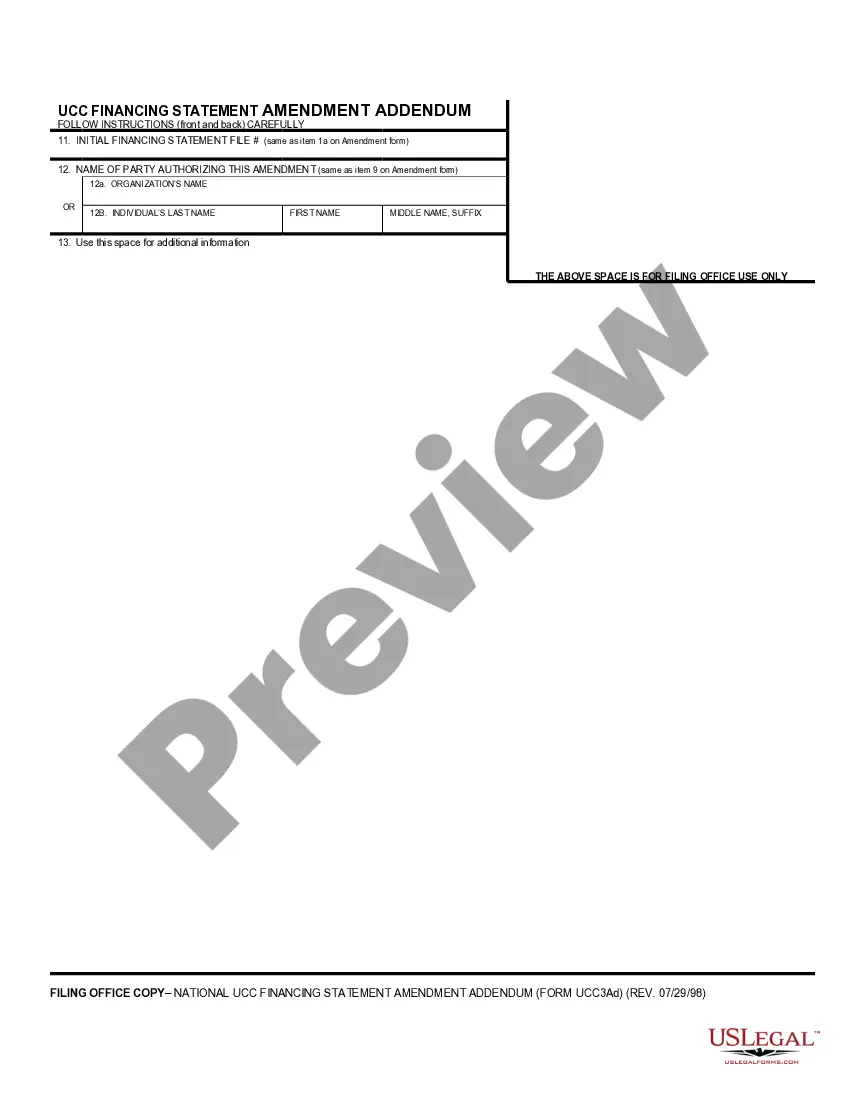

How to fill out UCC1-AD Financing Statement Addendum?

It’s well known that you cannot instantly become a legal authority, nor can you quickly learn how to prepare a Uniform Commercial Code File For Liens without a specialized background.

Assembling legal documents is a lengthy process that demands specific education and expertise. So, why not entrust the preparation of the Uniform Commercial Code File For Liens to the professionals.

With US Legal Forms, one of the most extensive legal template collections, you can find everything from court documents to templates for internal communication.

You can access your documents again from the My documents tab at any time. If you are an existing customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the aim of your paperwork—whether financial and legal, or personal—our website has you covered. Try US Legal Forms today!

- Find the document you need using the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine if the Uniform Commercial Code File For Liens is what you are looking for.

- Begin your search anew if you require a different document.

- Create a free account and select a subscription plan to purchase the document.

- Click Buy now. Once the transaction is completed, you can download the Uniform Commercial Code File For Liens, fill it out, print it, and send or mail it to the necessary individuals or organizations.

Form popularity

FAQ

Under the UCC, a secured party can perfect their security interest in certain collateral by controlling that collateral. The types of collateral that can be perfected by control include: investment property. deposit accounts.

Typically, perfection is achieved by filing a document called a ?financing statement,? sometimes referred to as a ?UCC 1.? The financing statement must identify the debtor, the creditor, and the collateral against which the creditor has a claim.

Typical collateral For example, if you take out a loan to buy new machinery, the lender might file a UCC-1 lien and claim that new machinery as collateral on the loan. You would, of course, work with your lender to designate what the collateral will be before you sign any documentation committing to the loan.

The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default. However, in many cases, the terms UCC lien and UCC filing are used interchangeably.

It's possible to avoid a UCC filing by taking out an unsecured business loan rather than a secured one. For example, many online and alternative lenders offer unsecured loans, and you can get an SBA 7(a) loan of up to $25,000 without collateral.