Accounting For Contract Incentives

Description

How to fill out Bookkeeping Agreement - Self-Employed Independent Contractor?

Managing legal documents and tasks can be a lengthy addition to your entire day.

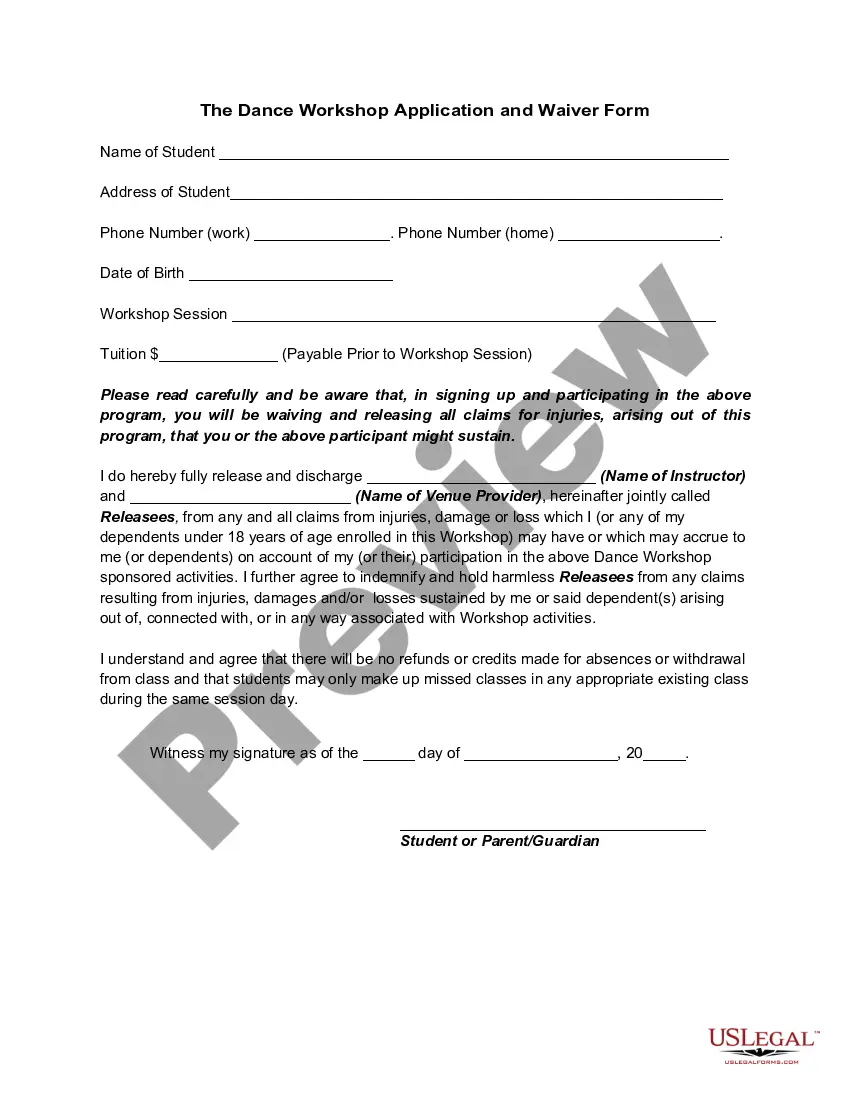

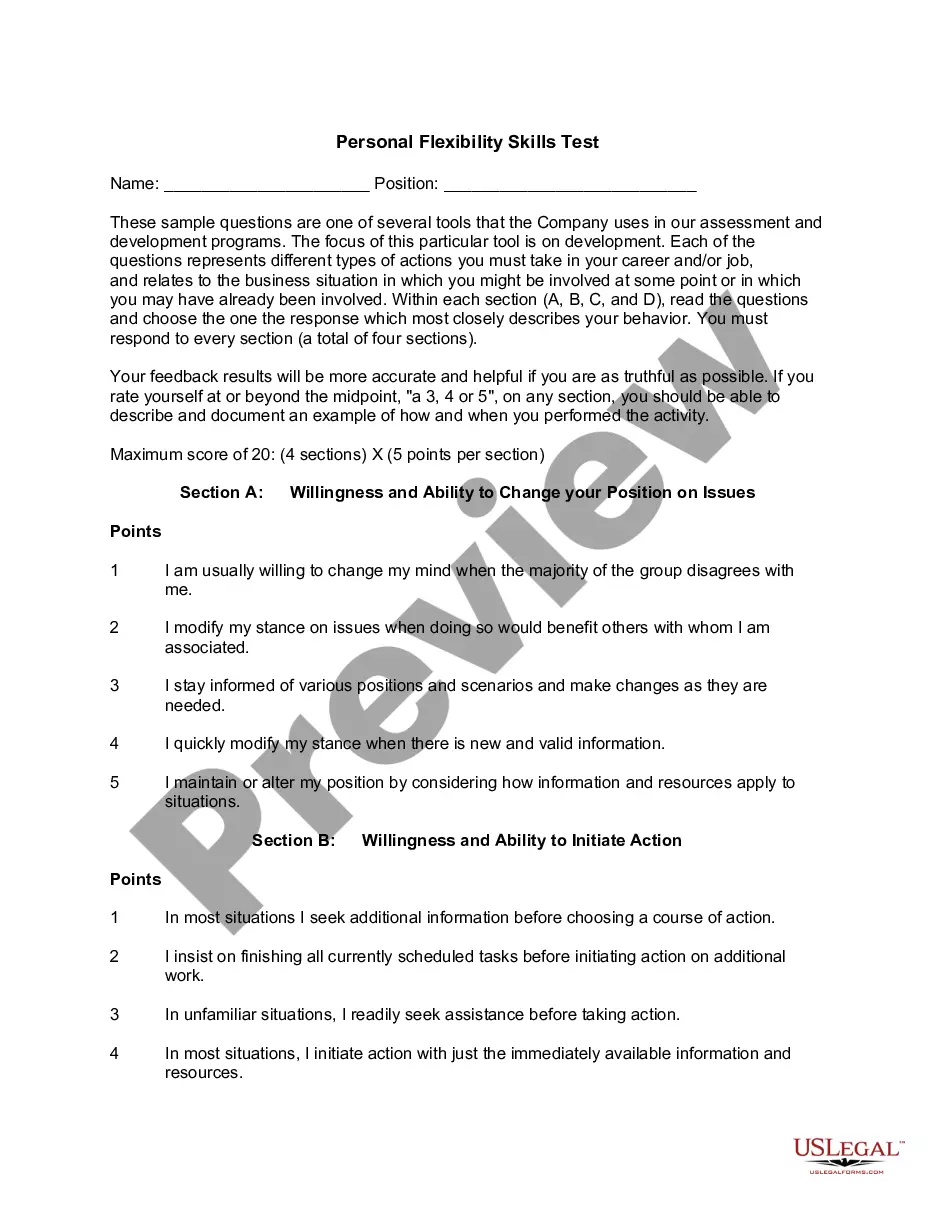

Accounting For Contract Incentives and similar forms typically require you to locate them and maneuver through the process to complete them correctly.

Consequently, whether you are dealing with financial, legal, or personal affairs, utilizing a thorough and efficient online directory of forms whenever needed will be beneficial.

US Legal Forms is the premier online resource for legal documents, offering over 85,000 state-specific templates and a wide range of tools to assist you in effortlessly finalizing your paperwork.

Is this your first experience with US Legal Forms? Register and create a free account within minutes, granting you access to the document library and Accounting For Contract Incentives. Then, follow these steps to complete your form: Ensuring that you've identified the correct form using the Preview feature and reviewing the form details. Click Buy Now when ready, and choose the monthly subscription plan that fits your needs. Click Download, then fill out, sign, and print the document. US Legal Forms boasts twenty-five years of experience helping clients manage their legal documents. Locate the form you require today and simplify any procedure effortlessly.

- Browse the selection of relevant documents available to you with just one click.

- US Legal Forms presents state- and county-specific documents accessible for download at any time.

- Safeguard your document management processes with a high-quality service that enables you to create any form in minutes without extra or undisclosed fees.

- Simply Log In to your account, find Accounting For Contract Incentives, and download it immediately from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

Sales incentives offered to customers are typically recorded as a reduction of revenue at the later of the date at which the related sale is recorded by the vendor or the date at which the sales incentive is offered.

An accounting-based incentive is a type of compensation that is offered to corporate executives of business firms based on certain long-term performance indicators such as earnings per share (EPS), capital gains, cash flow, return on assets, return on equity, and gross profits.

Below are 10 sales incentive ideas that you can use in any situation to motivate and engage your sales team. Gift Cards. ... Food Delivery Credit. ... Subscription to a Streaming Service. ... Tech Gadgets. ... Wine Club Membership. ... Subscription Boxes. ... A Gym Membership. ... Learning Opportunities.

Incentive Account means the account credited with the number of Incentive Units equal to the number of 'shares of restricted stock or performance stock awarded to a Participant under an Incentive Plan and deferred by such Participant hereunder.

Incentive/Disincentive (I/D) is an alternative contracting technique that uses incentive monies, which are paid to the contractor for early completion of a project as provided for in the contract. Disincentive monies are subtracted from the contractor for completing the project later than time allowed by the contract.