Llc Change Of Ownership Form With Two Points

Description

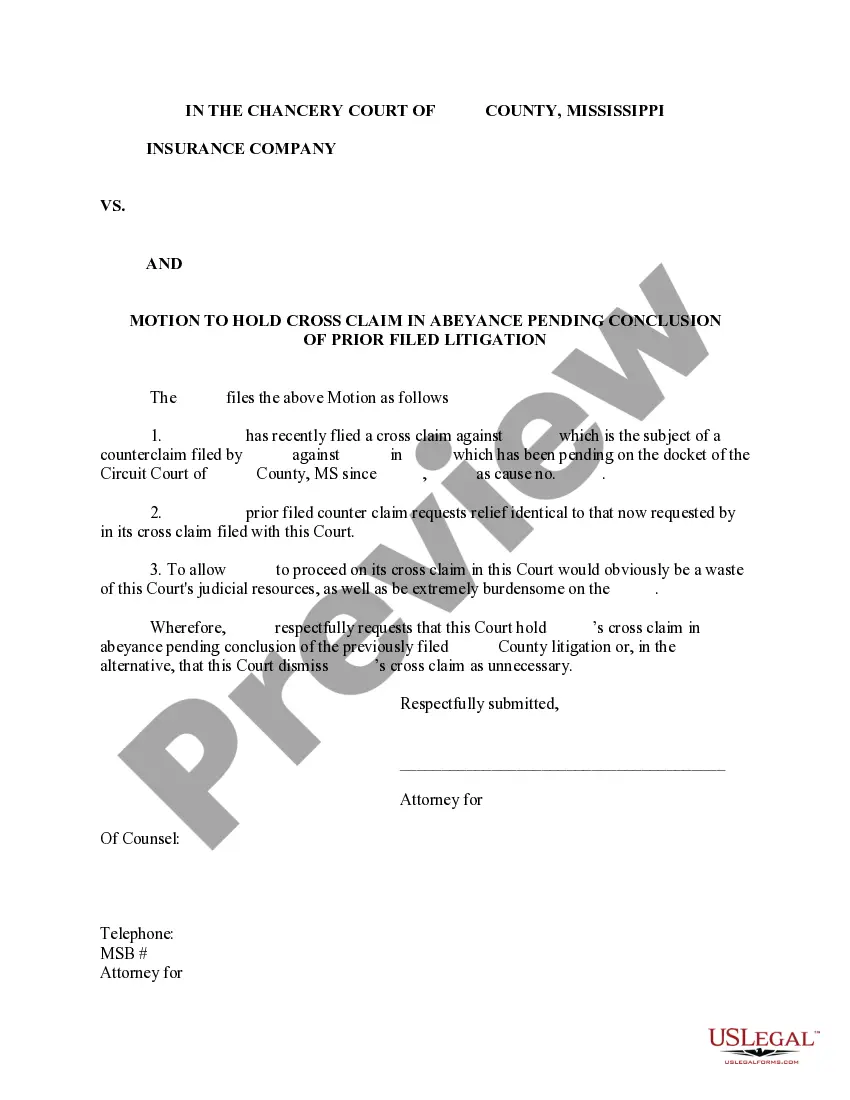

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

Legal administration can be perplexing, even for the most adept professionals.

When you are seeking a Llc Change Of Ownership Form With Two Points and lack the time to devote to finding the appropriate and current version, the processes can be stressful.

US Legal Forms meets all requirements you may have, from personal to commercial documents, all in one location.

Use sophisticated tools to complete and manage your Llc Change Of Ownership Form With Two Points.

Here are the steps to follow once you have accessed the form you require: Confirm this is the correct form by previewing it and reading its description. Ensure that the sample is acceptable in your state or county. Select Buy Now when you are prepared. Choose a subscription plan. Locate the file format you need, and Download, complete, sign, print, and deliver your documents. Make the most of the US Legal Forms online library, supported by 25 years of experience and reliability. Streamline your document management process today.

- Access a valuable repository of articles, guidelines, handbooks, and materials related to your situation and needs.

- Save time and effort searching for the documents you require, and utilize US Legal Forms’ advanced search and Preview feature to find the Llc Change Of Ownership Form With Two Points and obtain it.

- If you hold a monthly subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Review the My documents section to view the documents you have previously saved and to manage your folders as you wish.

- If this is your first visit to US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- Utilize a robust online form library that could be transformative for anyone looking to manage these circumstances effectively.

- US Legal Forms stands as a leading source for online legal documents, boasting over 85,000 state-specific legal forms available to you at any time.

- Access state- or county-specific legal and business documents.

Form popularity

FAQ

Dividing ownership of an LLC involves determining each member's share based on their contributions or agreed-upon percentages. Use an LLC change of ownership form to formalize these adjustments and ensure all members are on the same page. Clear communication can prevent misunderstandings later. Platforms like US Legal Forms can assist you in creating the necessary documents efficiently.

To split LLC ownership, you first need to review your operating agreement to understand how ownership is structured. Then, draft an LLC change of ownership form to officially document the new ownership percentages. It's essential to clearly define each member's duties and contributions moving forward. Additionally, consider consulting US Legal Forms for templates and guidance to streamline the process.

You can show ownership of an LLC through the operating agreement and the issuance of membership certificates. These documents outline each member's ownership stakes and contributions. An LLC change of ownership form plays a significant role when ownership transitions occur, ensuring that changes are formally registered. Clear documentation helps avoid misunderstandings and supports transparent ownership structures.

The correct title for the owner of an LLC is 'Member'. Members can play various roles within the organization, including managing it or contributing capital. It's important to clarify each member's role in the operating agreement. Utilizing an LLC change of ownership form can help when titles or responsibilities change among members.

Documenting ownership in an LLC involves maintaining an accurate operating agreement that details each member's contribution and ownership percentage. Additionally, using formal documents like an LLC change of ownership form is crucial when changes occur. This ensures that all modifications are legally recognized and easy to reference in the future. Proper documentation is vital for managing the business and fulfilling regulatory requirements.

To change the ownership percentage of an LLC, members should draft an amendment to the operating agreement. This amendment should outline the new ownership percentages and be signed by all members. Alternatively, using an LLC change of ownership form simplifies this process, ensuring legal compliance. Keeping records updated protects everyone's interests and avoids potential disputes.

Ownership in an LLC is typically expressed through membership interests. Each member holds a percentage based on their investment and contributions to the company. To formalize and document changes, an LLC change of ownership form is essential. This form helps maintain clear records of ownership distribution among members.

To add ownership to an LLC, you need to have an agreement among existing members regarding the new member. After reaching a consensus, fill out the LLC change of ownership form to document the addition. This ensures that the new member’s stake and rights are clearly defined. Resources like Uslegalforms can help you create the necessary legal documents without hassle.

Filing taxes for an LLC with two owners typically requires the completion of a partnership tax return. Each owner needs to report their share of the profits or losses on their individual tax returns. It’s essential to keep accurate records of the LLC's finances to ensure compliance. You may find it beneficial to consult tax professionals or platforms such as Uslegalforms for guidance on specific forms and requirements.

Yes, your LLC can have two owners, also known as members. This is a common structure, allowing both owners to share management responsibilities and profits. When you have two owners, each should be clearly defined in the LLC operating agreement, including their ownership percentages. If you need to formalize this arrangement, consider using the LLC change of ownership form.