Loan Document Form For Bank

Description

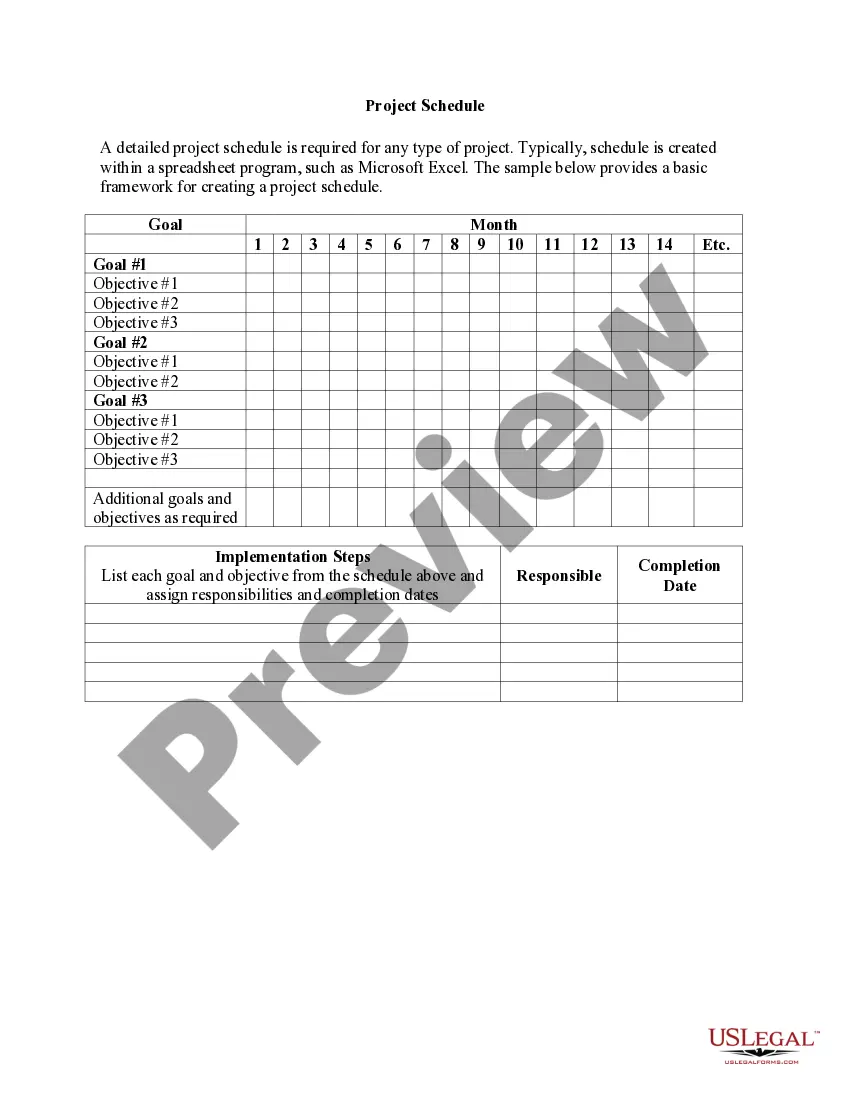

How to fill out Personal Loan Agreement Document Package?

Accessing legal templates that meet the federal and regional laws is a matter of necessity, and the internet offers many options to choose from. But what’s the point in wasting time looking for the appropriate Loan Document Form For Bank sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and personal case. They are simple to browse with all files organized by state and purpose of use. Our specialists keep up with legislative changes, so you can always be sure your form is up to date and compliant when getting a Loan Document Form For Bank from our website.

Getting a Loan Document Form For Bank is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the steps below:

- Analyze the template using the Preview feature or through the text outline to make certain it meets your needs.

- Locate another sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Loan Document Form For Bank and download it.

All documents you locate through US Legal Forms are multi-usable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Take advantage of the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

How To Write A Loan Request Letter Your name. Your address. Your business name. Your business address. Name of loan agent or lender. Contact information of lender or loan agent. Subject line with the requested loan amount.

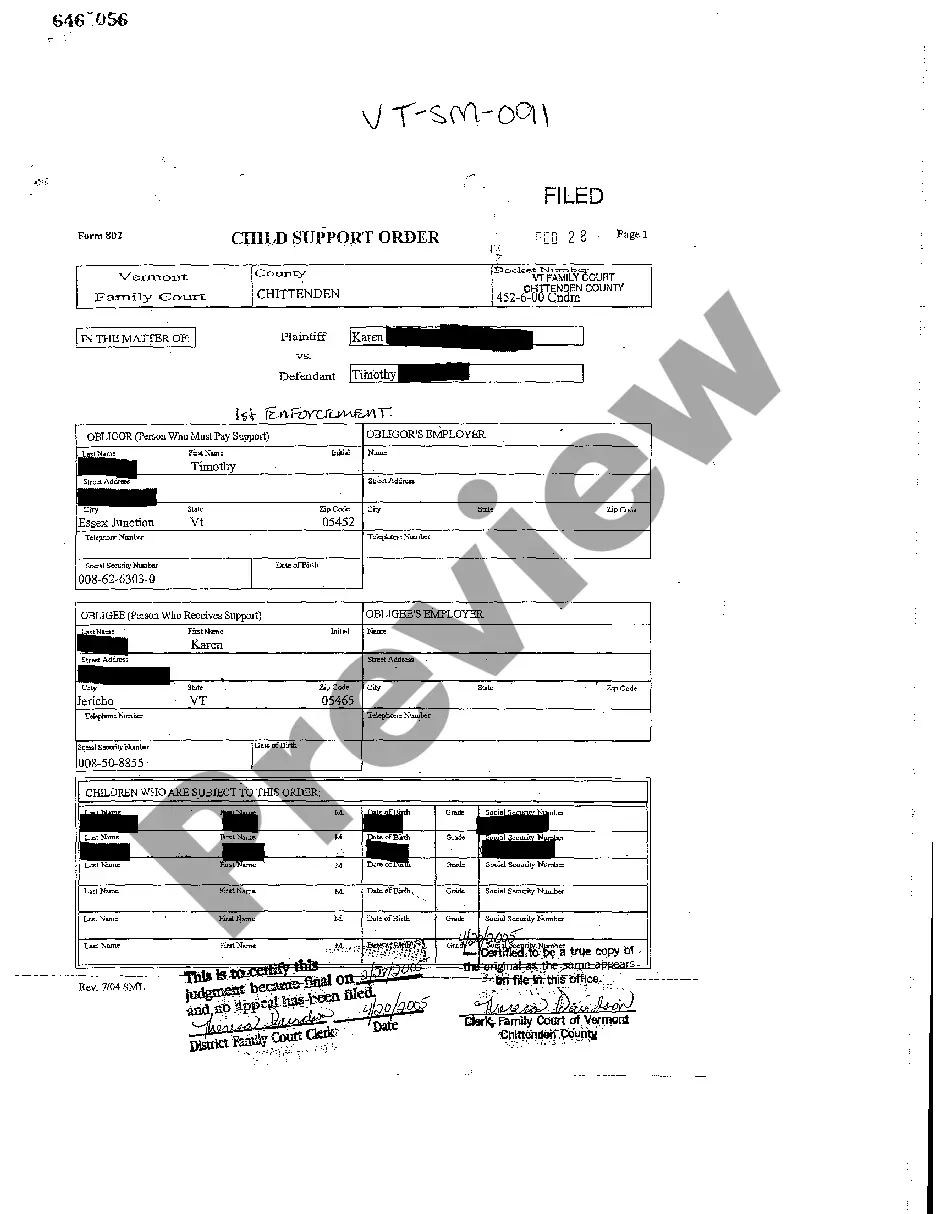

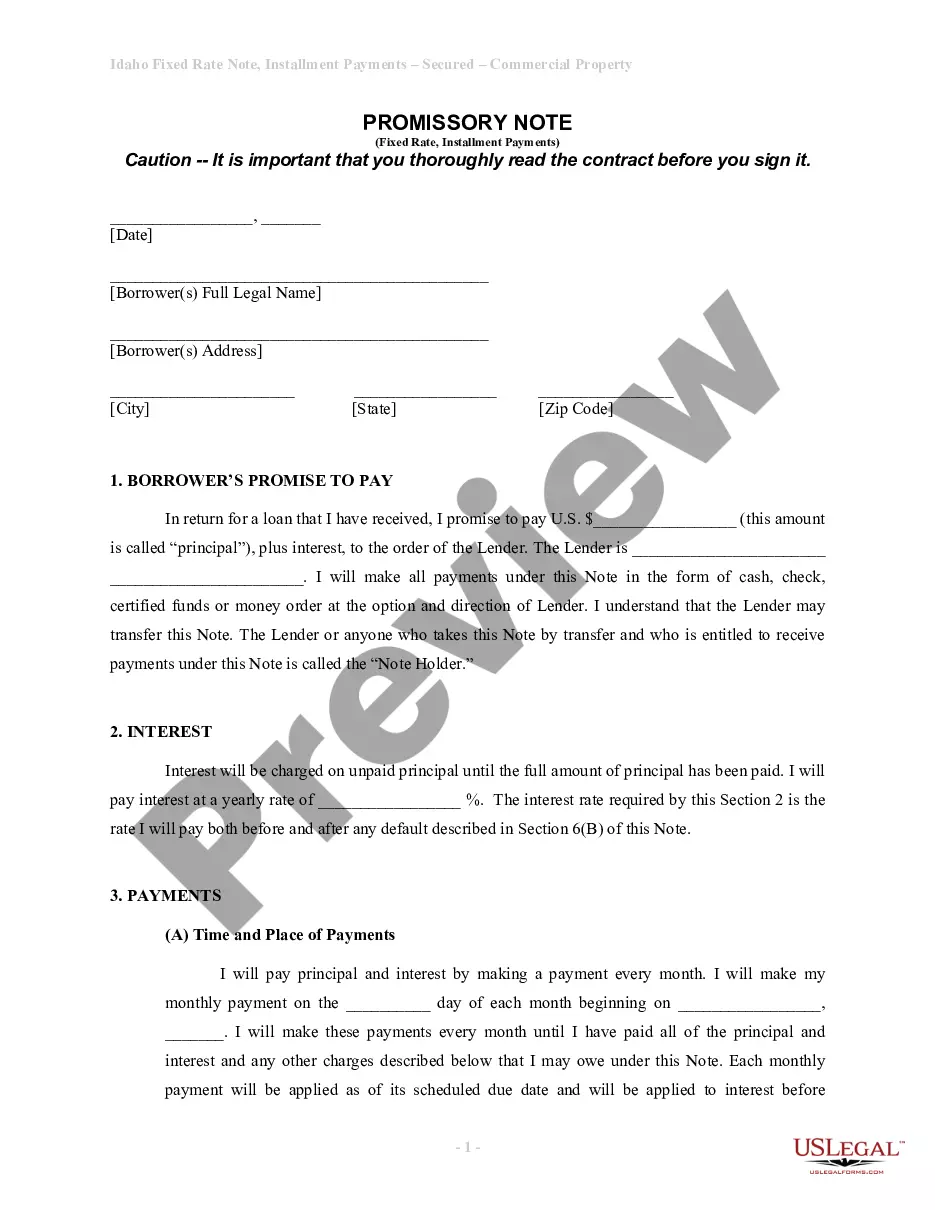

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

What You Need To Know About Writing A Loan Request Letter Your name. Your address. Your business name. Your business address. Name of the money lender or loan agent. Contact information of the loan agent. Subject. Requested loan amount.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

Visit the branch of the financial lender. Procure the personal loan application form and enter all the required details. Submit relevant documents that prove one's income, age, address and identity. The lender will then verify the documents and check the eligibility of the applicant.