Attorney Fee For Consultation

Description

How to fill out Attorney Fee Contract - Contingency - 50%?

Identifying a reliable location to acquire the most up-to-date and pertinent legal templates is a significant portion of navigating red tape.

Finding the appropriate legal documents necessitates accuracy and meticulousness, which is why it is crucial to obtain Attorney Fee For Consultation samples solely from reputable sources like US Legal Forms. An incorrect template can squander your time and delay the matter at hand.

Once the form is saved on your device, you can modify it with the editor or print it out to fill in manually. Eliminate the hassle associated with your legal documentation. Browse the extensive US Legal Forms catalog where you can locate legal samples, verify their suitability for your circumstances, and download them instantaneously.

- Use the library navigation or search feature to find your template.

- Review the form’s description to ensure it meets the specifications of your state and locality.

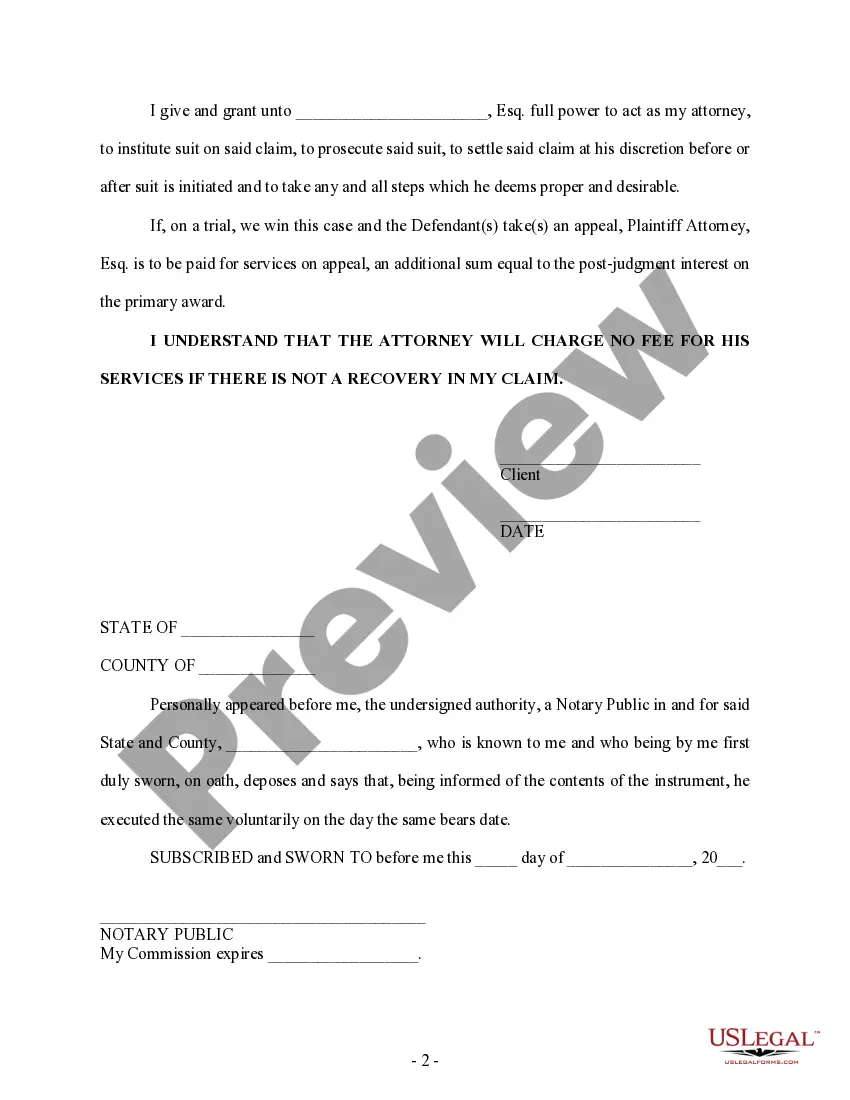

- Inspect the form preview, if available, to confirm that it is the correct form you require.

- If the Attorney Fee For Consultation does not satisfy your needs, continue searching to locate the right document.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not yet have an account, click Buy now to purchase the form.

- Choose the pricing option that suits your needs.

- Move forward with the registration to finalize your purchase.

- Complete the transaction by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Attorney Fee For Consultation.

Form popularity

FAQ

In a legal settlement, the attorney typically receives the 1099, especially if the payment involves attorney fees. However, if the settlement contains various components, each party may have specific requirements for reporting. Make sure to clarify this with your attorney to ensure proper compliance with the IRS.

Yes, a trust must issue a 1099 for trustee fees if the payments exceed a certain threshold set by the IRS. The trustee should report this income, and it helps maintain clear records for tax purposes. If you are uncertain about the process, consider reaching out to a legal professional to help you navigate these requirements.

Yes, attorney fees for consultation generally count as taxable income. If you receive a settlement that includes attorney fees, the IRS considers that part of your gross income. It’s essential to report these fees accurately on your tax return to avoid any issues with the IRS.

A note is a debt security obligating repayment of a loan, at a predetermined interest rate, within a defined time frame. Notes are similar to bonds but typically have an earlier maturity date than other debt securities, such as bonds.

A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.

There are two major types of promissory notes, secured and unsecured. Secured promissory notes have collateral behind them to secure the loan. Unsecured notes might have a personal guarantee but no valuable collateral, which carries a higher degree of risk of financial loss.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

First, and subject to certain enumerated exceptions, biometric identifiers may not be collected or retained from consumers without first providing clear and conspicuous notice, obtaining consent, and providing a mechanism to prevent subsequent use of biometric identifiers. 9 V.S.A.

Promissory notes are a written promise to pay a specified amount to a specific entity at a specific time or upon demand, with or without interest. Promissory notes are presumed to be securities.

An unsecured note carries no collateral, backed only by the promise of the borrower to repay. An example would be an IOU between parties, stipulating a certain interest rate and maturity. Once that arrangement is sold to a third party, the note may become a security.