Dui Pasco County Withholding

Description

How to fill out Driving Under The Influence - DUI - Guide And Information For Your DUI - USLegal Guides?

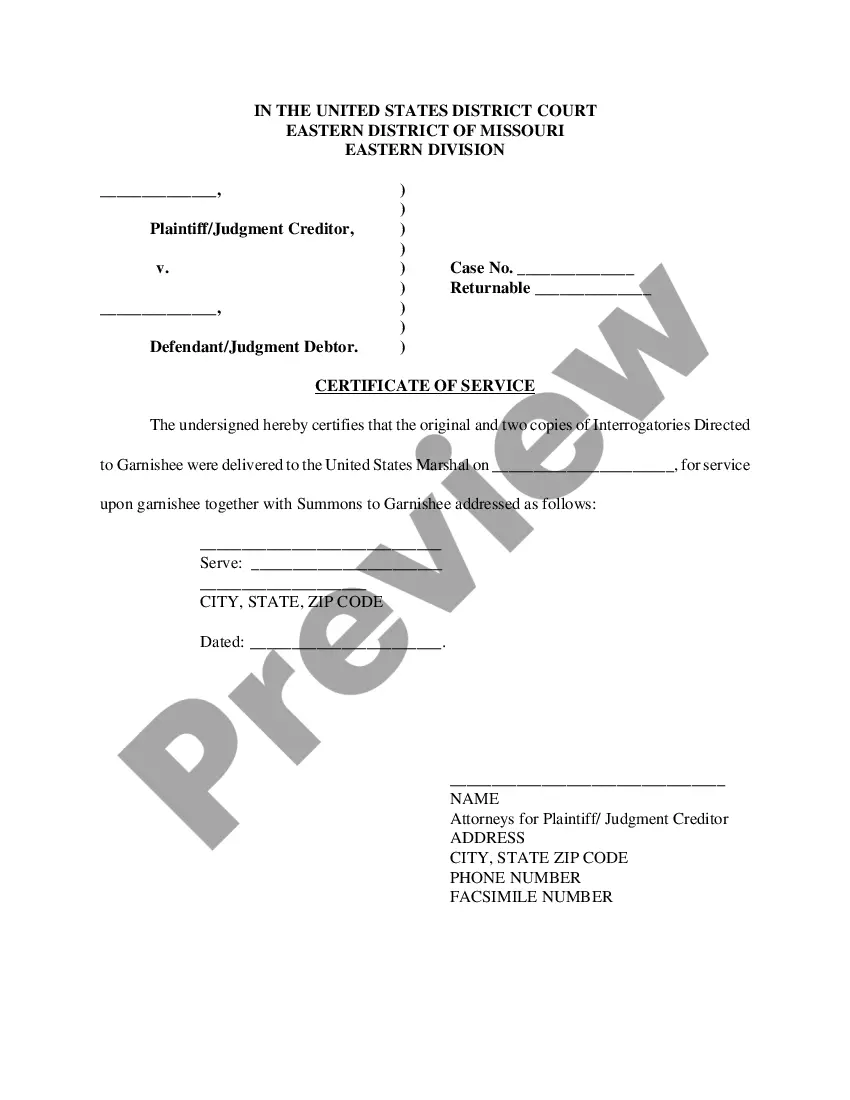

The Dui Pasco County Withholding displayed on this page is a reusable legal document crafted by expert attorneys adhering to federal and local laws.

For over 25 years, US Legal Forms has offered individuals, entities, and legal practitioners access to more than 85,000 validated, state-specific documents for any business and personal scenario. It’s the quickest, simplest, and most trustworthy method to acquire the forms you require, as the service promises bank-level data security and anti-malware safeguards.

Re-download your documents whenever required. Utilize the same file again at any time needed. Access the My documents tab in your profile to retrieve any forms you have previously downloaded.

- Search for the document you require and examine it.

- Browse through the file you looked for and preview it or review the form description to ensure it meets your requirements. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you locate the template you need.

- Choose and Log Into your account. Select the pricing plan that fits you and establish an account. Use PayPal or a credit card to make an instant payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template. Select the format you prefer for your Dui Pasco County Withholding (PDF, Word, RTF) and save the document on your device.

- Fill out and sign the document. Print the template to complete it by hand. Alternatively, use an online multifunctional PDF editor to quickly and precisely fill out and sign your form with an electronic signature.

Form popularity

FAQ

Generally, if Social Security benefits were your only income, your benefits are not taxable and you probably do not need to file a federal income tax return.

You must file a Mississippi Resident return and report total gross income, regardless of the source. You are a single resident and have gross income in excess of $8,300 plus $1,500 for each dependent.

If you can prove that you have lived elsewhere for a minimum of six months, most states allow you to end your residency and thus do not require you to file. However, some states require you to file a state return unless you can prove definitively that you are not returning (i.e., that you are ?breaking residency?).

Code § 1-3-27. The term "minor," when used in statute, except as otherwise provided by law shall include any person, male or female, under twenty-one (21) years of age.

You may check the status of your refund online at TAP. If you cannot check online, you may call (601) 923-7801. Office representatives do not have any information that you cannot view online in TAP.

Which Are the Tax-Free States? As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

Understanding the Mississippi Distracted Driving Law Code Ann. § 63-33-1, no driver in Mississippi may: Write, send, or read a text message, email, or similar. Access, read, or post to a social networking site.