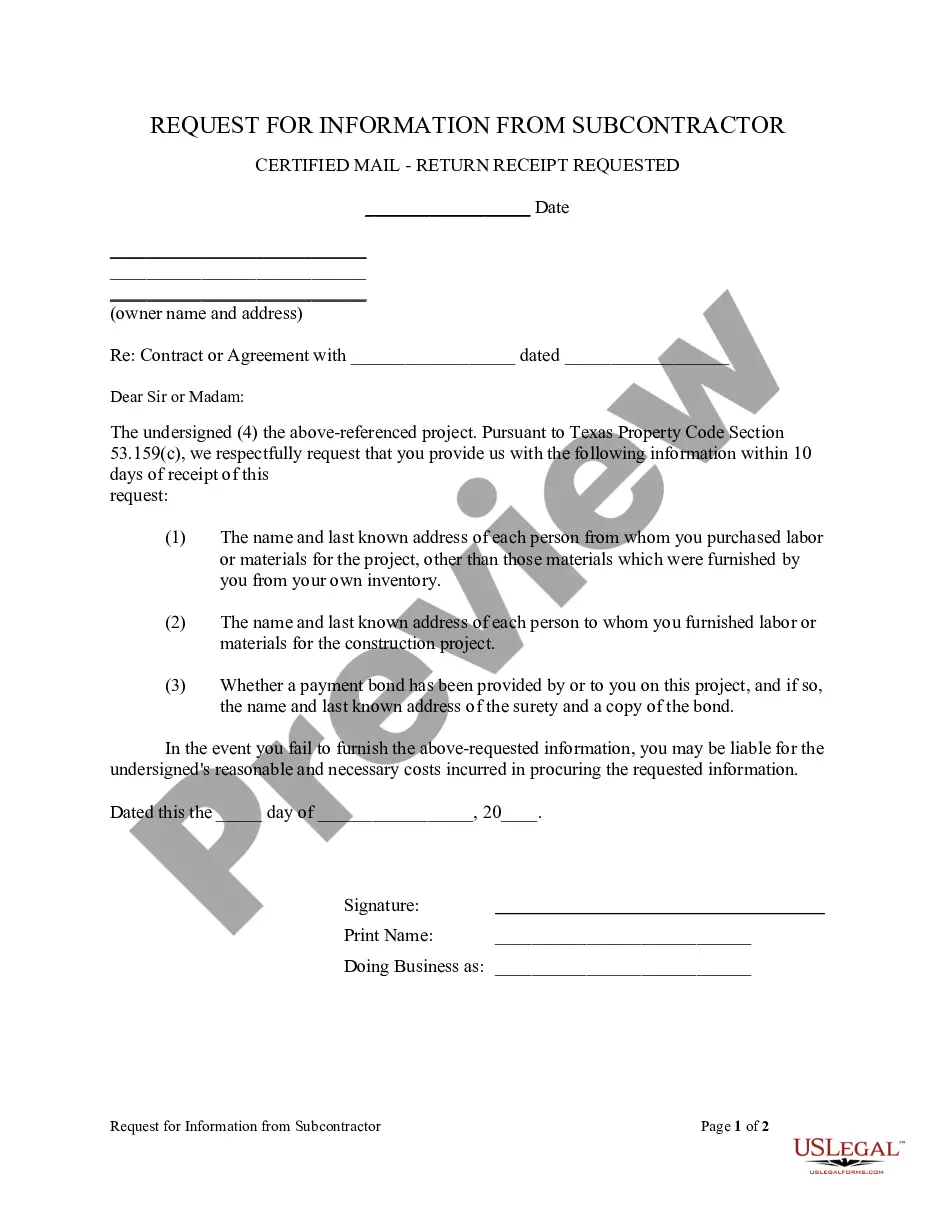

Parent Court Step Within

Description

How to fill out USLegal Pamphlet On Stepparent Adoption?

Acquiring legal templates that adhere to federal and local regulations is essential, and the web provides numerous selections to choose from.

However, what is the purpose of squandering time searching for the properly drafted Parent Court Step Within example on the internet when the US Legal Forms online repository already consolidates such templates in a single location.

US Legal Forms is the premier online legal repository boasting over 85,000 fillable forms created by attorneys for any professional and personal situation. They are straightforward to navigate with all documents categorized by state and intended use.

All templates you discover through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents section in your account. Enjoy the most comprehensive and user-friendly legal document service!

- Our experts keep up with legislative changes, so you can always trust that your form is current and compliant when obtaining a Parent Court Step Within from our site.

- Obtaining a Parent Court Step Within is simple and swift for both existing and new clients.

- If you already have an account with an active subscription, Log In and download the document sample you need in the appropriate format.

- If you are visiting our website for the first time, follow the steps below.

- Review the template using the Preview option or through the text description to ensure it satisfies your requirements.

Form popularity

FAQ

One of the biggest mistakes in a custody battle often involves failing to prioritize the child's best interests. Emotional reactions can cloud judgment, leading to decisions that harm your case. Additionally, not understanding the legal processes and implications, such as the parent court step within, may hinder your position. Seeking assistance and understanding can make a significant difference in these challenging situations.

A stepchild is generally the biological child of your spouse, who is not your biological child. This relationship is often recognized even without formal legal adoption. Bonding with your stepchild through shared experiences, care, and support enhances this connection. If you're unsure about your rights or responsibilities, exploring resources like uslegalforms can clarify the parent court step within aspects.

The statute of limitations for most Louisiana debts is 10 years.

Under federal law, the Louisiana Department of Revenue can garnish federal income tax refunds to reduce or pay income tax debt owed to the state. To garnish a federal income tax refund, the Department files an offset claim with the United States Department of the Treasury.

Taking action means they send you court papers telling you they're going to take you to court. The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment.

Debt Collector Licensing Requirements Any collection agency or debt collector doing business in this state must register with the Louisiana Secretary of State. ( ) This requirement does not apply Page 3 to individual collectors working at a law firm.

Key Takeaways: The statute of limitations for most Louisiana debts is 10 years.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Statutes of limitations for each state (in number of years) StateWritten contractsOpen-ended accounts (including credit cards)Iowa105Kansas53Kentucky155Louisiana10347 more rows ?

What/who is the Office of Debt Recovery (ODR)? Act 399, through La. R.S. 76, established the ODR as a centralized debt collection unit authorized and required to collect delinquent debt owed to the state of Louisiana. What statutes created and govern the operations of ODR?